Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 23, 2020

Daily Global Market Summary - 23 April 2020

Today's flash PMI summaries were filled with a version of the statement "lowest reported level in survey history" across several metrics and multiple countries, which offers some of the earliest reads into what to expect in other upcoming economic releases which were measured during some of the regional peaks of the pandemic. It's worth noting that the US dollar and US government bonds continue to slowly strengthen each week, which could indicate some growing concerns about the rapidly deteriorating macroeconomic backdrop and the reemergence of COVID-19 in some previously infected regions.

Americas

- US equity markets closed almost flat after toggling between being gains and losses throughout the day. The Russell 2000 +1.0% was the best performer on the day, with the DJIA +0.2%, Nasdaq flat, and S&P 500 -0.1%. The S&P 500 was as high as +1.6% at 10:45am ET, but closed near its lowest point of the day:

- 10yr US govt bonds closed -2bps/0.61% yield.

- Crude oil closed +19.7%/$16.50 per barrel.

- The WTI May 2020 contract's meltdown on Monday has left the natural gas market with much to think about. The US oil market is in uncharted territory as storage quickly fills and WTI front-month prices will need to hold at levels low enough to bring oil supply to heel through forced shut-ins. Such forced oil shut-ins will accelerate US natural gas production declines; the 17% week-on-week jump in summer 2020 HH prices tells us that gas market speculators are eager to engage off the news. The reality of summer 2020 is that the market must inject 3 Bcf/d less gas into storage between week ended 10 April and 31 October in order to avoid breaching a 4 Tcf end-of-season storage level. (IHS Markit Energy Advisory's Roger Diwan)

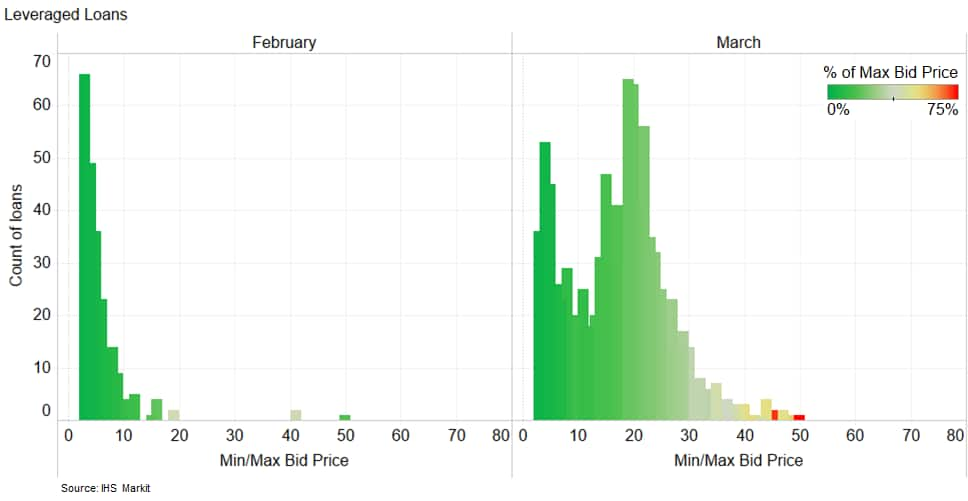

- The below chart compares the highest and lowest dealer bid side quotes (size ≥$1 million) on individual leveraged loans during the months of February and March. The x-axis indicates the number of individual loans that had a given max-min bid price range and the color indicates the range's average percentage of the highest bid. The data illustrates the unusually high degree of price dispersion that occurred in the leveraged loan market last month.

