Equity markets closed mixed across the US, APAC, and Europe. US government bonds closed lower, while European bonds were mixed. iTraxx-Xover and CDX-NAHY high yield credit indices closed modestly tighter while IG was close to flat. The US dollar closed unchanged, and oil, gold, silver, and copper were higher. Today's January ADP US employment report came in much better than expected after a disappointing December, with all eyes now on tomorrow morning's US weekly jobless claims and Friday's non-farm payroll reports.

Americas

- US equity indices closed mixed; Russell 2000 +0.4%, DJIA/S&P 500 +0.1%, and Nasdaq -0.1%.

- 10yr US govt bonds closed +4bps/1.14% yield and 30yr bonds closed +6bps/1.93% yield.

- CDX-NAIG closed flat/53bps and CDX-NAHY -5bps/297bps.

- DXY US dollar index closed flat/91.17.

- Gold closed +0.1%/$1,835 per ounce, silver +1.9%/$26.89 per ounce, and copper +1.4%/$3.57 per pound.

- Crude oil closed +1.7%/$55.69 per barrel and is now only 16% below the two-year high from April 2019.

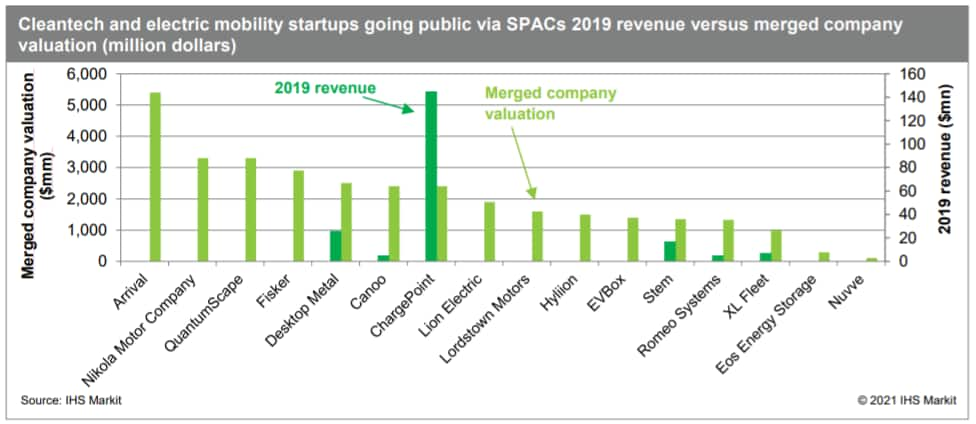

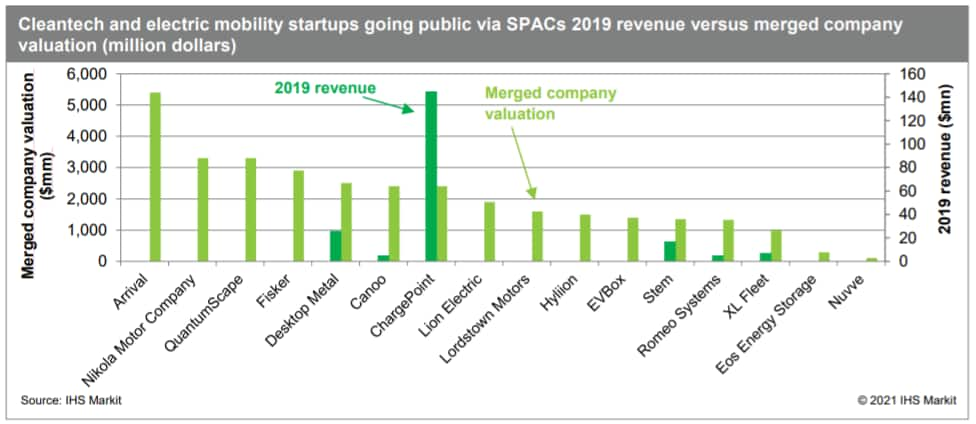

- More than a dozen companies developing clean energy technologies went public in 2020 via mergers with special-purpose acquisition companies (SPACs) that are listed in the US in a new cleantech financing trend. SPACs allow the cleantech industry to raise large amounts of capital in a short space of time even without earning any revenue. IHS Markit expects more companies will choose to enter the public markets using SPACs, as this pathway offers high cash benefits and media attention invaluable to companies looking to quickly capture market share. (IHS Markit Energy Advisory's Roger Diwan and EnergyView Climate and Cleantech's Chloe Holzinger)

- In 2020, 16 cleantech and electric mobility startups choosing to go public via SPACs received an average valuation of $2 billion, with the resulting net proceeds from the merger averaging $470 million among the companies that disclosed this metric. It is remarkable that 50% of this cohort do not yet offer any commercial products.

