Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 07, 2020

Daily Global Market Summary - 7 July 2020

Most equity markets closed lower across the globe today, while gold rallied to another multi-year high. US government bonds closer higher and the curve flattened on the flight to quality. iTraxx and CDX credit indices widened across IG/high yield, while both Brent and WTI closed pretty much unchanged on the day. The rolling seven-day average of daily new US COVID-19 cases broke records yesterday for the 28th consecutive day and the growth in cases has been having a measurable dampening effect on US retail traffic for the past two weeks.

Americas

- US equity markets closed lower; Russell 2000 -1.9%, DJIA -1.5%, S&P 500 -1.1%, and Nasdaq -0.9%.

- 10yr US govt bonds closed -3bps/0.65% and 30yr bonds -6bps/1.38% yield.

- CDX-NAIG closed +3bps/71bps and CDX-NAHY +21bps/509bps.

- Crude oil closed almost flat, for the second consecutive day, at $40.62 per barrel.

- Gold futures closed +0.9%/$1,809 per ounce today, breaching a new almost nine-year high.

- Retail traffic in the U.S. was down the most (-82.6% Y/Y) so far in 2020 during the week ended April 18, according to data from the retail consultancy ShopperTrak. From then until the past 14 days, there were slight improvements, but over the past two weeks, retail traffic declines have accelerated once more. The week ended June 27 traffic in the U.S. was down 35.7%, according to ShopperTrak. Last week it was down 39.5% compared with the prior year. (CNBC)

- According to the latest data by FAIR Health's monthly telehealth regional tracer, telehealth claims during April increased by more than 8,335% compared with the previous year. FAIR Health tracked telehealth usage using a database of over 30 billion private medical and dental claims. Telehealth claims by volume represented almost 20% of all claims in April 2020 compared with 0.07% in April 2019. According to the data, the top five diagnoses were for mental health conditions (34.1%), joint/soft tissue diseases and issues (5.8%), hypertension (3.7%), acute respiratory diseases and infections (3.1%), and skin infections and issues (3.0%). Regarding regional discrepancies, the northeast (including New York, New Jersey, Connecticut, Maine, Massachusetts, Vermont, Pennsylvania, and Rhode Island) recorded the most significant jump year on year in April, increasing by about 26,209% compared with the previous year. (IHS Markit Life Science's Margaret Labban)

- The US FDA has issued an emergency use authorization (EUA) for Becton Dickinson's (BD; US) COVID-19 rapid antigen diagnostic test, Veritor System for Rapid Detection of SARS-CoV-2, which can provide results within 15 minutes. The diagnostic test can detect fragments of proteins in samples collected from nasal cavity swabs. Its use is restricted to laboratories that are certified under the Clinical Laboratory Improvement Amendments of 1988 (CLIA) regulations for high, moderate, or waived complexity testing, and for those already using the BD Veritor Plus Analyzer Instrument. This is the second antigen test to garner an FDA EUA for COVID-19, after the agency approved Quidel Corporation's (US) diagnostic in May. Unlike traditional diagnostic tests that rely on amplifying extracted RNA material from the virus over several hours to obtain readouts, the rapid antigen tests detect SARS-CoV-2 nucleocapsid proteins via immunoassays. (IHS Markit Life Science's Margaret Labban)

- The May JOLTS report indicates the number of US hires jumped by

2.4 million to an all-time high of 6.5 million after slumping to an

all-time low of 4.0 million in April. The accommodation and food

services industry accounted for more than 30% of the hires. The

number of job openings increased to 5.4 million in May. (IHS Markit

Economist Akshat Goel)

- Job separations continued to decline; after hitting an all-time high of 14.6 million in March and 10.0 million in April, separations fell to 4.1 million in May.

- The layoffs and discharges rate fell from 5.9% to 1.4% in May; the two-year pre-pandemic average of the rate was 1.2%. The quits rate, a valuable indicator of the general health of the labor market, recovered to 1.6%; it is still significantly below its two-year pre-pandemic average of 2.3%.

- Hires exceeded separations for the first time in three months. However, over the 12 months ending in May, there is still a net employment loss of 11.3 million.

- There were 3.9 workers competing for every job opening in May. With the exception of the last three reports, the number of job openings has exceeded the number of unemployed in every report in the last two years.

