Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 23, 2020

Daily Global Market Summary - November 23, 2020

US and APAC equity markets closed higher across both regions, while Europe was modestly lower on the day. US government bonds closed lower on the day and benchmark European bonds closed mixed. European iTraxx and CDX-NA closed tighter across both IG and high yield. Oil was higher on the day with both WTI/Brent close to touching recent highs in August, while gold, silver, and copper were all lower on the day. US flash PMIs came in particularly strong today, while the Eurozone and UK reports indicated a modest deacceleration as a result of recent COVID-19 restrictions in those regions.

Americas

- US equity markets closed higher; Russell 2000 +1.9%, DJIA +1.1%, S&P 500 +0.6%, and Nasdaq +0.2%.

- 10yr US govt bonds closed +3bps/0.86% yield and 30yr bonds +3bps/1.55% yield.

- CDX-NAIG closed -2bps/54bps and CDX-NAHY -11bps/329bps.

- DXY US dollar index closed +0.1%/92.49.

- Copper futures closed -0.9%/$3.26 per pound today, with Friday's close of $3.29/pound being only $0.01 away from the highest price in almost three years.

- Gold closed -1.8%/$1,838 per ounce and silver -3.0%/$23.63 per ounce.

- Crude oil closed +1.5%/$43.06 per barrel and is only 0.8% below the recent five-month high close of $43.39 per barrel on 25 August.

- The US General Services Administration acknowledged Joe Biden as the apparent winner of the presidential election on Monday, following weeks of inaction, and President Donald Trump called on his agencies and departments to cooperate. The designation triggers a formal transition process, giving Biden and his team access to current agency officials, briefing books, some $6 million in funding and other government resources. (Bloomberg)

- President-elect Joe Biden plans to nominate former Federal Reserve Chairwoman Janet Yellen, an economist at the forefront of policy-making for three decades, to become the next Treasury secretary, according to people familiar with the decision. (WSJ)

- Adjusted for seasonal factors, the IHS Markit Flash U.S.

Composite PMI Output Index posted 57.9 in November, up from 56.3 in

October. The rate of growth was the sharpest since March 2015, as a

steep upturn in service sector activity was accompanied by an

accelerated rise in manufacturing production. (IHS Markit Economist

Chris Williamson)

- As well as a sharp increase in business activity, companies reported a marked rise in new orders during November. The rate of growth was the fastest since June 2018, with a substantial acceleration in manufacturing new business growth to a 30-month high boosting total sales, joined by the quickest rise in service sector sales for 26 months. The increase in total orders was largely driven by domestic demand, as both goods producers and service providers indicated only marginal upturns in new export business.

- Manufacturing firms indicated the strongest improvement in operating conditions since September 2014, as highlighted by the IHS Markit Flash U.S. Manufacturing Purchasing Managers' Index™ (PMI™) posting 56.7 in November.

- The seasonally adjusted IHS Markit Flash U.S. Services PMI™

Business Activity Index registered 57.7 in November, rising from

56.9 in October, to signal the strongest expansion in output since

March 2015.

Contributing to the steep rise in business activity was a faster increase in new orders at service providers, and one that was the quickest since September 2018. - The rate of input price inflation picked up to the fastest since October 2018, as demand for inputs increased once again and amid a record-breaking deterioration in vendor performance.

- Higher supplier prices were passed on to clients in part, however, through the sharpest rise in charges for over two years.

- Business confidence among manufacturers soared in November, as the year-ahead outlook for output improved notably. The level of optimism was the strongest since February 2015.

- The count of seated diners on the OpenTable platform weakened materially last week. Relative to year-ago levels, the count of seated diners was down 54% averaged over the last seven days. This was down sharply from the prior week (down 47%) and the weakest year-on-year comparison over a seven-day window since mid-August. (IHS Markit Economists Ben Herzon and Joel Prakken)

- New York City residents received $40 billion in stimulus benefits that have been critical to the city's recovery from the coronavirus, Mayor Bill de Blasio said. The $40 billion, which includes stimulus checks, unemployment benefits and Paycheck Protection Program loans, shows how much the city needs action on additional federal stimulus, de Blasio said. The city avoided deeper revenue declines because of the first round of stimulus, he said. The city must now close a $3.8 billion fiscal 2022 budget gap with federal stimulus, the mayor said. It is in "dire, dire shape," without action from Washington, he said. The mayor said the city is trying to avoid more layoffs but that without federal help, more "could well be on the table." (Bloomberg)