- Following its approval in the Senate on Tuesday, House of Representative lawmakers prepared to approve the next infusion of $484 billion in aid for small businesses and hospitals grappling with the outbreak's toll. (WSJ)

- US initial claims for unemployment insurance decreased to 4,427,000 in the week ended 18 April. Claims remained at historically high levels, although below the all-time high of 6,867,000 in the week ended 28 March. This was the fifth straight week with claims in seven figures and illustrates the depth of the layoffs seen across the country due to COVID-19. Seven states reported an increase of more than 1,000 in unadjusted initial claims compared with the prior week. Florida led all states with an increase of 324,718 in the unadjusted level of initial claims. Forty-two states reported a decrease of more than 1,000 in unadjusted initial claims, and some may have hit a peak. In the last four weeks, 24.380 million people (not seasonally adjusted) have filed for unemployment benefits—14.8% of the entire civilian labor force. (IHS Markit Economist Akshat Goel)

- US new home sales tumbled 15.4% (±14.8%, statistically significant) to a seasonally adjusted annual rate of 627,000 in March from February. This report, like February's report, should be ignored because of the way the Census Bureau handles cancellations—it does not adjust for them. This matters because an unknown number of homes sales for March and previous months will be cancelled on account of the collapsing economy. (IHS Markit Economist Patrick Newport)

- IHS Markit Agribusiness analysts in the UK, Germany and the US have been collaborating to examine the entire food supply chain from farm to plate. The principal supply issue is not enough labor to harvest the crops, which is partly due to transport problems and partly because of lockdowns. News that Romania is flying in labor to pick the UK's crops or that the USA's National Guard is being employed as extra staff in slaughterhouses are signs of response, but also signs of utter desperation. (IHS Markit Agribusiness' Neil Murray)

- Transport - Road freight is delayed at every stage, partly because of the labor issue, partly because of domestic lockdown restrictions and partly because of delays at international frontiers (mainly in Europe). The Far East ports are jammed with containers because of lockdowns and quarantine.

- Withholding of supplies and shortages - Already, countries are banning or blocking their exports of food products, particularly of rice, to ensure that there is enough for their own populations. The US is exporting more wheat that may fill the gap - it recently signed a huge contract with China - but IHS Markit believes that the USA's inventory of export wheat is running low.

- Meat - US farmers are sending all their herds to early slaughter because the catering market is closed for business.

- Oil - The biggest use for ethanol is the motor fuel market and vehicle traffic is minimal because of lockdowns. As nobody's making ethanol, that means a shortage of animal feed because after fermentation, the mash is dried, pelletized and fed to animals.

- Unrest - IHS Markit expects food riots and looting in any country where there are huge numbers of people living in squalor in very crowded slums and (importantly) where the lockdown has really disrupted food distribution at a time when a lot of dispossessed people have returned home and the infrastructure cannot get enough food into the cities

- Fertilizer company Yara International today announced its first-quarter financial and operational results, including a net loss after noncontrolling interests of $117 million compared with a net profit of $96 million in the year-earlier quarter. Total sales and marketing deliveries were 10% higher compared with a year earlier, primarily reflecting a 15% increase in deliveries in Europe, and commercial margins were stable compared with a year earlier, Yara says. Yara's ammonia production, at 1.924 million metric tons (MMt), was down 7%, and finished fertilizer production was 3% lower at 5.31 MMt compared with a year earlier.

- Air Products reported net income before one-time items for the quarter ended 31 March of $490 million, up 7% YOY on higher pricing and volumes in all three regions. The company estimated a negative overall volume impact of 1% from COVID-19, primarily due to lower Asia merchant volume during the quarter. The company said it does expect the negative impact on Americas and Europe, Mideast, and Africa (EMEA) merchant volumes to be more significant in the June quarter and potentially longer depending on impacts of the COVID-19 pandemic.

