Most major US equity indices closed higher, while Europe and APAC markets were mixed. US government bonds closed higher, while benchmark European bonds were sharply lower on the day. CDX-NA and European iTraxx closed wider across IG and high yield. The US dollar and oil closed higher, while natural gas, silver, gold, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher, except for Russell 2000 flat; Nasdaq/DJIA +0.3% and S&P 500 +0.2%.

- 10yr US govt bonds closed -2bps/1.56% yield and 30yr bonds -5bps/1.93% yield.

- CDX-NAIG closed +1bp/52bps and CDX-NAHY +5bps/305bps, which is flat and +3bps week-over-week, respectively.

- DXY US dollar index closed +0.8%/94.12.

- Gold closed -1.0%/$1,784 per troy oz, silver -0.7%/$23.95 per troy oz, and copper -1.6%/$4.37 per pound.

- Crude oil closed +0.9%/$83.57 per barrel and natural gas closed -5.8%/$5.53 per mmbtu.

- Rising natural gas prices in the US and globally represent a "structural change in the [price] curve," said EQT CEO and President Toby Rice during the company's earnings call on 28, and as a result EQT is raising its forecasted free cash flow for 2021 through 2026 by 40% to $10 billion. (IHS Markit PointLogic)

- EQT had been bullish already about natural gas prices, but Rice said the price surge happened more quickly and to a greater extent than the company had anticipated. It will be able to capture much of this gain thanks to its relatively low hedging of its production for 2022 (65% hedged) and 2023 (under 50%). For NGLs, the company's hedges are just 15% for 2022 and 7% for 2023.

- Although EQT, a major producer in the Marcellus, is benefitting from the rise in natural gas prices, Rice sounded alarms about the driving forces that led to tight supply-demand situations and send prices soaring. He blamed environmental policies that discourage drilling and interfered with expansion of the natural gas infrastructure, and he said that those policies have led to underinvestment in oil and gas production.

- This is a global phenomenon, not just a US problem, Rice said. "What we are witnessing in Europe and Asia is a crisis borne out of an undersupplied of traditional energy sources, one that highlights the dislocation between the perceived good intentions of addressing climate change through policies of elimination, and how these policies play out in the real world," he said.

- While acknowledging the encroachment of renewable power on the traditional domain of coal and natural gas, Rice said that the power generation industry has tried to move too far, too fast. Natural gas is needed more than ever, he said, because it provides stability to a power grid that must handle the intermittency of wind and solar power.

- Given the strong prices for natural gas, EQT has raised its 2021 free cash flow estimate to $950 million, its 2022 number to $1.9 billion, and its 2023 forecast to $2.6 billion. That last figure is 30% free cash flow yield. Helping to drive the cash flows in the short term are rising production, which was 495 Bcf-equivalent for the quarter that ended 30 September.

- Personal income declined 1.0% in September, reflecting sharp declines in unemployment insurance transfer payments, as eligibility for pandemic-era unemployment insurance benefits expired early in the month. The overall decline in personal income also reflected declines in economic impact payments and the Paycheck Protection Program. (IHS Markit Economists James Bohnaker and William Magee)

- Wages and salaries rose 0.8% in September, not enough to offset the declines in social benefits. Real disposable personal income decreased 1.6% in September.

- Advance payments of the Child Tax Credit authorized under the American Rescue Plan have provided support to personal income in recent months as other support has waned. In September, they boosted personal income by $219 billion (annual rate).

- Real personal consumption expenditures (PCE) increased 0.3% in September, following an upwardly revised 0.6% gain in August. The monthly profile for real PCE through September implies less momentum for fourth-quarter PCE than we previously assumed, so we lowered our forecast for fourth-quarter growth of real PCE from 5.3% to 5.0%.

- Real PCE for durable goods fell 0.5% in September as spending on new motor vehicles declined 5.7% amid ongoing supply chain disruptions. Real PCE for nondurable goods and services each rose 0.4%.

- The core PCE price index increased 0.2% in September, and its 12-month change was 3.6%. Outside of core, the price index for energy goods and services rose 1.3% and the price index for food rose 1.1%. Over the last 12 months, these indices were up 24.9% and 4.1%, respectively.

- The US Employment Cost Index (ECI) increased 1.3% in the three-month period ending in September 2021 (the sample is from monthly payroll records that include 12 September). (IHS Markit Economist Patrick Newport)

- Year-over-year (y/y) growth moved up from 2.9% in June to 3.7% in September.

- Wages and salaries (about 70% of compensation costs) rose 1.5% for the three-month period and 4.2% y/y; benefits (about 30% of compensation) increased 0.9% for the three-month period and 2.5% y/y.

- The acceleration in compensation is taking place in private industry, where total compensation grew at a 5.7% annualized rate, the fastest pace since the fourth quarter of 1983. State and local compensation moved up an annualized 3.0% and 2.3% y/y, the same pace registered in September 2020 and lower than the last y/y pre-pandemic reading of 2.9%. Private industry compensation grew 4.1% y/y, wages and salaries (about 70% of compensation costs) rose 4.6%, and benefits (about 30% of compensation) climbed 2.6%.

- State and local government compensation increased 2.3% y/y; for this sector, wages and salaries (about 62% of compensation costs) rose 2.4% and benefits (about 38% of compensation) grew 2.1%.

