Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 29, 2020

Daily Global Market Summary - 29 May 2020

US and APAC equity markets closed mixed, while European markets were lower across the region. However, all major equity markets closed higher week-over-week, with Japan the best at +7.3% and Hong Kong the lowest at +0.1%. iTraxx IG/HY credit indices closed lower and CDX IG/HY closed higher, with credit across both continents much better on the week. Most market participants seem to be in agreement that, barring a second major wave of COVID-19 infections, there's a good chance that we saw the worst two months of the economic fallout from the pandemic, but there is still wide range of views on the speed/timing of the recovery and how it will permanently alter many sectors.

Americas

- US equity indices closed mixed today, with a late day rally triggered by President Trump's press conference on China being less harsh than expected; Nasdaq +1.3%, S&P 500 +0.5%, DJIA -0.1%, and Russell 2000 -0.5%.

- 10yr US govt bonds closed -4bps/0.66% yield and 30yr bonds closed -4bps/1.41% yield.

- Crude oil closed +5.3%/$35.49 per barrel.

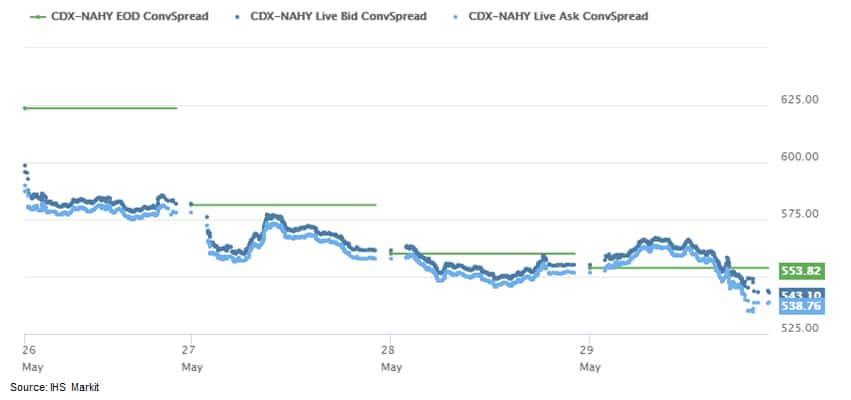

- CDX-NAIG closed flat/78bps and CDX-NAHY -13bps/541bps, with the indices rallying a significant -9bps and -83bps week-over-week, respectively (not to mention it being a holiday-shortened week). The below is this week's CDX-NAHY intraday prices:

- President Trump said Friday that the U.S. would terminate its relationship with the World Health Organization, suspend entry for Chinese foreign nationals whom the U.S. views as a security risk and roll back some of the special preferences the U.S. has granted Hong Kong. (WSJ)

- A new report by Jefferies Research has warned the rate of zoonotic transfer of coronaviruses is accelerating. In the last 500-800 years, there have been seven human coronaviruses that originated in animals. Jefferies noted the novel SARS-CoV-2 virus behind the ongoing COVID-19 pandemic is the third virus from a bat to infect humans not only in this century but within the last 20 years - indicating a heightened pace of zoonotic transfer. However, the research also highlighted the challenge in finding solutions - it said a vaccine against SARS-CoV-2 would be the best defense against the current crisis and future coronaviruses but one may never arrive. To date, an effective vaccine against a human coronavirus has never been developed. This could in turn benefit businesses in the animal health space, which are lending their expertise to speed R&D for treatments in human health. Jefferies pointed out collaboration between firms in the actual manufacturing of any vaccine would also be key. (IHS Markit Animal Pharm's Sian Lazell)

- Monthly US GDP plunged 11.3% in April on the heels of a 5.4% decline in March. The decline in April was mainly accounted for by personal consumption expenditures (PCE), reflecting profound weakness in all major categories (durables, nondurables, and services). (IHS Markit US Macroeconomics Group)

- Declines were also posted for residential and nonresidential fixed investment, government consumption and gross investment, and nonfarm inventory investment. Net exports are estimated to have risen.

