Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 02, 2020

Daily Global Market Summary - 2 July 2020

Global equity markets closed higher across every region today, with a particularly strong performance out of Europe. A better than expected US non-farm payroll report led to a much higher open in the US, which gradually faded on news of more closures in California and parts of the US south and southwest due to the rapid increase in COVID-19 cases. iTraxx and CDX indices tighter higher across IG/high yield, as well as oil and US/European government bonds rallying on the day.

Americas

- US equity markets closed modestly higher, but near session lows; Nasdaq/S&P 500 +0.5%, DJIA +0.4%, and Russell 2000 +0.3%. The S&P 500 closed +4.0% on the week.

- 10yr US govt bonds closed -1bp/0.67% yield.

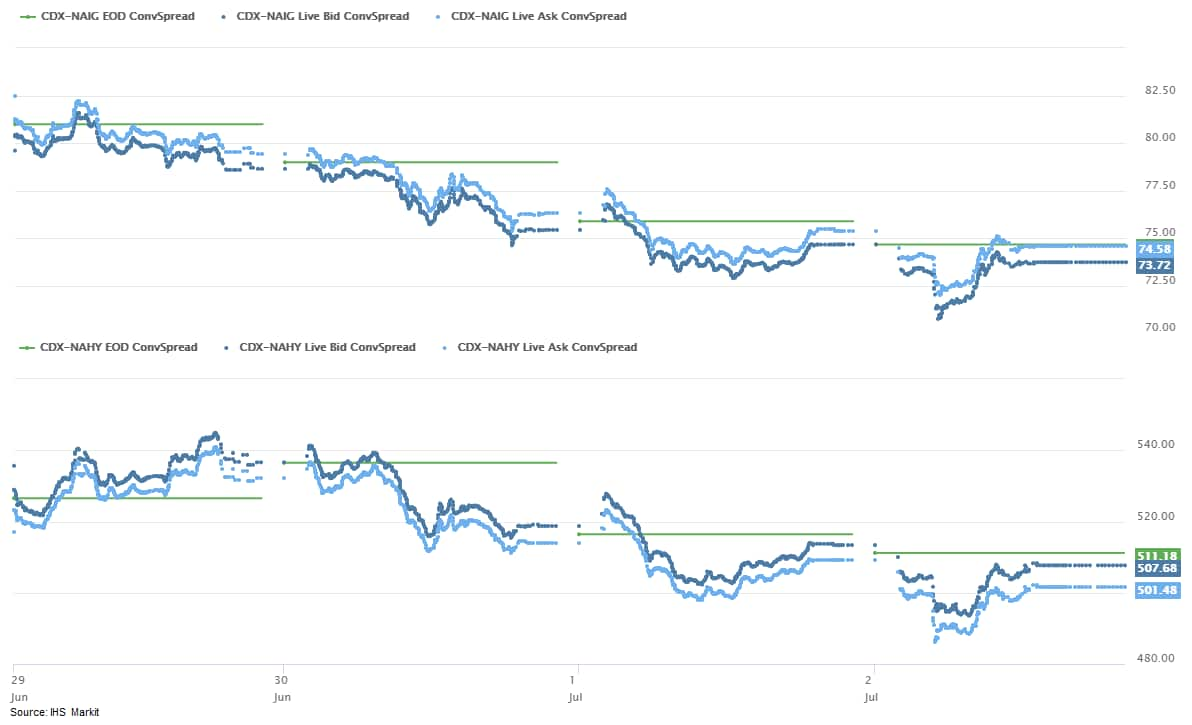

- CDX-NAIG closed -1bp/74bps and CDX-NAHY -7bps/505bps, which is

-7bps and -22bps on the week, respectively.

- Crude oil closed +2.1%/$40.65 per barrel, which is +5.6% on the week.

- US nonfarm payroll employment rose 4.8 million in June, beating

our expectation as well as the Bloomberg consensus by fairly wide

margins. The unemployment rate fell 2.2 percentage points to 11.1%,

also better than expected. (IHS Markit Economists Ben Herzon and

Michael Konidaris)

- The broad tone of the report was one of a robustly recovering labor market, a least through mid-June. However, an alarming surge in new COVID-19 cases over the last couple of weeks has led some states to pause their reopening plans and others to begin reversing them. Combined with the likelihood of rising caution on the part of consumers, this threatens to slow payroll gains as early as this month or even reverse a portion of recent gains.

