Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 10, 2024

By Sian Jones

S&P Global PMI sector data signalled diverging trends within the Consumer Goods category, as Automobiles & Auto Parts weighed on total output despite expansions in the other constituent parts during March. Moreover, autos manufacturers were one of the worst performers at the global level with regional sector PMI data also indicating challenging demand conditions in Europe.

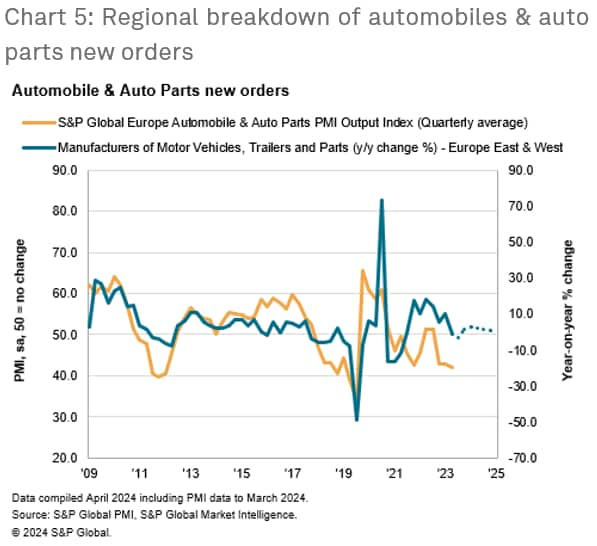

New orders received by automobile and auto parts manufacturers contracted for the fourth successive month in March, according to S&P Global Sector PMI data, with the pace of decline the second-fastest since December 2022 at the global level. Subdued demand conditions reportedly stemmed from a challenging economic environment domestically and in respective key export markets, according to panellists.

Looking at the regional breakdown, European autos producers weighed heavily on the overall performance of the consumer goods sector. Output and new orders fell markedly. The pace of decline softened from February's recent low but remained sharp. In contrast, Asian automobile and parts manufacturers saw a renewed rise in new orders in March, following a modest fall in February.

Meanwhile, demand for household & personal use products strengthened, as new sales rose at the sharpest pace in just over two years. At the same time, Beverages & Food saw a softening in new orders growth, but the pace of expansion was nonetheless the second-steepest since July 2022.

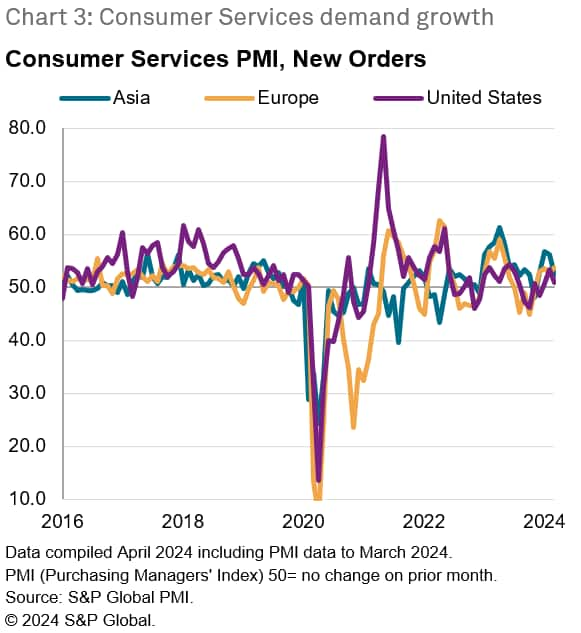

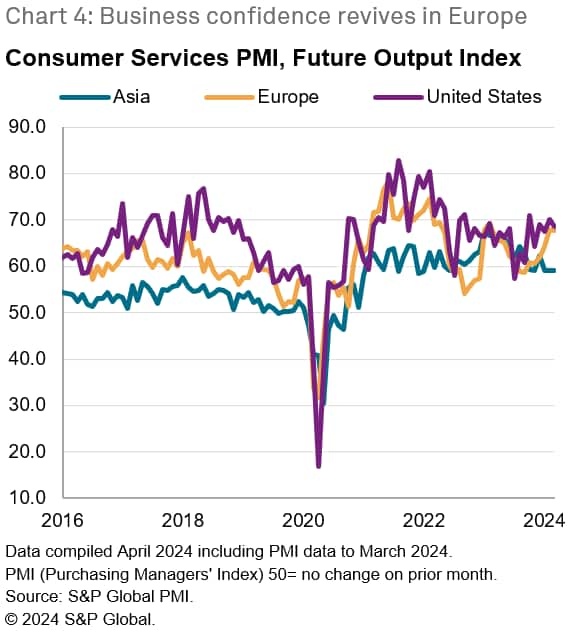

Though European consumer goods continued to lag Asia and the US, there were signs of the downturn moderating as the cost of living squeeze eases. This was underscored by consumer services, where signs were especially encouraging in Europe. Consumer services demand continued to rise in Europe, with the rate of growth in March outpacing that in the US.

Moreover, European consumer services firms' expectations for output in the year ahead have surged in recent months, catching up with the level of confidence in the US, according to the latest PMI data.

Turning back to the Automobile & Auto parts sector, muted demand conditions led firms to assess their outgoings in a more detailed manner as the first quarter progressed. As a result, employment at autos manufacturers globally contracted. The rate of job shedding eased on the month, however, with regional breakdowns signalling job losses at European automobile and parts producers drove the decline. In line with the trend seen for new orders, European autos manufacturers cut employment at a marked rate, with some looking to scale down work schedules and reduce the number of contractors used, according to anecdotal evidence.

Meanwhile, supply issues across the automobile & auto parts industry dissipated in Europe, with supplier lead times falling to the greatest extent since June 2023 amid some resolution at firms to challenges regarding the re-routing of shipping to avoid the Red Sea. That said, disruption continued to hamper manufacturers in Asia as vendor performance worsened for the sixth month running.

Easing pressure on supply chains led to a softer increase in input prices at the global level. The pace of cost inflation was only marginal and the slowest in four months. At the regional level, Asian automobiles & auto parts producers saw a further increase in operating expenses, but European autos manufacturers saw a sharper drop in input prices. Meanwhile, subdued demand conditions constrained firms' ability to pass-through greater costs to customers, as global factory-gate charges declined for the first time since July 2020, and at the fastest pace since May of that year. A quicker decrease in selling prices in Europe was accompanied by a renewed fall in Asian output charges.

Nevertheless, at the global level, automobile & auto parts manufacturers were optimistic regarding the outlook for output over the coming year in March. Producers were among the most upbeat in just under a year amid hopes of more stable global economic conditions.

Sian Jones, Principal Economist, S&P Global Market Intelligence

Tel: +44 1491 461 017

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.