Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 22, 2020

Daily Global Market Summary - 22 May 2020

Most European and US equity markets closed modestly higher today, while APAC markets were lower across the region on concerns over growing tensions between China and the US. Several central banks and governments continued to ease rates and/or launch stimulus programs today to provide liquidity and financial support as their economies rebuild from the impacts of the COVID-19 pandemic.

Americas

- Most US equity markets closed higher, except for DJIA which was almost flat on the day; Russell 2000 +0.6%, Nasdaq +0.4%, and S&P 500 +0.2%.

- 10yr US govt bonds closed higher at -1bp/0.66% yield.

- Crude oil broke its six-day positive streak and closed -2.0%/$33.25 per barrel.

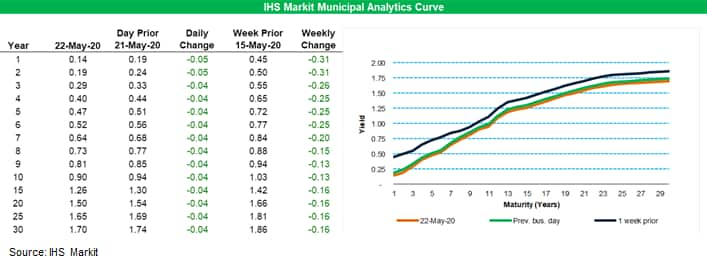

- IHS Markit's AAA Municipal Analytics Curve rallied 4bps across the entire curve today and remains steeper week-over-week, as demand for shorter maturities continues to strengthen from the tailwinds of the Fed's Municipal Lending Facility.

- Senator Thom Tillis of North Carolina was among the bi-partisan group of four US Senators, who on 14 May wrote a letter to Fed Chair Jerome Powell and Treasury Secretary Steven Mnuchin that encourages the Fed to buy longer-term debt issued by state and local governments to help ease the impact of coronavirus on municipal finances. IHS Markit's O'Hara Macken will be interviewing Senator Tillis on Wednesday, May 27 at 12:00pm ET to hear the Senator's thoughts on a wide array of economic and fiscal topics and we are inviting clients and recipients of the Daily Global Market Summary to attend online. Click here to register to attend

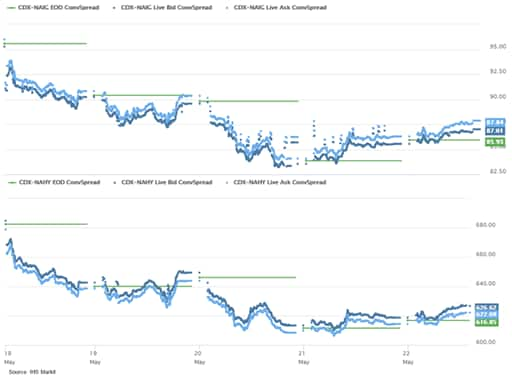

- CDX-NAIG closed +2bps/87bps and CDX-NAHY +8bps/624bps, with both indices tighter on the week:

- In the first quarter of 2020, IHS Markit registration data show that US registrations of electric vehicles (EVs), hybrid EVs (HEVs), plug-in hybrid EVs (PHEVs), and fuel-cell EVs (FCEVs) dropped only 1% y/y, despite a difficult market. The overall performance was on gains in EV registrations and nearly steady HEV registrations, while registrations of PHEVs and FCEVs continue to struggle. Against the backdrop of muted consumer demand from the impact of the COVID-19 pandemic and low fuel prices, electrified powertrains as a group fared relatively well in terms of US vehicle registrations in the first quarter. The struggle over PHEV registrations, which IHS Markit identified in registration data several months ago, seems to be increasing, while EVs continue to gain share. (IHS Markit AutoIntelligence's Stephanie Brinley)

- According to new data from Harvard University researchers, primates that have recovered from mild coronavirus disease 2019 (COVID-19) demonstrated neutralizing antibodies against SARS-CoV-2, which provided evidence of protective immunity against the virus during rechallenge tests. The research paper, published in the journal Science, evaluated antibody titers in nine rhesus macaques after inoculation with SARS-CoV-2 (three doses: 11,000, 110,000 or 1.1 million PFUs), which led to mild disease including decreases in appetite and responsiveness in all animals, but no fever, weight loss, respiratory distress, and mortality. All nine macaques developed neutralizing antibody (NAb) responses as measured by a pseudovirus neutralization assay, and a live virus neutralization assay. (IHS Markit Life Science's Margaret Labban)

- China imports of US shelled pecans are experiencing a robust increase leading to recovery in mid-term global sales. Exports totaled 9.6 million pounds (in-shell basis) in April 2020, one quarter more year-on-year, although seasonal sales (September-April) are still 13.1 million lbs less than in the same period last year, at 65.9 million lbs. (IHS Markit Agribusiness' Jose Gutierrez)

- No in-shell sales were recorded in April 2020 and seasonal exports were 16.6 million lbs, 27% less y-o-y.