- Canada's Ivey Purchasing Managers' Index (PMI) rose 19.1 points

to 58.2 in June, increasing for the second consecutive month and

settling above 50.0 for the first time in four months. (IHS Markit

Economist Alexander Minelli)

- Purchasing managers' spending activity showed a major improvement in June, a reassuring sign that the worst is over as pandemic-related restrictions continue to be loosened.

- The supplier deliveries index grew by 15.7 points to 53.4, indicating faster deliveries compared with May as supply-chain disruptions were remedied.

- The inventories index again rose for the third month from its low in March, increasing 15.0 points to 61.8 as purchasing managers prepare for a rebound in customer demand.

- The employment index further improved by 10.9 points, reaching 52.8, as businesses began to bring back workers, albeit in modified settings to enhance worker safety.

- The prices index, the only sub-index that did not fall below 50.0 in prior months, tacked on 1.5 points to 56.4, indicating mild inflation pressure.

- Volkswagen (VW) AG has met its obligations under the settlement with the US government over the diesel emissions scandal, based on the results of a third and final audit, specifically addressing governance and processes that could increase risk of non-compliance with US and California laws and rules. According to a VW statement, the audit was prepared by the company's independent compliance auditor, Larry Thompson. VW states, "The report did not find any new violations and states that Volkswagen has met its obligations under the Third Partial Consent Decrees with the United States Department of Justice (DOJ) and California Attorney General." Hiltrud D Werner, VW AG board of management member for integrity and legal affairs, commented, "We are proud of the progress we have made to enhance our internal compliance, reporting and monitoring functions. We would like to thank Mr. Thompson and his team for their guidance through the audit and support in satisfying our obligations under the Third Partial Consent Decrees with the U.S. authorities." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Light-vehicle (LV) registrations in Brazil decreased 42.6% year

on year (y/y) in June, according to data from the National

Association of Motor Vehicle Manufacturers (Associação Nacional dos

Fabricantes de Veículos Automotores: Anfavea). Brazil's LV exports

dropped 54.1 y/y in June, while LV production declined 58.5% y/y.

(IHS Markit AutoIntelligence's Tarun Thakur)

- June's figures are an improvement over May's y/y numbers. LV registrations in Brazil decreased 75.8% y/y in May, according to data from Anfavea. Brazil's LV exports dropped 92.6 y/y in May, while LV production declined 85.6% y/y.

- Brazilian LV sales topped 2.66 million units in 2019, roughly 8% higher than in 2018. The LV sales were driven by increased availability of credit, and the sales increased last year despite a somewhat sluggish economy, which grew at 1%.

- We expect a serious drop in LV sales in Brazil in 2020 to less than 1.8 million units, owing to the impact of the COVID-19 virus pandemic.

- Along with announcing the month's results, Luiz Carlos Moraes, president of Anfavea, indicated that the organization has dropped its expectations and forecasts that full-year sales will fall 40% to only 1.67 million units, although it did not provide a forecast for production or exports.

Europe/Middle East/ Africa

- Most major European equity markets closed lower; UK -1.5%, Spain -1.4%, Germany -0.9%, France -0.7%, and Italy -0.1%.

- 10yr European govt bonds closed mixed; Italy/UK -2bps, Spain -1bp, France flat, and Germany +1bp.

- iTraxx-Europe closed +2bps/63bps and iTraxx-Xover +11bps/365bps.

- Brent crude closed almost flat at $43.08 per barrel.

- Saudi Arabia's General Authority for Statistics announced that

real GDP declined only modestly, by 0.4% quarter on quarter in

seasonally adjusted terms in Q1 2020, as the full impact of the

lockdown measures was not reflected yet and the agreement of the

OECD+ countries, which included severe cuts to Saudi oil

production, came into force only in April. (IHS Markit Economist

Ralf Wiegert)

- In annual terms, it went down by 1.0% largely thanks to government consumption (+8.0% year on year).

- The services industries showed hardly any major change in the first quarter compared to the final quarter of 2019, and production of crude oil edged up a mere 0.3%.

- Manufacturing, though, went down by 5.1% on the quarter, reflecting the steep decline of IHS Markit Purchasing Manager Index for Saudi Arabia in March down to 42.4 points, while the index was still firmly above 50 in January and February.

