Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 06, 2024

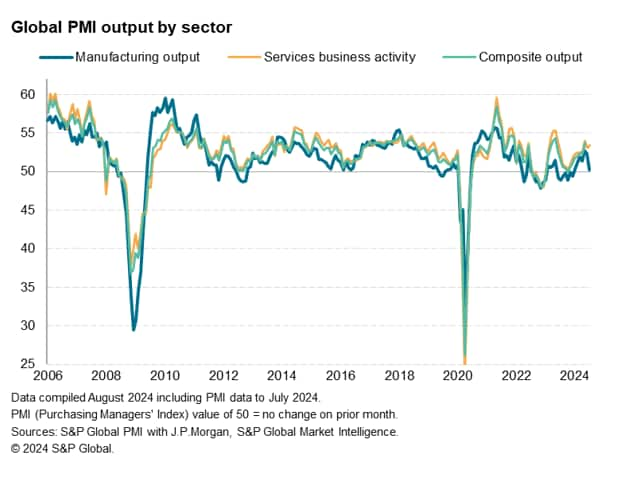

Global economic growth trends varied markedly by sector in July. Sustained - but slower - services growth, led by financial services, contrasted with a near-stalling of output growth in the manufacturing economy amid falling goods orders and lower trade volumes.

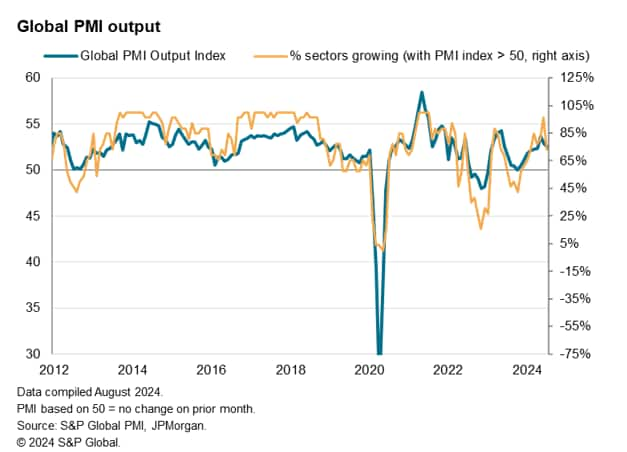

The July PMIs showed a growing global divergence between the fast-expanding service sector and a near-stalling manufacturing economy. Service sector growth ticked up to the second fastest in 13 months, but manufacturing output barely rose to register the weakest expansion seen in the current seven-month upturn.

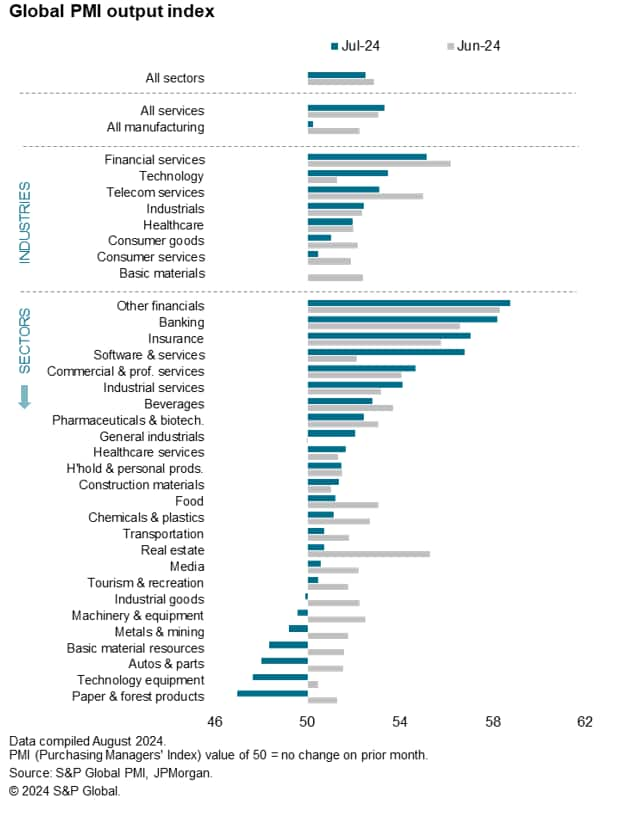

Whereas all of the 25 sub-sectors covered by the PMI avoided contraction globally in June, the situation was more varied in July, with seven sectors reporting falling output. That was the highest proportion for six months, and coincided with a cooling of overall output growth globally for a second month in a row, albeit being sustained at one of the fastest rates recorded over the past year.

Many of the contracting sectors were ones which typically supply inputs to other firms, and suffered from a global pull-back in raw material buying by manufacturers in July.

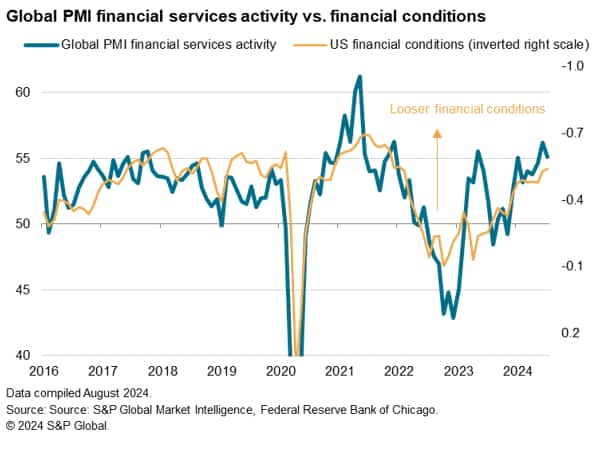

Growth was meanwhile led again by 'Other Financials', Banking and Insurance, in part buoyed by a further loosening of financial conditions in July, though Real Estate saw weaker growth after enjoying a two-and-a-half year high in June.

The capex-oriented machinery & equipment sector also notably suffered from a cooling of demand, leading to a renewed lowering of output, as did the autos sector.

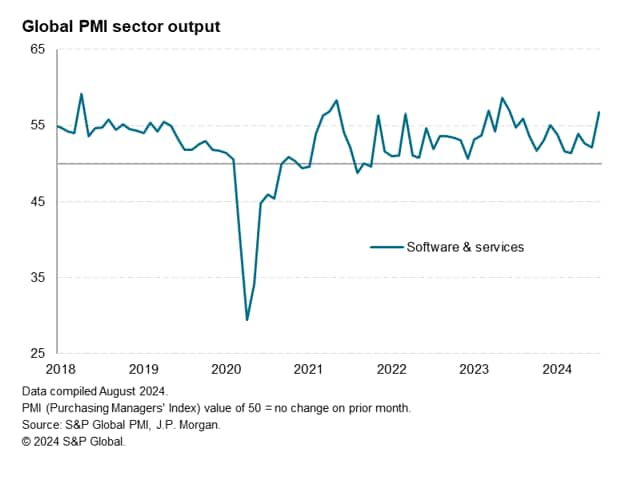

The largest acceleration of growth was seen in software and services, coinciding with the CrowdStrike disruptions.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.