- Honda has announced that it will extend its plant shutdown in Brazil until 25 June due to the advance of the COVID-19 virus outbreak, reports Automotive Business. The extension to the shutdown impacts on production at Honda's plants in Sumaré and Itirapina in São Paulo state (Brazil). (IHS Markit AutoIntelligence's Tarun Thakur)

- Argentina did not service the interest portion (USD503 million) of three bonds issued in 2016 to finance the settlement with holdout creditors (Global 2021, 2026, and 2046). Argentine authorities have restated their willingness to service the bonds despite the extreme difficulties created by the COVID-19 pandemic, while also noting that the restructuring offer made to bond holders expires on 8 May. (IHS Markit Economist Paula Diosquez-Rice)

- The central bank of Mexico (Banco de México: Banxico) on 21 April, during its second unscheduled meeting, cut the policy rate by 50 basis points to 6.0%. The bank has not indicated whether the next meeting, originally scheduled for 14 May, will still be held or has been replaced by the 21 April meeting. The policy rate is still high in nominal and in real terms, so there may be ample room for further cuts. However, Banxico is cautious and is concerned about likely capital outflows in search of safe heavens or lower risk countries; this would imply a further depreciation of the local currency. (IHS Markit Economist Rafael Amiel)

Europe/Middle East/ Africa

- European leaders agreed to set up a massive recovery fund, closely tied to the bloc's seven-year budget. They also confirmed that €540bn of financial support would be released through existing mechanisms starting 1 June. European Commission chief Ursula von der Leyen said the fund would mobilize €1 trillion of investment. (BBC)

- The European Commission's "flash" estimate of consumer sentiment in the eurozone plunged by a record 11 percentage points in April, the biggest month-on-month (m/m) decline in the history of the series by a huge margin. At just 13.5 in April, the level of the composite PMI's output index is more than 20 percentage points below its trough in March 2009 . Back then, the peak quarter-on-quarter (q/q) fall in eurozone GDP was a little over 3%, implying a very high likelihood of much larger contractions during the first half of 2020. (IHS Markit Economist Ken Wattret)

- The composite business sentiment index fell from 94 in March to 62, the lowest reading since the survey started to be collected in 1980 by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). The previous low was 69, reached in March 2009. The employment climate indicator plummeted from 95 to 70 in April, also a record low. (IHS Markit Economist Diego Iscaro)

- France's National Agency for Medicines and Health Products Safety (ANSM) and National Health Insurance Agency (CNAM) have published analysis suggesting that sales of chronic disease medicines, anti-depressant and anti-epileptic drugs, and HIV anti-retrovirals, as well as purchases of paracetamol, have surged as consumers stocked up on supplies during the early weeks of the country's coronavirus disease 2019 (COVID-19)-virus-related lockdown measures. In comparison, prescription sales of anti-inflammatory drugs such as ibuprofen fell by 60% after French medical authorities recommended against their use in the event of COVID-19 infection. (IHS Markit Life Science's Eóin Ryan)

- The composite index measuring UK output across the manufacturing and services sectors has dropped by 23.1 points to 12.9, the lowest level since the survey began in January 1998. This signals an unprecedented decline in private-sector output, well below the prior low of 38.1 in November 2008 during the height of the financial crisis. The service sector in April endured the sharpest fall since the survey began in July 1996, with the business activity index dropping to 12.3 from 34.5 in March. Overall, we now expect to release a projection for an even sharper fall in GDP in both the second quarter and the whole of 2020 in the next forecast update (15 May). (IHS Markit Economist Raj Badiani)