- Indeed, leisure and hospitality accounted for 38% of job losses over March and April (8.3 million out of 22.2 million) and 47% of job gains over May and June (3.5 million out of 7.5 million). The fate of these jobs is linked closely to the progression of the pandemic.

- For now, IHS Markit is assuming a slowing in payroll gains in coming months, but not a reversal.

- Outside of leisure and hospitality, gains in employment in June were smaller but broad-based.

- Private payroll employment also rose 4.8 million in June, and the index of aggregate weekly hours rose 3.6%. For the second quarter, though, the hours index declined at a 41.6% annual rate, as hours plummeted in April.

- Seasonally adjusted US initial claims for unemployment

insurance, at 1,427,000 in the week ended 27 June, remained at

historically high levels, although well below the all-time high of

6,867,000 in the week ended 28 March. Initial claims have been

trending downward since 28 March; however, the recent spike in

COVID-19 cases could reverse this trajectory. (IHS Markit Economist

Akshat Goel)

- The seasonally adjusted number of continuing claims (in regular state programs), which lag initial claims by a week, rose by 59,000 to 19,290,000 in the week ended 20 June. Although the latest count is marginally higher than the previous week, it is well below the all-time high of 24,912,000 in the week ended 9 May and indicates that as businesses reopen, furloughed workers are cautiously getting recalled. The insured unemployment rate in the week ended 20 June stood at 13.2%.

- There were 839,563 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 27 June. In the week ended 13 June, continuing claims for PUA rose by 1,785,816 to 12,853,163.

- In the week ended 13 June, 749,703 individuals were receiving Pandemic Emergency Unemployment Compensation (PEUC) benefits with 39 states accepting claims for PEUC so far.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. The unadjusted total for the week ended 13 June was 31,491,627, an increase of 916,722 from the previous week. 56% percent of this total is from regular state programs and 41% from the PUA program.

- American Airlines will have more than 20,000 front-line employees this autumn than it needs to operate its reduced flying schedule, executives said on Thursday. Doug Parker, chief executive, and Robert Isom, president, said in a memo to employees that, given reduced customer traffic, the Fort Worth, Texas, airline anticipated that it would have 20-30% more pilots, flight attendants, airport agents, mechanics and baggage handlers than it needs. On Wednesday the airline decided to abandon 19 international routes from six hubs. (FT)

- The nominal US trade deficit widened in May by $4.8 billion to

$54.6 billion, somewhat more of a widening than both we and the

Bloomberg consensus had expected. (IHS Markit Economist Kathleen

Navin)

- Underlying the headline number, nominal exports fell 4.4% and nominal imports eased 0.9% in May. This marked the third consecutive monthly decline in exports and the fifth in imports. We look for exports to turn up in June and for imports to post another decline.

- As air travel was all but shut down for much of March and April, exports and imports of transport and travel services declined sharply during those months. While air travel in May was up from its lows in March and April, the recovery remained slow, and trade in both transport and travel services remained depressed in May.

- In addition to the continued weakness in services, today's report included further declines in both exports and imports of goods. Over the three months ending in May, real goods exports have declined at a 75.4% annual rate while real goods imports have declined at a 40.4% annual rate.

- US manufacturers' orders rose 8.0% in May, while shipments rose

3.1%. This followed cumulative declines over March and April of

about 23% for orders and 19% for shipments; the levels of orders

and shipments remain well below pre-pandemic levels. Manufacturers'

inventories rose 0.2% in May. (IHS Markit Economists Ben Herzon and

Lawrence Nelson)

- Most of the increase in orders in May was in durable goods, and, in particular, in transportation equipment. Orders for nondefense aircraft and parts rose sharply and are not far below pre-pandemic levels.

- About two-thirds of the increase in shipments was in durable goods and largely in transportation equipment, mainly reflecting rising shipments of motor vehicles and parts.

- Manufacturers' inventories were revised lower for April but rose somewhat more than expected in May.