- Many of the private companies pursuing mergers with public SPACs have capital-intensive business models. These companies plan to use their new funding to develop a commercial product, scale manufacturing, and expand their offerings in an accelerated timeframe to penetrate a rapidly expanding market.

- Institutional investors have responded positively to the influx of cleantech and electric mobility companies entering the public market, as investors are increasingly looking for opportunities to capitalize on the energy transition, and as environmental, social, and governance (ESG) increasingly influences investor behavior.

- A month after reporting the first loss since April, the employment picture bounced back in January as companies added 174,000 new jobs, according to a report Wednesday from payroll processing firm ADP. The gain beat the 50,000 estimate from economists surveyed by Dow Jones and improved on the 78,000 December decline, a number that was revised from the initially reported drop of 123,000. (CNBC)

- The seasonally adjusted final IHS Markit US Services PMI Business Activity Index registered 58.3 in January, up from 54.8 in December and higher than the earlier released 'flash' estimate of 57.5. The rate of growth was the second-sharpest in almost six years, with firms linking the upturn to stronger client demand and an increase in new business. In line with strong client demand and a spike in input prices, service providers recorded a steep increase in selling prices during January. The rate of charge inflation was the second quickest on record, only slower than the peak seen in November 2020. (IHS Markit Economist Chris Williamson)

