Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 09, 2020

Daily Global Market Summary - 9 December 2020

Most APAC equity markets closed higher except for Mainland China, while European markets were mixed and major US indices were lower. US government bonds closed lower and the curve steepened, and benchmark European bonds were mixed. European iTraxx credit indices were flat across IG/high yield and CDX-NA indices were modestly wider on the day. WTI, gold, and silver were lower and copper closed higher. The midsized US stimulus bill appears to be making progress, but challenges still exist relating to the Democrat's provisions for state and local government aid and Republican's push to shield entities from COVID-19 related operating liabilities.

Americas

- US equity markets closed lower; Nasdaq -1.9%, Russell 2000/S&P 500 -0.8%, and DJIA -0.4%.

- 10yr US govt bonds closed +2bps/0.94% yield and 30yr bonds +3bps/1.69% yield.

- CDX-NAIG closed +1bp/52bps and CDX-NAHY +3bps/300bps.

- DXY US dollar index closed +0.1%/91.09.

- Gold closed -1.9%/$1,839 per ounce, silver -3.0%/$23.99 per ounce, and copper +0.3%/$3.51 per pound.

- Crude oil closed -0.2%/$45.52 per barrel.

- The Federal Trade Commission and a bipartisan group of 46 states filed broad antitrust lawsuits against Facebook Inc. on Wednesday, alleging the social-media giant engaged in a years long campaign to buy up or freeze out nascent technology companies that one day might have become rivals. The FTC's case is its most ambitious in recent memory and seeks to unwind Facebook's prior acquisitions of the photo-sharing app Instagram and messaging service WhatsApp. It comes just weeks after the Justice Department brought an antitrust lawsuit targeting Google's flagship search business. Each federal agency now has its own once-in-a-generation case at the same time, a signal of the level of U.S. concern about the power of dominant online platforms. (WSJ)

- California reported 30,851 new COVID-19 cases, topping the record of 30,075 set over the weekend. The average rate of positive tests over 14 days reached 8.8%, the highest since the spring. Hospitalizations jumped 3.8% in the past 24 hours to a record to 11,965 patients. With cases soaring, much of the state is now in lockdown as officials warn of intensive-care units becoming overwhelmed. (Bloomberg)

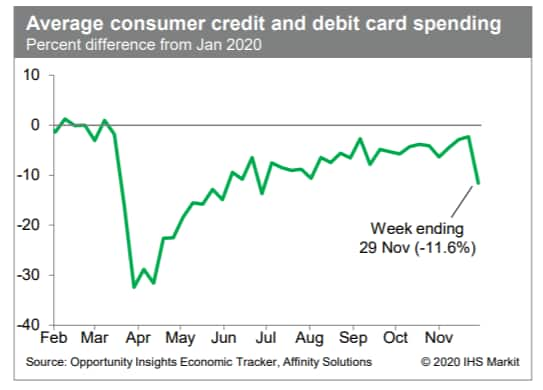

- Average consumer credit- and debit-card spending during the

week ending 29 November was 11.6% below the January average,

according to the Opportunity Insights Economic Tracker, down

sharply from prior weeks. This could reflect unusually low "Black

Friday" shopping, much of which may have occurred online in

surrounding days (and weeks). Meanwhile, the IHS Markit

GDP-weighted US weekly containment index rose 3.9 index points this

week to a value of 50.6. Nearly three-quarters of the increase

reflected new restrictive measures in California, with the balance

accounted for by tightening conditions in five other states (Ohio,

Colorado, Oregon, Rhode Island, and Maine). The increase in the

containment index this week extended a string of increases over the

last eight weeks, as new COVID-19 cases have been surging, and was

by far the largest increase over this period. (IHS Markit

Economists Ben Herzon and Joel Prakken)

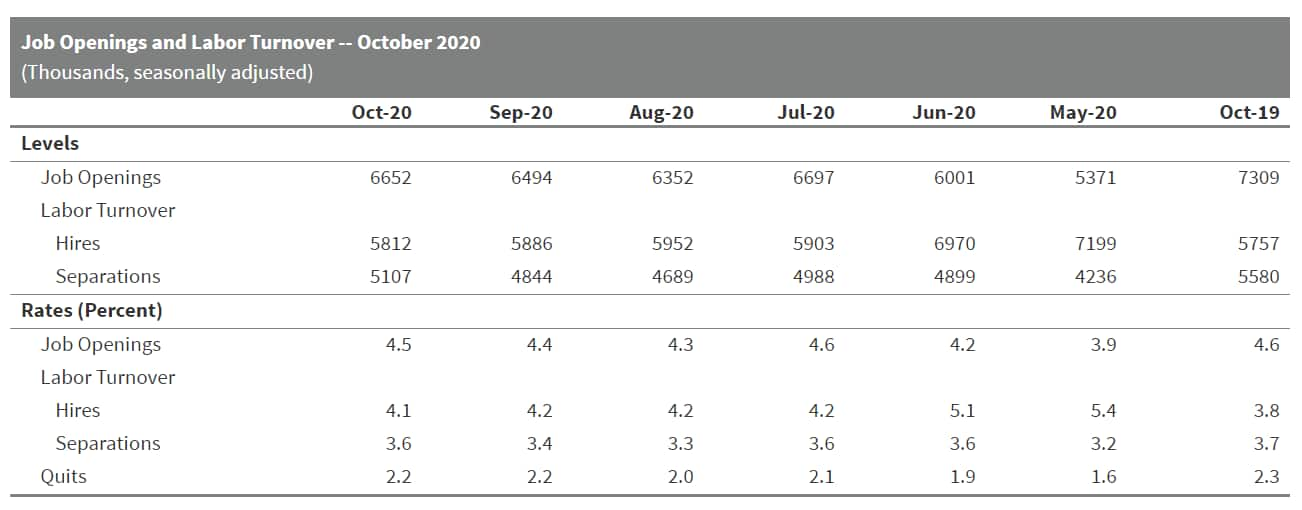

- The October JOLTS report suggests that the labor market

recovery is losing steam, with employment still short of the

pre-pandemic peak. The number of hires edged lower to 5.8 million

and the number of job openings edged up to 6.7 million in October.

Both are hovering near their long-term pre-pandemic averages. (IHS

Markit Economist Akshat Goel)

- Job separations rose to 5.1 million in October but are well below the all-time high of 10.0 million reached in April.

- The layoffs and discharges rate edged up to 1.2% in October. The quits rate, a valuable indicator of the general health of the labor market, was unchanged at 2.2%, just shy of the two-year pre-pandemic average of 2.3%.

- Over the 12 months ending in October, there was a net employment loss of 5.7 million.

- There were 1.7 workers competing for every job opening in

October. In the two years prior to the pandemic, the number of job

openings exceeded the number of unemployed in every report.