- The level of monthly GDP in April was 46.2% below the first-quarter average at an annual rate.

- Implicit in our forecast of a 42.9% annualized decline in GDP in the second quarter is the beginning of recovery in May and June.

- US Personal income increased 10.5% in April and real disposable personal income increased 13.4%. The Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 provided $300 billion in direct "economic impact payments" to individuals, with advance tax rebate payments distributed mostly in April 2020. This, along with expansion of pandemic-related unemployment insurance benefits, contributed to an increase of $2.999 trillion (annual rate) in government social benefits in April. (IHS Markit Economists James Bohnaker and David Deull)

- Real personal consumption expenditures (PCE) declined 13.2% in April, a sharper contraction than we had expected. Combined with an assumed stronger recovery over May and June, this left our forecast of second-quarter PCE growth unrevised at -47.8%.

- Within goods, the leading contributor to the decrease in real PCE was spending on food and beverages for off-premise consumption, which declined 17.2% after surging 21.9% in March. Within services, the largest contributors to the decrease were spending for healthcare (down 28.8%) and food services and accommodations (down 34.4%).

- With personal income outstripping outlays in April, the personal saving rate shot up to 33.0%, easily the highest rate on record dating back to 1959.

- The core PCE price index declined 0.4% in April, enough to lower the 12-month change by 0.7 percentage point to 1.0%.

- The goods deficit widened by $4.7 billion in April to $69.7 billion. This was in contrast to expectations for a narrowing. Moreover, the combined inventories of wholesalers and retailers fell 1.7%, more of a decline than we had expected. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Nominal goods exports declined 25.2% in April, reflecting large declines broadly across most major categories.

- Imports of goods declined 14.3% in April, with roughly one-half of the decline in the motor-vehicles category.

- Inventories of retailers fell 3.6% in April, the largest percentage decline on record (data begin in 1967). This is a startling development, considering how weak retail sales were in April (retail sales declined 15.1%).

- The University of Michigan Consumer Sentiment Index edged up 0.5 point (0.7%) in May after a colossal 29.2-point plunge between February and April. This reading is consistent with our assumption that April represented the low point of the slump in consumer spending induced by the spread of and responses to COVID-19. (IHS Markit Economists David Deull and James Bohnaker)

- Relative to the preliminary May reading, the Consumer Sentiment Index surrendered 1.4 points of its prior gain. Though a difference of this size is not monumental, the decline suggests that there was no great rebound in consumer mood as the month progressed and more states began or continued reopening.

- The current conditions index recovered 8.0 points in May, to 82.3, while the expectations index fell a further 4.2 points to 65.9, the lowest since October 2013. Expectations in particular continued worsening as the month progressed. Although economic activity is gradually reawakening as stay-in-place orders expire, consumers increasingly expect some economic damage to last.

- Consumer sentiment increased 3.2 points to 75.1 among households earning more than $75,000 a year, but fell a further 2.8 points to 69.1 for those earning less.

- Buying conditions broadly improved in May. The index of buying conditions for large household durable goods recovered 19 points to 105, that of homes increased 14 points to 119, and the index of buying conditions for vehicles clawed back 15 points to 131. Of the three, only the measure for vehicles was near its pre-COVID-19 level.

- Inflation expectations surged in May; the expected one-year inflation rate jumped 1.1 percentage points to 3.2%, the highest since July 2014, while the expected five-year inflation rate rose 0.2 percentage point to 2.7%.

- Canada's economy plunged into a deep recession in first quarter because of COVID-19. (IHS Markit Economist Arlene Kish)

- Canada's real GDP nosedived 8.2% quarter on quarter annualized (q/q a.r.) in the first quarter, which was better than the initial advance estimate Statistics Canada provided earlier this year.

- Final domestic demand was decimated, falling 6.0% q/q a.r. as household consumption and inventory investment were the biggest losers subtracting from growth.