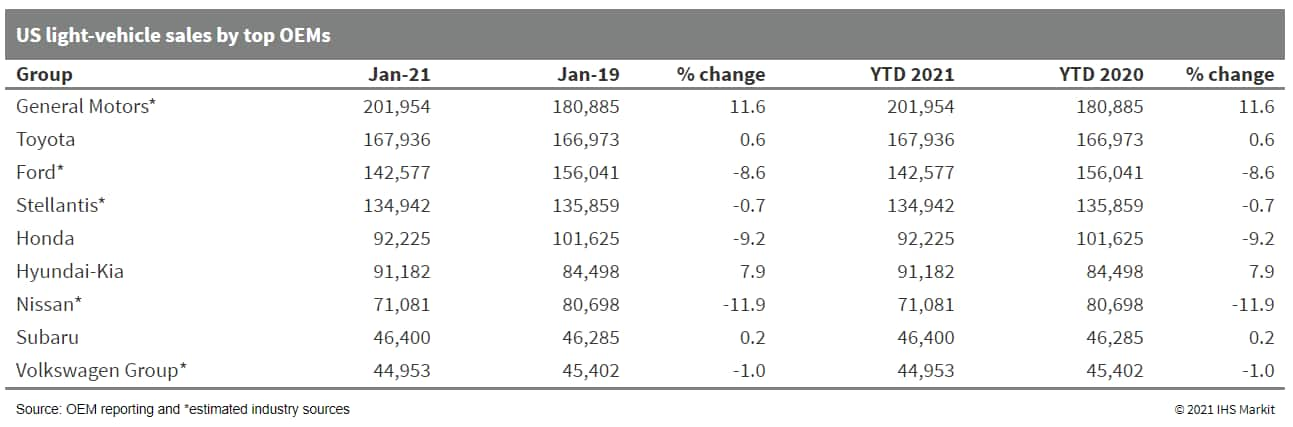

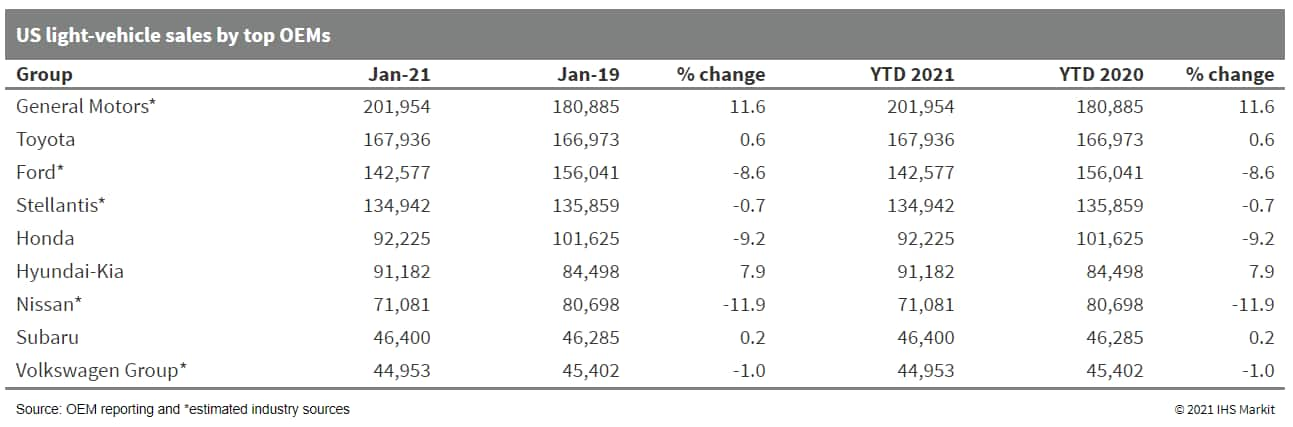

- January 2021 had one fewer selling day than in 2020, and the year started with a 3.3% y/y volume decline. However, with a SAAR estimated to be in the range of 16.6-16.8 million units in January, the pace of sales is set to match pre-COVID-19 virus levels. January's automotive demand presented a tremendous start to the new year. The sales pace for the month will come close to matching pre-COVID-19 virus levels (16.9 million units in January 2020) and the best monthly performance of the auto demand recovery since March 2020. The result is even more impressive given the potential headwinds from vehicle inventory concerns, semiconductor supply issues, the political unrest, still-wavering economic conditions as a result of the pandemic, and still-recessed levels of the total fleet sales volume. Some of these pitfalls remain prevalent and point to the potential for some volatility in the monthly results ahead. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Kia reportedly plans to sign a KRW4-trillion (USD3.6-billion) deal with Apple to produce the latter's electric vehicles (EVs) at its Georgia plant in the United States, reports Reuters, citing South Korean online news outlet DongA.com as its source. The deal is expected to be signed on 17 February. Apple aims to produce 100,000 vehicles annually by 2024 at Kia's plant, with plans to expand annual capacity to 400,000 units at a later stage, according to the report. Apple and Hyundai Motor Group declined to comment on the matter. In January, it was reported that Hyundai Motor Group was in preliminary talks with Apple over a business partnership to make EVs and batteries. (IHS Markit AutoIntelligence's Jamal Amir)

- Karma has announced a partnership to explore methanol fuel cell systems, working with Danish company Blue World Technologies. In a press statement, Karma said the two companies will "explore the viability of a fuel cell system to provide primary propulsion power for a variety of future passenger and light commercial vehicles." Blue World Technology's fuel cell system will be integrated with Karma's electric vehicle (EV) architecture in a Karma GS-6 test vehicle in the US and Denmark in 2021. The Blue World Technology fuel cell uses a methanol reformer to produce hydrogen on board. Dr. Lance Zhou, Karma's CEO, said in the statement, "We are investing in these types of powertrain technologies now to prepare for an emission-free world by having various extended-range electrification solutions that include hydrogen, ethanol and methanol fuel cells as a propulsion system. This collaboration brings together Blue World's strength in fuel cell development and our vast expertise in engineering hybrid propulsion systems and integrating electric vehicle technologies." (IHS Markit AutoIntelligence's Stephanie Brinley)

- According to the Central Bank of Paraguay (Banco Central del Paraguay: BCP), the consumer price index rose by 2.6% year on year (y/y) in January 2021, the largest y/y increase since January 2020. IHS Markit expects inflation to rise gradually during 2021, but to remain below the 4% target. (IHS Markit Economist Jeremy Smith)

- Consumer price inflation in Paraguay continues its gradual upward trend since bottoming out at 0.5% y/y in June 2020. The January 2.6% y/y result falls within the lower band of the BCP's 4% +/- 2% target range.

- Compared with December 2020, food and non-alcoholic beverages was the only category in which prices rose significantly on a y/y basis (5.4% y/y in January versus 3.3% y/y in December), with beef prices in particular jumping by 17.3% y/y. This mirrors a trend of increasing food inflation across many countries in the region. The price of healthcare products is also notably elevated, at 4.3% above the level a year earlier.

- Core inflation was still outside the target range at 1.9% y/y, the same value as in the previous month, signaling that underlying inflationary pressures remain weak and reflecting the stalling pace of economic recovery.

- On 22 January, the BCP monetary policy committee voted unanimously to leave its policy interest rate unchanged at the historic low of 0.75%, where it has been since last June. Given that significant inflationary pressure is unlikely in the short term and the BCP's commitment to pursuing policy that is consistent with achieving a 4% target, IHS Markit anticipates little change to the central bank's accommodative stance in 2021.

- According to Reuters, five Venezuelan banks have begun to provide debit cards for clients who have US dollar accounts. This will only allow customers with this type of account to make payments and cashier withdrawals. However, prices must still be set in local currency, meaning that for every transaction the payment will be made at the official exchange rate. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- This move represents a step towards the legalized dollarization of the country. Previous movement towards this came nearly a year ago, when the regulator allowed banks to receive and keep US dollars from corporate customers, but banks could only offer this as a vault service. This meant that clients could not make payments with the funds available in their accounts.

- However, several steps more will be needed to achieve full dollarization. First, banks will need to be permitted to give foreign-currency loans, something that the banking regulator asserted recently is banned in Venezuela. Second, banks should be allowed to make dollar transfers between themselves. Moreover, it is standard for dollarized economies to have liquidity assistance schemes where dollar reserves are set up for periods of monetary contraction; this is unlikely to be implemented in Venezuela over the short term, given its poor sovereign solvency.