- Mitsubishi Chemical says it has acquired a greenfield property at a large integrated site at Geismar, Louisiana, and plans to advance a feasibility study for the design and construction of a 350,000-metric tons/year methyl methacrylate (MMA) plant there. The facility will be the third and largest to employ ethylene-based Alpha production technology developed by Mitsubishi's Lucite International subsidiary. The company in March this year announced its intention to build an Alpha MMA plant on the US Gulf Coast but it did not disclose the project's location. Mitsubishi says the location at Geismar is suitable due to readily available key raw materials, logistics infrastructure, integrated services, and a skilled workforce. The project is in the early engineering stage and scheduled for a final investment decision in early 2022. If approved, the plant would commence production in 2025. The two existing Alpha MMA plants are a wholly-owned Mitsubishi unit in Singapore and a joint venture with Sabic at Jubail, Saudi Arabia. Mitsubishi announced in November that it would close an MMA plant on the US Gulf Coast. It said it had decided to end production of MMA and methacrylic acid at Beaumont, Texas, in an effort to boost competitiveness. Production at this plant will be terminated on 28 February 2021. It has the capacity to produce 135,000 metric tons/year of MMA. (IHS Markit Chemical Advisory)

- A Tesla US Securities and Exchange Commission (SEC) filing indicates the company will sell common shares to raise USD5.0 billion, through an Equity Distribution Agreement with several banks and securities companies authorized to sell shares of common stock through an "at-the-market" offering up to USD5.0 billion. This funding round is the third time Tesla has gone this route in 2020, as it looks to generate cash to support capital investment in new German and US assembly plants, as well as in new products like the Cybertruck. Tesla took similar actions in September and February 2020, raising USD5 billion and USD2 billion, respectively. According to Tesla's SEC filing, at close of the NASDAQ where its shares are traded, common stock was valued at USD641.76 per share. At the end of the third quarter of 2020, Tesla's financial reporting indicated it had USD14.5 billion of cash and cash equivalents on hand. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US chemical production is regaining momentum after the first-half shocks linked to the global COVID-19 pandemic, according to ACC's Year-End 2020 Chemical Industry Situation and Outlook. US chemical production volume excluding pharmaceuticals is expected to fall by 3.6% in 2020 followed by growth of 3.9% in 2021. The US decline is the sharpest since the 2008 and 2009 financial crisis. Global chemical volumes are expected to fall 2.6% in 2020, the largest drop in at least 40 years, followed by a 3.9% rebound next year. "The post-pandemic outlook is for broad-based growth in chemicals supported by solid fundamentals," said Martha Moore, senior director of policy analysis and economics at ACC. "Growing customer demand, stabilizing export markets, and a competitive edge linked to domestic supplies of shale gas and natural gas liquids (NGLs) are among the factors pointing to continued gains in U.S. chemistry." US basic chemicals demand fell 1.3% in 2020 helped a bit by continued growth in plastic resins, one of the areas to maintain positive growth, up 0.9%, this year. Basic chemicals should rebound with 5% growth in 2021, led by 6.9% growth for plastic resins. US specialties volumes were down 10.8% in 2020 as lockdowns were especially negative for oilfield chemicals, rubber processing, foundry chemicals, and printing ink sectors. Specialty volumes are forecast to improve 2.4% in 2021 led by recovery in rubber processing, antioxidants, plastic compounding, catalysts, plastic additives, and lubricant additives. (IHS Markit Chemical Advisory)

- There was no change to any of the Bank of Canada's interest

rates. Plus, in conjunction with the extraordinary forward

guidance, large-scale asset purchases of at least $4 billion per

week will continue as needed. (IHS Markit Economist Arlene Kish)

- Canada's third-quarter economic bounce was within the bank's expectations. Going forward, the outlook remains "choppy" as fast-rising daily COVID-19 counts and current containment measures will weaken growth momentum heading into next year until the wide distribution of a vaccine, which should strengthen demand and the economic recovery.

- The Bank of Canada will keep the overnight rate at 0.25% until the inflation rate hits 2% on a sustainable basis, which is expected in 2023.

- The economic and inflation outlooks are generally aligned with the Bank of Canada's expectations of a couple of months ago. The development of effective vaccines provides support for strengthening demand, but the uncertainty regarding the global and domestic distribution of the vaccine against the backdrop of the virus's rapid spread, deepening the severity of the pandemic, poses a risk of some "set back recoveries" in many regions. In contrast, monetary policy remains accommodative and prices for many commodities are rising, supporting the outlook for Canada.

- Inflation is low, with higher prices for some food items driving a slight acceleration in inflation to 0.7% in October. Core inflation measures remain below 2%. While the economic data suggests that the economy is on track to expand in the final quarter of the year, another round of restrictions, now expanded into 2021 in some regions, weighs on the outlook. Excess capacity will keep price pressures muted for a while longer.

- In a press release, Canadian Natural Resource Limited announced its 2021 capital budget of C$3.2 billion. That compares with revised 2020 capital budget of C$2.7 billion, announced in May 2020. The company slashed its 2020 capital budget to around C$2.7 billion in response to the commodity price volatility and global COVID-19 situation, down about 33% from its original capital budget of C$4.05 billion, announced in December 2019. The 2021 budget allocates C$1.345 billion to conventional and unconventional assets and $1.86 billion to long life low decline assets. The company is targeting 1,190,000-1,260,000 boe/d of production in 2021 (78% crude oil, Synthetic Crude Oil and NGLs), up 5% from 2020 forecasted levels. Crude oil, Synthetic Crude Oil, NGL production is targeted to be in range from 920,000 b/d to 980,000 b/d. Long life low decline production is targeted to be approximately 81% of total liquids production. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- November auto sales in Mexico continued to decline owing to the COVID-19 virus impact. However, as the US looks to replenish inventory, production (up by 1.4%) and exports (up by 4.7%) gained in November. In the YTD, production, sales, and exports were all down compared with the same period of 2019, and production of passenger cars continued to decline as LCV production improved. Mexico's overall light-vehicle sales declined in 2018 and 2019, and 2020 had started off soft prior to the pandemic. November demand posted a double-digit decline, while YTD results were still down by 28.9%. The latest forecast revision projects that the country's full-year sales will fall by 29.2% to 934,498 units. IHS Markit forecasts production in Mexico to slip to 3.03 million units in 2020, compared with 3.82 million units in 2019. The decline in production is also less sharp than had been expected earlier in 2020. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Chile's central bank maintained its monetary policy rate at

0.5% during its 7 December meeting and the use of non-conventional

liquidity and credit support. IHS Markit projects that the stimulus

will be maintained through 2021. (IHS Markit Economist Claudia

Wehbe)

- After accelerating since July, monthly inflation fell by -0.1% in November, mainly driven by a downturn in the categories of apparel and shoes, and housing and basic services. Annual inflation decelerated to 2.73% from 2.95% during October.

- During October, Chile's monthly economic indicator (a proxy for GDP) contracted by 1.2% year on year (y/y), a milder drop than the September -4.8% result. The non-mining sector fell by -1.5% y/y while the mining sector recovered by 1.6% y/y.