- Air Products will partner with ACWA Power (Riyadh, Saudi Arabia) and NEOM to develop a $5-billion green ammonia production facility in Saudi Arabia to supply carbon-free hydrogen for transportation markets. The joint venture will be owned equally by the three partners. The facility will be in an industrial cluster within the NEOM economic zone in northwest Saudi Arabia, a planned model city that will be powered by renewable energy sources. The project is scheduled to come onstream in 2025. The green ammonia produced will be largely for export. "Air Products will be the exclusive off-taker of the green ammonia and intends to transport it around the world to be dissociated to produce green hydrogen for the transportation market," it says. The facility will be powered by over four gigawatts of renewable power from solar, wind, and storage with up to 650 metric tons/day of green hydrogen to be produced by electrolysis using technology supplied by Thyssenkrupp, according to Air Products. The 1.2 million metric tons/year of green ammonia will be produced using Haldor Topsoe technology. The project will also include an air separation unit to supply nitrogen. Air Products plans to invest a combined total of approximately $3.7 billion in the JV production facility and its 100%-owned distribution network for the green ammonia and hydrogen to end customers worldwide. Air Products says the focus is on fueling hydrogen fuel cell buses and trucks.

- Italy's retail sales in volume terms increased by 24.3% month

on month (m/m) in May after falls of 10.7% m/m in April and 21.2%

m/m in March. It was still 12.6% below its level in February 2020.

(IHS Markit Economist Raj Badiani)

- Importantly, spending on non-food items jumped by 66.3% m/m in May after crashing in April and March.

- Retail sales were 10.5% lower than a year ago in May. The largest year-on-year (y/y) drops occurred for furniture and textile items and household furnishings (34.8%), clothing (38.1%) and shoes, leather goods, and travel items (37.4%).

- Foreign visitors are still sparse, which will weigh down on the country's retail sector. Italy's sizeable tourism sector, which accounted for 13.2% of GDP in 2018 (source: World Travel and Tourism Council), is an important support to the country's retail sector.

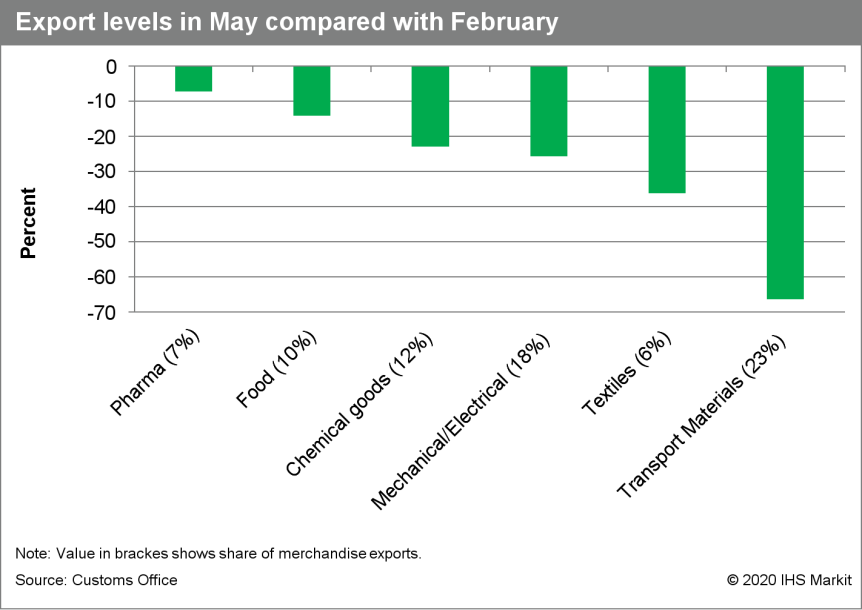

- French exports of goods (by value) rebounded by 16.8% month on

month (m/m) in May, following declines of 16.8% m/m in March and

32.7% m/m in April. However, they still stood more than a third

below their level in February. (IHS Markit Economist Diego Iscaro)

- Exports to other eurozone member states rebounded strongly by 21.3% m/m, following a fall of 31.4% m/m in April, boosted by higher sales to Germany (+27.9% m/m), Belgium (+22.4% m/m), and Spain (+17.1% m/m). Exports to the United Kingdom, which had halved on a m/m basis in April, rose by 35.7% m/m.

- The breakdown by type of goods shows strong m/m rebounds in exports of transport materials (+68.0%), textiles (+74.4%), and electrical equipment (+33.2%). However, in all cases, they followed even larger declines during the previous two months and still stood well below their pre-COVID-19 virus peaks.