- Shelled exports grew by one-third to 4.8 million lbs this April, data revealing an unexpected highlight: Chinese imports totaled 744,850 lbs, a monthly record. As a result, seasonal China's imports doubled to 1.2 million lbs.

- Germany also showed a strong recovery as its lockdown is gradually easing, importing 1.5 million lbs, 50% more than last March and up from 700,000 lbs April 2019.

- US shelled product storage increased by 1.5 million month-on-month in March, although it fell by 12% y-o-y. The main origins, South Atlantic (Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia and West Virginia) fell by 29.0% y-o-y to 12.4 million lbs and West South Central (Arkansas, Louisiana, Oklahoma and Texas) by 6% to 44.4 million lbs.

Europe/Middle East/ Africa

- European equity markets closed mixed; Italy +1.3%, Spain +0.2%, Germany +0.1%, France flat, and UK -0.4%.

- 10yr European govt bonds closed mixed; Italy/Spain -2bps, UK flat, Germany +1bp, and France +2bps.

- Brent crude closed -2.6%/$35.13 per barrel.

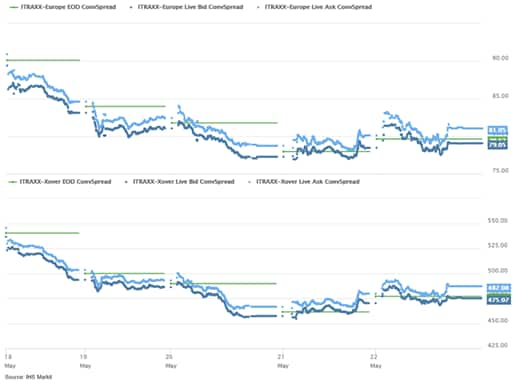

- iTraxx-Europe closed flat/80bps and iTraxx-Xover +4bps/481bps, with both closing tighter on the week.

- As expected, UK retail spending was under considerable pressure during April after the enforced closure of non-essential stores from 24 March. (IHS Markit Economist Raj Badiani)

- Retail sales (including fuel sales) in volume terms decreased by a staggering 18.1% month on month (m/m) in April, which was the largest fall in the survey's history.

- Excluding fuel, retail sales volumes shrank by 15.2% m/m in April and have now fallen in seven of the last 10 months.

- April's monthly decline was primarily due to falling sales in textile, clothing and footwear stores (down 50.2% m/m), household goods (45.4%) and fuel (52.0%).

- Non-store retailing was the only sector to show growth in volume terms in April, posting the strongest growth on record, at 18.0% m/m.

- Online retailing accounted for a record-high 30.7% of total retailing in April (from 19.1% a year earlier), with overall growth of 33.0% compared with April 2019.

- Nissan is to resume production at its Sunderland (United Kingdom) facility from early June, reports ITV News. The company said in a statement released to the broadcaster, "A phased resumption of vehicle production will begin at Nissan Sunderland Plant on Monday 8th June." It added, "This resumption has been made possible following extensive work at the plant to allow the safe return of our employees, with a full and comprehensive set of measures in place to protect staff." (IHS Markit AutoIntelligence's Ian Fletcher)

- McLaren Group is said to be in a dispute with its bondholders about using certain assets as security to raise further funds. The Financial Times (FT) has been told by people familiar with the matter that a group of investors that took part in a GBP525-million bond issued in 2017 have hired US law firm Paul Hastings to push back against the plan. A letter was sent to the company on 20 May, highlighting their opposition. (IHS Markit AutoIntelligence's Ian Fletcher)

- As expected, the Turkish central bank cut interest rates once again at its regularly scheduled monthly meeting on 21 May, by 50 basis points to 8.25%. The cut will add to the lira's vulnerability, likely contributing to the reversal of the currency's recent rally. A recently announced swap deal with Qatar will do little to prevent the expected depreciation. Given the TCMB's end-year inflation estimate of 7.4%, we do not anticipate that this is the end of the rate-cutting round. Further rate cuts in June and, likely, July are expected as the repo rate is likely brought down to below 8%, in line with inflationary expectations. These inflationary expectations are, however, far more optimistic than those of consensus and, in particular, of IHS Markit, which forecasts end-year inflation of 10.9%. (IHS Markit Economist Andrew Birch)