- Despite these setbacks, dollarization appears to be the only solution to Venezuela's hyperinflation. Between 2016 and 2019, the country averaged an inflation rate of roughly 60,000% per year, a trend likely to extend until at least 2022.

- For banks, this phenomenon has translated into an extreme focus of their assets into government securities and into a virtual collapse in lending. This is revealed by the sector's credit-to-GDP ratio of 0.7% in September 2020, a big drop from its peak of 41.3% in September 2015.

Europe/Middle East/Africa

- European equity markets closed mixed; Italy +2.1%, Spain +0.8%, Germany +0.7%, France flat, and UK -0.1%.

- 10yr European govt bonds closed mixed; Italy -6bps, Spain flat, France +1bp, and Germany/UK +2bps.

- Italian government bonds and equities rallied as investors cheered the news that former European Central Bank President Mario Draghi had been asked to form a new government. The gap between yields on 10-year Italian bonds and their German equivalents fell to the tightest level in nearly five years, at 1.05 percentage points, according to Tradeweb. (WSJ)

- iTraxx-Europe closed -1bp/49bps and iTraxx-Xover -8bps/249bps.

- Brent crude closed +1.7%/$58.46 per barrel.

- Following five months of sub-zero eurozone Harmonised Index of Consumer Prices (HICP) inflation rates, January's "flash" HICP release shows a jump from -0.3% to 0.9%, exceeding the market consensus expectation (of 0.5%, according to Reuters' survey). (IHS Markit Economist Ken Wattret)

- The exceptionally sharp pick-up was driven by a range of factors, including the following:

- First, continued upward pressure on the energy inflation rate due to higher crude oil prices. The year-on-year (y/y) rate of change rose from -6.9% to -4.1% in January, contributing around one-quarter of the overall 1.2-percentage-point acceleration in the headline inflation rate.

- Second, the annual readjustment of eurozone HICP item weightings, which takes place in January each year. The full impact of these changes will only become clear when the full breakdown of January's HICP is released on 23 February. However, we know that areas of the economy hit very hard by the COVID-19 virus pandemic, and where inflation rates have been relatively low (for example, package holidays and clothing and footwear), will have seen their weights in the HICP fall, reflecting shifts in consumption patterns during 2020.

- In contrast, the weights of items where demand and inflation rates have been more elevated, such as food, have risen. For example, the combined weight of food, alcohol, and tobacco in the eurozone HICP has increased from 19.1% in 2020 to 21.8% in 2021.

- Third, special factors in Germany, including the unwinding of July 2020's VAT reductions and a rise in the minimum wage. HICP inflation in Germany surged by 2.3 percentage points in January, a much larger acceleration than in other large member states of the eurozone

- Has the situation in the eurozone shifted from concerns about deflation to worries about reflation, all in the space of just one month? We very much doubt it. HICP inflation rates for some items are notoriously volatile from month to month (the figures are not seasonally adjusted). It is not uncommon to see spikes from time to time, particularly at key times of the year for seasonal price changes, including January.

- The head of the VW Group's volume premium brand Audi, Markus Duesmann, has said the company will look to make the majority of its AV technology in-house while not ruling out collaborations, and it is also looking at sourcing its own semi-conductors. While VW is sensibly not ruling out collaborations with tech companies or with other OEMs, it will look to develop the majority of its AV technology in house in order to retain its own IP and proprietary technology. (IHS Markit Automotive Mobility's Surabhi Rajpal and Tim Urquhart)

- Estonian future growth prospects are clouded by grim consumer expectations and weakening labor market dynamics. (IHS Markit Economist Vaiva Seckute)

- Industrial production increased by 0.3% year on year (y/y) in the last quarter of 2020 after decreasing by 2.8% in the previous quarter, while manufacturing increased by 0.6% y/y. Manufacturing growth was mostly driven by 20% y/y growth in production of computer and electronic products.

- Exports of goods accelerated significantly and rose by 9.5% y/y in October-November as exports of machinery and electrical equipment rose by 32.2% y/y. Exports of services are showing little signs of recovery and contracted by 23.3% y/y.

- Retail trade growth accelerated to 6.5% y/y indicating limited effect on household finances so far, but possibly also consumption diversion from services to goods.

- Labor market dynamics weakened during the first three quarters of 2020. Wage growth decelerated from 7.5% in 2019 to 3.2% in 2020, while the number of employed people declined by 1.8% y/y after rising by 0.6% in 2019.