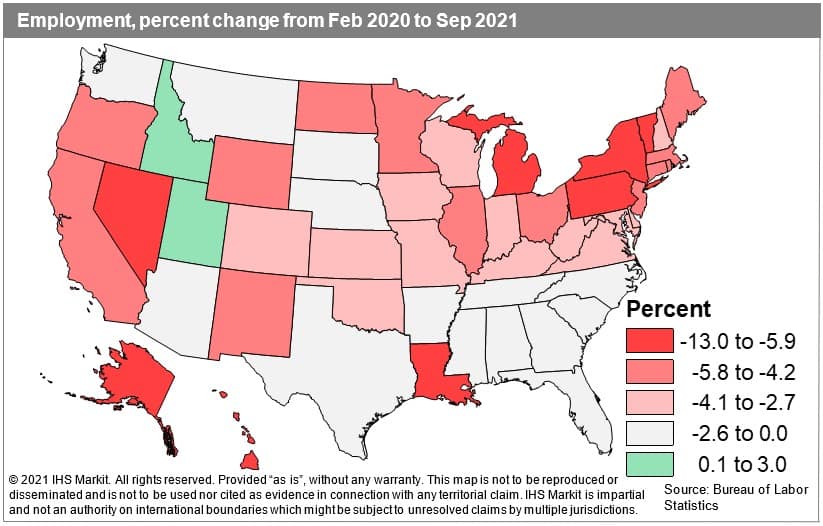

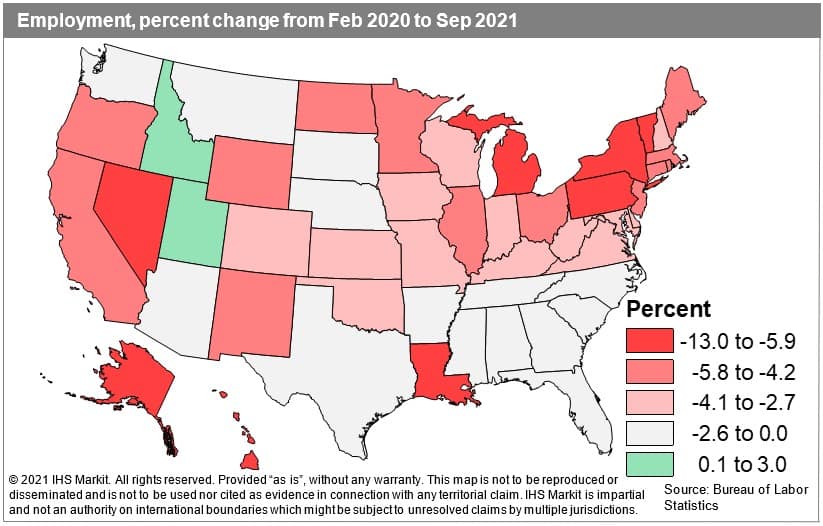

- Although fallout from the surging Delta variant hammered August job gains, the economic recovery's stumble proved to be short-lived, as employment accelerated in most regions during September. Total private nonfarm job growth gained momentum in the Northeast, Midwest, and South. The West's already robust gains continued to ease, but nevertheless remained strong. Consumers, who had pulled back on spending at restaurants, bars, hotels, and attractions during the August Delta surge, began to resume these activities in September, particularly in the South and Midwest. Much of the South experienced a notable pickup in both business services and hospitality services in August, helping these states make further progress toward their pre-pandemic employment levels. The South and Midwest still lag the Northeast and West, though, where deeper job deficits incurred over the course of the pandemic are still fueling stronger overall job recoveries in 2021. While Northeast and West states like Hawaii, New York, and Nevada experienced sharply plunging employment in early 2020 resulting in very large overall job deficits, the August wave proved to be only a transitory slowdown in their job gains. (IHS Markit Economist James Kelly)

- The US University of Michigan Consumer Sentiment Index decreased 1.1 points from its September level to 71.7 in the final October reading—still slightly below its nadir in April 2020 and nearly the lowest in a decade. (IHS Markit Economists James Bohnaker and William Magee)

- The final October reading was only 0.3 point higher than the preliminary estimate, suggesting that consumer sentiment was virtually unchanged over the course of the month.

- The decline in October was driven by worsening views on both the present situation and the future. The present situation index fell 2.4 points to 77.7, and the expectations index declined 0.2 point to 67.9.

- Elevated consumer prices are weighing on sentiment. The median expected one-year inflation rate in the University of Michigan survey ticked higher by 0.2 point to 4.8% to its highest level since 2008. This is likely a reaction to higher retail gasoline prices, which averaged a seven-year high of $3.48/gallon during the week-ended 25 October.

- Consumers expect price pressures to ease over the longer term; the expected 5-to-10-year inflation rate declined 0.1 point to 2.9%, which is well within the historical range over the past several decades.

- Views on buying conditions for big-ticket items remained poor. The index of buying conditions for large household durable goods and automobiles slumped further, as high prices and limited inventories continued to be challenges. The index for homebuying conditions improved off of cycle lows but is severely depressed in a historical context.

- Consumer attitudes were roughly unchanged in late October. The low level of sentiment is somewhat at odds with the ongoing recovery in spending. Retail sales and data on credit- and debit-card spending suggest that consumers are spending confidently heading into the fourth quarter. We expect sentiment will soon track spending more closely as the ongoing anxieties about the Delta variant are alleviated and prices ease from their current highs.

- Aurora has released the commercial beta version of its autonomous platform, Aurora Driver, according to a company statement. It consists of hardware, software, and data services needed to operate an Aurora-powered autonomous vehicle (AV) safely. Aurora Driver Beta is a set of subscription services that help carriers and fleet owners to transport goods more safely and efficiently, says the company. Currently, the service is being deployed for hauling loads between Dallas and Houston in Texas, United States. (IHS Markit Automotive Mobility's Surabhi Rajpal)