- FeedKind is currently being produced solely at Calysta's pilot facility in the UK, which has been running for two years. However, the company expects to open its first aquafeed facility in China during 2022 through a partnership with French firm Adisseo. This facility - located in Changshou, Chongquing - will mark a major milestone on the path to the global commercialization of FeedKind. FeedKind is an alternative feed ingredient for pets, livestock and fish. It is made through the fermentation of natural gas and can be used in either dry pellet or powdered forms. The production process uses no arable land or water. According to Calysta, the Changshou plant reflects the firm's commitment to increasing its investment in China and pursuing aquafeed opportunities across Asia. The company said the Asian aquafeed sector is worth $28 billion and represents 70% of the global market. The development of the Chinese facility will be fully financed by the $30 million investment Calysta received from BP Ventures last year. The new site is expected to produce 20,000 metric tons of FeedKind per year once operational. However, the company's co-founder and chief executive Alan Shaw told IHS Markit Animal Health this is only the first phase in cementing Calysta's international presence and addressing a global protein deficit. He explained: "There is a substantial protein gap worldwide and aquaculture is touted quite loudly to be one of the best ways to plug the gap for humans. This is because it is one of the most efficient forms of food-rearing in the world. The problem with expanding aquaculture is a lack of feed, as the protein gap for humans translates into a protein gap in feed. You can't keep using more soy and keep burning down more rainforests. (IHS Markit Animal Health's Daniel Willis)

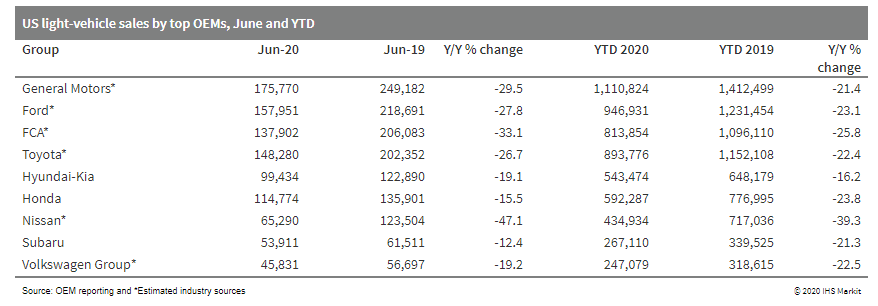

- Light-vehicle sales in the United States dropped 26.4% year on

year (y/y) to 1,111,311 units in June. Nevertheless, US

light-vehicle demand continued to improve in June from the

depressed level in April as online sales and reopening of

activities - especially by auto dealerships - supported sales.

However, over the first half of the year, the market has declined

23.6% y/y to 6,447,864 units. With the rising number of COVID-19

cases in some US states, it will be important to track auto sales

developments over the next few months. Several automakers have

moved to quarterly reporting of US sales. Along with the three

Detroit automakers, Audi, BMW, Daimler, Nissan, Porsche, and

Volkswagen (VW) have shifted to quarterly reporting of US sales.

Subaru announced on 30 June that it will shift to quarterly

reporting as well, beginning in July. (IHS Markit

AutoIntelligence's Stephanie Brinley)

- Autonomous trucking startup TuSimple plans to create the first autonomous freight network (AFN) in the United States by partnering with private package delivery company UPS, transportation company Penske, and trucking companies US Xpress and McLane. TuSimple announced the framework agreement and partners on 1 July. According to TuSimple, the AFN is an ecosystem consisting of "autonomous trucks, digital mapped routes, strategically placed terminals, and TuSimple Connect, a proprietary autonomous operations monitoring system". The company added that the collective system is the safest and most efficient way for bringing autonomous freight trucks to the market. TuSimple president Cheng Lu said in a statement, "Our ultimate goal is to have a nationwide transportation network consisting of mapped routes connecting hundreds of terminals to enable efficient, low-cost long-haul autonomous freight operations. By launching the AFN with our strategic partners, we will be able to quickly scale operations and expand autonomous shipping lanes to provide users access to autonomous capacity anywhere and 24/7 on-demand." The company plans to roll out the project in phases. The first phase will be developed in 2020 and 2021 and offer services between cities in the US states of Arizona and Texas, including Phoenix, Tucson, El Paso, Dallas, Houston, and San Antonia. The second phase will be developed in 2022 to 2023 and will expand the network with a service from Los Angeles, California, to Jacksonville, Florida, and connect the country's west coast with the east coast. TuSimple sees a nationwide roll-out of the AFN beginning in 2023 and 2024, adding major routes throughout the lower US 48 states. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Chile on 1 July reported 282,043 cases of confirmed COVID-19