- The U.S. government isn't liable for losses on $3 billion in Puerto Rico pension bonds, a federal judge said Monday, rejecting efforts to put U.S. taxpayers on the hook for compensating investors. Judge Richard A. Hertling of the U.S. Court of Federal Claims said bondholders can't hold the U.S. government responsible for losses they may incur in the court-supervised restructuring of Puerto Rico's debts. A federally appointed oversight board has been steering that restructuring since 2016, part of a broader push to rehabilitate the U.S. territory's public finances. (WSJ)

- Food prices at US grocery stores and restaurants are now

forecast to increase slightly more in 2020 than previously

expected, as some food price categories continue to decline slowly

from their spike earlier this year at the onset of the COVID-19

pandemic, according to USDA's Economic Research Service (ERS). (IHS

Markit Food and Agricultural Policy's Richard Morrison)

- For 2020, ERS now sees food-at-home (grocery store) prices rising 3.0% to 4.0% in 2020, up from ERS' previous forecast for a rise of 2.5% to 3.5%. For 2021, ERS forecasts grocery store prices will increase 1% to 2%, the same as its October estimate.

- Meanwhile, food-away-from-home (restaurant) prices are seen increasing 2.5% to 3.5% in 2020, ERS said, up from the prior forecast of a 2% to 3% increase. For 2021, the food-away-from-home price increase is seen at 2% to 3%, the same as last month's forecast.

- Continued upward pressure on restaurant prices is in line with pre-pandemic trends which saw restaurant prices "steadily increasing," and slightly above the rise expected for grocery store prices, ERS explained.

- Overall food price inflation is seen at 2.5% to 3.5% for 2020, and 2.0% to 3.0% for 2021—both unchanged from ERS' October forecast.

- Dairy product prices are now forecast to rise 3.5% to 4.5% for 2020, up from the 3% to 4% increase ERS forecast in October.

- For fresh vegetables, ERS noted a 1.1% increase in prices between September and October, putting the year-over-year rise at 4.2% in October. "The price spike from September to October was primarily driven by a 7.2% increase in the price of fresh lettuce over the same period," ERS explained. By contrast, fresh fruit prices are down 1% year-over-year.

- US-based software-as-a-service (SaaS) solution provider Ridecell has raised an undisclosed amount of funding from venture capital firm Fort Ross Ventures. The startup company will use the capital as part of automating and digitalizing its platform, supporting larger customers globally, and accelerating its international growth. Aarjav Trivedi, CEO of Ridecell, said, "The leading fleets in the world were already prioritizing digital transformation. COVID-19 created an urgent need for them to reduce risk and manage costs by enabling key-less digital access to their fleets, self-service touch-less monetization across B2B and B2C business models and automating fleet operations. Ridecell is experiencing an acceleration in opportunities to help new customers and partners quickly meet the shifting consumer and enterprise demand for contactless commerce and fleet operations automation." Ridecell was founded in 2009 to offer a platform for car sharing, ride sharing, and autonomous fleet management. Ridecell says its shared mobility platform helps companies to get their fleet operational rapidly, as well as to maximize efficiencies. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Siemens Energy has partnered with Houston-based ProFlex Technologies to provide spontaneous leak detection services for pipeline operators. As part of the agreement, Siemens Energy gains exclusive access to ProFlex Technologies' digital Pipe-Safe™ leak detection technology. The technology, combined with Siemens Energy's Internet of Things (IoT) system, will enable operators to reduce the environmental risk associated with operating their infrastructure by minimizing unplanned releases of product into the ecosystem. The solution leverages remote pressure monitoring and complex data processing algorithms to rapidly detect and localize pipeline leaks within +/-20 feet of their location. It is particularly relevant for companies that operate aging infrastructure, enabling detection of small leaks in pressurized lines transporting any type of liquid or gas medium (i.e. natural gas, crude oil, water, petrochemicals, etc.). Specific applications include long-distance oil and gas transmission lines (i.e. multi-node systems), production gathering networks at well sites, and offshore production risers. Using complex data processing algorithms at the monitoring nodes, pressure pulses created by leaks are identified, and leak locations can be accurately determined. This data can be transmitted to mobile devices or back to a central location using the cloud-based technology. Immediate actions can be taken to repair leaks. The IoT-based approach has broad applicability and is suitable for use with any asset type, including new installations and existing assets. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

Europe/Middle East/Africa

- Most European equity markets closed modestly lower; UK -0.3%, Germany/France -0.1%, and Spain/Italy flat.