- The decline in services and goods production was mainly due to limits in mobility and disruptions to business activity; although commerce contributed positively, the overall growth result was negative. The seasonally adjusted broad indicator contracted by 0.5% during October compared with the September result, amid modest contractions in both the mining and non-mining sectors.

- IHS Markit forecasts that Chile's central bank will maintain its policy rate into the beginning of 2022, while the non-conventional measures that provided liquidity to markets and stimulated credit flow to the economy during the pandemic - equivalent to approximately 20% of GDP - will be extended as needed.

- Inflation is projected to remain below or close to the inflation target through 2022. Inflationary pressures are expected to be contained on the back of excess production capacity and high unemployment rate, which stood at 11.6% in the August-October moving quarter - down from the 12.3% recorded in the moving quarter ended in September. IHS Markit predicts a milder recession for 2020; currently our projection for real GDP growth stands at about -6.0% for 2020 as various sectors gradually open up again, with the average growth at approximately 4.5% in 2021-22.

Europe/Middle East/Africa

- European equity markets closed mixed; Germany +0.5%, Spain/UK +0.1%, France -0.3%, and Italy -0.4%.

- 10yr European govt bonds closed mixed; France +1bp, Germany/UK flat, and Spain/Italy -1bp.

- iTraxx-Europe closed flat/47bps and iTraxx-Xover flat/241bps.

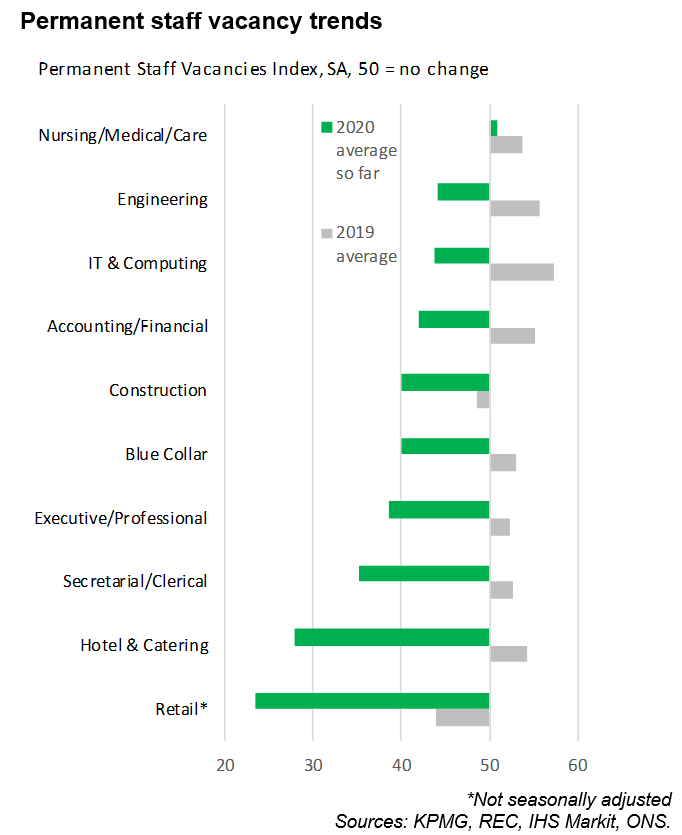

- The latest KPMG and REC UK recruitment survey data, compiled by

IHS Markit, highlighted mixed hiring trends in November. A further

drop in permanent placements contrasted with marked growth of temp

billings. Recruiters indicated that the second national lockdown

and ongoing uncertainty regarding the COVID-19 pandemic led clients

to opt for short-term staff until the outlook brightened and

businesses were operating at more normal levels. (IHS Markit

Economist Annabel Fiddes)

- Weaker levels of business activity were highlighted by the latest UK PMI survey releases, which also showed employment levels falling sharply. The PMI and Report on Jobs surveys both widely commented on redundancies, as many companies faced weak demand and adopted cost-cutting measures. As a result, overall vacancies fell further, with retail and hospitality the worst affected areas.

- The Report on Jobs survey, which monitors over 400 recruitment consultancies across the UK, provides advance signals of labor market trends. After rising through the third quarter of 2020, permanent staff appointments across the UK fell for the second month running in November as increased COVID-19 infection rates led to a second national lockdown.

- The rate of decline was considerably slower than recorded at the height of the pandemic earlier in the year. Further disruptions to business operations led companies to instead opt for short-term workers, as highlighted by a further marked rise in temp billings, until market conditions begin to normalize.

- The furlough scheme has also meant that the unemployment rate has remained relatively low through the COVID-19 crisis so far. However, as more redundancies have been reported, particularly in consumer-facing sectors such as retail, unemployment has been creeping up in recent months, rising to 4.9% in the three months to September; the highest since Q4 2016. The increase in unemployment was signaled in advance by the substantial increases in staff availability recorded by the recruitment survey in each month since April, which have shown candidate numbers rising at the steepest rate since the global financial crisis.

- Official data have likewise highlighted a marked drop in vacancies since the pandemic hit, and they remain well down on the levels seen this time last year (-34.6% on an annual basis in the three months to October 2020). Encouraging, the recruitment survey data have shown that demand conditions are near stabilizing, however it's likely to still be some time before vacancy numbers fully recover.

- Detailed sector data reveal that consumer-facing sectors such

as retail and hospitality remained the weakest performers in terms

of permanent vacancies, as restrictions continued to severely limit

business operations and customer numbers. In contrast, the

Nursing/Medical/Care sector has seen the most resilience in 2020 to

date and was the only sector that recorded growth of demand on

average through the year.

- Bolt has launched a Zero Emission Transition fund worth GBP250,000 (USD336,082) to support its drivers' switch to electric vehicles (EVs) in London, UK. To achieve this, Bolt has partnered with Ubitricity and Splend to enhance EV infrastructure in the city. Bolt's partnership with Ubitricity will involve deployment of new charging points in London neighbourhoods where its drivers currently reside. Splend will allow Bolt drivers to access a new EV for a reduced deposit and with this, Bolt expects to add 500 more drivers into EV network in the first six months of next year. A portion of the funds will also be spent on developing a tool that will compare the total cost of ownership of fossil fuel vehicles with EVs and on corporate social responsibility initiatives. Sam Raciti, general manager of Bolt, said, "We're confident that the groundwork being laid by our Zero Emission Transition pilot will help identify the mechanics that are most efficient at getting Bolt drivers into electric vehicles, and are excited at the potential benefit this could have for our drivers and the wider city". (IHS Markit Automotive Mobility's Surabhi Rajpal)