and has emerged as one of the countries with the highest total

number of cases in the world, despite its capital Santiago having

been under total obligatory lockdown since 15 May. (IHS Markit

Economists Carla Selman and Ellie Vorhaben)

- COVID-19-virus-related restrictions are likely to remain in place in Chile through July, further contracting the economy.

- Additional fiscal relief and stimulus packages provide some relief, with Chile's solid fiscal position and access to credit likely to facilitate an economic recovery in 2021.

- Prolonged unemployment is likely to undermine recovery. The National Statistics Institute of Chile (Instituto Nacional de Estadisticas: INE) reported on 30 June that unemployment had reached 11.5% in March-May (since the implementation of confinement measures), the highest rate in 10 years. In May alone, the Chilean economy lost 0.8 million jobs, bringing total losses for the year to 1.64 million (18% of the employed population). The worst-hit sectors have been retail (22% of job losses), agriculture (13.5%), and construction (12.3%).

- Protests are likely towards year-end, increasing looting and property damage risks. Protests are likely to re-emerge towards year-end if the pandemic abates and to coincide with a referendum on a new constitution scheduled to take place on 25 October.

- As per IHS Markit's Commodities at Sea, copper concentrates shipments from Chile and Peru during June 2020 were calculated at 900kt (down 235kt y-o-y) and 355kt (down 77kt y-o-y), resp. Both the countries are battling from surging cases of Covid-19. As per Federation of Copper Workers Union, out of Corporation Nacional del Cobre de Chile's (Codelco) 71,000 workforce around 1,951 workers have been infected with coronavirus. As per Federation data, El Teniente mine (in central Chile) and Chuquicamata (in north Chile) have been hardest hit with 664 and 473 cases reported until 25 June 2020. Overall Codelco's companywide infection rate has surged to 2.7pc vs Chile's average industry wide rate at 1pc. During week-26, Codelco in order to maintain social distancing implemented 14-days-on-14 days-off roster at El Teniente mine. At the Chuquicamata mine the company has reduced workforce leading to halting of smelting and reducing refining plans. And from this mine Codelco is focusing on production and concentrator areas. Unions is asking the company to shut down Chuquicamata operations for two weeks in order to sanitize the complex thoroughly. Reduced copper concentrates supply from Chile and Peru but strong demand from China is providing strength to copper prices with bids at LME on 01 July 2020 at $ 6016.50 for cash and $ 6023.50/t (3-MO). In the cash market copper prices have surged 30pc in the last three months. (IHS Markit Maritime & Trade's Rahul Kapoor and Pranay Shukla)

- S&P Global Ratings (S&P)'s downgrade for Belize follows the government's announcement seeking a debt exchange for US-dollar denominated public-sector bonds maturing in 2034; moreover, the government is seeking a grace period until February 2021, which could imply missing a coupon payment in August 2020 if an agreement with bondholders is not reached by then. The downgrade reflects the agency's perception that the possible changes in the bond's terms would fall in the distressed debt-exchange category. In addition, the short time frame to finalize an agreement along with the critically diminished fiscal resources because of the COVID-19-virus pandemic could result in the country missing scheduled debt service. The rating agency has noted that the global spread of the COVID-19 virus will hamper the tourism-dependent Belizean economy, as the industry brings in more than 50% of the country's foreign-exchange receipts. (IHS Markit Economist Paula Diosquez-Rice)

Europe/Middle East/ Africa

- Most European equity markets closed sharply higher; Spain +3.8%, Italy +2.9%, Germany +2.8%, France +2.5%, and UK +1.3%.

- 10yr European govt bonds closed higher across the region; Italy -6bps, Spain/France -5bps, Germany -4bps, and UK -2bps.