- The decline in investment was weaker than forecast.

- Export and import trade volumes were down sharply, but the net impact on GDP was negligible.

- Canada's industrial output declined in March to lowest level since August 2016. (IHS Markit Economist Chul-Woo Hong)

- Real GDP by industry output fell 7.2% month over month (m/m) in March.

- Output in the goods-producing industries decreased 4.6% m/m while services-producing industries declined 8.1% m/m.

- Industrial production dropped 5.2% m/m, mainly because of sharp decreases in mining and oil and gas extraction and manufacturing output.

- Given Statistics Canada's estimated 11.0% m/m plunge in April, the COVID-19 pandemic shock to second-quarter real GDP growth is expected to be much bigger than we forecast in early May.

- The largest declines were concentrated in the services sector, led by arts, entertainment, and recreation (down 41.3% m/m); accommodation and food service (down 36.9% m/m); education (down 13.5% m/m); and health care and social assistance (down 11.1% m/m).

- While markets, and individuals, are still adapting to the shifting realities of the immediate global pandemic crisis, there has been a recent shift in our client conversations away from tactical considerations to strategic implications. Gas market players have been no exception, and rightfully so, as we continue to think this oil market downturn will have material near- and medium-term implications on the US natural gas market. Specifically, we expect the downturn to accelerate the trend towards a more structurally sound business model for US oil producers, with more focus on returns and less on growth. (IHS Markit Energy Advisory's Roger Diwan, Breanne Dougherty, Justin Jacobs, and Sean Karst)

- The once robust oil associated gas production trajectory that underpinned balances has been re-based forcing non-associated gas production to take on a larger role.

- The gas cost of supply curve will inch higher than assumed in previous base-case outlooks to reflect the relative reduction of extremely low-cost associated gas and increase of higher cost non-associated gas within the supply stack.

- Virginia is targeting the development of at least 5.2 GW of offshore wind power by 2034. The Clean Economy Act requires electricity to come from 100 percent renewable sources. Nearly all coal-fired plants are required to close by end 2024. Dominion Energy and Ørsted are currently developing Virginia's first offshore wind project - the 12 MW Coastal Virginia Offshore Wind (CVOW) demonstration wind farm. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- General Motors (GM) has announced that it will start increasing vehicle production in North America from the first week of June to meet rising demand, reports the Detroit Free Press. From 1 June, the company's sport utility vehicle (SUV) assembly plants in Spring Hill, United States, and Ingersol, Canada, will operate in two shifts, rather than one as currently, and the three US assembly plants that build pick-ups - Flint, Fort Wayne, and Wentzville - will start operating in three shifts, rather than one. Meanwhile, GM also said that it will resume production at its Fairfax plant (US), as previously confirmed, on 1 June. GM is investing an additional USD20 million at its Arlington Assembly plant to upgrade conveyors in preparation for the launch of GM's all-new full-size SUVs. (IHS Markit AutoIntelligence's Tarun Thakur)

- Braskem has given an update on the impact that the COVID-19 pandemic is having on the company and measures it is taking to tackle current challenges. It has reduced staffing levels at its facilities to the minimum and cut by 50% the number of industrial workers and contractors at its sites. The company says that plant utilization rates in Brazil and the US were reduced in response to lower demand and inventory effects in the petrochemical and plastics production chain. Utilization rates will be adjusted according to market demand and the potential opportunities for export to other regions, especially with the resumption of activities in Asia, the company says. In Brazil, adjustments so far included reduction in ethylene production to about 65% of its total capacity, which is 3.6 million metric tons/year (MMt/y), while in the US the company reduced its polypropylene (PP) production to about 85% of the 1.6 MMt/y total capacity.

Europe/Middle East/ Africa

- European equity markets closed lower across the region; UK -2.3%, Spain -1.8%, Germany -1.7%, France -1.6%, and Italy -0.8%.

- 10yr European govt bonds closed higher except for Italy +6bps; Germany/UK -3bps, Spain -2bps, and France -1bp.