- 10yr European govt bonds closed mixed; UK +2bps, France +1bp, Germany/Spain flat, and Italy -1bp.

- iTraxx-Europe closed -1bp/51bps and iTraxx-Xover -6bps/276bps

- Brent crude oil closed +2.4%/$46.04 per barrel and is only 0.3% below the recent five-month high close of $46.16 per barrel on 26 August.

- On 20 November, the European Commission launched a public

consultation on how the EU will classify some of the green

investments for the bloc's main economic sectors, including

agriculture. (IHS Markit Food and Agricultural Policy's Steve

Gillman)

- This consultation will feed into the new 'EU Taxonomy Regulation', which aims to direct sustainable investment in line with the bloc's "climate change adaptation, biodiversity and the circular economy objectives".

- The regulation tasks the Commission with defining the criteria for sustainable investments and the public consultation will examine which economic activities can qualify in the areas of climate change mitigation and climate change adaptation.

- For agriculture, investments could be considered green if they strengthen land carbon sinks through measures such as avoiding deforestation and forest degradation, restoration of forests, sustainable management and restoration of croplands, grasslands and wetlands, afforestation, and regenerative agriculture.

- The EU rules are also planned to apply to sustainable agricultural practices that contribute to enhancing biodiversity or to halting or preventing the degradation of soils and other ecosystems, and habitat loss.

- For energy investments to be classified as sustainable, the Commission has set that they should go to projects emitting under 100g of CO2/kWh, which rules out most fossil fuels but allows for some gas infrastructure.

- The public consultation process will run until 18 December, after which EU member states and the European Parliament will have two months to raise any objections. If they do not, the text will enter into force and the definitions can become legally binding in the EU.

- There will be four other objective areas examined in a similar way - sustainable use of water and marine resources, circular economy, pollution prevention and healthy ecosystems.

- The flash IHS Markit/CIPS composite UK PMI, based on around 80%

of normal monthly replies, slumped from 52.1 in October to 47.4 in

November, signaling a deterioration of business activity after four

months of expansion. (IHS Markit Economist Chris Williamson)

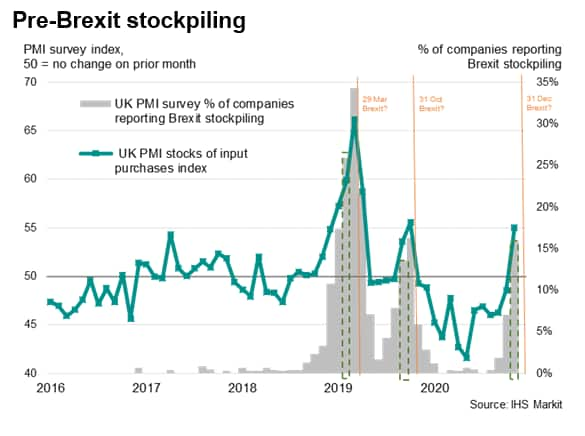

- The decline was considerably less severe than markets had been expecting, with a reading of 44.1 anticipated according to Reuters polling. Although hospitality sectors saw business collapse amid the new virus containment measures, some respite came in the form of a temporary boost to manufacturing from pre-Brexit stockpiling.

- The decline takes the PMI's composite output index to a level historically consistent with GDP contracting at a quarterly rate of approximately 0.3%, but - as seen during the height of the first lockdown in the second quarter - the actual hit to GDP from enforced closures of many businesses may be considerably greater.

