Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — May 27, 2024

By Matt Chessum

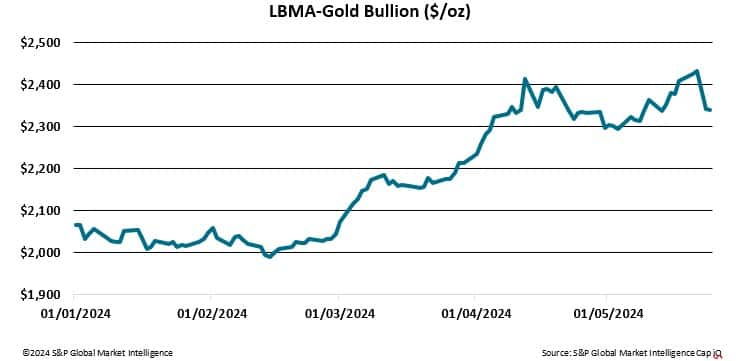

Over the last few weeks, the price of gold has reached record highs. According to CFTC data, hedge funds and other large speculators have been increasing their net-long positions in Comex futures and options after buying 21, 030 contracts during the week ending May 21st. Despite this marked increase in interest from institutional investors, activity across gold ETFs remains muted.

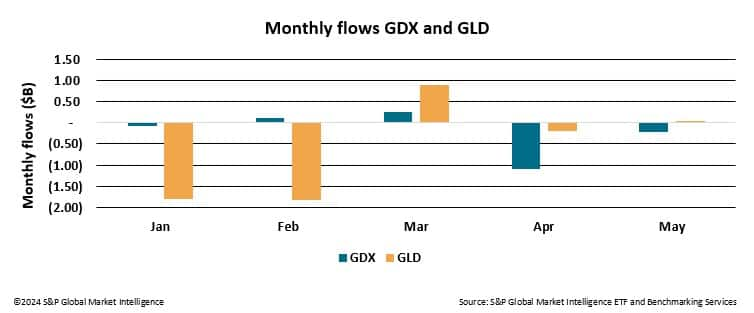

When looking across two of the largest gold related ETFs (by assets under management), GDX, Vaneck Vectors Gold Miners ETF ($13.26B) and GLD, SPDR Gold Trust ETF ($61.71B), year-to-date flows remain muted, with both funds only experiencing positive flows during two out of the first five months of the year. Collective year-to-date net flows across the two funds total -$3.946B.

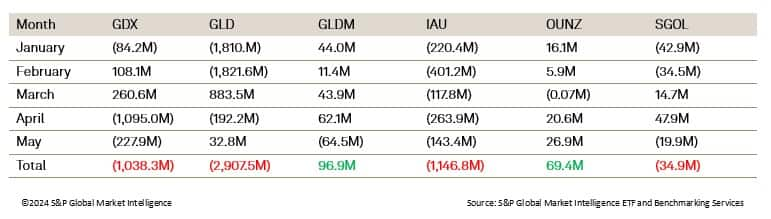

After expanding the universe of ETFs investing in gold, it is clear to see that the majority of funds have been experiencing a similar trend, with sizeable outflows being seen since the beginning of the year. Net flows across the following six funds have totaled -$4.96B since the beginning of the 2024 (to May 24th, 2024).

Given the current level of geopolitical risk, on-going conflict, and growing uncertainty regarding inflationary trends across a number of major global economies, central banks have reportedly been behind the recent spike in demand, pushing gold prices higher by circa 13% year-to-date. As central banks embark upon a period of interest rate divergence, investors can also expect to see growing volatility in currency markets. As interest rates move, currencies either strengthen or weaken and gold is often used as a hedge against this risk. This may explain why exchange traded fund buyers may not be too enthusiastic about its recent increase in valuation, as when coupled with a lack of periodic cash flows, higher than average management fees (due to issues such as storage costs) and the fact that gold has little industrial value (unlike silver), the commodity is likely to remain less attractive for retail portfolios.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.