- Ford has announced a new investment into its Silverton Assembly Plant in South Africa. The USD1-billion (ZAR10.3-billion) investment will support expanded production of an all-new Ranger in 2022, including adding production of a version of the truck for Volkswagen (VW). The investment will increase jobs at the facility to 5,500, with 1,200 additional employees. A Ford statement indicates the investment will increase capacity to 200,000 vehicles (from 168,000 today), for Ford and VW local demand and exports. While Ford is aiming to improve quality and efficiency at the plant, the extra capacity element is also related to the addition of the VW variant. Ford's investment contributes to the overall economy and can enable increased localization of components, as investment supports suppliers as well as expanding the capability of Ford's own operations. (IHS Markit AutoIntelligence's Stephanie Brinley)

Asia-Pacific

- APAC equity markets closed mixed; South Korea +1.1%, Japan +1.0%, Australia/India +0.9%, Hong Kong +0.2%, and Mainland China -0.5%.

- Contemporary Amperex Technology Limited (CATL) plans to invest CNY29 billion (USD4.49 billion) to expand its production capacity in China. According to a company statement, the Chinese battery maker will invest CNY12 billion to expand its Yibin project, which is currently under construction, and CNY5 billion to expand its joint venture (JV) plant with FAW Group. Another CNY12 billion will be allocated to build a new manufacturing plant in Zhaoqing, Guangdong province. The three new projects will add a combined capacity of 82 GWh for CATL. Rising consumer demand for electric vehicles (EVs) and tightened vehicle fuel consumption and emissions standards will continue to drive the expansion of China's EV market. IHS Markit expects production volumes of EVs in the country to reach over 5.2 million units in 2025, compared with less than 1 million units in 2019. The booming market presents huge growth potential for battery manufacturers, especially those with strong technology capacity. CATL currently has a battery capacity of 53 GWh in China, with around 100 GWh under construction. (IHS Markit AutoIntelligence's Abby Chun Tu)