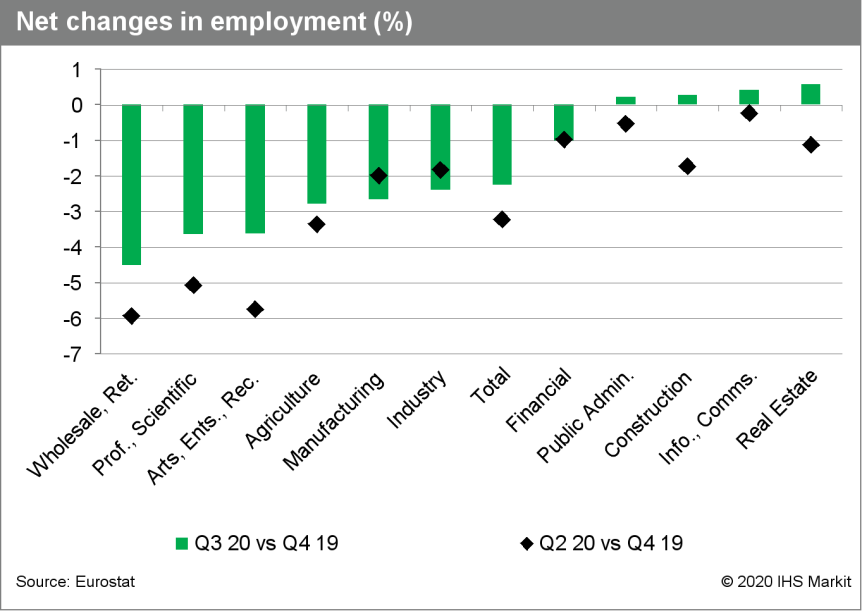

- An initial breakdown of the third-quarter Eurozone employment

sector data highlights outperformance of construction and real

estate and underperformance of retail and recreation. Employment

losses have been particularly large in Spain. (IHS Markit Economist

Ken Wattret)

- Eurozone employment rebounded by 1.0% quarter on quarter (q/q) in the third quarter of 2020 according to Eurostat's second estimate, a slight upward revision from the initially reported 0.9% q/q rise (which exceeded market expectations).

- Still, as this followed successive q/q contractions, including a record 3.0% collapse in the second quarter, eurozone employment remained 2.2% below its fourth-quarter 2019 level despite the third-quarter rebound.

- This translates into a net loss of 3.6 million jobs, following a 5.2-million decline over the first half of the year. By way of comparison, employment fell by 4.2 million cumulatively over the eight quarters from the first quarter of 2008 during the global financial crisis.

- On a year-on-year (y/y) basis, the contraction in eurozone employment eased to 2.3% in the third quarter of 2020, versus a record drop of 3.1% in the second quarter. The peak y/y decline during the global financial crisis was a little over 2%.

- Consistent with variations in economic structure, output losses, and policy support, employment losses have diverged markedly across the eurozone's member states.

- Looking at the largest 11 member states, by far the biggest y/y decline in employment in the third quarter came in Spain (-5.0%), followed by France and Portugal (both -2.6%). The smallest declines were in Belgium (-0.4%) and the Netherlands (-0.5%).

- There have also been significant variations in eurozone employment trends across sectors. Looking at the net adjustments in levels of employment between the fourth quarter of 2019 and the third quarter of 2020, the best-performing areas were real estate, information and communications, construction, and public administration. They all recorded net increases over the three quarters.

- In contrast, the other eight key sectors recorded significant net job losses. The biggest declines by far were evident in wholesale and retail (-4.5%), professional and scientific (3.6%), and arts, entertainment, and recreation (-3.6%).

- Surveys of businesses' employment intentions suggest that the

peak rates of decline in employment are behind us, including IHS

Markit's PMI data, although with the eurozone set for another GDP

contraction in the fourth quarter of 2020, labor market conditions

will remain challenging.

- Germany's Federal Statistical Office (FSO) external trade data

for October (customs methodology, seasonally adjusted, nominal)

reveal export and import increases of 0.8% and 0.3% month on month

(m/m), respectively. The recent underperformance of imports needs

to be seen against the background of the surge in August (5.9% m/m)

- in level terms, exports as well as imports are roughly 6% below

the levels both one year ago and in February 2020. (IHS Markit

Economist Timo Klein)

- The seasonally adjusted trade surplus, which had dipped temporarily to EUR15.4 billion (USD18.7 billion) in August, recovered further to EUR18.2 billion in October, thus approaching its monthly average of 2019 (EUR18.9 billion) anew. This compares with April's near 20-year low of EUR3.4 billion.

- As in September, October's regional breakdown (see table below for details) reveals a relatively uniform picture, with the exception of outperformance by EU countries outside the eurozone. This reflects the above-average economic resilience of Eastern European EU members to knock-on effects of the pandemic during its initial phase.

- With respect to non-EU trade, exports to and imports from China stood out positively at +0.3% and -3.3% year on year (y/y), respectively. In contrast, exports to the United Kingdom declined by 11.7% y/y and imports from there even fell by 17.6% y/y as Brexit foreshadowing effects dampened matters, while trade with the United States has increasingly been hurt by the deteriorating pandemic situation (exports: -10.5% y/y; imports: -18.8% y/y).

- In unadjusted terms, the trade and current-account surpluses both slipped in October versus September. The y/y comparison looks more favorable for the current account, given its increase from EUR19.0 billion in October 2019 to EUR22.5 billion in October 2020 (enabled mostly by an improving balance for services), whereas the surplus for merchandise goods declined from EUR21.3 billion a year earlier to EUR19.4 billion.

- Germany's external trade remained on an upward path in October, but momentum waned compared with preceding months. Foreign demand from China was still very supportive for exports but not as much as in September. The resurgence of COVID-19 cases since October and the ensuing renewed (partial) lockdown in November should lead to a fresh setback for German trade volumes in the near term. However, this must not be overstated because the administrative tightening measures that have been imposed mostly affect the service sector rather than manufacturing, which is much more dependent on functioning international trade.

- US battery start-up QuantumScape, which has the Volkswagen (VW) Group as its major shareholder, says research data show that its latest battery chemistry has the potential to charge twice as quickly as the cells Tesla is using in the Model 3, according to a Bloomberg report. The company's current prototype cell can be charged to as much as 80% of full capacity in 15 minutes, almost twice as fast as a Tesla Model 3. The company's published performance data on its latest battery chemistry suggest that QuantumScape's batteries could offer about 50% more miles than the same battery electric vehicle (BEV) with current commercial battery technology. They also can be charged 800 times with minimal degradation, which is a current industry benchmark. VW made its investment in Quantum Scape on the basis of the start-up's impressive research results in the area of solid state battery chemistry, which is widely tipped as affording a step change in battery electric vehicle cell technology, which will massively boost range and cut charging times. Solid state batteries have a number of advantages over lithium-ion batteries, including low flammability, higher electrochemical stability, higher potential cathodes, and higher energy density as compared to liquid electrolytes. They have the potential to supply more energy than lithium-ion batteries which will increase range, reduce charging times and improve safety. (IHS Markit AutoIntelligence's Tim Urquhart)