- iTraxx-Europe closed -2bps/64bps and iTraxx-Xover -4bps/368bps.

- Brent crude closed +2.6%/$43.12 per barrel.

- The UK retail and aviation sectors have announced a wave of job

redundancies, with thousands of jobs to be shed by some of the

country's most prestigious companies. In total, some 12,000 job

cuts have been announced in the past 48 hours. (IHS Markit

Economist Raj Badiani)

- Major retailers Harrods and the Arcadia Group have announced significant redundancies, while John Lewis intends to close stores, with job losses to follow.

- Travel food retailer SSP Group, owner of the Upper Crust bakery chain, announced up to 5,000 job losses as it has been hit by the fact that passenger numbers at rail stations are 85% lower than a year ago.

- The aviation sector has announced a flurry of job cuts, with the global lockdown measures and travel restrictions imposed in response to the COVID-19 virus outbreak decimating demand for air travel, which fell by 90% year on year in April and May. Specifically, Airbus and EasyJet have warned of possible job cuts, following on from announcements from Ryanair and British Airways.

- The Financial Times (1 July) calculates that more than 100,000 redundancies have been announced by large companies during the COVID-19 virus pandemic.

- The national statistical office confirmed that the Spanish

economic upturn ended abruptly in the first quarter of 2020.

Specifically, real GDP shrunk by a record 5.2% quarter on quarter

(q/q) in the first quarter, the first drop since the second half of

2013. (IHS Markit Economist Raj Badiani)

- In annual terms, the economy was down by 4.1% year on year (y/y) in the first quarter, down dramatically from a 2.0% y/y gain in 2019.

- Consumer spending fell more aggressively in the first quarter. The fall in consumer spending in the first quarter was well aligned with awful retail sales in March. Indeed, the volume of retail sales contracted by 15.3% between February and March. It was down 14.1% y/y, which was the sharpest fall since the series began in 2001, with spending on household and personal equipment most affected.

- Fixed investment contracted aggressively during the first quarter. A breakdown by asset reveals falling dwellings and other buildings and structures construction alongside lower spending on machinery and equipment. The industrial climate was notably more challenging, partly due to a collapse in corporate financials and plunging manufacturing activity.

- Net exports were a drag on activity, with exports and imports falling by 8.2% q/q and 6.6% q/q, respectively.

- The collapse of tourist activity and the national lockdown in Spain entailed further damage to Spain's major service sectors in the second quarter of 2020. The most exposed sector was restaurants and hotels, which accounted for 16.6% of GDP in 2018, dwarfing a comparable value of 4.8% for the eurozone as whole.

- The Italian and Spanish passenger car markets have struggled

again during June following their emergence from COVID-19 virus

pandemic lockdowns. (IHS Markit AutoIntelligence's Ian Fletcher)

- The passenger car market in Italy fell by 23.1% year on year (y/y) during June, according to the latest data published by the National Association of Foreign Vehicle Makers' Representatives (Unione Nazionale Rappresentanti Autoveicoli Esteri: UNRAE). Demand fell from 172,312 units in May 2019 to 132,457 units. As a result of the declines since the beginning of the year, registrations at the end of the first half of 2020 are now down by 46.1% y/y to 583,960 units.

- Spain recorded even steeper declines in June, although it still performed better than recent months. The latest data published by the Spanish Association of Passenger Car and Truck Manufacturers (Asociación Española de Fabricantes de Automóviles Turismos y Camiones: ANFAC), show that registrations contracted by 36.7% y/y to 82,651 units. The YTD figures now stand at 339,853 units, a decline of 50.9% y/y.