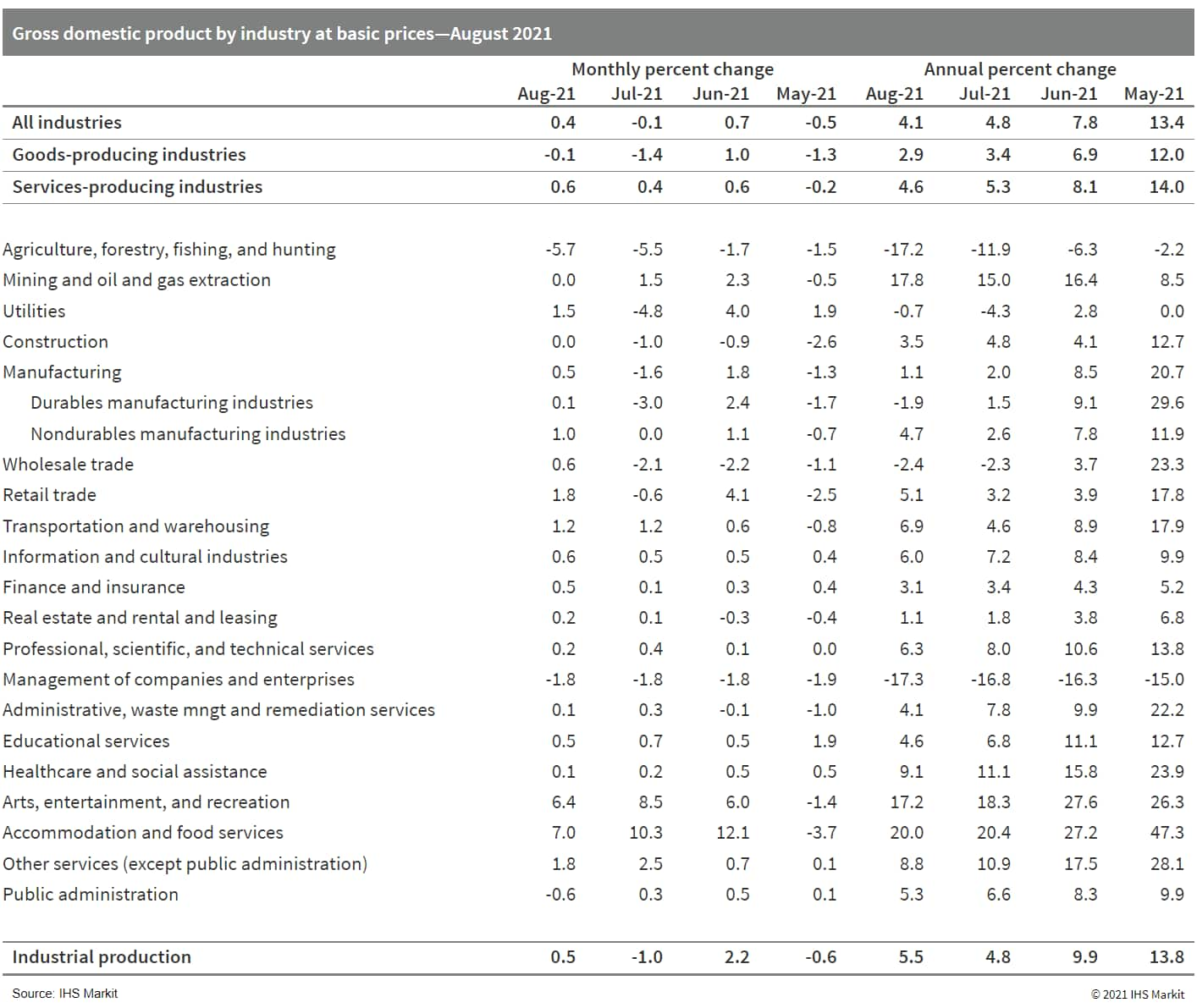

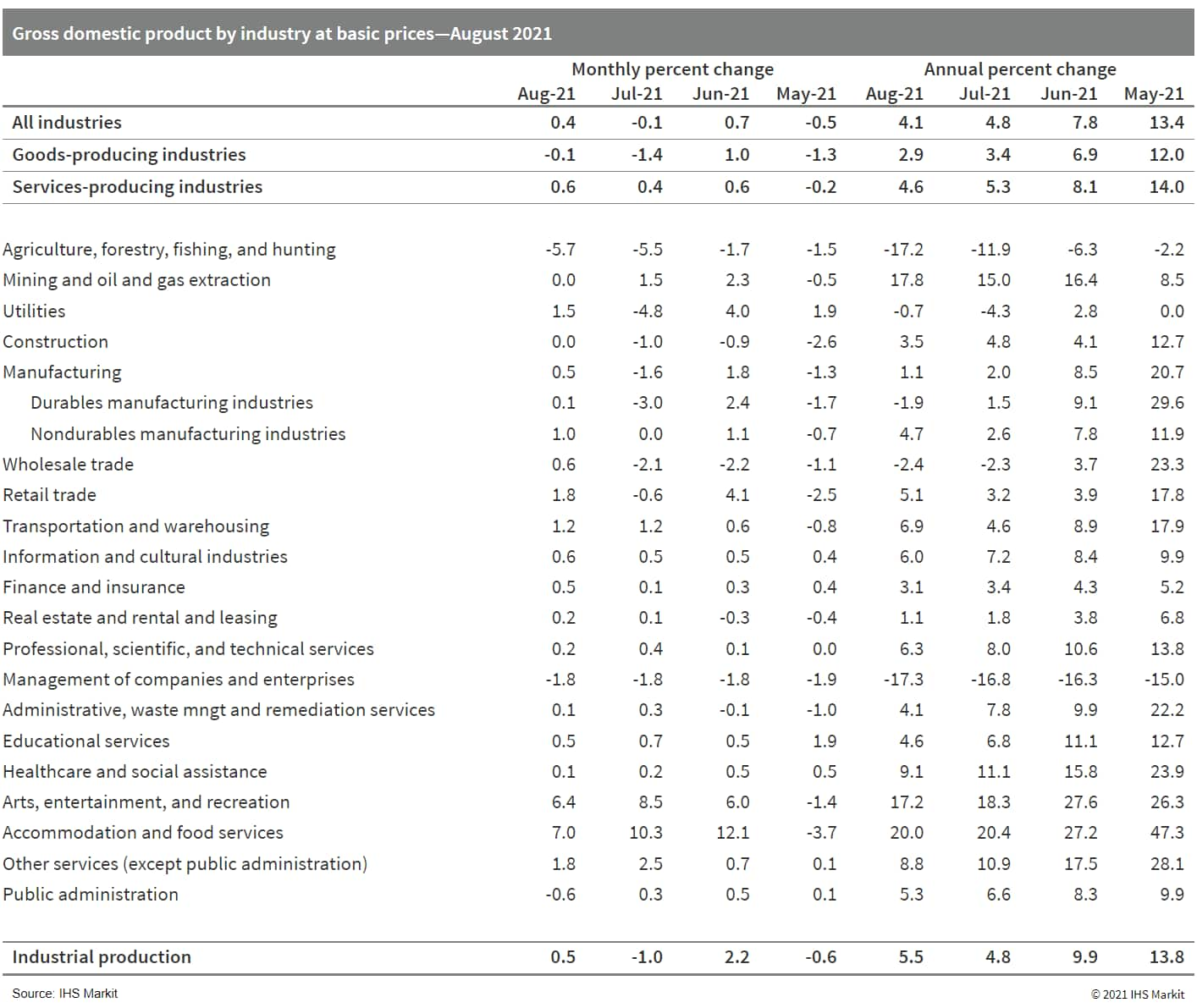

- The rebound in Canada's August GDP was smaller than initially estimated by Statistics Canada with the 0.4% month-on-month (m/m) advance. Goods-producing output slipped 0.1% m/m and services-producing industry output robustly jumped 0.7% m/m. (IHS Markit Economist Arlene Kish)

- The 1.5% m/m leap in utilities output was the fastest increase within the goods-producing industry. This coupled with the 0.5% m/m gain in manufacturing led to the 0.5% m/m increase in industrial production.

- Lifting of additional pandemic restrictions, like the border reopening, within the month contributed to the surges in accommodation and food services as well as arts, entertainment, and recreation. Accommodation and food services was the largest contributor to growth in the month.

- Statistics Canada estimates September's real GDP by industry output will be unchanged, as more industries experience bumps in output due to global supply restrictions. This is lower than expected and will result in third-quarter real GDP being revised down, below 3% quarter on quarter, at an annualized rate.

