Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — May 14, 2024

By Matt Chessum

The recent rally in the share price of Gamestop (GME) has been causing a growing headache for short sellers. As the share price of the company once again achieved a daily increase only previously seen during the hay-day of the meme stock frenzy (+74%), short covering has started to take hold.

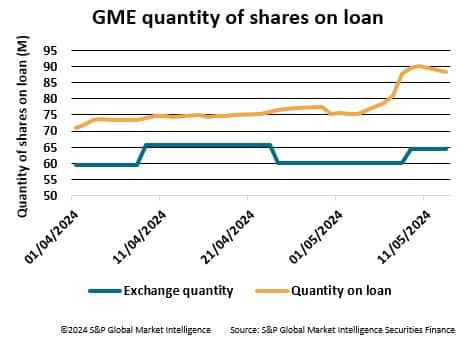

As can be seen by the graph, the exchange quantity, which signifies the quantity of shares shorted and reported to the exchange, remains significantly lower than the stock on loan quantity seen in S&P Global Market Intelligence Securities Finance Short Interest data. The difference is due to the delay in the exchange data publication and the existing regulations regarding the treatment of short positions - only those meeting the minimum threshold of the outstanding free float need to be reported. S&P Global Market Intelligence Short Interest data is published on an intraday (updated every 15 mins) and close of business basis, and therefore represents a more accurate view of the short interest currently taking place in Gamestop.

As can be seen in the S&P Global Market Intelligence Securities Finance Short Interest data, as the Gamestop share price has continued to climb, short interest has started to fall as borrowers fear a possible short squeeze. This transition cannot yet be seen in the exchange reported data. As the meme frenzy attempts a comeback, with AMC shares increasing 15% and Reddit shares jumping 9% in a single day, having access to the most timely and accurate data will help investors monitor liquidity, manage risk, and predict the next move of Roaring Kitty and his followers.

For more information on how to access this data set, please contact the sales team at:

h-ihsm-global-equitysalesspecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.