- Following a modest decline in March, Polish industrial production posted its largest monthly drop on record in April. On an unadjusted basis, it was down by 24.6% year on year (y/y), while it was down by 20.8% month on month (m/m) on an adjusted basis. (IHS Markit Economist Daniel Kral)

- The large declines were broad-based (see table below). On an unadjusted basis, manufacturing was down by 27.5% y/y in April, with the largest drop in the manufacture of motor vehicles, which was down by 78.9% y/y. April was the peak month for the severity of lockdowns in Poland and across Europe in response to the COVID-19 virus outbreak, which led to a collapse in car sales and production across the continent

- The only sub-category that recorded a rise in April was the manufacture of pharmaceuticals, which rose by 14.8% y/y on an unadjusted basis. This is consistent with data from other countries as consumers stocked up on basic medicines.

- Industrial producer prices dipped further into deflationary territory following a mild drop in March. In April, they were down by 1.3% y/y.

- For the first time since late 2013, enterprise employment shrank by 2.1% y/y in April. The scale of the contraction in employment was on a par with drops seen in the second half of 2009 during the global financial crisis.

- In a separate release, retail sales in April were reported to have fallen by 22.9% y/y. Drops were recorded across all sub-categories and reflected the impact of the lockdown.

- The South African Reserve Bank (SARB) cut its policy rate by a further 50 basis points to 3.75% during the May meeting of its monetary policy committee (MPC) held on 20-21 May. This brings the cumulative reduction in the repo rate to 275 basis points since the beginning of 2020. The SARB also lowered the GDP forecast for 2020 to a contraction of 7.0%, from 6.1% previously. For 2021, the SARB now expects GDP growth to average 3.8%. The central bank's estimates show headline inflation averaging 3.4% in 2020, increasing to 4.4% in 2021-22. The risk to the inflation outlook is tilted towards the downside, the SARB states. (IHS Economist Thea Fourie)

- Sasol, the embattled South African coal-to-fuel- and-chemicals company, today warned investors to expect a decline of at least 20% in its headline earnings per share (HEPS) in the current financial year to end-June 2020, compared with the 30.72 South African rand ($1.73) reported in its last financial year. Headline EPS, a term defined by the Johannesburg stock exchange (JSE), is intended to indicate the underlying trading performance of a business, excluding such non-cash items as asset revaluations and impairments, and gains and losses on available-for-sale financial assets. In a trading statement to the JSE, Sasol also warns that reported earnings per share are also expected to decrease by at least 20%, compared with the figure of ZAR6.97 in its last financial year. The company's shares fell 7.2% on the news.

Asia-Pacific

- APAC equity markets closed lower on the day; Hong Kong -5.6%, China -1.9%, South Korea -1.4%, Australia -1.0%, and Japan/India -0.8%.

- The Bank of Japan (BoJ) introduced the new measure to aid funding to mitigate financial difficulties of businesses related to the COVID-19 pandemic. (IHS Markit Economist Harumi Taguchi)

- The BoJ held an unscheduled Monetary Policy Meeting (MPM) on 22 May. The unusual unscheduled meeting was held to introduce a new funding measure the BoJ first said it was considering at the April MPM. The new measure is aimed at providing funds to financial institutions to support small and medium-sized enterprises (SMEs) by providing funds against eligible loans, such as interest-free and unsecured loans made by eligible counterparties based on the government's emergency economic measures, up to about JPY30 trillion (USD279 billion).

- The BoJ's special program to support financing in response to the COVID-19 virus outbreak now totals JPY75 trillion with the expansion of purchases of commercial paper (CP) and corporate bonds and the special funds-supply operation, which were introduced in the previous MPMs in March and April. The central bank also extended the duration of the program from September 2020 to March 2021. The BoJ maintained its other monetary policy.