- Covestro says it now expects full-year 2020 EBITDA to total €1.44-1.50 billion ($1.74-1.82 billion), compared with previous guidance of €1.20 billion, due to better-than-expected business conditions in the fourth quarter. Relatively strong margins in the polyurethanes and polycarbonates businesses, in particular, are behind the improved guidance. Covestro also expects full-year free operating cash flow to total €400-550 million, compared with guidance of €0-300 million previously, in line with the higher EBITDA guidance. Core volumes are expected to decline 5-6% for the full year, unchanged from the previous forecast. The company has increased its full-year guidance twice since economic conditions began to improve from the sharp COVID-19 downturn in June. The most recent increase in guidance came in October. Covestro reported improving sequential demand trends for the third quarter. In 2019, Covestro generated full-year revenue of €12.4 billion and EBITDA of €1.6 billion. (IHS Markit Chemical Advisory)

- Polish ice cream exports reached EUR179million (USD216.8 million) in value during the first nine months of 2020; 10% higher y/y - with full-year 2020 exports therefore set to break a new record, according to preliminary data from Eurostat. The higher value was achieved due to an increase in ice cream volume sales, which in January-September 2020 increased by 7.3% to 80,500 tons. Around 96% of the volume was destined for the EU, while extra-EU deliveries took a 5% share in the total export volume. Extra-EU exports had a 50% increase to 3,600 tons. The biggest increase was recorded in exports to mature markets, where Polish ice cream was already present, with shipments to Germany increasing by over 14% y/y to 22,000 tons, and to France by 71% to 10,000 tons. Poland ice cream exports, like its consumption, is characterized by seasonality. In 2019, ice cream exports from March to August accounted for 72% of the sales volume for the entire year. For this reason, the export results after eight months of this year, to a large extent show the shape of foreign demand in 2020. There are many indications that it will be record-breaking in history. Much higher demand was also recorded in the UK, where Poland exported 36.3% higher volumes than in the first nine months of 2019 and amounted to 7,100 tons. In the context of the future sales of ice cream to the country, it should be noted that if the EU does not sign a trade agreement with the UK after the end of the Brexit transition period (1 January 2021), an 8% customs duty rate will have to be applied. Like other dairy industries, ice cream business operators had to face the challenges of the development of the COVID-19 pandemic: restricted demand in the foodservice sector, shifts in sales channels and product categories. According to Paweł Wyrzykowski, analyst in the agri-food sector at BNP Paribas Bank Polska, the increased export demand was an opportunity for Polish producers to compensate for the lower domestic retail sales in the first half of the year. According to Nielsen data, the value of retail ice cream sales in the first half of 2020 was 10% lower than in the corresponding period last year. As a result, the revenues of companies involved in the production of ice cream amounted to PLN1.23 billion (USD333.6 million) and were only 0.7% higher than in the previous year, according to Pont-Info data. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- Russia's state technology investment company Rostec has announced a debt consolidation plan regarding loans it has made to AvtoVAZ, according to a Kommersant news agency report. The scheme will effectively write off AvtoVAZ's debt to Rostec, which currently stands at RUB20 billion (USD269.75 million). As a result 50% of the debt will be offset against the debt to OAT, one of AvtoVAZ's main domestic suppliers. The other 50% will be allocated to increase AvtoVAZ's capital, although it will not result in growth of Rostec's stake in AvtoVAZ's charter capital as part of measures to offset mutual claims. The completion of the procedure for writing off the debts is being delayed due to a shift of Netherlands-based Alliance Rostec Auto, which owns AvtoVAZ and operates as a joint venture (JV) between Rostec and Renault, to having a Russian jurisdiction. As a result, Rostec's stake in AvtoVAZ will decrease from the current 32.4% to 25%, in a deal that will improve the company's balance sheet and gearing, which will in turn make borrowing from other sources easier. (IHS Markit AutoIntelligence's Tim Urquhart)

- Aramco and Baker Hughes start construction of non-metallics plant in Saudi Arabia. Aramco and Baker Hughes will own the JV 50/50 and develop and commercialize a broad range of non-metallic products for multiple applications in the energy sector. Both companies signed a memorandum of understanding to create a non-metallics JV in July 2019. Novel's new facility is being developed at King Salman Energy Park (SPARK), in Saudi Arabia's Eastern Province. Initially, the facility will produce onshore non-metallic pipelines, including reinforced thermoplastic pipes, from composite materials. (IHS Markit Upstream Costs and Technology's Helge Qvam)

- South Africa's GDP bounced back by 13.5% quarter on quarter

(q/q) during the third quarter. Economic growth is unlikely to

experience similar strong growth during the fourth quarter. (IHS

Markit Economist Thea Fourie)

- South Africa's real GDP bounced back during the third quarter from a contraction of 16.6% q/q in the previous quarter. The sharp rebound in economic activity during the third quarter was not enough to bring GDP back to the pre-COVID-19 virus level. Instead, the country's headline GDP fell by 6.1% y/y during the third quarter, leaving overall GDP down by 7.9% year on year (y/y) during the first nine months of 2020.

- All sectors in the South African economy recovered from the low base in the second quarter, when harsh COVID-19 virus-related lockdown measures were implemented alongside temporary business closures. Sectors that showed the strongest gains include mining and quarrying (contributing 11.8% percentage points to the third-quarter growth), manufacturing production (16.2 percentage points), and the wholesale and retail trade sectors (14.1 percentage points).

- A strong rebound in household consumer spending (contributing 43.8 percentage points to the third-quarter GDP growth), followed by exports of goods and services (38.2 percentage points) positively affected demand-side GDP growth during the third quarter. A strong inventory drawdown was further mitigated by a lackluster return in import demand for goods and services over the period. Fixed capital formation contributed only a meagre 5.2 percentage points to headline GDP growth during the third quarter.

- The rebound in economic activity during the third quarter exceeded IHS Markit's initial estimates. We have been of the view that fixed capital formation is unlikely to recover strongly in the short term while growth will be propelled by household spending and exports of goods over the period. The slow return in import demand during the third quarter is likely to reflect ongoing global supply-chain disruptions and ultimately leave overall GDP higher than initially expected. Domestic demand and exports have been supported primarily through a drawdown in inventories over the period.

Asia-Pacific

- Most APAC equity markets closed higher except for Mainland China -1.1%; South Korea +2.0%, Japan +1.3%, India +1.1%, Hong Kong +0.8%, and Australia +0.6%.