- Looking in the detail of the November flash PMI, the decline was led by a collapse of business activity in the hotels, bars & restaurants sector amid enforced temporary closures, with other consumer-facing services, travel and transport also suffering steep drops in activity, albeit with rates of decline not quite as severe as seen during the spring lockdown.

- Financial services activity meanwhile also fell for the first time since May and business service providers reported the weakest expansion since the recovery from the first lockdown began in June.

- Total service sector activity consequently fell sharply, dropping for the first time since June. The sector's business activity index deteriorated from 51.4 in October to 45.8 in November.

- In contrast to the steep loss of output in the services sector, manufacturers reported faster production growth during November, albeit with the expansion often linked to a temporary boost from stockpiling ahead of the end of the UK's Brexit transition period on 31st December. Output rose for a sixth straight month, with the rate of increase picking up slightly, though remaining below the highs seen during the summer. The factory output index rose from 55.8 to 56.3, helping push the headline PMI up to 55.2, it's joint-highest in nearly three years.

- Disappointingly, the upturn in sentiment about the year ahead was not matched by increased hiring. In fact, job losses accelerated during the month to the fastest since August. Job losses in manufacturing eased to a nine-month low but remained high by historical standards, while headcounts were cut at an increased rate in the service sector.

- A rising number of manufacturers meanwhile reported that

worries over Brexit led to increased stockpiling of inputs, which

also temporarily boosted demand at firms supplying these inputs to

other companies. Roughly 16% of manufacturers citied Brexit as the

cause of higher stocks of inputs, which rose in November to the

greatest extent since October 2019, ahead of the first Brexit

'deadline' which was subsequently postponed.

- Hyundai and London-based chemicals company Ineos have signed a memorandum of understanding (MOU) to explore new opportunities to accelerate the global hydrogen economy, according to a Hyundai press release. Under the MOU, the two companies will jointly investigate opportunities for the production and supply of hydrogen as well as the worldwide deployment of hydrogen applications and technologies. Both companies will initially seek to facilitate public- and private-sector projects focused on the development of a hydrogen value chain in Europe. They will also evaluate Hyundai's proprietary fuel-cell system for the recently announced Ineos Grenadier 4×4 vehicle. This co-operation represents an important step in Ineos' efforts to diversify its powertrain options at an early stage, according to Hyundai. The Grenadier is expected to be built at a former Mercedes-Benz plant in France, having earlier been slated for production in the United Kingdom. IHS Markit currently forecasts that production of the Grenadier will begin at Hambach in late 2021, with volumes peaking at over 17,000 units during 2023. (IHS Markit AutoIntelligence's Jamal Amir)

- The flash IHS Markit Eurozone Composite PMI® slumped from 50.0

in October to 45.1 in November, its lowest since May. With the

exceptions of the declines seen in the first two quarters of this

year, the average PMI reading of 47.6 in the fourth quarter so far

is the lowest since the closing quarter of 2012 (during the

region's debt crisis) and indicative of a steep decline in GDP.

(IHS Markit Economist Chris Williamson)

- The deteriorating performance was broad-based, albeit with the service sector hardest hit from virus containment measures. While manufacturing output growth merely slowed in November to the lowest since the start of the sector's recovery back in July, attributable to a marked slowing in order book growth, service sector output fell for a third month running, with the rate of decline accelerating sharply to the fastest since May.

- Inflows of new orders rose in manufacturing at the slowest rate recorded over the past five months, while new business placed at service providers collapsed to an extent not seen since May. Hospitality, travel and consumer-facing companies reported especially weak demand due to additional measures implemented by various governments across the region amid second waves of virus infections.

- At 39.9, the flash composite PMI for France fell from 47.5 to indicate a third successive monthly decline in business activity and the steepest drop since May, acting as a major drag on the region as a whole. A third, and accelerating, month of services decline was accompanied by a downturn in factory output for the first time since May.

- Germany, in contrast, continued to expand, albeit with the flash composite PMI dropping from 55.0 to 52.0 to register the weakest expansion since the recovery began in July. Although manufacturing output growth eased, it remained among the highest seen over the survey's history. However, service sector activity fell for a second month running, contracting at the sharpest rate since May.

- Employment meanwhile fell across the eurozone as a whole for a ninth consecutive month, with the rate of job losses holding steady on the post-pandemic low seen in October.