- Among the main types of goods, pharmaceutical goods performed well, while exports of transport materials were still more than 60% below their February level.

- Imports rose by 20.7% m/m in May, following a fall of 24.8% m/m

in April. Imports were less affected by the COVID-19 virus shock

than exports, although they still stood 26.1% below their February

level.

- Seasonally and calendar-adjusted German industrial production

excluding construction bounced by 9.7% month on month (m/m) in May,

having fallen by 28.8% during March-April. Importantly, as the 9.7%

increase relates to a much smaller base, this recovers only

one-quarter and not one-third of the ground lost in March-April.

The latter's -28.8% compares with a decline by 22.7% during the

global financial crisis of 2008-09, although at that time the drop

occurred over a period of eight instead of two months. (IHS Markit

Economist Timo Klein)

- Total production including construction rebounded by only 7.8% m/m in May, following a combined fall of 24.8% during March-April. Construction activity had declined to a much smaller extent in the two preceding months (-4.5%), thus the absence of much of a rebound in May (0.5%) does not surprise (see table below).

- Expectedly, the manufacturing breakdown reveals that rebounding investment goods output was the main factor in May by far. Its jump by 27.6% m/m stands out compared to only stagnating intermediate goods production and only a small increase in consumer goods output.

- The split according to industrial branches shows that car output - which was only resumed by most major manufacturers at the very end of April - leapt by 216% m/m. However, this only boosts the output level from 14% to 44.5% of the average level in 2015.

- In other sectors, monthly rebounds were much more restrained (9.8% for machinery & equipment, 5.4% for metals) or essentially non-existent; at 0.4% for electronic/electrical equipment, -1.1% for the food sector, and even -6.1% for the chemicals/pharmaceuticals sector, which had outperformed the rest during the downturn.

- The manufacturing orders recovery was even more modest than the production rebound when compared to the preceding decline. May's 10.4% follows a combined drop by 37.3% during March-April, implying that less than one-fifth of the drop in orders has been recovered (given differing base levels). There was no major difference to orders excluding big-ticket items, which posted an even smaller 8.9% increase in May

- Domestic orders recovered more strongly than foreign orders, the latter being restrained by non-eurozone demand (only 2.0% m/m) whereas Eurozone orders bounced quite sharply (20.9% m/m).

- The orders split by industrial branch also reflects the automobile sector's return to life (44.4% m/m), followed by the machine-building industry (12.4%). The demand recovery in the metal processing sector was already much more subdued (2.8%), and there were even further declines in the electronic/electrical equipment (-0.6%) and chemicals/pharmaceuticals sectors (-2.3%).

- S&P Global Ratings has issued a long-term rating of BBB with a stable outlook to Siemens Energy, which will soon operate as an independent entity after Siemens AG implements its planned spinoff of its gas and power operations and its 67% stake in Siemens Gamesa Renewable Energy SA. According to S&P Global, the stable outlook reflects the expectation that Siemens Energy will successfully manage the transition to a publicly listed independent company and maintain strong credit metrics over the next two years, despite the expected coronavirus-related economic slowdown and ongoing group restructuring. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

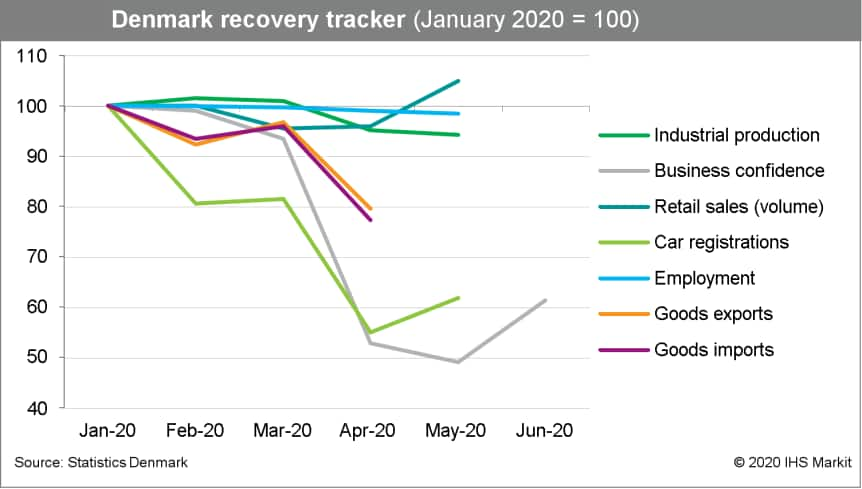

- In May, Danish industrial and manufacturing output collapsed by

14.2% and 13.2% year on year (y/y), respectively. This is the

steepest rate of collapse since the global financial crisis and

much more severe than in April. However, compared to January 2020,

industrial and manufacturing output is down by just 5.8%. (IHS

Markit Economist Daniel Kral)

- The only sub-components to grow in May and the year to date (YTD) were the manufacture of chemicals and transport equipment. However, these have a combined weight of just 8.5% in the index.