- Malta Inc., a developer of pumped heat energy storage technology, and Canadian utility NB Power on October 28 announced the signing of a term sheet and that they are working toward establishing an Energy Storage Benefits Agreement to advance the first long-duration energy storage facility in the province of New Brunswick's history. (IHS Markit PointLogic's Barry Cassell)

- While still in the planning and development stage, the facility is targeted to be in-service in 2024. A sustainable energy solution, Malta's energy storage facility will help achieve emissions reductions, improve grid stabilization and increase the grid's capacity for the integration of renewables, the companies said. Upon its completion, the 1,000-MWh facility would be one of the largest energy storage systems of its kind in the world.

- The Malta system is a long-duration energy storage system that can store power when it is generated and discharge the power when it is needed. An additional benefit of the plant is that it will produce a large quantity of high-quality heat as a byproduct that can be used in a number of commercial, industrial, and district energy operations, with the potential to reduce greenhouse gas emissions and drive further economic growth.

- Malta is working on grid-scale solutions that can store energy up to 50x longer than typical battery technology. The company is backed by energy industry leaders Alfa Laval, Proman and Chevron Technology Ventures, as well as investors Breakthrough Energy Ventures and Piva Capital. Malta is based in Cambridge, Massachusetts.

- At its 27 October meeting, the monetary policy committee of the Central Bank of Brazil (BCB) decided unanimously to increase the policy rate from 6.25% to 7.75%; this was in response to accelerating inflation and elevated risks of fiscal mismanagement. As of mid-October, inflation amounted to 10.3%, well above the central bank's target (3.75% +/- 1.5 percentage points) and very high by most standards. (IHS Markit Economist Rafael Amiel)

- As in most regions in the world, the drivers of inflation in Brazil are high energy prices, high food prices, supply-chain disruptions, and shortages. The most concerning part of the inflationary picture is that inflation in services is also increasing, which implies that there have been second-round effects or contagion from the price escalation that started in the energy and food sectors.

- A severe drought, which led to increased electricity tariffs, and the depreciation of the currency compound inflationary pressures.

Europe/Middle East/Africa

- Major European equity indices closed mixed; France/Spain +0.4%, Germany/Italy -0.1%, and UK -0.2%.

- 10yr European govt bonds closed sharply lower; Germany/UK +3bps, France +8bps, Spain +10bps, and Italy +15bps.

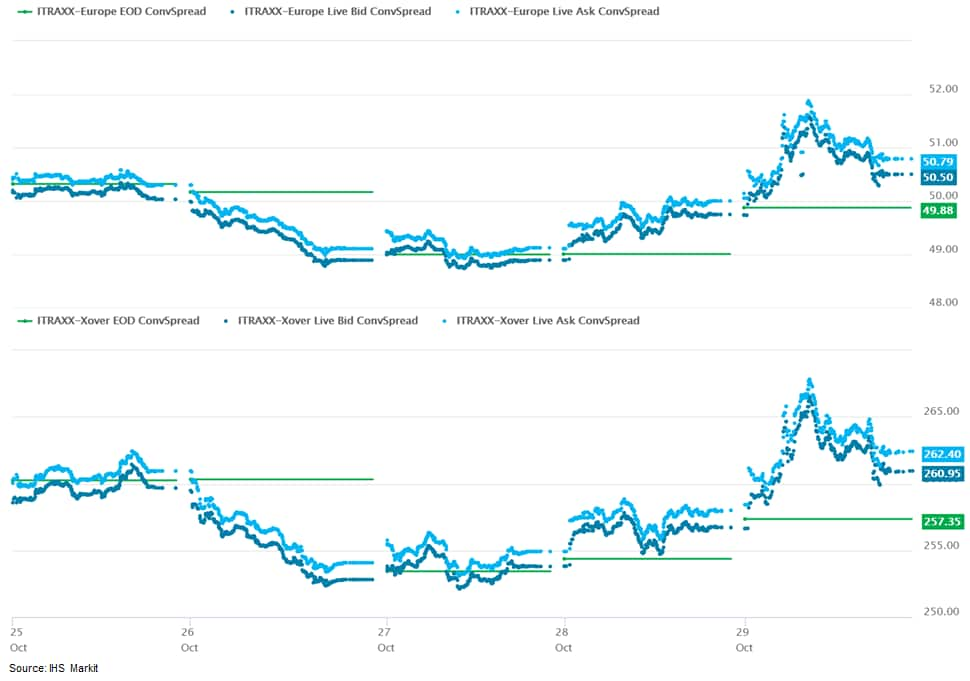

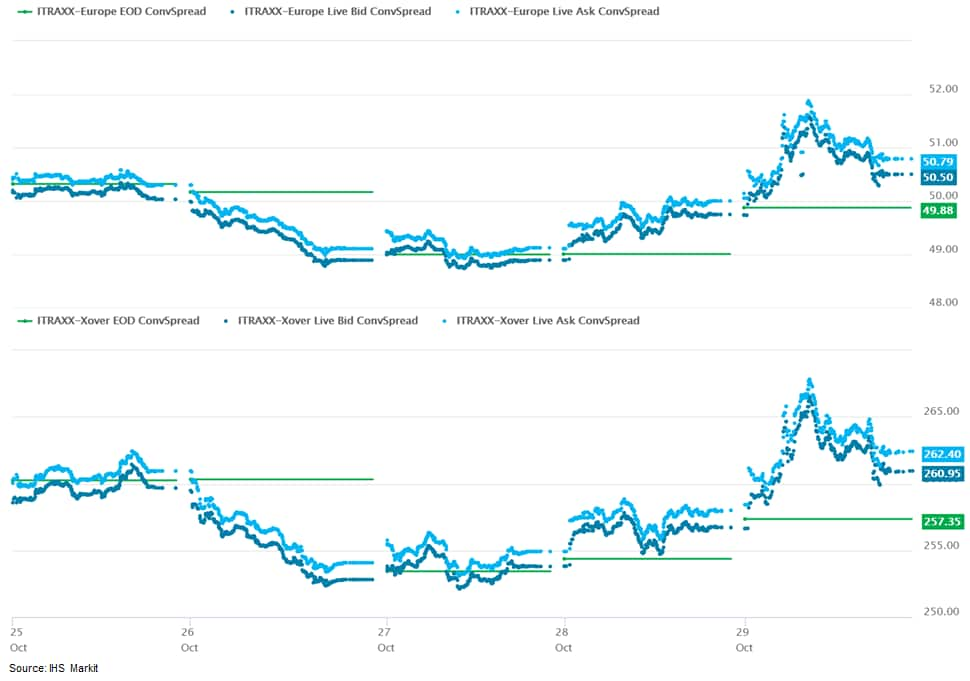

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +4bps/262bps, which is +1bp and +2bps week-over-week, respectively.