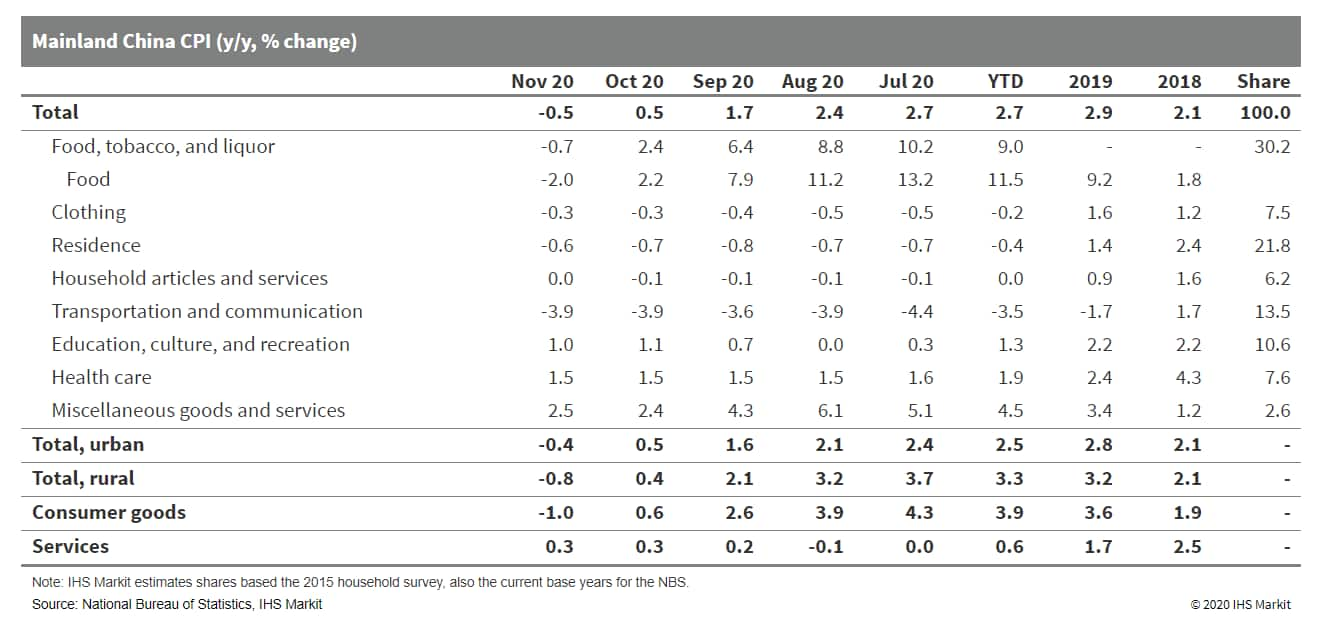

- China's headline Consumer Price Index (CPI) deflation is

largely attributed to the high base effect of pork prices. With

core CPI and services prices remaining in inflation territory and

Producer Price Index (PPI) deflation narrowing, monetary policy is

set to continue to be held stable. (IHS Markit Economist Lei Yi)

- Mainland China's Consumer Price Index (CPI) declined 0.5% year on year (y/y) in November, falling into deflation territory for the first time since 2009, according to a data release by the National Bureau of Statistics. Month-on-month (m/m) CPI inflation continued to edge down to -0.6% m/m, 0.3 percentage point lower than the October reading.

- By component, the 2% y/y food price deflation was the main driver of the headline CPI decline in November. Sustained supply restoration further widened pork price deflation to 12.5% y/y in November, from 2.8% y/y in October. Although overall prices of consumer goods declined 1% y/y, services price inflation remained unchanged from October's reading, at 0.3% y/y. The core CPI excluding food and crude oil rose by 0.5% y/y, unchanged for the fifth straight month.

- PPI deflation narrowed to 1.5% y/y in November, up 0.6 percentage point from October. Month-on-month, PPI inflation increased from 0.0% to 0.5% in November, with 24 out of 40 surveyed industrial sectors reporting month-on-month price gains, doubling the month-ago number.

- The pickup in global oil prices in November supported the improvement in the headline PPI figure. Prices in oil-related sectors, including petroleum and natural gas exploration and fuel processing, rose month on month. Prices in the ferrous metals and non-ferrous metals smelting and pressing sectors increased month on month, with year-to-date price inflation of the latter sector back in positive territory. Price deflation of consumer goods manufacturing further expanded to 0.8% y/y, driven by the disinflation in the food subcategory.

- Cumulatively, the CPI increased 2.7% y/y through November, compared with 3.0% y/y over the first 10 months of 2020. The PPI deflated by 2.0% y/y over the first 11 months of 2020, unchanged from the last release.

- The latest CPI release poses slight downward revision risks to

our full-year CPI forecast, which currently stands at 2.8% y/y for

full-year 2020. Despite the headline deflation in November,

persistent core CPI and services price inflation suggests sustained

economic recovery; this growth momentum is expected to last through

2021. That said, the central bank is unlikely to stray from the

current track of fine-tuning monetary policy just to respond to a

pork price-induced CPI deflation.

- Nestlé entered China's fast-growing market for meat alternatives today (9 December) as it launched its plant-based Harvest Gourmet brand while also inaugurating a new production facility in Tianjin. The Swiss food giant said the range would include chicken nuggets, kung pao chicken, braised meatballs, braised pork belly, sausages and a spicy wok, all of which are a spin on classic Chinese dishes and are designed to be cooked at home. It also includes four products aimed at foodservice customers: burger patties, chicken nuggets, beef mince and pork mince. As demand for meat substitutes grows in China, several other large companies have already made a move into the country's alternative protein market. These include US-based firms such as Beyond Meat and local players such as Starfield. Harvest Gourmet products will be made at a new production facility in Tianjin, which is Nestlé's first plant-based production site in Asia. At a launch event in Beijing, Qureshi said the new launch showed the company's commitment to propelling China to the forefront of plant-based development. Nini Chiang, Nestlé GCR's CMO and Head of Confectionary and Plant-Based Food, went on the highlight how 2020 has seen a surge in interest among Chinese consumers for environmentally-friendly meat alternatives. Harvest Gourmet's official flagship store will officially open on Tmall in December, with plans afoot to gradually enter Hema offline stores in Beijing and Shanghai starting from the end of 2020. Nestlé already has a strong plant-based presence in Europe with Garden Gourmet and in the US with Sweet Earth brands. The group's Harvest Gourmet range is already available in Australia. (IHS Markit Food and Agricultural Commodities' Max Green)

- Volkswagen (VW), along with its joint-venture (JV) partner JAC Motors, will invest CNY20 billion (USD3.06 billion) in an electric vehicle (EV) plant in Hefei, in eastern China's Anhui province, according to China Daily. The plant will be set up by the end of 2022, with vehicles due to roll off the assembly line from 2023. The two partners have also announced that their JV has changed its name to Volkswagen (Anhui) from JAC Volkswagen. With a 75% stake in the JV, VW has taken over management control at Volkswagen (Anhui). The company has also inaugurated its new research and development (R&D) center in China. It is expected to employ 500 engineers and technicians by 2025. VW CEO Dr Herbert Diess said, "Volkswagen Anhui is a promise for stronger partnership and e-mobility power in China. Within the next three years, we can expect state-of-the-art MEB production, a new full-electric portfolio and technology solutions from its R&D center in Anhui. This year's investment of around one billion Euro accelerates the progress within the joint venture. Volkswagen Anhui will strengthen China's role in the electrification and digitalization of the Volkswagen Group." VW aims to expand the local R&D competence in the localization of MEB-based derivatives and to drive global synergies. The new R&D center is expected to play a key role in growing and optimizing the automaker's new-energy vehicle (NEV) portfolio to address the differing needs of Chinese customers. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Headwinds from the resurgence of COVID-19 are likely to weigh

on Japan's near-term recovery, but an economic package announced

recently is likely to support business and employment. (IHS Markit

Economist Harumi Taguchi)

- Japan's real GDP growth for the third quarter was revised up to 5.5% quarter on quarter (q/q; or 23.9% q/q annualized) from 5.2% q/q (or 22.7% q/q annualized), following a 29.2% q/q annualized drop (downward revision from a 28.8% q/q decrease). The historical revision included a benchmark-year revision to 2015 (from 2011) and some methodology changes. The larger-than-expected rebound reflected upward revisions for domestic demand, particularly for private consumption and private capital expenditure. The solid rise in domestic demand was partially offset by a downward revision of imports largely because of the inclusion of copyright services in the national account.