- In 2019, Danish manufacturing output grew by 4.4%, almost exclusively driven by pharmaceuticals subcomponent, which grew by 15.3% and has the largest weight in the index (20.1%). However, pharmaceuticals have become a major drag in 2020, with the high base effects likely a contributing factor.

- In a separate release, Statistics Denmark shows that retail sales have rebounded strongly in May and were 5.0% higher than in January 2020. Meanwhile, the number of people in employment has shrunk by just 1.5% compared to January 2020. Car registrations appear to have bottomed out in April with an improvement visible in May.

- Recent data releases by Statistics Denmark covering May and

June provide the latest view on the developments in the Danish

economy. We have captured some of them in the below activity

tracker chart.

- The UK passenger car market posted another accelerated decline

in June as the country began lifting its COVID-19 virus-related

lockdown and dealerships began to reopen. The market was down 34.9%

and 78,044 units year on year (y/y) to 145,377 units during June.

(IHS Markit AutoIntelligence's Tim Urquhart)

- However, this compared favorably at least to the massive 89.0% y/y decline in May, when dealers throughout the country were closed.

- The UK government's COVID-19-related restrictions were eased and dealers began reopening in England on 1 June, but this was not the case in other parts of the UK. Northern Ireland dealers opened on 8 June, Welsh dealers reopened on 22 June and Scottish dealers did not open until 29 June and these different opening times will have had a negative impact on the overall picture.

- The June result meant that the market for the first half of the year was down by 48.5% y/y to 653,502 units.

- The demand from private buyers proved far more resilient than that of private registrations, indicating that there was substantial pent-up demand waiting to be unlocked for the private market during lockdown as many potential buyers spent the time considering a vehicle purchase.

- Private sales only fell by 19.2% y/y in June to 72,827 units, despite large numbers of dealers not having reopened yet.

- Fleet sales fell at a much more marked level with a 45.2% y/y to 69,498 units, with businesses understandably reluctant to commit to short-term expenditure in a time of such economic uncertainty.

- The UK's leading brand was Ford, which fell slightly short of the overall market performance in June, with a 38.2% y/y decline in sales volumes to 13,622 units. This left it down by 53.2% for the first half of the year with sales of 59,874 units.

- According to the National Bank of Georgia (NBG), the current

account in the first quarter of 2020 showed a deficit of USD417

million, widening of 86% year on year (y/y). As a percentage of

GDP, the gap deteriorated to 11.0% from 5.9% in the first quarter

of 2019. (IHS Markit Economist Venla Sipilä)

- With exports falling and imports modestly rising, the goods trade deficit grew by some 11% y/y. Meanwhile, the service account surplus dwindled by one-third, as the fall of exports, at nearly 16% y/y, far outpaced the retreat of imports, at 3% y/y.

- Conversely, the secondary income surplus strengthened, as inflows increased by 10.5% y/y. This was entirely due to favourable developments in private-sector transfers, whereas government transfers were negative.

- On the financial account, FDI inflows to Georgia amounted to USD167 million, falling by 40% y/y. They covered 40% of the first-quarter current-account gap, after having been more than enough to finance the whole 2019 deficit.

- Gross external debt of Georgia at the end of March totaled USD18.3 billion, having eased by 1.9% during the first quarter of the year. General government debt, in particular, remained nearly stable, accounting for around 31% of total debt.

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong -1.4%, South Korea -1.1%, Japan -0.4%, Australia flat, China +0.4%, and India +0.5%.