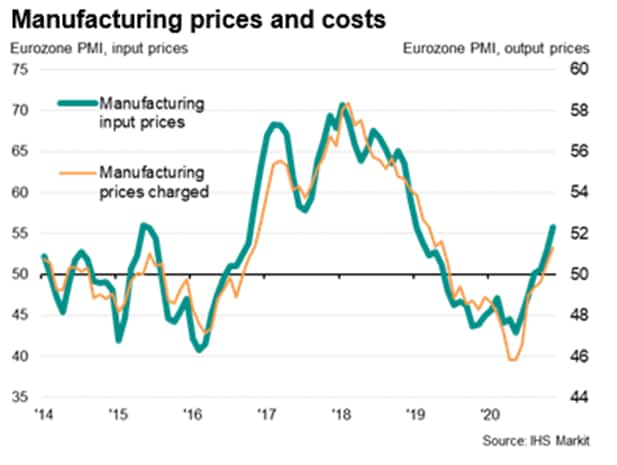

- With demand having weakened, companies increasingly sought to boost sales via discounts, causing average selling prices for services to fall at an increased rate in November, though goods prices rose modestly, registering the largest increase since May 2019 due to higher input costs. Manufacturers reported the steepest rise in average input prices since January 2019, often linked to rising demand and widespread shortages for many key raw materials. Delivery times lengthened to the greatest extent since May.

- Looking ahead, business expectations about the coming 12 months

recovered most of the slump seen in October to run at the second

highest since February. Manufacturers were especially upbeat, with

confidence rising to the strongest since March 2018, though service

providers also grew more optimistic about the year ahead, commonly

attributed to encouraging news of vaccine developments in recent

weeks.

- Daimler and Geely have announced another major collaborative project that will further strengthen the ties between the two companies. According to a company statement, the two firms will collaborate on developing a highly efficient conventional powertrain system that will support both companies' next-generation hybrid vehicle applications. The alliance is focused on enhancing competitiveness through creating significant economies of scale by co-operation in the areas of engineering, sourcing, industrialization and efficiency measures In the statement, it was claimed that both companies will use global R&D networks to work together on a next-generation gasoline (petrol) engine specified for hybrid applications to be produced at the companies' powertrain facilities in Europe and China. The powertrain will potentially be used by Mercedes-Benz together and its joint venture (JV) partners in China, as well as the wider Geely Holding Group portfolio of brands including Volvo Cars. As a result it is also highly likely that the powertrain will end up being exported from China to other markets. To this end, the export of the engine from China is considered to be an option.Markus Schäfer, Member of the Board of Management of Daimler AG and Mercedes-Benz AG; for Daimler Group Research and Mercedes-Benz Cars COO, said, "Our goal continues to be CO2-neutrality. By 2039, our ambition is a completely carbon-neutral new passenger car fleet. The consequent electrification of our powertrain portfolio therefore is an integral part of our drivetrain strategy. To this end, we are systematically converting our portfolio, so that by 2030 more than half of our passenger car sales will be comprised of plug-in hybrids or purely electric vehicles. We are looking forward to the future; when, together with Volvo's ICE unit and Geely, we will further extend our synergies in the field of highly efficient drivetrain systems in China and the world. At Mercedes-Benz, the newly established unit Mercedes-Benz Drive Systems will spearhead the project and create cost efficiencies." This is project strengthens the ties between Daimler and Geely, which announced it was taking a 9.69% stake in Daimler in 2018. At the time it was initially seen as something of a hostile move and was not welcomed by Daimler's management. However, over time Daimler has changed this attitude and now sees the value of an enhanced collaboration with a Chinese OEM to supplement its existing production JV with Beijing Automotive (BAIC). (IHS Markit AutoIntelligence's Tim Urquhart)