- Private consumption was revised up from 2.1% q/q to 2.6% q/q, largely reflecting stronger rises for spending in durable goods and services. While the improved increase in spending in durable goods was due partially to a downward revision for the second quarter, the upward revision in spending in services reflects the inclusion of September data. The resumption of economic activities in September (in line with easing social distancing guidelines and government subsidies) lifted spending in services such as amusement, eating and drinking, and domestic travel.

- The contraction for investment in housing softened to 5.8% q/q from a 7.9% q/q drop thanks to a change in methodology, as the revision now includes refurbishing and renovation works and the sales margins of built-for-sale houses. While the narrower contraction of capex (down 2.4% q/q from a 3.4% q/q drop) reflected the latest supply-side data, the continued decline was attributed to four consecutive quarters of declining investment in machinery and equipment (down 5.2% q/q) and a 3.7% q/q drop in intellectual property products. These weaknesses were partially offset by a 9.6% q/q rise in investment in transport equipment because of the improved supply chain and the resumption of economic activity.

- While the revision was larger than IHS Markit had expected, we forecast that upward momentum will weaken in the fourth quarter of 2020 and probably in the first quarter of 2021 because the resurgence of COVID-19 is likely to make consumers cautious over the short term. Lockdowns in the European Union and some parts of the US could suppress Japan's exports. Japan's government has suspended travel subsidies for areas experiencing high COVID-19 infections, and regional governors have asked bars and pubs to cut their business hours. Requested guidelines on end-of-year sales have dampened retailers, bars and pubs, and travel-related businesses. The diffusion indices of current and future business conditions in the November Economic Watchers Survey weakened by 8.9 points to 45.6 and by 12.6 points to 36.5, respectively.

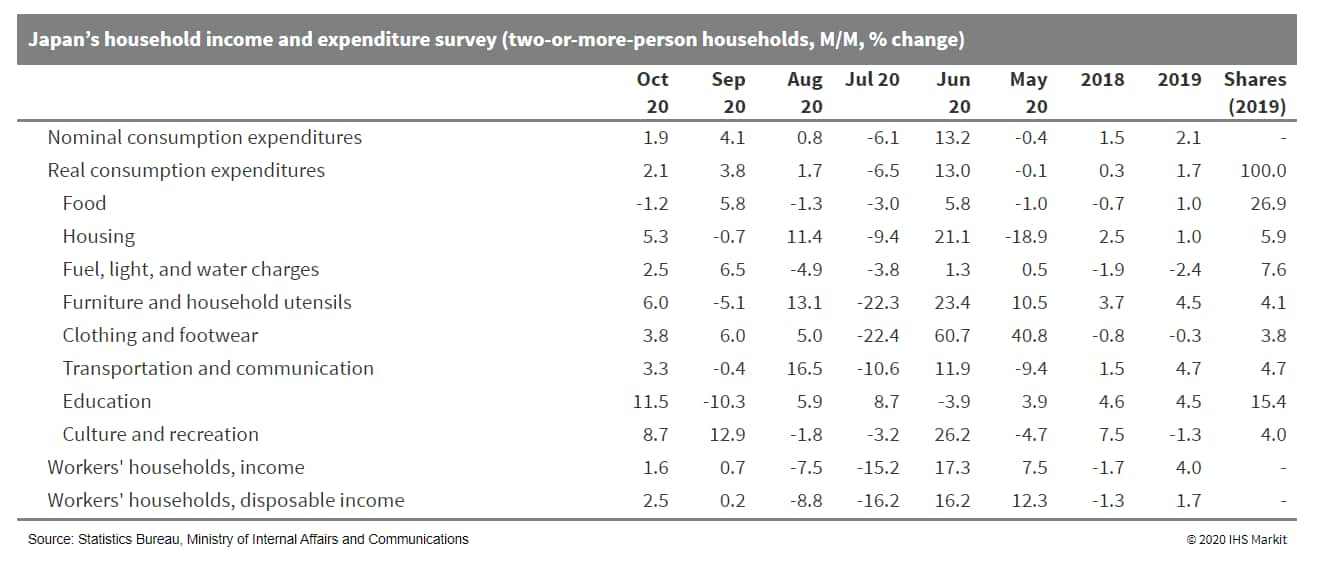

- Japan's real household expenditures rose by 1.9% month on month

(m/m) in October for the third consecutive month of increase.

Year-on-year (y/y) growth also turned positive with a 1.9% rise,

although this was partially due to low base effects, as household

expenditures dropped sharply after the drop-out of front-loaded

demand before the consumption tax increase in October 2019. (IHS

Markit Economist Harumi Taguchi)

- The improvement was largely thanks to continued spending increases in culture and recreation and rebounds in spending for education and medical care, transportation and communication, furniture and household utensils, and housing.

- Monthly nominal cash earnings declined for the seventh consecutive month in October, but the contraction continued to narrow, easing to -0.8% y/y from -1.3% y/y in September. Growth for scheduled cash earnings turned positive with a 0.3% y/y uptick, while the decline in non-scheduled cash earnings continued with an 11.7% y/y drop in line with the resumption of economic activity, which eased decreases in non-scheduled hours worked. However, growth in the number of regular employees softened to 0.6% y/y, reflecting a weaker increase in the number of full-time employees.

- Although the government's travel and other subsidies and easing

social distancing guidelines encouraged consumers to leave their

homes and resume household expenditures in October, the resurgence

of COVID-19 is likely to weigh on the recovery over the short term.

Limits on the operating hours of drinking places and

self-containment measures will dampen wages in eating and drinking

services and living-related service; this could bring headwinds for

the recovery for wages.

- The resumption of industrial production and business activity

led to solid rises in Japan's machinery orders in a broad range of

industries in October. Private capital expenditure (capex) is

likely to start improving. (IHS Markit Economist Harumi Taguchi)

- Japan's private machinery orders (excluding volatiles), a leading indicator for capex, rose by 17.1% month on month (m/m) in October following a 4.4% m/m drop in September. The solid increase reflected growth in orders from manufacturing and non-manufacturing (excluding volatiles), with rises of 11.4% m/m and 13.8% m/m, respectively.