- Brent crude closed +0.1%/$83.72 per barrel.

- Eurostat's 'flash' estimate for October reveals another large jump in Harmonised Index of Consumer Prices (HICP) inflation from September's 3.4% to 4.1%, well above the market consensus expectation (of 3.7%, based on Reuters' survey). (IHS Markit Economist Timo Klein)

- The inflation rate now matches the eurozone lifetime high recorded in September 2008, having risen by 4.4 percentage points versus December 2020.

- Energy inflation is again the dominating boosting force, standing at 5.5% month on month (m/m) and thus pushing its year-on-year (y/y) rate to 23.5%, a record high.

- Core inflation rates have maintained their upward trend, the rate excluding food, energy, alcohol, and tobacco prices increasing from 1.9% in September to 2.1% in October. This exceeds the market consensus expectation of 1.9% and is the first time since end-2002 that the 2% level has been surpassed.

- Looking at its two key components, eurozone services inflation has extended September's 0.6-percentage-point jump and increased from 1.7% in September to 2.1% in October, now well above its pre-pandemic rate (1.6%). Following the lifting of many restrictions, the rebound of activity in the service sector in conjunction with labor shortages has created both a need and an opportunity for suppliers to raise prices.

- Meanwhile, non-energy industrial goods (NEIG) inflation, which surged to a record high of 2.6% in August before correcting to 2.1% in September, has edged down to 2.0%. The softening during September-October is linked to changes to the timing of seasonal sales and to COVID-19-related base effects, whereas the underlying trend remains strongly upwards owing to various factors. This is underlined by the monthly increase of 0.8% m/m and the fact that the NEIG inflation rate was only 0.5% prior to the pandemic in February 2020.

- The excess in supplies of live pigs to abattoirs in the EU relative to demand for pigmeat is persisting. There remains little change in the market fundamentals, with the EU's benchmark pig price now down below EUR130 per 100kg for the first time since January. A slight increase in wholesale demand has been detected as the Christmas holidays move nearer, but this has been insufficient so far to arrest the downward price trend. (IHS Markit Food and Agricultural Commodities' Chris Horseman)

- Exports remain disappointing overall, with sales to China and the Far East well down on the levels of the past few years.

- The UK is at least providing a useful outlet for EU exporters, with exports to Britain in July and August running at more or less the same levels as last year - compared with EU imports of UK pigmeat, which continue to run at just one-third to one-half of monthly levels seen in 2020.

- The core problem of oversupply is persisting, with Covid-related absenteeism among meat plant staff in many countries serving to exacerbate a backlog of live pigs, which is pushing the price still lower.

- The EU average price for Class E pigs in the week ending 24 October was EUR129.44 per 100kg, down by 0.7% on the previous week.

- This is now the nineteenth consecutive week-on-week fall in the EU benchmark price - although this weekly reduction was among the lowest since the price started falling in June.

- At 1.8% quarter on quarter (q/q), German real GDP growth was roughly the same pace in the third quarter as in the second. Private consumption apparently contributed the most, which had been expected following the late start to the loosening of lockdown conditions in mid-May. Disruption to external trade and investment from worsening supply-chain problems broadly offset impulses from consumer demand, however, and the growth forecasts for 2021 and 2022 need to be reduced modestly further. (IHS Markit Economist Timo Klein)

- 'Flash' data released by the Federal Statistical Office (FSO) show that German real GDP increased by 1.8% q/q in the third quarter, thus still falling about 1% short of its pre-pandemic level in the fourth quarter of 2019. Third-quarter growth was somewhat weaker than expected, but upward revisions to data for the first two quarters of 2021 of about 0.4 percentage point combined limited the deviation. Nevertheless, IHS Markit needs to reduce its forecast for average growth in 2021 from 2.8% to 2.7% and that for 2022 from 4.3% to 4.0%.

- As usual, only the flash data relating to total GDP (real and nominal) have been released at this point; detailed component data will be provided on 25 November. Once again, the FSO has provided only very limited guidance in its press release, highlighting that private consumption was the key factor driving economic growth in the third quarter.

- Information gleaned from recent monthly frequency indicators has signaled that the industrial upswing observed until April has since gone somewhat in reverse, and the surge in retail sales that lasted until mid-2021 has equally stalled. Consumer demand is not the problem, given that consumer confidence has retained an upward tendency through to October, helped by labor market indicators that have rather surprised positively of late.

- Bosch is planning to invest EUR400 million (USD467 million) in its semiconductor manufacturing facilities in 2022 to expand production to help mitigate the supply shortage for its customers, reports Automotive News Europe (ANE). According to the report, the company's investment is to be made at two plants in Germany, in Dresden and Reutlingen, while it is also said to open a new semiconductor test center in Penang, Malaysia. Bosch chairman Volkmar Denner said, "Demand for chips is continuing to grow at breakneck speed. In light of current developments, we are systematically expanding our semiconductor production so we can provide our customers with the best possible support." The bulk of the investment is to go to the Dresden facility, which the company only opened with an investment of USD1.17 billion in June. (IHS Markit AutoIntelligence's Tim Urquhart)

- The Borssele 1 & 2 offshore wind farm suffered a fire incident in a wind turbine's nacelle, resulting in the shut-down of three turbines. The rest of the wind farm continues to operate while owner Ørsted is working with turbine supplier Siemens Gamesa to investigate the cause of failure. Two of the turbines that were shut down have not suffered any damage, and show no abnormalities, may resume operations earlier. The Borssele offshore wind farm consists of 94 wind turbines of which the last was installed in September 2020. The wind farm was commissioned in November 2020. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Swedish freight tech company Einride has partnered with GE Appliances to launch its autonomous electric transports (AET) - called pods - in the US, according to a company statement. This partnership will represent Einride's first deployment of its autonomous electric pods in the country. Einride will implement electric transportation solutions at three of GE Appliances' locations in Kentucky, Tennessee, and Georgia. As a result, GE Appliances is expected to save 970 tons of CO2 emissions within the first year. Einride focuses on designing and building technologies for freight mobility. Its T-Pod has no cab, which makes the vehicle lighter and less costly as it does not have the space for a safety driver. The trucks feature the company's AET system and can be tele-operated by a human operator. It has begun building a more traditional type of truck with human drivers as part of the transition to full autonomy. This move is in line with the company's belief that the shift to autonomous transport may take longer than had been predicted. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Volvo Cars has announced that its initial public offering (IPO) is "substantially oversubscribed" prior to the company being listed on the Nasdaq Stockholm exchange. According to a statement published by Reuters, the company said, "The offering was substantially oversubscribed as it attracted strong interest from institutional investors in Sweden and abroad as well as from the general public in the Nordics." Volvo Cars shares began trading this morning (29 October). The oversubscription is a broadly positive outcome for the IPO. However, this has taken place in the wake of the company pricing its shares at SEK53, the lower end of its announced price range. Furthermore, the automaker's key shareholder, Geely Sweden Holdings, is now converting its A shareholding to B shares as part of the IPO and relinquish some influence it has on the business which concerned some investors. The IPO will have raised more than SEK20 billion for the business before costs, with these proceeds being invested in technology development and growing the business. (IHS Markit AutoIntelligence's Ian Fletcher)

Asia-Pacific

- Major APAC equity indices closed mixed; Mainland China +0.8%, Japan +0.3%, Hong Kong -0.7%, India -1.1%, South Korea -1.3%, and Australia -1.4%.