- Symrise (Holzminden, Germany) has agreed to acquire Sensient Technologies' (Milwaukee, Wisconsin) fragrance and aroma chemicals activities, comprising a range of aroma molecules and fragrances from natural and renewable sources. The business had 2019 sales of about €77 million ($91 million). Symrise and Sensient have agreed to keep the purchase price confidential. The transaction is subject to antitrust and regulatory approvals and other customary closing conditions. Symrise says the acquisition will strengthen its backward integration and broaden its leadership position as a supplier of fragrance ingredients that are increasingly in demand, especially in personal- and home-care products. The company will also gain access to additional customers and strengthen its presence particularly in EMEA and Latin America. Symrise, meanwhile, plans to strengthen its manufacturing footprint in Spain with targeted investments at a manufacturing site at Granada that is included in the acquisition. Sensient's overall flavors and fragrances business sales totaled $700 million in 2019. The company also has a colors business that generated 2019 sales of $535 million. Symrise had 2019 sales of €3.4 billion. The deal is the second major transaction to be announced in the flavors and fragrances industry in a week, following Croda's acquisition of Iberchem. (IHS Markit Chemical Advisory)

- Passenger car production in Czechia rose the first time on a monthly basis since the outbreak of the COVID-19 virus pandemic, according to a Reuters report. The country's passenger car output for September rose by 2.8% year on year (y/y) to 128,754 units up from last October's 125,211 units. For the first 10 months of the year, car production in Czechia was down by 21% y/y to 937,033 units. (IHS Markit AutoIntelligence's Tim Urquhart)

- Kazakhstan's GDP continued to contract in the third quarter.

Kazakhstan's OPEC+ oil output restriction commitments and the need

for continued lockdown measures due to the regional flare-ups of

the COVID-19 virus pandemic and uncertainty about the recovery of

external demand keep risks related to recovery significant. (IHS

Markit Economist Venla Sipilä)

- According to preliminary, quarterly national accounts data from the State Statistics Committee, Kazakhstan's GDP in January-September 2020 contracted by 2.8% year on year (y/y) in real terms. This implies contraction of 4.4% y/y in the third quarter, following a slide of 5.7% y/y in the second quarter.

- Economic contraction slowed down even as gains in the GDP deflator accelerated. The deflator increased by 4.1% in January-September, following an increase of 1.2% y/y in the first half of the year.

- Growth in the industrial sector dwindled to just 0.2% y/y in the first nine months of the year. Coming after growth of 3.2% y/y in the first half of 2020, this implies expected y/y contraction in the third quarter.

- With expansion nearly halting, the GDP-share of the industrial sector eased further, although it remained above 29%. Even with some deceleration in growth, the construction sector retained its position as the sector expanding by far the fastest, its January-September growth rate lifting its GDP-contribution further, to 6.2%.

- Growth in the agriculture sector accelerated to 5.0% y/y from 2.4% y/y in the first half, lifting the sector's GDP-share to over 5%. The success was partly driven by rising crop output.

- The contraction of 6.1% y/y in the service sector as a whole signals deteriorating performance in the third quarter. Consequently, their share of GDP in January-September fell to 53.3%, from nearly 56% in the first half.

- Third-quarter economic performance benefited from the recovery of oil prices; the average price of Brent crude oil in the third quarter averaged USD42.82 per barrel (pb), compared to USD29.58 pb in the second quarter.

- According to the Minister of National Economy Ruslan Dalenov, quoted by Interfax, budget revenues excluding transfers are now expected at KZT6.539 trillion (USD15.3 billion), up from KZT6.414 trillion, while the guaranteed transfer from the National Fund remains at KZT4.77 trillion, With total revenues rising to KZT12.0 trillion, and budget spending increasing to KZT14.475 trillion, up from KZT14.270 trillion, the targeted budget deficit remains at 3.5% of GDP.

- Autonomous vehicle (AV) sensor manufacturer Luminar Technologies will supply its laser-based LiDAR sensors to Mobileye for the latter's robotaxi fleet. LiDAR sensors are necessary for AV operations as they measure distance via pulses of laser light and generate 3D maps of the world around them. Luminar will deploy its LiDAR sensors in Mobileye's AV hardware and software system, which also uses radar and surround-view cameras, reports Reuters. Mobileye, an Israeli-based company acquired by US chipmaker Intel, develops advanced perception systems that enable drivers to detect nearby vehicles, other road users, and unexpected hazards. Recently, Intel acquired Israeli public transit app Moovit to help Mobileye develop robotaxis, with plans to launch them in early 2022. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The South African Reserve Bank's (SARB) monetary policy committee (MPC) left the central bank's key policy rate, the repo rate, unchanged at 3.5% during its November meeting. The SARB's Quarterly Projection Model (QPM) shows a 25-basis-point hike in the repo rate during the third and the fourth quarters of 2021. (IHS Markit Economist Thea Fourie)

Asia-Pacific

- APAC equity markets closed higher across the region; South Korea +1.9%, Mainland China +1.1%, India +0.4%, Australia +0.3%, and Hong Kong +0.1%.