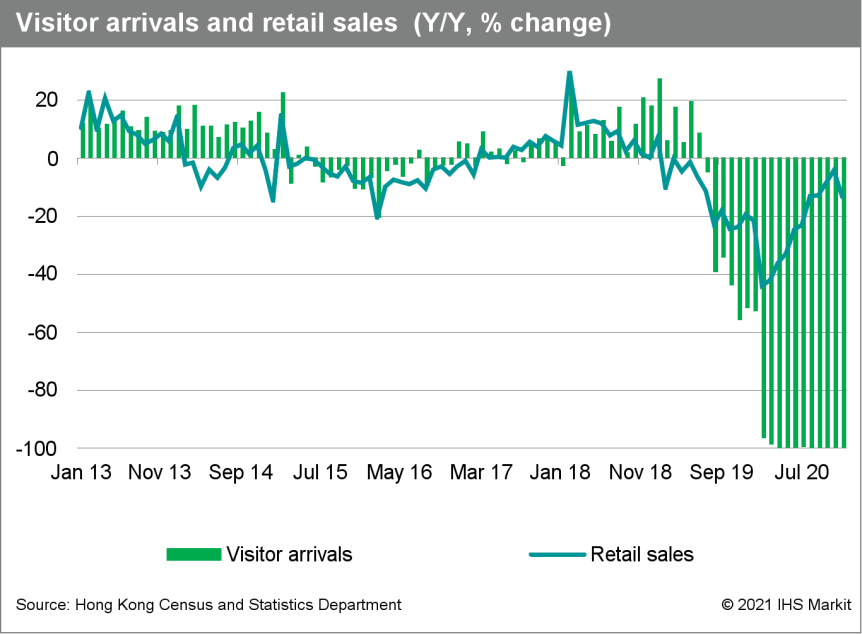

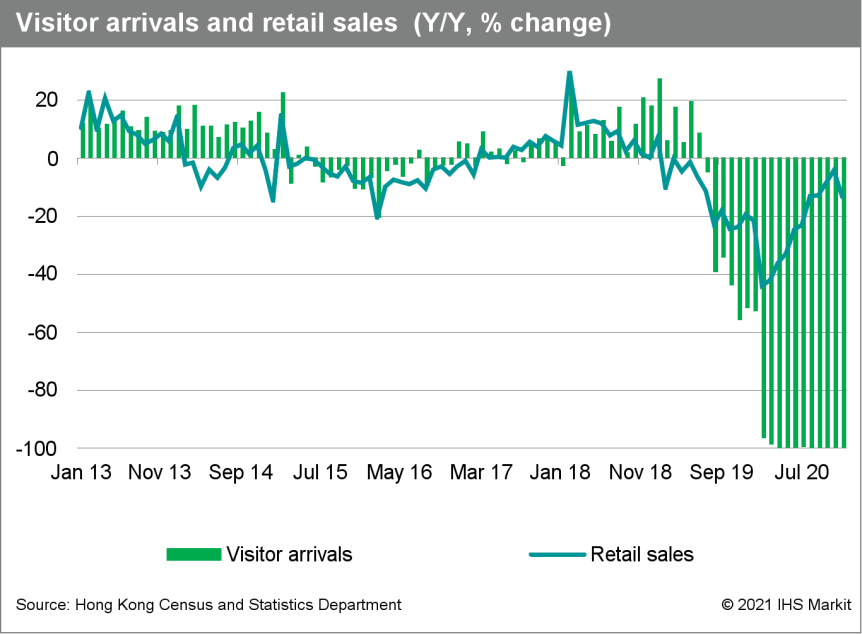

- Advance estimates show that Hong Kong SAR's economy contracted for the second year in 2020, marking the worst and longest recession in history. Although merchandise exports rebounded further, driven by mainland China-led recovery in regional trade flows, the economy's improvement in the fourth quarter was stalled by still-plunging exports of services and private consumption amid the fourth wave of infections and prolonged travel restrictions. (IHS Markit Economist Ling-Wei Chung)

- Preliminary data show that Hong Kong's real GDP contracted by 3% year on year (y/y) in the fourth quarter, narrowing marginally from a 3.6% y/y drop in the third quarter. It also marked a sharp deceleration from a 9% y/y plunge in the first half of 2020, which came in the largest on record.

- A further rebound in merchandise exports continued to drive the recent improvement because of the recovery in mainland China's economy and the revivals in other regional economies. On the other hand, exports of services continued to plunge and domestic demand remained subdued as private consumption continued to shrink at a noticeable rate, despite a modest gain in investment spending.

- December's exports were boosted by a 13.8% y/y expansion in shipments to Asia as the regional economies recovered, with exports to Taiwan surging 28.9% y/y, to South Korea jumping 20.1% y/y, to Vietnam climbing 18.2% y/y, and to mainland China expanding 17.5% y/y. Shipments to the US gained a modest 3.2% y/y, while demand from Europe also improved. They helped offset continued double-digit contractions in exports to India and Singapore.

- Tourist arrivals plunged 99.8% y/y in the fourth quarter, driven by the same rate of plunge in visitors from mainland China. Due to the COVID-19 outbreak, social distancing measures, and travel restrictions, tourist arrivals started to plunge by more than 96.0% y/y since February 2020 and over 99.6% y/y since April. For 2020 as a whole, tourist arrivals tumbled 93.6%, after falling 14.2% in 2019.