- iTraxx-Europe closed +3bps/72bps and iTraxx-Xover +14bps/429bps, but the indices were a solid -7bps and -49bps week-over-week, respectively.

- Brent crude closed +5.0%/$37.84 per barrel.

- Passenger car production in the United Kingdom plummeted in April because of COVID-19 virus-related stoppages that lasted through the month at many sites. According to the latest data published by the Society of Motor Manufacturers and Traders (SMMT), output this month dropped by 99.7% year on year (y/y) to just 197 units. Of this, 152 units were designated for export and 45 units for domestic sale. The drop has meant that year-to-date (YTD) volumes are now down by 27.6% y/y to 441,260 units. At the same time, the SMMT has also confirmed that only 15 units of commercial vehicles were produced, down 99.3% on April 2019, all of which were built for local sale. This has meant that output in the YTD is now down by 27.6% y/y to 29,675 units. (IHS Markit AutoIntelligence's Ian Fletcher)

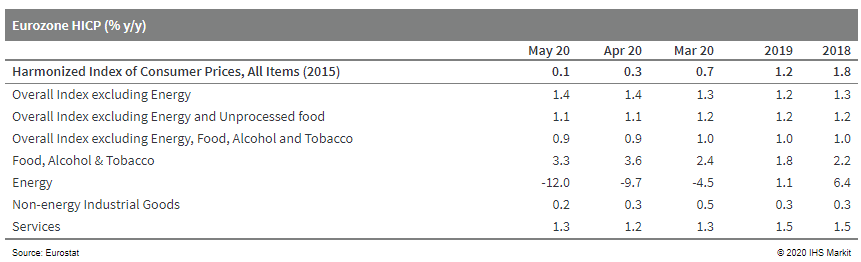

- The Eurozone's HICP inflation fell from 0.3% to just 0.1% in May according to Eurostat's flash estimate, its lowest level since June 2016. Deeply negative energy inflation was again the main item driving the deceleration. At -12% y/y (see table below), its rate of decline was the deepest since July 2009. Simultaneously, inflation for unprocessed food also moderated for the first time in nine months. (IHS Markit Economist Ken Wattret)

- The inflation rate excluding food, energy, alcohol and tobacco prices was unchanged at 0.9%, remaining at its lowest level since August 2019.

- A modest and only partial rebound in service sector inflation following weakness in March and April was offset by a further deceleration in non-energy industrial goods inflation (again see table below). Weak factory gate inflation data point to further downward pressure on the latter.

- Based on the evolution of crude oil prices since late April, headline inflation in the eurozone will probably just avoid slipping into negative territory.

- German Tier-1 component supplier and transmissions specialist ZF Friedrichshafen will cut around 15,000 jobs by 2025, according to an internal memo that was reported by Reuters. The job cuts were shared in an internal email that was seen by the news agency. It said, "As a result of the demand freeze on the customer side, our company will make heavy financial losses in 2020.These losses threaten our financial independence. The crisis will last longer, and even in 2022 we will fall noticeably short of our targets for sales." Tier 1 suppliers and OEMs alike are having to adjust to the new reality that is the post-COVID-19 virus pandemic economic environment. The fallout is unlikely to be short-lived or easy for these companies to cope with. (IHS Markit AutoIntelligence's Tim Urquhart

- According to Germany's Federal Statistical Office (FSO) data, real retail sales excluding cars declined by 5.3% month on month (m/m; seasonally and calendar adjusted) in April, while revisions curtailed the drop in March from -5.6% m/m to -4.0% m/m. These declines have been smaller than expected given the forced closure of most non-essential shops between mid-March and late April, but they still represent a sharp break with the preceding upward tendency between November 2019 and February 2020. (IHS Markit Economist Timo Klein)

- Unadjusted year-on-year (y/y) rates nonetheless have declined further from -1.2% to -6.5% in real terms and from 0.3% to -5.3% in nominal terms, with there being no distortions from shopping-day effects this time. These numbers compare with the average growth of 3.1% (real) and 3.6% (nominal) in 2019.