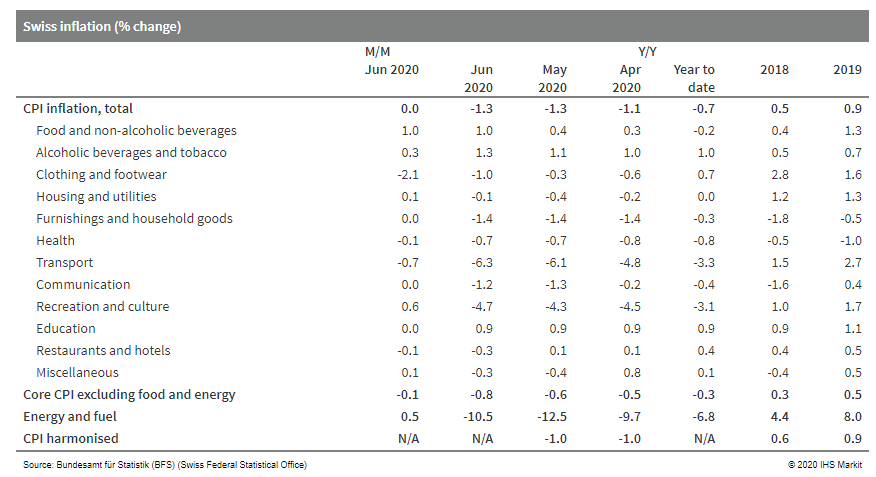

- According to the Swiss Federal Statistical Office (SFSO), Swiss

consumer prices remained flat month on month (m/m) in June,

matching the long-term average for this month. The rebound in oil

prices since mid-May has been supportive, albeit to a lesser degree

than expected. The annual rate of consumer price index (CPI)

inflation therefore stabilized at May's four-year low of -1.3% year

on year (y/y). The EU-harmonized measure, with its somewhat

different composition, was softer in m/m terms (-0.1%), its y/y

rate falling from -1.0% to -1.3% and thus dovetailing with the

national measure. (IHS Markit Economist Timo Klein)

- According to the Austrian Labor Market Service (AMS), there

were 414,766 unemployed people in Austria at the end of June, down

59,000 from May and up 150,000 (56.8%) versus June 2019. (IHS

Markit Economist Timo Klein)

- The annual gap narrowed compared with May (69.7% year on year; y/y).

- The unadjusted unemployment rate declined anew from 11.5% to 10.1%. Some of this was purely seasonal, but the gap with the rate a year earlier (6.5%) is now only 3.6 percentage points, down from 4.7 percentage points in May and even 5.5 percentage points at its peak in April.

- The unemployment rate on a harmonized, seasonally adjusted basis, as calculated according to European Union and thus International Labor Organization (ILO) criteria, which is only available until May, has now increased to 5.4%. This is up from April's 5.2%, which has been revised up sharply from 4.8% initially.

- May's rate of 5.4% was 0.9 percentage point higher than a year earlier. The ILO data are survey-based and therefore do not react as rapidly to changes in economic activity as the national numbers, which reflect registrations for unemployment benefits.

- Vacancies, which had still exceeded their year-earlier level until February, were down 25.2% y/y in June (absolute level: 63,194). Vacancies are also rebounding, albeit only gradually as firms aim to hold onto their existing workforces first.

- Dependent employment declined by 125,000 (or 3.3%) y/y in June, demonstrating waning downward momentum - in April, the annual drop had been 200,000.

- According to the first quarterly balance of payments results of

2020, the Finnish current account registered a deficit of EUR1.6

billion (USD1.8 billion) in January-March. This marks a sharp

deterioration compared with the virtually balanced current account

in the first quarter of 2019. (IHS Markit Economist Venla Sipilä)

- A fall of 5% year on year (y/y) in goods imports was no match to the significantly faster decline of about 12% y/y in exports, which resulted in the goods trade surplus being eliminated. Service exports also decreased faster than imports, and the service trade deficit widened by 25 y/y.

- On the primary income account, outflows increased by nearly 15% y/y, dwarfing the 2.4% gain in inflows, and the surplus dwindled by two-thirds as a result. Property income supported both outflows and inflows, being mostly related to interests and dividends on related portfolio investments in the case of outflows, and to foreign direct investment (FDI)-related income in the case of inflows.

- There was a net capital inflow of EUR2.9 billion. In particular, net capital inflows of other investments totaled EUR5.0 billion, but net outflows of portfolio investments reached EUR2.3 billion.

- At the end of the first quarter, Finland's total gross foreign assets stood at EUR836.7 billion, while liabilities amounted to EUR836.8 billion, leaving the net international investment position at -EUR0.1 billion. Portfolio investment assets decreased markedly from the previous quarter, mostly because of the changes in valuation, while price changes also explain a large part of the fall in portfolio investment liabilities.