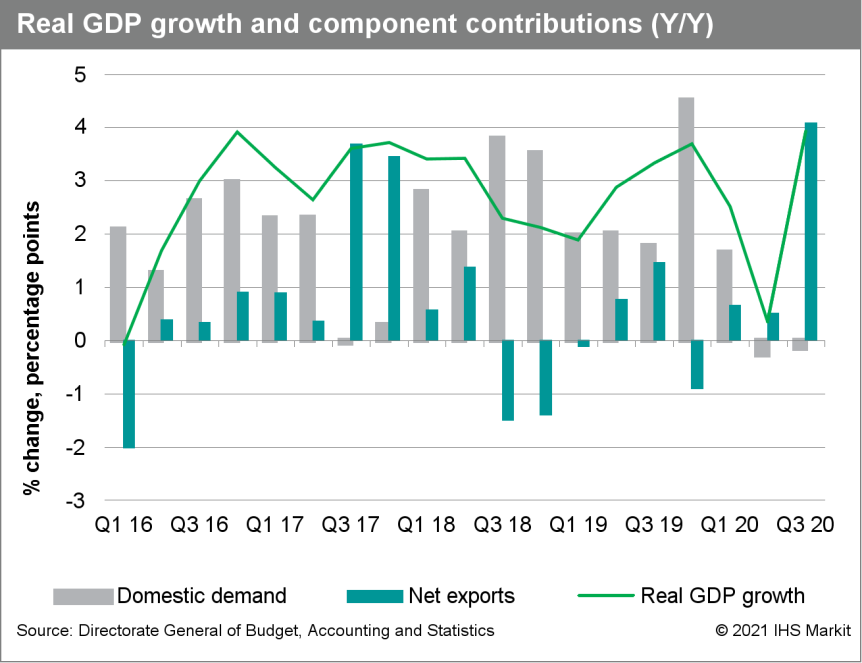

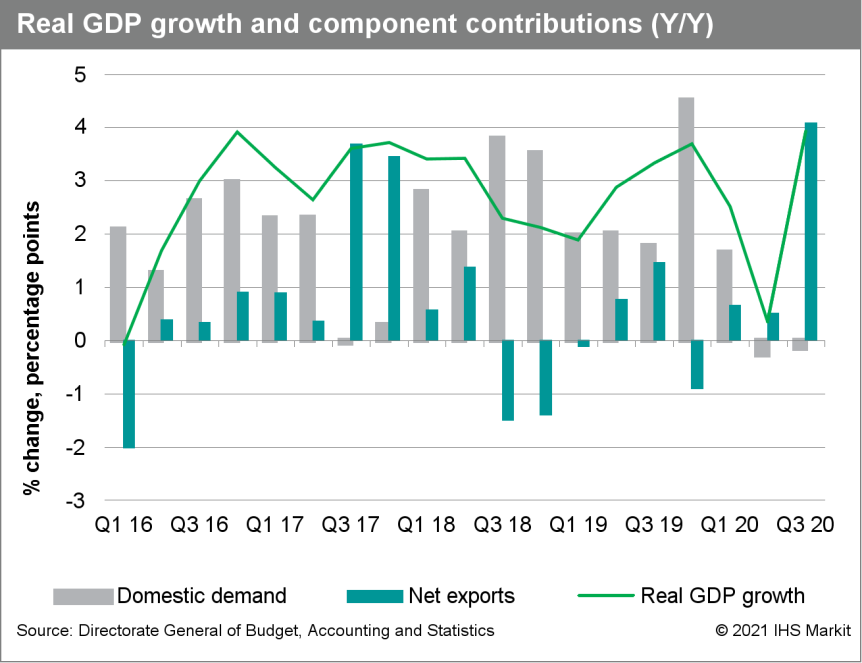

- Taiwan's economy concluded 2020 on a surprisingly strong footing as real GDP strengthened at the fastest pace in a decade, prompted chiefly by booming exports as domestic demand remained sluggish. The results indicated that the boom in technology demand has not shown any sign of receding and the momentum could carry into 2021 as the world economy stages a strong rebound, although the fallout of the COVID-19 pandemic and the global rollouts of vaccinations will be the main uncertainties to the short-term outlook. (IHS Markit Economist Ling-Wei Chung)

- Preliminary data show that Taiwan's economy strengthened at the fastest pace in a decade, prompted chiefly by booming exports. Real GDP jumped 4.9% year on year (y/y) in the fourth quarter of 2020, marking the fastest expansion since the first quarter of 2011. It accelerated from an already-strong increase of 3.9% y/y in the third quarter, after bottoming out from a mere 0.4% y/y gain in the second quarter that was weighed down by the COVID-19 pandemic. For 2020 as a whole, the economy expanded by 3%, similar to the rate posted in 2019.

- In seasonally adjusted quarter-on-quarter (q/q) terms, the economy continued to rebound but at a slower pace in the fourth quarter. Real GDP expanded by an annualized 7.8% in the fourth quarter of 2020, decelerating from a 16.6% surge in the third quarter, which also represented the fastest quarterly growth since the fourth quarter of 2009. They reversed two consecutive quarters of contractions in the first half of 2020.

- Strong net exports have remained the key driver of recent economic recovery, contributing 5.1 percentage points to the fourth-quarter GDP growth, as exports jumped at a pace not witnessed in three years, while imports continued to contract. Domestic demand remained weak as private consumption continued to shrink and investment spending turned negative in the fourth quarter. Domestic demand fell by 0.2% y/y, after contracting 0.3% y/y in the second quarter and 0.1% y/y in the third quarter.

- Merchandise exports surprised on the upside with a double-digit jump in the fourth quarter as they continued to thrive on booming technology demand, especially from mainland China and the US. Shipments of electronics as well as information and communication products surged by 21.2% y/y and 18.9% y/y, respectively. Recovering regional demand also prompted exports of non-technology products to resume growth, led by a double-digit expansion in plastic shipments and modest gains in exports of machinery, chemicals, and base metals.

- Japan's soft drinks domestic market was valued at JPY5.1 trillion (USD48 billion) in 2018 and is projected to reach USD54 billion in 2021, growing annually by CAGR of 3.7% in 2022-2025. This is the positive growth forecast of the Japan Soft Drink Association. The Japanese soft drinks market depends on the weather, having high sales in hot years. Ready-to-drink (RTD) tea leads the market with 28.6% share, followed by RTD coffee (19.6%), carbonated drinks (14.8%), bottled water (14.2%), fruit juices (10.7%), sports drinks (6.0%), and others (6.1%). In recent years, lactic acid bacteria beverages have been growing fast, followed by mineral water. In contrast, the market share of coffee drinks is decreasing year by year. The tea category, which has rapidly increased its market share for a while, is now mature. In terms of industry players, Coca Cola Japan accounts for 27% of the market, followed by Suntory (21%), Asahi (13%), Kirin (12%), Itoen (12%) and others (15%). Next ranking players are Yakult Honsha, Otsuka, DyDo group and Kagome. In terms of sales channels, supermarkets account for the biggest share of less than 40%, followed by vending machines with less than 30%, convenience stores with more than 20%, and others with about 10%. In the past, the share of vending machines was high, and the number increased explosively due to the campaign of 'vending machine owners and additional income' set up by beverage makers, but in recent years it has shrunk. As employees are encouraged to work from home due to COVID-19, market players must rethink their strategies and reposition their products to maintain sales. (IHS Markit Food and Agricultural Commodities' Mainbayar Badarch)