- General Motor (GM)'s brand Buick has launched vehicle-to-everything (V2X) technology in China. The technology is designed to enable vehicles to communicate with other vehicles and infrastructure, thereby improving safety and reducing traffic congestion. Initially, the V2X technology will support eight safety applications: Emergency Braking Warning, Control Loss Warning, Abnormal Vehicle Warning, Intersection Collision Warning, Speed Limit Warning, Signal Violation Warning, Hazard Location Warning, and Green Light Optimization Speed Advisory. Molly Peck, executive director of Buick sales and marketing at the SAIC-GM joint venture, said, "Buick is showing a strong presence with our most advanced portfolio ever in Guangzhou. From electrification to connectivity to future mobility, Buick is riding an unprecedented technology wave to strengthen its market leadership and bring the greener, safer and more intelligent future a step closer to our customers in China." China is planning to roll out 5G technology across major cities and is expected to introduce regional standards for V2X technologies. V2X facilitates the operation of advanced driver-assistance systems (ADAS) and is designed to be compatible with 5G technology. Buick claims it will be the first brand in China to officially launch market-ready V2X technology on a production vehicle later this year. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Tata Motors has announced that it has achieved a 4-million-unit sales milestone for its passenger vehicle business, according to a company statement. The automaker released a video to commemorate the occasion showcasing its journey since inception in 1945. Vivek Srivatsa, head of marketing of the passenger vehicle business unit (PVBU) at Tata Motors, said, "Historically, Tata Motors has always broken barriers and created new benchmarks by consistently bringing innovative products that cater to the 'Indian' customer, thus contributing to an 'Atmanirbhar' or a 'self-reliant' India, since the very beginning. Our recently launched BS6 range of products further solidifies our commitment towards our customers, as we prepare ourselves to not only become future ready by staying New Forever but by also carving the road to safer mobility in India." (IHS Markit AutoIntelligence's Isha Sharma)

- Alternative-powertrain car registrations in South Korea jumped 34% year on year (y/y) to 766,464 units as of end-October, accounting for 3.16% of vehicles registered in the country, reports the Yonhap News Agency, citing data released by the South Korean Ministry of Land, Infrastructure and Transportation (MLIT). This is the first time that the share of alternative-powertrain cars has exceeded the 3% mark; its share has been increasing steadily and reached 1.99% in 2018 and 2.54% last year. Of the total alternative-powertrain car registrations, hybrids registrations grew 29.5% y/y to 628,164 units, electric vehicle (EV) registrations surged 54.4% y/y to 128,258 units, and fuel-cell electric vehicles (FCEVs) registrations increased 154.1% y/y to 10,041 units. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korea will begin testing autonomous public transportation and delivery services in six regions, reports Pulse News Korea. The Ministry of Land, Infrastructure, and Transport has selected the six regions - Seoul, North Chungcheong Province, Sejong, Gwangju, Daegu, and Jeju - for companies to conduct these trials. These regions are designated as regulation-free special zones to allow private companies to test their autonomous vehicles (AVs) for various applications. In Seoul, autonomous shuttle buses will travel on a 6.2-square-km area and in North Chungcheong Province a bus rapid transit (BRT) shuttle will operate on a 22.4-km road. Sejong will test a demand responsive transport (DRT)-based circulation shuttle bus and Gwangju will test an autonomous road cleaning car and a garbage truck. Daegu will test shuttle bus and DRT taxi services and Jeju will operate an autonomous shuttle bus. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-23-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-23-2020.html&text=Daily+Global+Market+Summary+-+November+23%2c+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-23-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - November 23, 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-23-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+November+23%2c+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-23-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}