- Japan's monthly cash earnings fell by 2.1% year on year (y/y)

in May. The weakness was due largely to a 25.8% y/y drop in

non-scheduled cash earnings, reflecting a 29.7% decline in

non-scheduled hours worked in response to continued containment

measures for the COVID-19 virus. (IHS Economist Harumi Taguchi)

- The contraction of monthly cash earnings was particularly severe for eating and drinking services (down 11.2% y/y), transportation and postal services (down 9.0% y/y), and manufacturing (down 4.8% y/y) because of closures or shortened business hours during the state of emergency. The containment measures also led to a 3.0% y/y decline in the number of part-timers.

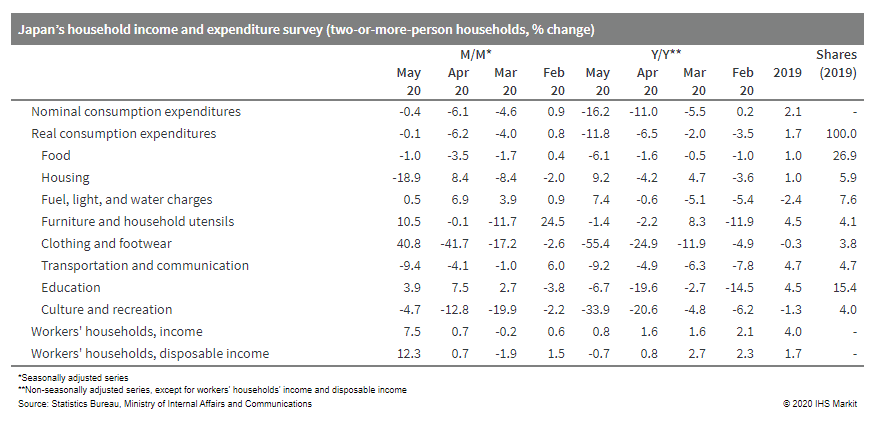

- Monthly household expenditure continued to drop, despite the

lifting of the state of emergency in late May, moving down by 0.4%

month on month (m/m) or 16.2% y/y. Although the reopening of

non-necessary stores helped lift spending from the previous month

on clothing and footwear and furniture and household fittings,

spending on transportation and culture and recreation continued to

fall as households and firms followed the government's request to

avoid crowds and domestic travel in May.

- Imported vehicle sales in Japan declined 29% year on year (y/y)

to 25,354 units during June, compared with 35,676 units in June

2019, according to the Japan Automobile Importers Association

(JAIA). (IHS Markit AutoIntelligence's Isha Sharma)

- Of this total, sales of foreign-brand imported vehicles declined by 32% y/y to 21,252 units, while sale of Japanese-branded imported vehicles fell 8% y/y to 4,102 units.

- By brand, Mercedes-Benz continued to lead the imported market with an 18.19% share, its sales declining 25.4% y/y to 4,611 units.

- BMW followed with sales of 3,220 units (down 36.8% y/y) and a market share of 12.7%.

- Volkswagen (VW) took third place with a market share of 10.85% and sales of 2,752 units, down 42.5% y/y.

- Among the Japanese brands, Toyota sold 789 imported units last month (down 55% y/y), followed by Honda with 497 units (down 59% y/y).

- The main creditor bank of SsangYong, Korea Development Bank (KDB), has rolled over the automaker's KRW90 billion (USD75.3 million) worth of debt maturing this month to help it stay afloat amid the COVID-19 virus pandemic, reports the Yonhap News Agency. KDB has extended the deadline for the payment of KRW70 billion, which matured on 6 July, and KRW20 billion maturing on 19 July to the end of this year. As of 6 July, SsangYong Motor has KRW199 billion worth of short-term debt that has to be paid back to KDB and foreign lenders such as JP Morgan, BNP Paribas, and Bank of America within the next 12 months. SsangYong is struggling and recorded a net loss for the 13th consecutive quarter in the first quarter of 2020. The automaker recorded a net loss of KRW193.5 billion in that quarter, compared with a net loss of KRW26.1 billion during the same period in 2019. (IHS Markit AutoIntelligence's Jamal Amir)

- LG Chem is planning to produce lithium-ion (Li-ion) batteries for Tesla at its plant in South Korea, reports Reuters. The plan is in line with Tesla's aim to meet the increasing orders for batteries for the Chinese market. LG Chem is reportedly converting some of its production in South Korea to cater to Tesla's order. LG Chem already supplies batteries for Tesla's Shanghai plant, which are manufactured at LG Chem's plant in Nanjing (China). While Tesla sources batteries from Panasonic for its operations in the United States, the automaker has partnered with LG Chem and Chinese battery maker Contemporary Amperex Technology Limited (CATL) for operations at its Shanghai plant. (IHS Markit AutoIntelligence's Jamal Amir)

- Bloomberg and the South China Morning Post reported on 6 July

that the Hebei branch of the People's Bank of China (PBoC) has

begun asking both retail and business customers to pre-report any

intended large deposits or withdrawals from banks from 1 July. (IHS

Markit Banking Risk's Angus Lam)

- Retail and business depositors are required to make requests before withdrawing more than CNY100,000 (USD14,000) and CNY500,000, respectively.