- Teijin (Japan) has signed an agreement to acquire Japan Tissue Engineering Co (J-TEC, Japan) from Fujifilm (Japan) through a tender offer, the companies said in separate statements. Under the tender offer, which is open from 1 February through 2 March 2021, Teijin will buy Fujifilm's 50.13% stake in J-TEC at JPY820 (USD7.81) per share, leading to an anticipated acquisition cost of up to JPY21.6 billion. Overall, Teijin is expected to acquire a stake of between 50.13% and 64.98% of J-TEC, with the transaction scheduled to close on 9 March 2021. J-TEC focuses on the development, manufacturing, and sales of regenerative treatments that target tissue generation, such as skin and cartilage. Given that Teijin's management policy and business strategy are similar to those of J-TEC, the companies are expected to create synergies between their existing treatments in the orthopedic treatment area, the source said. The acquisition, if completed, will expand Teijin's regenerative offerings. It will also create synergies between Teijin's and J-TEC's existing treatments in the orthopedic treatment area, as well as leveraging Teijin's expertise in chemical synthesis, polymer chemistry, and processing and engineering. (IHS Markit Life Sciences' Sophie Cairns)

- South Korea returned to first place in the latest Bloomberg Innovation Index, while the U.S. dropped out of a top 10 that features a cluster of European countries. Korea regained the crown from Germany, which dropped to fourth place. The Asian nation has now topped the index for seven of the nine years that it's been published. Singapore and Switzerland each moved up one spot to rank second and third. (Bloomberg)

- SsangYong may head straight for bankruptcy court this week as it has failed to obtain much-needed operating capital from a new investor or creditors, reports the Maeil Business Newspaper. Discussions between SsangYong, its Indian parent company Mahindra & Mahindra (M&M), and the US-based automotive distribution company HAAH Automotive Holdings have hit an obstacle. "It does not seem there will be further discussions among SsangYong, KDB, Mahindra & Mahindra and HAAH Automotive Holding due to disagreements in the terms," said Korea Development Bank (KDB; the main creditor bank of SsangYong) vice-chairman Choi Dae-hyun. The HAAH Automotive delegation has left South Korea without agreeing to the terms and demanded that the state lender provide additional funding as a condition for its equity investment. "This is not [the] time for KDB to decide whether to offer additional funding to SsangYong as the potential investor has not yet made an investment decision," said Dae-hyun, adding, "All decisions will be made on the agreed prepackage plan after careful evaluation on the execution progress and the validity of [the] restructuring plan." (IHS Markit AutoIntelligence's Jamal Amir)

- Following its first meeting of 2021, the Reserve Bank of Australia's (RBA) monetary policy board left the policy interest rate and the yield target for three-year Australian Government Securities unchanged at 0.10%, but there was an expansion to the government bond buying program. The RBA does not expect to raise the official cash rate target until at least 2024 - one year later than previously indicated - due to expected slack in the labor market. (IHS Markit Economist Bree Neff)

- Although markets were not surprised that the central bank left the policy interest rate and yield target on hold, there was surprise at the RBA's announcement that it would extend the bond buying program after it ends in April. The bank announced another AUD100 billion (USD76.1 billion, or AUD5 billion per week) in funding to buy federal, state, and territorial government bonds. The central bank has to date purchased a total of AUD52 billion in government bonds in the initial program.

- The central bank currently forecasts real GDP growth of 3.5% in both 2021 and 2022, with the economy returning to pre-pandemic levels of output by the middle of 2021. The bank will closely monitor how the gradual withdrawal of fiscal stimulus measures will affect household and business balance sheets in the near term, but it has been encouraged by the strength of retail sales, as well as households that had deferred loan payments recommencing payments in recent months.

- Even with the robust economic growth, there will still be considerable slack in the economy - particularly in the labor market, with the RBA forecasting an unemployment rate of 5.5% at the end 2022. The RBA believes that the slack in the labor market will keep inflation from reaching even the bottom band of the RBA's 2-3% inflation target range in 2021 or 2022.

- When combined with the unemployment forecast, this explains why RBA Governor Philip Lowe indicated that the bank does not expect to increase the policy interest rate until 2024 "at the earliest".

- IHS Markit continues to expect the RBA to leave the policy interest rate on hold at 0.10% until late 2023, but given the latest statements from Lowe, the central bank could potentially leave the policy rate on hold into 2024. The RBA is likely to very gradually unwind the bond buying and yield targeting programs starting in the latter part of 2021.

Posted 03 February 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.