- Major categories of the price-adjusted y/y data for April (total -6.5% y/y; reveal - as in March - a very large divergence between food (6.2%) and non-food sales (-14.5%).

- The most extreme declines were observed in textiles and shoes at -70.7% y/y and in sales at general department stores at -40.3 y/y.

- Italy's national statistical office (ISTAT) reports that the impact of the COVID-19 virus pandemic was more severe on the economy during the first quarter of 2020 than initially reported. The national lockdown and the social-distancing measures have stalled the hotel and restaurant, and the travel and transport sectors, and recreational, cultural, and personal services from 11 March. (IHS Markit Economist Raj Badiani)

- ISTAT estimates that the Italian economy shrunk by 5.3% quarter on quarter (q/q) in the first quarter, revised downwards from the initially reported 4.7% q/q drop in the 'flash' release.

- Italy is now in a technical recession (defined as two successive quarters of q/q decline) after contracting by 0.3% q/q in the fourth quarter of 2019. In addition, the economy in the first quarter was 5.4% smaller compared with a year earlier.

- France's Q1 GDP is now estimated to have contracted by 5.3% quarter on quarter (q/q), as opposed to a fall of 5.8% q/q as initially estimated, but high-frequency data point to an extremely large decline in activity during the second quarter. The declines in private consumption (-5.5% q/q as opposed to 6.0% q/q) and fixed investment (-10.5% q/q as opposed to -11.8% q/q) were particularly revised by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). (IHS Markit Economist Diego Iscaro)

- Households' gross disposable income declined by only 0.1% q/q during the first quarter, as a sharp fall in wages (-1.8% q/q) was offset by a strong increase in social benefits in cash (+2.8%) as the government provided income support to households affected by a sudden loss of income.

- Consumer prices rose by just 0.3% q/q during the first quarter. This, combined with the marginal decline in disposable income, led to a fall in households' purchasing power of 0.4% q/q during the first three months of the year. Given the 5.5% q/q decline in consumption, households' saving rate rose markedly from 15.1% during the fourth quarter of 2019 to 19.6%, its highest level in more than 40 years

- Consumption of goods, which accounts for around one-third of total consumption, declined by 20.2% month on month (m/m) in April. This follows a fall of 16.9% m/m in March.

- High-frequency data already available for the second quarter suggest that the decline in activity is likely to accelerate sharply during the period. The easing of the containment measures - yesterday (28 May) the government lifted travel restrictions within the country and announced the reopening of restaurants and other 'non-essential' shops from 2 June in most of the country.

- According to the revised estimate, Danish GDP contracted by 2.1% quarter on quarter (q/q) and by 0.3% year on year (y/y). This is the largest quarterly drop in GDP since the fourth quarter of 2008, the peak of the financial crisis, and worse than the "flash" estimate contraction of 1.9% q/q published in mid-May. Government consumption dropped by 1.5% q/q, while fixed investment was largely flat, contracting by 0.1% q/q. The fall in imports of goods and services was smaller than the fall in exports, hence net trade was also a drag. With respect to the quarterly path, IHS Markit expects the bottom to be reached in the second quarter with a q/q drop of close to 10%, followed by a rebound from the third. For the full year, we expect GDP to contract by over 7%. (IHS Markit Economist Daniel Kral)

- During its session on 28 May, Poland's Monetary Policy Council (MPC) reduced the policy interest rate by 40 basis points, marking the third straight month of easing. Other key interest rates were also cut, including the Lombard rate (from 1.0% to 0.5%), the rediscount rate (from 0.55% to 0.11%), and the discount rate (from 0.60% to 0.12%), while the deposit rate remains at zero. While some analysts were surprised by the MPC's latest interest rate move given the downside risks for the zloty, IHS Markit was anticipating another cut at the May session, albeit somewhat milder (to 0.25%). (IHS Markit Economist Sharon Fisher)