- The South China Morning Post reported that this scheme will be expanded to Zhejiang province and the city of Shenzhen from 1 October, but with a higher trigger point for retail customers, at CNY300,000 and CNY200,000, respectively.

- There were two cases of bank runs in China in May and June, affecting two smaller banks in Hebei and Shanxi provinces. The regulators were quick to assure bank customers and detained individuals for spreading rumors.

- Although latest financial reports are yet to be released and banks' health cannot be confirmed, the fast credit growth to micro, small, and medium-sized enterprises (MSMEs) and associated loan moratorium are likely to put pressure on banks' liquidity, especially when sudden and fast withdrawals take place.

- Geely Auto has announced its sales results for June. The

combined sales volumes of Geely- and Lynk & Co-branded vehicles

in June totaled 110,129 units, up 21% year on year (y/y). (IHS

Markit AutoIntelligence's Abby Chun Tu)

- The data include sales in the Chinese market and exports. The company reports its sales volumes in China were 106,020 units in June.

- Geely Auto's total sales volumes in June also marked an improvement of 1% from 108,822 vehicles in May.

- In the first half of the year, the total sales volumes of Geely Auto were 530,446 units, down 19% y/y, which represents 38% of the company's target of 1.41 million units in 2020.

- A breakdown of Geely Auto's sales by vehicle type shows sport utility vehicles (SUVs) are still in high demand, along with sedan models. Geely Auto's sales of SUVs and sedans stood at 70,167 units and 37,154 units respectively in June.

- Geely Auto's sales of multi-purpose vehicles (MPVs) totaled 2,808 units in June.

- The sales volumes of Lynk & Co brand surged 53% y/y in June to 13,214 units.

- The strong results in June also marked a six-month high in sales for the Lynk & Co brand.

- Geely Auto's export business, by contrast, continues to decline as demand falls in overseas markets due to the COVID-19 virus outbreak. The automaker's exports continued to contract in June, with volumes slumping 34% y/y to 4,109 units.

- Beijing Innovation Center for Mobility Intelligent (BICMI) has released a list that indicates six companies have received permits to conduct autonomous vehicle (AV) road tests in the Chinese capital in 2020. According to BICMI, the city's AV testing service agency, the companies are Toyota Motor Engineering & Manufacturing (China), Beijing Baidu Netcom Science Technology, Beijing Pony.ai Science and Technology, Daimler Greater China, Audi (China) Enterprise Management, and Beijing Sankuai Online Technology, reports Gasgoo. Beijing was one of the earliest Chinese cities to implement policies for AVs and announced the policies in December 2017. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Mylan (US/Netherlands) has said that it will launch its generic version of Gilead Sciences' antiviral Veklury (remdesivir) for COVID-19 in India at a price of INR4,800 (USD64.31), intensifying the price competition over licensed generic versions of the medicine. Mylan, Hetero Labs (India), Cipla (India), and Jubilant Life Sciences (India) have all received approval from the Drug Controller General of India (DCGI) for restricted emergency use of their locally manufactured licensed generic remdesivir products for the treatment of COVID-19 under an accelerated pathway. According to Reuters, Mylan has said that it will price its product at INR4,800 per 100 mg vial/dose, which is around 80% "below the price tag on the drug for wealthy nations". The price announced for India by Mylan is marginally lower than the prices announced so far by Cipla and Hetero Labs. Cipla announced last week that the price of its remdesivir generic Cipremi will be "less than" INR5,000 (USD65) per 100 mg vial/dose. Hetero has priced Covifor at INR5,400 per 100 mg vial/dose for the Indian market. (IHS Markit Life Science's Sacha Baggili)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-july-2020.html&text=Daily+Global+Market+Summary+-+7+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 7 July 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+7+July+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}