- Social security funds, which include employment pension schemes, continued to hold the largest assets. However, social security fund's net assets weakened owing to price changes in equity and mutual fund shares.

- Czech car production is set to slip by 20% in 2020 according to the country's Automotive Industry Association's forecast which was reported by Reuters. The impact of the coronavirus disease 2019 (COVID-19) virus pandemic has had a marked effect on vehicle production, as a result of the direct impact of plant shutdowns, while falling demand across Europe and the rest of the world is also set to have a massive impact. The Czech car industry employs around 180,000 people directly, according to the association, and about half a million when all suppliers are counted. However, while only a few hundred jobs have been cut officially at this point, the Association's President Bohdan Wojnar said it was vital that governmental job support be extended. He added, "At the moment, we [recognize] the companies' efforts to keep people on board. However, this situation is very fragile and it is in the state's utmost interest to help, especially in terms of employment." (IHS Markit AutoIntelligence's Tim Urquhart)

- The Volkswagen (VW) Group has completely abandoned plans to build a new multi-brand plant in Turkey as a result of falling global demand after the COVID-19 virus pandemic. According to an Automotive News Europe (ANE) report, VW has now completely put a halt to the project after initially delaying the plan to locate a plant to build Skoda and VW brand cars in Manisa as a result of Turkish government military action in Syria in 2019. The company said that the pandemic had pushed market growth expectations far into the future and that "the construction of additional capacities is therefore from today's viewpoint not needed." (IHS Markit AutoIntelligence's Tim Urquhart)

Asia-Pacific

- APAC equity markets closed higher across the region; Hong Kong +2.9%, China +2.1%, Australia +1.7%, South Korea +1.4%, India +1.2%, and Japan +0.1%.

- South Korean automakers posted a 19.0% year-on-year (y/y)

plunge in their combined global vehicle sales to 549,684 units in

June, according to data released by the five major domestic

manufacturers and reported by the Yonhap News Agency, as compiled

by IHS Markit. (IHS Markit AutoIntelligence's Jamal Amir)

- The five automakers reported a 41.2% y/y surge in combined domestic market sales last month to 176,468 units, while their combined overseas sales nosedived 32.6% y/y to 373,216 units.

- South Korea's top-selling automaker, Hyundai, posted global sales of 291,854 units in June, down 22.7% y/y. Hyundai's domestic market sales grew by 37.2% y/y to 83,700 units last month, while its overseas sales declined 34.2% y/y to 208,154 units.

- In the domestic market, the Grandeur (Azera) led the automaker's sales last month with 15,688 units. A strong performance by its premium Genesis brand, with the all-new G80 sedan and GV80 sport utility vehicle (SUV) models, also helped to maintain robust sales momentum in South Korea, according to the automaker.

- Global sales of Hyundai's affiliate, Kia, decreased 12.1% y/y to 207,406 units in June. Kia's domestic sales climbed 41.5% y/y to 60,005 units last month, while its overseas sales fell 23.8% y/y to 147,401 units.

- General Motors (GM) Korea reported a 28.7% y/y decrease in its total sales to 25,983 units last month, with domestic sales up 61.5% y/y to 9,349 units and overseas sales down 45.8% y/y to 16,634 units.

- Renault Samsung's sales declined by 23.7% y/y to 14,260 units in June, its domestic sales surging 80.7% y/y to 13,668 units and its overseas sales plummeting 94.7% y/y to just 592 units. The plunge in the automaker's overseas sales was mainly due to the end of production of the Nissan Rogue at Renault Samsung's plant after its contract to produce the model expired in September 2019.

- SsangYong's global sales inched up by 0.2% y/y to 10,181 units during June. Last month, the automaker sold 9,746 units in South Korea, up 18.6% y/y, and just 435 units in its overseas markets, a decline of 79.8% y/y.