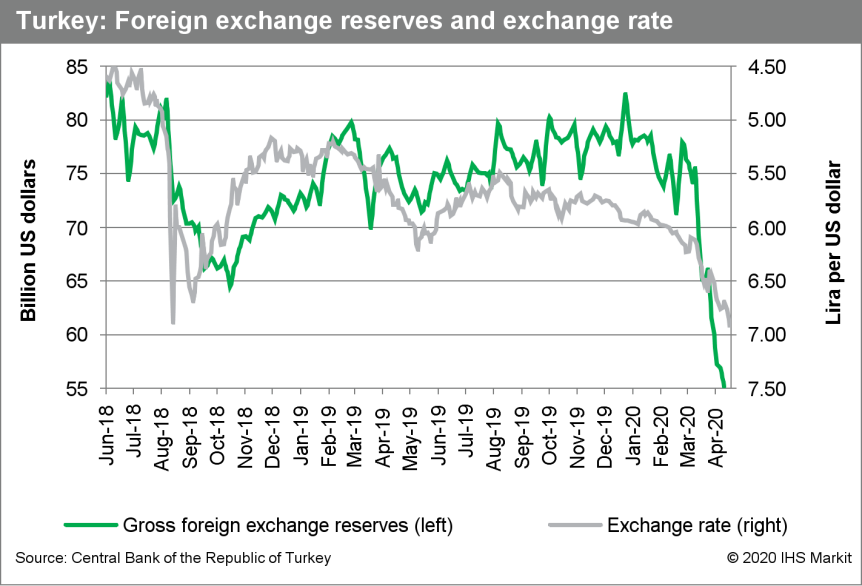

- At its regularly scheduled meeting yesterday (22 April), the Monetary Policy Committee of the Central Bank of the Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB) cut its main policy rate - the one-week repo rate - by 100 basis points, to 8.75%. This is the eighth time the rate has been cut in the eight meetings chaired by Governor Murat Uysal, who was appointed by Turkish President Recep Tayyip Erdoğan in July 2019. The further rate cut will ensure that the lira continues its sharp, downward trajectory into May. Along with local interest rates falling further and thus attracting fewer potential foreign capital inflows, the spread of the COVID-19 virus is continuing to worsen in Turkey, while in other regions the peak has already passed. The most recent weekly reported data from the TCMB (10 April) showed that gross foreign currency reserves had fallen to USD56.0 billion, down by more than USD25 billion from the beginning of the year and far lower than the lowest point in 2018. These reserves have presumably been spent in defense of the lira, as reserves had dropped by more than USD16 billion just in the preceding month. (IHS Markit Economist Andrew Birch)

- Renault Group has released its financial results for the first quarter of 2020, which have shown the scale of impact that the coronavirus disease 2019 (COVID-19) virus pandemic has had on its business. For the three months ending 31 March, the automaker's group revenues fell by 19.2% year on year (y/y) to EUR10,125 million. (IHS Markit AutoIntelligence's Ian Fletcher)

- In a press release, Total announced the signing of an agreement to acquire Tullow Oil's entire stake in the Lake Albert assets for a total consideration of $575 million in cash plus contingent payments. Tullow will sell its entire 33.34% interest in each of the assets comprising the Lake Albert development project. The upstream assets include four production sharing agreements for Blocks 1, 1A, 2 (operator) and 3A (nine production licenses and two exploration licenses). The midstream assets include the Uganda portion of the proposed East African Crude Oil Pipeline. The proposed East African Crude Oil Pipeline will export crude through Tanzania to the Port of Tanga from Uganda. (IHS Markit's Upstream Companies and Transaction's Karan Bhagani)

- Brent crude closed +21.7%/$24.79 per barrel.

- 10yr European govt bonds closed higher across the region; Italy -11bps, Spain -10bps, France -5bps, UK -3bps, and Germany -2bps.

- European equity markets closed higher across most of the region; Italy +1.5%, Germany/UK +1.0%, France 0.9%, and Spain +0.4%.