- Israel's Central Bureau of Statistics (CBS) released on 25 May its first estimate of the country's GDP in the first quarter. Israel's real GDP contracted at a 1.8% quarter-on-quarter (q/q) seasonally adjusted rate in the first quarter, or at a 7.1% q/q seasonally adjusted annualized rate (q/q SAAR). This 7.1% q/q SAAR decline exceeded previous estimates from the central bank, the Bank of Israel (BOI), of a contraction of around 5.0% and IHS Markit's projections of a 5.4% contraction. This followed unrevised growth of 4.6% q/q SAAR in the fourth quarter of 2019. (IHS Markit Economist Ana Melica)

- This was the first q/q contraction since the second quarter of 2012, and the largest since 1994. In the 15 years to 2019, there have been only three quarters of q/q contractions (in 2006, 2008, and 2012).

- On a year-on-year (y/y) basis, Israel's real GDP growth in the first quarter was still positive but fell to 0.6% y/y, from 3.7% y/y in the fourth quarter of 2019.

- Private consumption contributed the most to the decline, falling 5.5% q/q or 20.3% q/q SAAR in the first quarter. The categories showing sharp contractions were personal transport equipment (down 77.1% q/q SAAR); clothing (down 34.7%); furniture, jewelry, clocks and watches (down 31.4%); and fuel, electricity, and water (down 9.2%). The major categories that showed growth were food (7.7% q/q SAAR) and housing (2.2%).

- Fixed investment also declined steeply in the first quarter, with both the industries and the residential building categories shrinking by similar rates.

- Israel's exports fell 1.5% q/q, or 5.9% annualized in the first quarter. However, imports contracted sharply, by 7.7% q/q, or 27.5% annualized, with consumer-goods imports driven lower by a plunge in passenger-car imports.

- The Israeli government on 26 May awarded the USD1.5-billion contract for the Soreq B desalination plant to Israeli company IDE Technologies. IDE was chosen over Hutchison Water, which is majority-owned by the Hong Kong SAR-based CK Hutchison Holdings. The cost for water generation in the bid by IDE was unprecedentedly low, but the decision to award the Israeli company the contract came 10 days after US Secretary of State Mike Pompeo visited Israel and warned the government against allowing Chinese investment in major infrastructure projects for security reasons. In 2019, under similar US pressure, Israel formed an advisory oversight committee to actively monitor foreign investments. (IHS Markit Country Risk's Jack Kennedy)

Asia-Pacific

- APAC equity markets closed mixed; Australia -1.6%, Hong Kong -0.7%, Japan -0.2%, South Korea +0.1%, and China +0.2%.

- Japan's Index of Industrial Production (IIP) fell by 9.1% month on month (m/m) in April for the third consecutive month of decline. A slightly softer contraction in manufacturers' shipments (down 8.8% m/m) than in production led to a marginal decline in inventory (down 0.3% m/m), but the index of inventory ratio continued to surge (by 12.7% m/m), reaching the highest level since May 2009. (IHS Markit Economist Harumi Taguchi)

- The sharpest decline in the IIP since March 2011 (when the Great East Japan Earthquake and Tsunami severely damaged plants and the supply chain) was due largely to a sizeable decline in production of autos (down 33.3% m/m; 5.1-percentage-point negative contribution to the contraction of the IIP), reflecting sharp drops in exports as well as domestic sales. Sluggish demand, plant closures, and disruption to the supply chain caused by COVID-19 virus-related containment measures also hit other transport equipment and other auto-related industries.

- The decline in inventory largely reflected destocking in iron, steel, and non-ferrous metals as well as production machinery, and some other industry groupings. That said, weak demand boosted inventories in transport equipment, electronic parts and devices, and general-purpose and office machinery and other machinery.

- The April results suggest significant impacts of COVID-19 on the auto sector. The industry expects a 4.1% m/m drop in production in May, driven by continued declines in production of transport equipment and iron, steel, and non-ferrous metals, before a 3.9% m/m rise in June.