- Chinese battery-maker Contemporary Amperex Technology Limited (CATL) has broken ground on a lithium-ion battery manufacturing base in the city of Yichun, Jiangxi province, China, reports Gasgoo. The project involves an investment of CNY13.5 billion (USD2.1 billion) and the facility is expected to have an annual production capacity of 50 GWh in new-type lithium-ion batteries. In July, CATL signed a strategic co-operation framework agreement with the Jiangxi provincial government and the Yichun municipal government to locate the project in the city. In September, the company signed a deal with the Yichun government to invest CNY13.5 billion in the construction of the new-type lithium-ion battery manufacturing base. Yichun has the world's largest reserves of lepidolite, a lithium-bearing mineral, amounting to around 2.5 million tons of lithium oxide, highlights the report. Separately, CATL has signed a technology licensing and partnership agreement with Hyundai Mobis. Under the deal, CATL will grant its cell to pack (CTP) technology to Hyundai Mobis and support the company in the supply of related CTP products in South Korea and worldwide. CTP technology has a high level of integration efficiency and allows cells to be integrated directly into packs without the use of modules. The system energy density of the battery pack will be improved, and the production process will be simplified, resulting in cost savings, thanks to this technology, according to CATL. (IHS Markit AutoIntelligence's Jamal Amir)

- Baidu has unveiled three models of its robotaxi fleet, the Apollo Moon Arcfox, Apollo Moon WM Motor, and Apollo Moon Aion, reports China Daily. The Apollo Moon robotaxi models use a navigation pilot product that can reduce the weight of autonomous vehicle (AV) kits while sharing intelligent driving vehicle data to establish a closed-loop information ecosystem. Baidu said that fully autonomous operations can be achieved by combining these capabilities with a customised LiDAR and corresponding unmanned redundancy services. In addition, Baidu announced its new 5G remote driving for enterprises, which increases the number of AVs that can be supported in a single scenario to three. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese autonomous vehicle (AV) technology startup Leadgentech has completed a Pre-A round of financing worth tens of millions of yuan, reports Pandaily. The investment was secured from Deepshire, ZhenXin Capital, well-known economist Deng Haiqing, and the core team of Leadgenchtech. The company plans to use the infused capital towards accelerating the commercialization of autonomous buses and autonomous logistics vehicles for urban environments. It will also be used to expand the company's technical teams. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Signet Therapeutics (China/US) and XtalPi (US) have expanded their existing artificial intelligence (AI)-based drug discovery collaboration to include a new first-in-class program against a novel gastric cancer target, the companies said in a statement. According to the source, the companies first signed a collaboration agreement in 2020, and identified pre-clinical candidates for a new gastric cancer target. Under the expanded collaboration, the companies will leverage XtalPi's AI-based drug discovery technology with Signet Therapeutics' organoid disease models to generate pipeline candidates and advance them towards clinical trials. Financial details were not disclosed. (IHS Markit Life Sciences)