Asia-Pacific

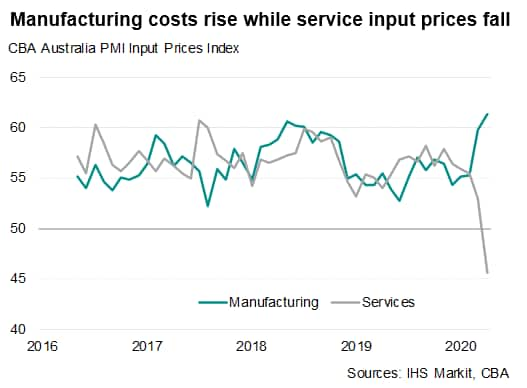

- The Commonwealth Bank Australia Flash PMI, compiled by IHS Markit and covering both the manufacturing and service sectors, fell by a record 17 points in April, building on a previous plunge of 9.6 points in March to drop from 39.4 to 22.4, its lowest in the four-year survey history and so far lower than any other composite PMI in the history of the IHS Markit surveys with the exception of Italy in March. Total input costs fell for the first time in the survey history due to a decline in costs predominantly driven by the service sector. However, manufacturing costs not only rose further, maintaining the unbroken trend of inflation, but also increased at a record rate. Inflation was driven by a combination of material shortages and a weaker exchange rate. The Australian dollar had depreciated just over 4% against the greenback this month. (IHS Markit Economist Bernard Aw)

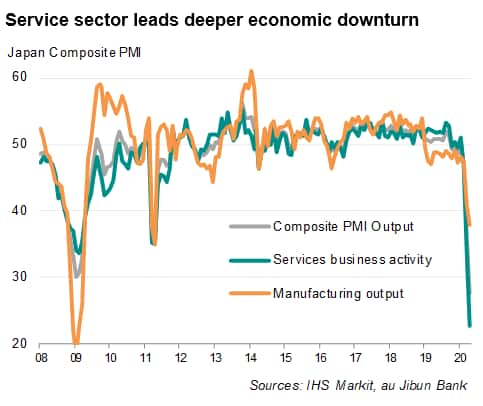

- The downturn in Japan's private sector economy gained momentum in April, with business activity slumping to the greatest extent on record, according to flash PMI data. The headline au Jibun Bank flash PMI plunged 8.5 points to 27.8. The contraction of services activity was at a new record pace in April amid cancellations, business closures and slumping demand. The level of new sales also fell at a rate not previously recorded since data on the service sector were first collected in 2007. (IHS Markit Economist Bernard Aw)

- South Korea's GDP for the first quarter of 2020, compared with the fourth quarter of 2019, was down 5.5% at an annualized rate (the actual percent decline was 1.4%). This was still up 1.3% from a year earlier, but that reflects the growth that took place during the second half of 2019. Following the pattern of the "Great Recession" of 2009, imports fell more than exports, causing net exports to actually increase. The huge drop in imports can be attributed to lower raw material imports for export production, but mostly to a sharp decline in imported consumer goods caused by the collapse of consumption. (IHS Markit Economist Dan Ryan)

- ExxonMobil on Wednesday broke ground on its previously announced petrochemical project at Daya Bay, a district of the city of Huizhou in southern China's Guangdong Province. The complex will have a total investment cost of about $10 billion and will be built in two phases. The first will include a mixed-feed steam cracker designed to produce 1.6 million metric tons/year (MMt/y) of ethylene, 1.2 MMt/y of polyethylene, and 860,000 metric tons/year of polypropylene. It is expected to be completed by 2023 when construction on the second phase is due to begin. TechnipFMC is providing its ethylene technology.

- China will continue to exempt new energy vehicles (NEVs) from vehicle purchase tax through 2022. The policy has been confirmed by a joint statement issued by China's Ministry of Finance, State Taxation Administration and Ministry of Industry and Information Technology (MIIT) last week. The latest sales data indicate that NEV sales in the first quarter fell by 56% year on year (y/y) to 114,000 units. The sector is expected to post another contraction in sales and production after its first decline on year on year basis in 2019. According to IHS Markit's latest forecast released in mid-April, NEV production in China is forecast to reach around 1.07 million units in 2020, down 13.8% from 2019. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Most APAC equity markets closed higher, except for China -0.2% and Australia -0.1%. India/Japan +1.5%, South Korea +1.0%, and Hong Kong +0.4%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-april-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-april-2020.html&text=Daily+Global+Market+Summary+-+23+April+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-april-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 23 April 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-april-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+23+April+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-april-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}