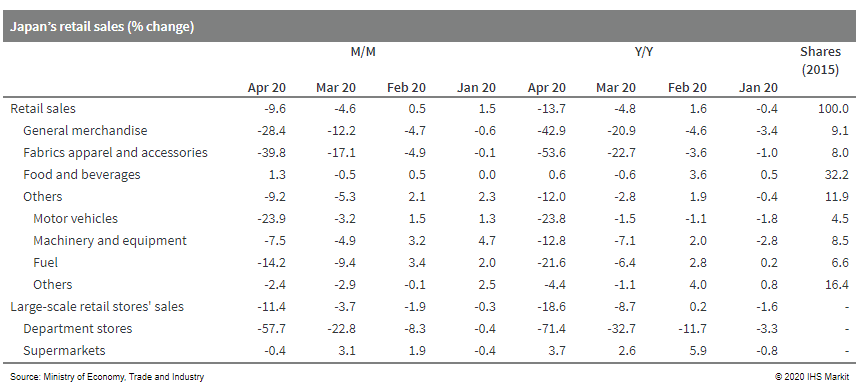

- Containment measures for the coronavirus disease 2019 (COVID-19) virus dampened Japan's retail sales and weakened labor demand in April. Although consumer sentiment improved in May, the recovery of consumer spending could be modest. (IHS Markit Economist Harumi Taguchi)

- Japan's retail sales fell by 9.6% month on month (m/m), or 13.7% year on year (y/y), in April. Stricter measures to contain the COVID-19 virus following the declaration of a state of emergency that included stay-at-home requests and the temporary closure or reductions of business hours for non-necessary goods retailers resulted in sizeable declines in figures for non-necessary goods retailers, particularly for department stores (down 57.7% m/m), fabrics apparel and accessories (down 39.8% m/m), and motor vehicles (down 23.9% m/m).

- Japan's unemployment rate eased up to 2.6% in April. While the number of employed workers fell by 107,000 from a month earlier (for the first y/y decline since December 2012), largely because of decreases for non-regular workers (females in particular), the moderate increase in unemployment rate was due largely to a fall in labor participation, as labor force dropped by 99,000 people from a month earlier.

- However, consumer confidence rose by 2.4 points to 24.0 in May 2020, the first rise since December 2019. While all component indicators improved, the improvement largely reflected indicators of overall livelihood and willingness to buy durable goods. This probably reflected the lifting of the state of emergency, a rise in the stock market, and cash benefits released under the government's stimulus package.

- Nissan has decided to stop its sales and marketing operations in South Korea, including its premium brand Infiniti, by December 2020, reports Yonhap News Agency. The move is part of its global business reorganization. "The company has reached a conclusion that it is hard to regain a sustainable growth structure in South Korea due to worsening business environments at home and abroad despite its efforts to keep operations here," said Nissan in a statement. However, the automaker will continue to offer after-sales services for South Korean owners of the Nissan and Infiniti models for eight years through 2028. (IHS Markit AutoIntelligence's Jamal Amir)