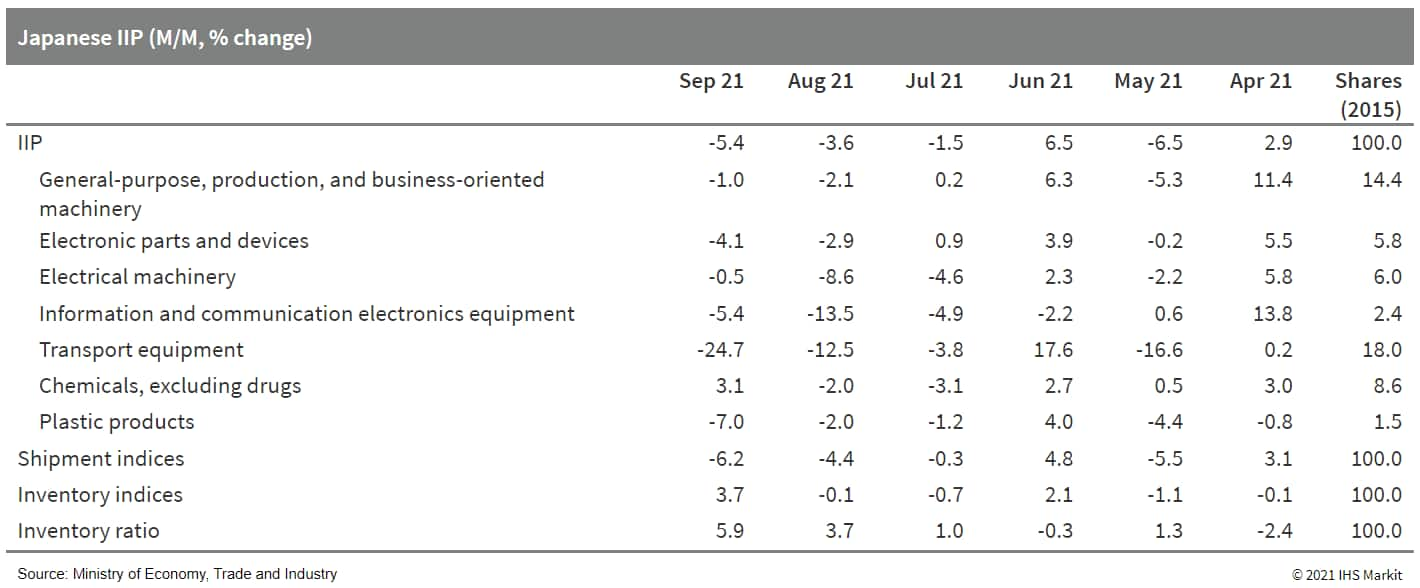

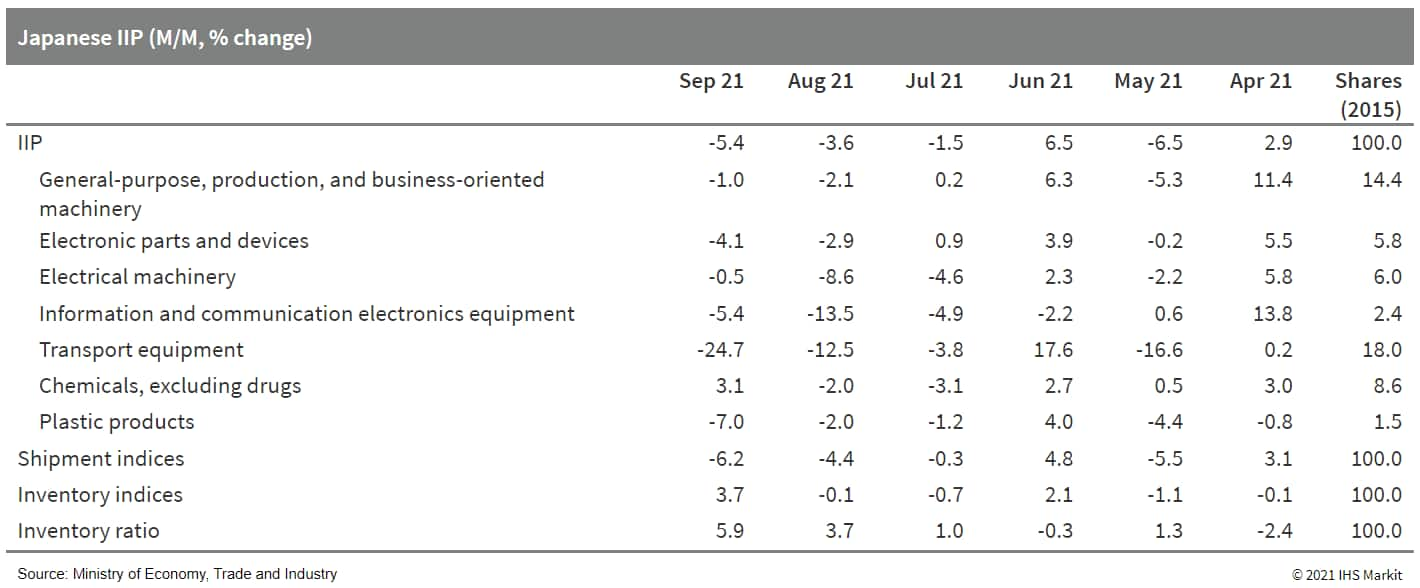

- Japan's Index of Industrial Production (IIP) fell by 5.4% month on month (m/m) in September for the third consecutive month of decline. Production dropped to its lowest level since August 2020. An accelerated decrease in manufacturers' shipments (down 6.2% m/m) and a rebound in inventories (up 3.7% m/m) continued to lift the index of inventory ratio (up 5.9% m/m). (IHS Markit Economist Harumi Taguchi)

- Major factors behind the weakness were continued declines in a broad range of industry groupings, particularly autos (down 28.2% m/m). Shortages of semiconductors and other components because of Delta-variant infections and supply-chain disruption in Asia had a more severe effect on auto production. Sluggish auto production affected the production of auto-related industries and increased inventory.

- Softer domestic orders and a shortfall in external orders for several product groups also weakened the production of general-purpose and business-oriented machinery as well as production machinery.