- Nissan is looking to cut over 20,000 jobs or about 15% of its workforce globally as part of its restructuring plan, reports The Mainichi, citing sources close to the matter. The majority of the job cuts will happen in Europe and some emerging countries, claims the report. The plan will be announced on 28 May along with the company's earnings for the financial year ended 31 March 2020. Nissan originally expected to complete the process by mid-May, but this has now been pushed back by two weeks because of the COVID-19 virus outbreak. Even before the COVID-19 virus outbreak, Nissan had been struggling with declining sales and profits. It reported an 87.6% year-on-year (y/y) decline in net profit during the first nine months of fiscal year (FY) 2019/20, ended in March 2020. Earlier in May, Nissan said that it is planning to cut USD2.8 billion in annual fixed costs in areas including marketing and research. (IHS Markit AutoIntelligence's Tarik Arora)

- The Reserve Bank of India (RBI) cut its policy repo rate by 40 basis points from 4.4% to 4.0% on 22 May, owing to the severe macroeconomic impact of the pandemic. The decision was made at an off-cycle meeting of the Monetary Policy Committee (MPC), which was held as a result of recent macroeconomic data showing the extend of economic damage that has been caused by the pandemic and protracted period of lockdown. The measures to ease financial stress include the granting of: (IHS Markit Economist Rajiv Biswas)

- 3 months moratorium on term loan instalments

- Deferment of interest for 3 months on working capital facilities

- Easing of working capital financing requirements by reducing margins or reassessment of working capital cycle

- Exemption from being classified as 'defaulter' in supervisory reporting and reporting to credit information companies

- Extension of resolution timelines for stressed assets

- Asset classification standstill by excluding the moratorium period of 3 months, etc. by lending institutions.

- Chinese Premier Li Keqiang delivered the 2020 government work report at the National People's Congress (CPC) on 22 May, two months delayed from its normal timing in March and the shortest report in the history. (IHS Markit Economist Yating Xu)

- Abandoning 2020 growth target. It is the first time that China has not set an annual growth target since it began the practice in 1990, reflecting the difficulties faced by the government to revive the economy from the COVID-19 virus pandemic as well as the uncertainties of global pandemic and foreign trade.

- Lowering employment target. The target for the surveyed urban unemployment rate is set at around 6% for 2020, up from 5.5% in the previous year and equivalent to the level in April. China aims to create more than 9 million new urban jobs this year, 2 million smaller than the goal set in 2019.

- Lifting consumer inflation target to 3.5%. It is the first time China has set a consumer price index (CPI) target above 3% since 2015, in the context of rising food price inflation amid the production and logistic disruptions in the first quarter.

- Expand fiscal stimulus with larger deficit and bond issuance. The total fiscal stimulus, including fiscal budget deficit, local government special-purpose bond and special sovereign bond is expected reach CNY8.15 trillion in 2020, up CNY3.6 trillion from a 2019.

- Cut more than CNY2.5 trillion of tax and fees for corporates, slightly increasing from a CNY2.36-trillion reduction in 2019. A larger scale of tax and fees cut will came with the ongoing reduction of value-added tax rate and pension fund contribution rate as well as extending the supporting policies for epidemic-hit sectors to the end of this year.

- Government-led investment will accelerate with expanded funding sources, focusing on new infrastructure, new urbanization and major traditional infrastructure projects.

- Targeting notable acceleration of M2 and total social financing (TSF) growth in 2020 from 2019.

- No easing or tightening for real estate market. The government insists on the idea that 'homes are for living, not for speculating', but re-emphasizes the "one city, one policy" strategy, allowing local authorities to conduct real estate policies according to their specific situations.

- Alibaba Group Holding Ltd. fourth quarter profit fell 88% from the same period a year ago after the COVID-19 pandemic triggered a net investment loss of $1.09 billion from the firm's equity investments. Revenue, mostly from ad sales and selling other services to third-party merchants on its platform, rose 22% to 114.31 billion yuan, exceeding FactSet's consensus estimates and China commerce retail sales grew 21% from a year ago. (WSJ)

- Unveiled measures aim to reduce transaction costs and alleviate liquidity burden for cross-border e-commerce enterprises, boosting the sector's development for stabilization in foreign trade and employment. (IHS Markit Economist Lei Yi)

- China offered a set of measures to facilitate foreign exchange (FX) settlement to further promote the development of cross-border e-commerce, according to a circular issued by the State Administration of Foreign Exchange (SAFE) on 20 May.

- Based on validated digital transaction information, SAFE allowed banks to provide FX settlement, payment and collection services for entities participating in cross-border e-commerce. Individual participants are also permitted to conduct FX settlement under their personal accounts, without taking up their annual FX purchase quotas.

- In particular, cross-border e-commerce enterprises will be able to send back their export sales revenues after netting storage, logistics, tax expenses incurred overseas. Domestic logistic firms and e-commerce platforms can also advance credit to their clients for the above expenses in a period of no longer than 12 months.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-may-2020.html&text=Daily+Global+Market+Summary+-+22+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 22 May 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+22+May+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}