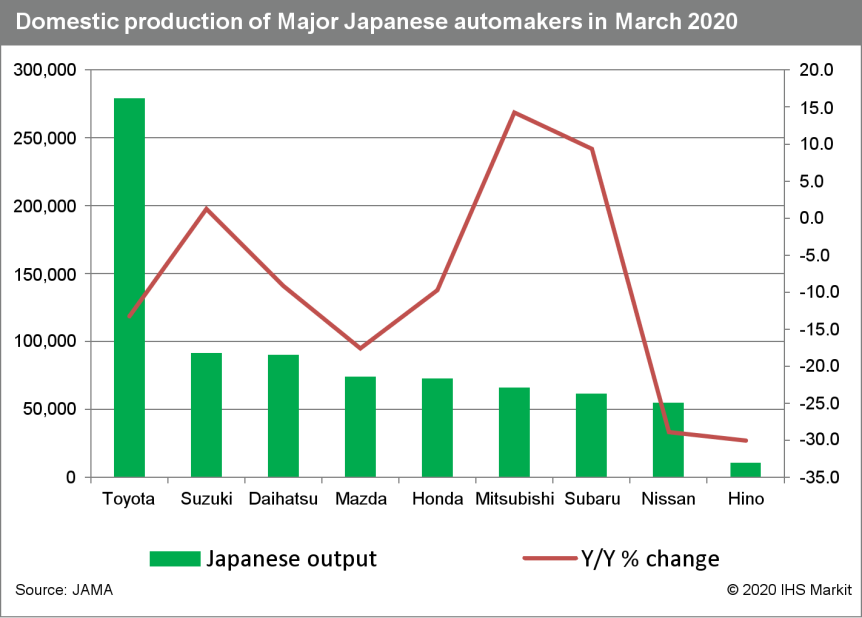

- Japanese vehicle production, including passenger vehicles, trucks, and buses, totaled 828,702 units during March, according to figures released by the Japan Automobile Manufacturers Association (JAMA). (IHS Markit AutoIntelligence's Nitin Budhiraja)

- This was a decline of 8.0%% compared with the corresponding month of last year. Output in the passenger car category reached 718,860 units during the month, down 7.86% y/y.

- Within the passenger car category, production of standard cars with an engine displacement of more than 2.0 liters was down by 12.17% y/y to 427,649 units during the month, while output of small vehicles were up by 1.11% y/y to 154,965 units.

- Production of minivehicles, categorized as vehicles equipped with engines smaller than 660cc, was down by 2.8% y/y to 136,246 units.

- Truck production fell 9.04% y/y to 101,105 units, while bus output declined by 5.8% y/y to 8,737 units.

- Daimler India Commercial Vehicles (DICV) plans to invest an additional INR22.77 billion (USD302 million) to expand production capacity at its Oragadam plant in Chennai, reports the Economic Times. The company signed a new memorandum of understanding (MoU) with the Tamil Nadu state government yesterday (28 May). DICV is a wholly owned subsidiary of Daimler and undertakes production of CVs at its Oragadam manufacturing plant. The company's product portfolio includes offerings with a gross vehicle weight (GVW) range from 9 to 49 tons. (IHS Markit AutoIntelligence's Isha Sharma)

- China Three Gorges New Energy plans to launch an initial public offering of its shares at a total value of USD 3.5 billion, with 80% of the raised funds to be used to invest in seven offshore wind projects. Listed projects include the 300 MW Yangxi Shapa, the 300 MW Changyi City Marine Farm and Three Gorges demonstration, the 400 MW Yangxi Shapa Phase II, the Zhangpu Liu'ao Zone D, the Changle Waihai Area A, the 400 MW Jiangsu Rudong H6, and the 400 MW Jiangsu Rudong H10. According to the pre-disclosure document, should the net amount of raised funds be lower than planned, CTGNE will bridge the gap with its own investments in the projects. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- Hai Long Offshore Wind intends to deploy Siemens Gamesa's new SG 14-222 DD offshore wind turbine at the 300 MW Hai Long 2 project off Taiwan. The exact number of units for the first 300 MW of the project remains to be confirmed depending on site-specific conditions. This will be the first installation of the SG 14-222 DD in Asia Pacific. The deployment of the new turbine for the rest of the 1,044 MW Hai Long pipeline is also being considered. Siemens Gamesa will commence nacelle production for the Hai Long 2 project in Taichung in 2024. The preferred supplier agreement, announced in November 2019, remains subject to contract and final investment decision from consortium partners Northland Power and Yushan Energy. The Hai Long offshore wind project is located 50 km off the coast of Changhua County. (IHS Markit Upstream Costs and Technology's Chloe Lee)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-may-2020.html&text=Daily+Global+Market+Summary+-+29+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 29 May 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+29+May+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}