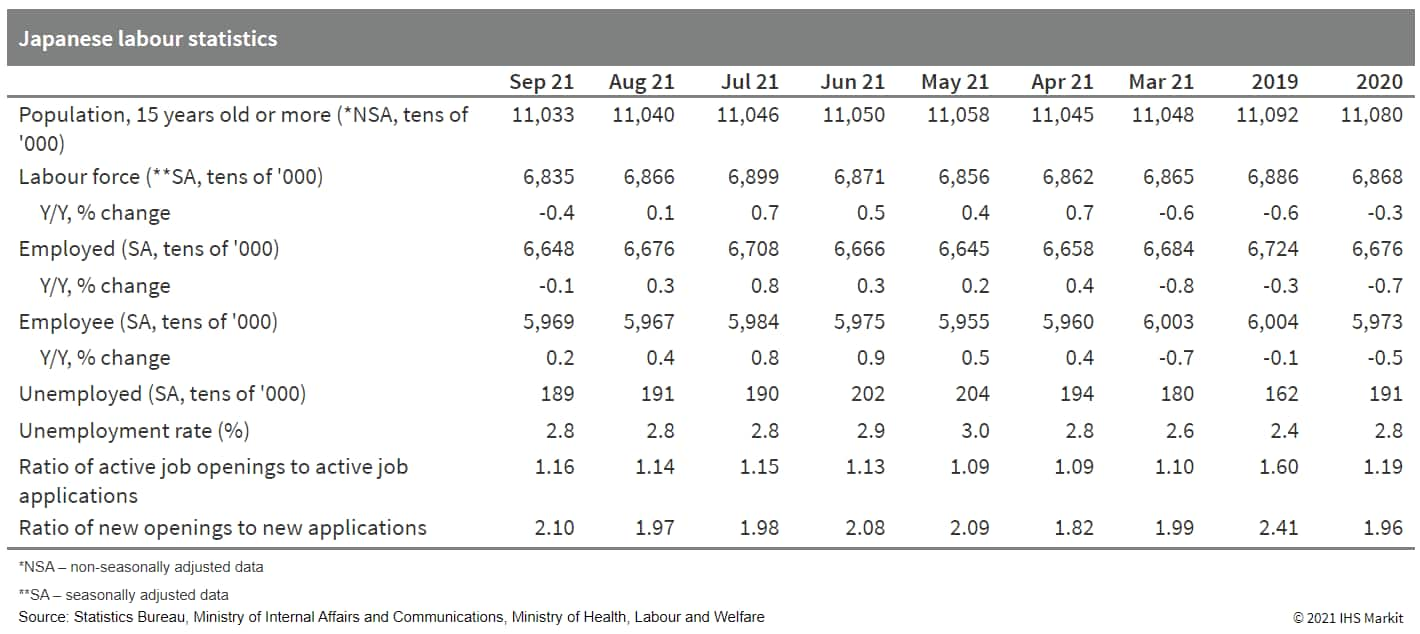

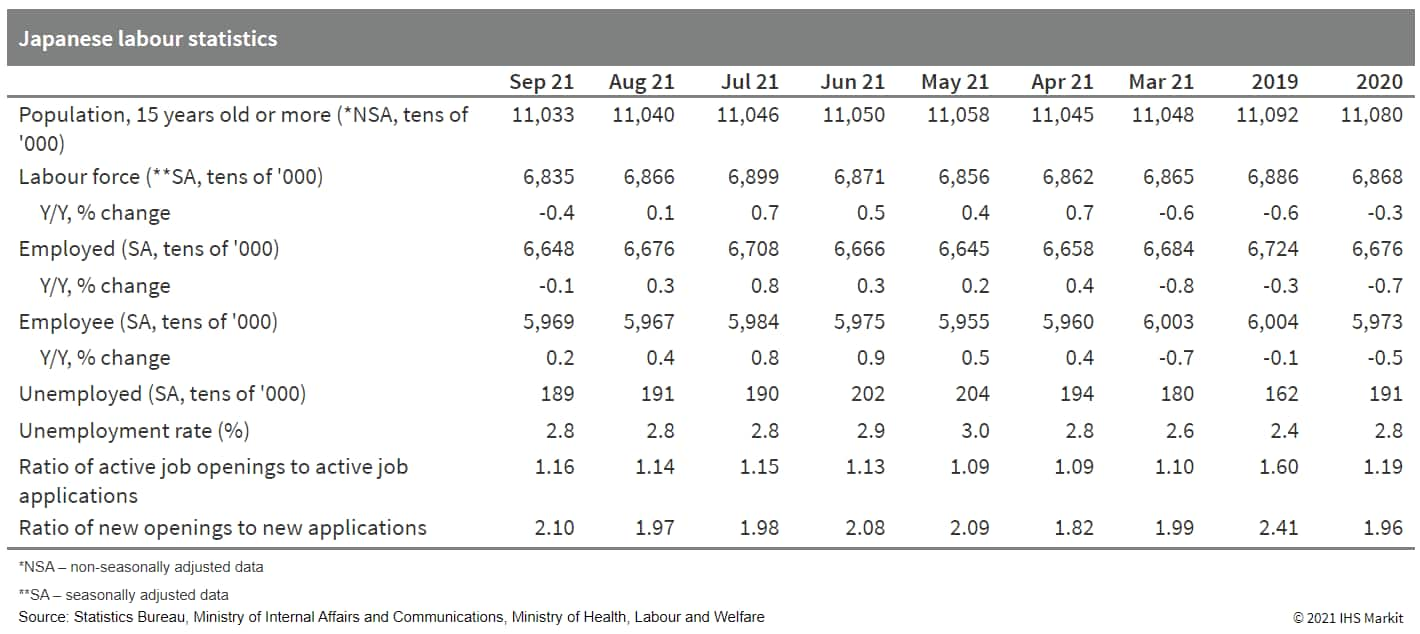

- Japan's unemployment rate held at 2.8% in September for the third consecutive month. Reflecting the negative effects of containment measures, the number of employed continued to decline by 280,000 month on month (m/m), which was largely offset by a drop in the labor force (down 31,000 m/m). (IHS Markit Economist Harumi Taguchi)

- The number of furloughed staff also rose, particularly in accommodations and eating and drinking services. While the number of male employees returned to the July level, weak employment figures reflected declines in the number of self-employed workers and female employees.

- The continued decreases in the number of employed in accommodations and eating and drinking, life-related, and amusement services were partially offset by increases in the number of employed in health and social welfare, information and communication services, and education. Conditions for face-to-face services remain downbeat, but the ratio of active job openings to active job applications improved to 1.16 in September from 1.14 in August thanks largely to a rise in new job openings.

- SsangYong and its lead manager, the EY Hanyoung accounting firm, last week submitted an official document selecting the South Korean consortium led by local electric bus manufacturer Edison Motors as the preferred bidder for the debt-laden automaker and the court approved the move early this week, reports the Yonhap News Agency, citing an unnamed company official. SsangYong and EY Hanyoung will sign a memorandum of understanding (MOU) with the Edison consortium for the deal on 1 November. The Edison consortium submitted KRW310 billion (USD264.8 million) as the acquisition price for SsangYong and will have to pay KRW15.5 billion, or 5% of it, to the automaker on 1 November. The Edison consortium is then scheduled to conduct a two-week due diligence on SsangYong next month before signing a deal to acquire the automaker. It is estimated that up to KRW1 trillion is needed to take over SsangYong and then pay its debts. SsangYong has been struggling with snowballing debts amid the COVID-19 virus pandemic and the Seoul Bankruptcy Court put the debt-laden automaker under court receivership on 15 April. A majority stake in SsangYong was put up for auction on 28 June after its Indian parent company Mahindra & Mahindra (M&M) failed to attract an investor. (IHS Markit AutoIntelligence's Jamal Amir)

- According to the Asia News Network, Bank Indonesia (BI), the country's central bank, announced on 19 October that it has extended the credit card payment preferential treatment until mid-2022. Under the special terms, the minimum credit card repayment has been reduced from 10% to 5%, while the late payment charge has been capped at 1% interest or IDR100,000 (USD7.1), whichever is lower. (IHS Markit Banking Risk's Angus Lam)

- According to the BI's annual report for 2020, published in April 2021, relaxed credit card policy is one of the key policies to "mitigate the COVID-19 impact" and "recover the national economy from COVID-19". This payment relaxation was first introduced in November 2020 and was originally due to end at the end of 2021.

- While these credit card policies aim to reduce the impact of COVID-19 on retail customers, the high interest rates charged by credit card operators had been questioned even before the pandemic.

- While the BI does not publish banks' credit card loans, overall loans for household consumption account for around 30% of total loans outstanding. Housing loans only account for around 40% of total household consumption loans. Even after removing other secured types of loans such as vehicle loans, IHS Markit estimates that credit card and other personal loans account for around 50% of total household consumption loans.

- Fortescue Metals Group founder and Chairman Andrew Forrest, one of Australia's richest people, has his eyes set on decarbonizing maritime transportation as his company begins to eradicate emissions across its value chain. (IHS Markit Net-Zero Business Daily's Max Lin)

- Earlier this month, Perth-based Fortescue said it plans to achieve net-zero Scope 3 emissions by 2040, becoming the first mining major to make a firm commitment to tackling the largest part of the industry's carbon footprint.

- The iron ore miner in March announced a target of operational carbon neutrality by 2030, 10 years earlier than its previous goal, set in June 2020.

- Fortescue, the world's fourth-largest iron ore producer, plans to develop hydrogen-based technologies to reduce emissions from shipping, iron- and steel-making in the coming decades.

- As part of the decarbonization pathway, its green energy arm-Fortescue Future Industries (FFI)-is tasked with producing 15 million metric tons (mt) of hydrogen from renewable power annually by 2030. The company recently announced it will build a 2-GW-per-year electrolyzer factory in Gladstone, Queensland in 2022, with an initial investment of A$114 million ($85.9 million).

Posted 29 October 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.