- Mercedes-Benz has launched its new electric vehicle (EV), the EQC 400 4MATIC Premium, in South Korea, reports The Korea Herald. The latest model follows the first EV model under Mercedes-Benz's EQ electromobility brand, the EQC 400 4MATIC, launched in South Korea in October 2019. The new model gets a heads-up display and ventilated seats, as well as a leather interior and Burmester's surround sound system. The vehicle is also equipped with the new Mercedes-Benz User Experience (MBUX) infotainment system, which allows a driver to control the functions inside the car such as navigation and temperature using voice commands. The price of the new EQC 400 4MATIC Premium begins from KRW114 million (USD94,782). However, it is eligible for a government subsidy and other tax incentives for alternative-powertrain vehicles, which will lower its price. (IHS Markit AutoIntelligence's Jamal Amir)

- The People's Bank of China (PBOC), the Hong Kong Monetary

Authority (HKMA), and the Monetary Authority of Macao (AMCM) made a

joint announcement on 29 June, introducing the framework of a pilot

scheme that enables individual residents to invest in bank

distributed wealth management products (WMPs) throughout the

Greater Bay Area (GBA). (IHS Markit Economist Lei Yi)

- Under this two-way scheme, mainland residents in the GBA will be allowed to purchase eligible WMPs through designated bank accounts opened in Hong Kong SAR and Macao SAR; and vice versa. Caps of such cross-border fund flows will be imposed on both an aggregate and individual basis, and funds in these accounts cannot be used for other investment.

- Settlement will be carried out in renminbi, with currency conversion conducted in offshore markets. More details on launch date and implementation are yet to be announced.

- The wealth management connect scheme is the third of such after the stock and bond connect programs connecting mainland China and Hong Kong SAR. Different from the previous two, the new scheme is more regional focused and expanded to Macao SAR for the first time, as the nation pushes for further financial integration of the GBA

- The scheme could better match the rising wealth management demand of mainland households with the supply of leading financial services in Hong Kong SAR.

- The Chinese government will allow local governments to use part of the proceeds raised from the sale of local government bonds to purchase convertible bonds from small and medium banks. According to Reuters on 1 July, local governments have been allowed to sell CNY3.75-trillion (USD531 billion) worth special bonds in 2020, a 75% increase from 2019. (IHS Markit Banking Risk's Angus Lam)

- Chinese electric vehicle startup Xpeng Motors is using Nvidia DRIVE AGX Xavier, an artificial intelligence microchip for autonomous driving, in its new electric sedan, the P7, reports the Nikkei. Danny Shapiro, Nvidia senior director, said, "Xpeng is helping usher in this new era of transportation with the AI-powered P7." According to the news source, Xpeng Motors is also likely to use Nvidia's DRIVE AGX Orin in its next-generation electric vehicle (EV). The Orin chip, according to Nvidia, has a processing performance seven times higher than that of the Xavier. Nvidia plans to start shipping Orin samples in 2021, with the earliest installation possible in vehicles around the end of 2022. He Xiaopeng, chief executive of the Chinese EV maker, said, "We don't intend to expand our business by depending [only] on domestic demand in China." He added, "We will grow in the global market while contesting head-on with Tesla." (IHS Markit Automotive Mobility's Tarun Thakur)

- FAW Group has released sales results for the Hongqi brand in June, which show sales of 15,400 units, up 92% year on year. In the first six months of the year, more than 70,000 Hongqi cars were sold, up 111% y/y. Sales figures for individual models were not given by the automaker. FAW has set an ambitious target for Hongqi in 2020. The automaker expects sales of Hongqi vehicles to reach 200,000 units this year. The sales growth will be supported by FAW's expansion of Hongqi's line-up of C- to E-segment vehicles. Hongqi became a standalone brand under FAW in late 2016. The brand has since become the main focus of FAW's efforts in the passenger vehicle market. During the past two years, FAW has introduced five models, including two sedans and three sport utility vehicles (SUVs), under the Hongqi brand. However, according to IHS Market's light-vehicle sales data, Hongqi's sales growth was driven mainly by the HS5, a mid-size SUV, and the H5, a mid-size sedan, while demand for its compact models remained weak. The two models are forecasted to account for 85% of Hongqi's sales this year. As a result, the sales target of 200,000 units in 2020 will be a challenging one for the brand. (IHS Markit AutoIntelligence's Abby Chun Tu)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-july-2020.html&text=Daily+Global+Market+Summary+-+2+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 2 July 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+2+July+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}