- The improvement in private machinery orders from manufacturing largely reflected rebounds in orders from non-ferrous metals, automobiles, and other transport equipment, as well as continued increases in orders from chemical products, general-purpose and production machinery, and miscellaneous manufacturing groupings. The improvement in orders from non-manufacturing was thanks largely to continued increases in orders from finance and insurance, wholesale and retail trade, and transportation and postal activities.

- The October results were stronger than IHS Markit had expected, and probably mean that the resumption of economic activity has lifted capacity utilization and corporate cash flows. Although private machinery orders are volatile month by month, continued rises in several industries signal that capex will begin to pick up.

- Toyota has launched the completely redesigned Mirai fuel-cell electric vehicle (FCEV) in Japan, according to a company statement. The vehicle has three high-pressure hydrogen tanks, instead of two in the previous model. The compact, high-output fuel-cell stack is located under the hood (bonnet), and the motor and drive battery are in the rear. Optimal placement of the fuel-cell stack, including the hydrogen fuel tank, helps achieve an optimal 50:50 weight distribution between the front and the rear. The model also features a new front and rear suspension system to achieve light and clean steering, a suitable vehicle posture when cornering, and a high-quality, comfortable ride. The 2021 Mirai concept indicates a dramatic shift from the first generation and promises more in terms of user-experience technology, with a redesigned user interface and interior, and a new exterior design language. The automaker debuted the first version of the Mirai in 2014 as the first mass-market hydrogen fuel-cell car. Its sales have increased year on year, rising from about 500 units in 2015 to around 2,477 units in 2019. The upcoming model will be based on the GA-L platform, replacing the existing MC-M platform. Although the Mirai is a low-volume model, Toyota is more concerned about continuing the development of the technology. Currently, the Mirai is sold in Japan, the United States, and certain countries in Europe. According to IHS Markit forecasts, we expect global sales of the Mirai to reach around 1,400 units in 2020 and around 7,400 units in 2021. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Hyundai has signed a memorandum of understanding (MOU) with South Korean-based LS Electric, a power system and automation company, to develop a fuel-cell power generation system, according to a company press release. Under the MOU, Hyundai will provide its proprietary fuel-cell system and technical support, while LS Electric will be in charge of manufacturing a power generation system and building integrated solutions. Hyundai's fuel-cell system is a 95-kW system installed in its Nexo hydrogen electric vehicle and its hydrogen-powered trucks and buses. The two companies plan to introduce a power generation system for pilot projects in 2021, after demonstrating the power plant. "Hyundai Motors is pursuing application to various fields such as passenger cars and commercial vehicles, as well as ships and trains based on the hydrogen fuel cell system. It is the first step toward full-scale expansion," said Hyundai Motor Group executive vice-president and head of the fuel-cell business division, Kim Se-hoon. (IHS Markit AutoIntelligence's Jamal Amir)

- US-based e-commerce giant Amazon is reportedly considering an investment infusion of around USD100 million into Apollo Pharmacy, a standalone business of the Apollo Hospitals Group (India), in a move that would give it "access to Apollo's 3,700 front-end pharmacy business for hyperlocal deliveries", reports local news source The Economic Times. The source cites unnamed sources with knowledge of the deal as stating, "The due diligence just got done and it seems to be a USD100-million investment", and claiming that PricewaterhouseCoopers (PwC) has undertaken the due diligence process. Although reports of a planned investment by Amazon have not been confirmed by the company itself, the speculation comes amid mounting competition in the burgeoning e-pharmacy sector in India. In August, Reliance Industries, an Indian multinational conglomerate company that includes the bio-pharmaceuticals Reliance Life Sciences subsidiary, acquired a majority stake in the online pharmacy outfit Netmeds (India) for INR6.2 billion (USD83 million). Amazon itself had announced its foray into India's online pharmaceutical retail space earlier that same month, with the launch of a trial of a new service, named Amazon Pharmacy, in Bengaluru. In February 2020, Indian management consultancy firm RedSeer Consulting projected that the e-pharmacy sector will grow to a value of around USD16 billion by 2024-25. (IHS Markit Life Sciences' Sacha Baggili)

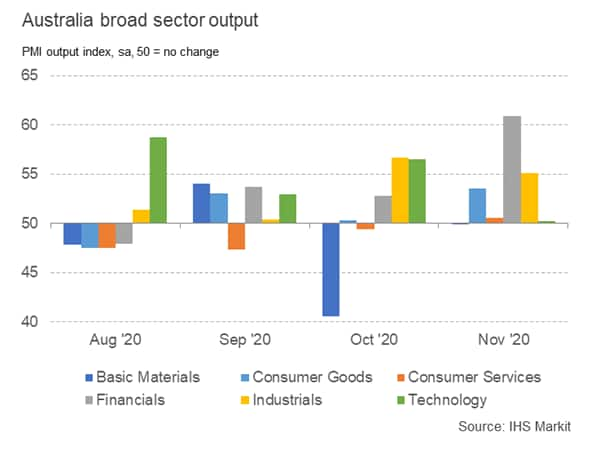

- The Australian economy has, like the rest of the world,

experienced a steep decline in economic activity as a result of

COVID-19 over the course of 2020. However, different parts of the

economy have suffered in different ways and to varying degrees. To

gain a deeper insight into these sectoral trends, we present new,

previously unpublished, PMI data that track business output and

other key metrics across 15 industry sectors. (IHS Markit Economist

David Owen)

- These PMI series include data for six broad industry sectors from our manufacturing and services survey panels where sample sizes are large enough to give a reliable indicator for output trends. Using the IHS Markit sector classifications, these include basic materials, consumer goods, consumer services, financials, industrials and technology.

- In April, when global containment measures designed to reduce the spread of COVID-19 were the most severe, four of the six broad sectors saw record drops in output (since Australia PMI data was first collected in May 2016), with consumer goods registering its sharpest fall during May. Basic materials was the only sector to not see a record downturn in the spring.

- As was also the case for published global and regional sector PMI data, consumer services firms across Australia were notably the worst-hit by lockdown measures during April. That said, when restrictions were eased, consumer services activity rose markedly and at the quickest pace across all six sectors in June.

- Employment PMI data meanwhile showed that consumer services firms also reported the strongest reduction in jobs as a result of lockdown measures in April. Most sectors registered steep declines in employment, with technology the only exception as firms saw a more modest decrease in staffing. Unlike output, however, employment has largely continued to fall, often reflecting efforts among companies to cut costs and reduce excess capacity.

- More recently, PMI data have shown that the economic impact of

the COVID-19 pandemic lessened over the Australian spring, with a

majority of the broad sectors having posted growth in output in

each month since September. Five of the six sectors saw a rise in

output during the latest survey period, while basic materials firms

reported an unchanged level of production. Growth was strongest

across the financial sector, overtaking industrials (which

registered the second-quickest rate of expansion).

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-december-2020.html&text=Daily+Global+Market+Summary+-+9+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 9 December 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+9+December+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}