Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 14, 2020

Daily Global Market Summary - 14 May 2020

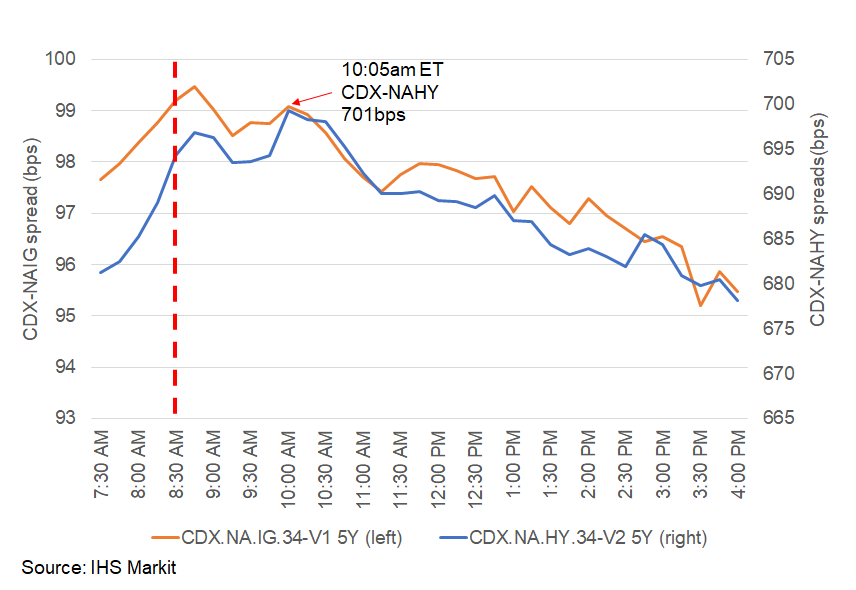

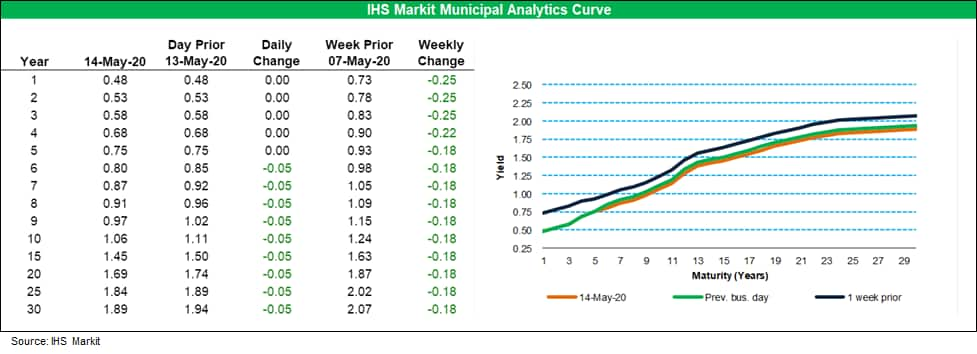

Most European and APAC equity markets closed lower today, while the US market opened lower, but ended higher on the day. European IG/HY credit closed weaker, with North America's CDX-HY selling off to a level last seen in early April, but ending the day only slightly lower. On a positive note, IHS Markit's Municipal Analytics Curve AAA yields continue to rally across maturities and closed 18+bps lower across the entire curve versus last week's level.

Americas

- US equity markets closed higher on the day after opening in negative territory; DJIA +1.6%, S&P 500 +1.2%, Nasdaq +0.9%, and Russell 2000 +0.4%.

- 10yr US govt bonds closed -3bps/0.62% yield.

- US Initial claims for unemployment insurance, at 2,981,000 in the week ended 9 May, remained at historically high levels, although below the all-time high of 6,867,000 in the week ended 28 March. (IHS Markit Economist Akshat Goel)

- This was the eighth straight week with claims in seven figures and suggests that more than 33 million workers have lost their jobs since mid-March because of COVID-19; this is 20.7% of the February labor force.

- Independent contractors, self-employed individuals, or individuals who otherwise would not qualify for regular benefits can now apply for claims under Pandemic Unemployment Assistance (PUA) and there were 841,995 initial claims for PUA in the week ended 9 May.

- Continuing claims, which lag initial claims by a week, rose by 456,000 to a new all-time high of 22,833,000 in the week ended 2 May.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. The total for the week ended 25 April is 25,363,208; 86% of this total is from the "Regular State" program and 13% from the PUA program.

- IHS Markit's CDX-NAIG closed -4bps/93bps and CDX-NAHY +2bps/677bps. The US jobless claims report release at 8:30am ET (indicated by the red dashed line) did not have an immediate impact on spreads, but the lowest point of the day for CDX-NAIG did occur 15min after the report. CDX-NAHY continued to sell-off through the report's release and reach its widest level of 701bps at 10:05am - which is its widest intraday spread since 7 April.

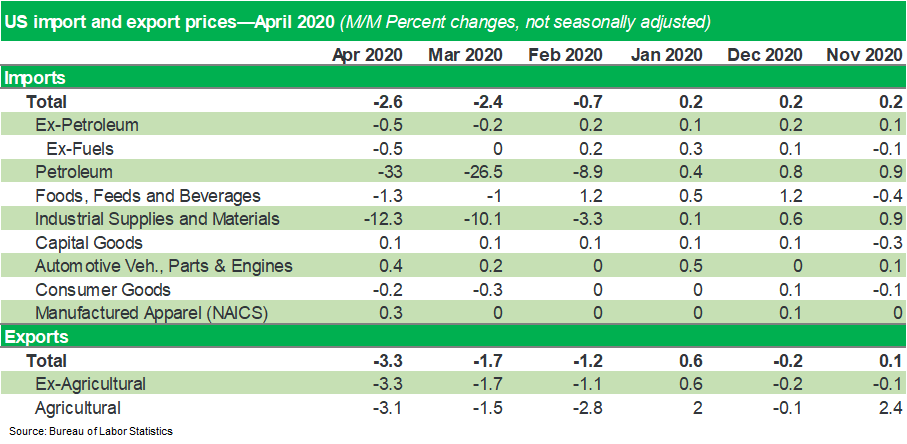

- The index of US import prices fell 2.6% in April following a downwardly revised 2.4% drop in March. The index's 12-month growth rate plunged 2.6 percentage points to -6.8%. (IHS Markit Economist Gordon Greer)

- The index of nonfuel import prices fell 0.5% in April, while its 12-month growth rate dropped to -1.0%.

- The recent fall in fuel import price growth continues to be rapid, marking a 31.5% month-on-month (m/m) drop in April after an upwardly revised 26.0% March decline. The cost of imported fuel was down 56.6% versus April in the prior year.

- Export prices fell 3.3% m/m in April, with the 12-month growth rate falling 3.2 percentage points to -7.0%. The monthly decline was driven by decreasing prices for both agricultural and nonagricultural exports.

- The IHS Markit Municipal Analytics Curve (MAC) shows that AAA municipal bonds yields rallied 5bps today for 2026 and later maturities, with 2024 and shorter maturities over 20bps tighter versus last week:

- University of Arizona is expecting to see a $250 million drop in revenue over the next 15 months through June 2021. So far, the Tucson-based public university has incurred losses of $58 million in fiscal 2020 and is projecting $97 million in losses by June 30, which is the end of its fiscal year. Beginning July 1, the university will begin a furlough-based salary program for most employees, except anyone making less than $44,500, according to a letter Dr. Robert Robbins, president of the University of Arizona, sent to staff this week. Specifics for the program will continue to be updated. (The Business Journals via Bitvore)

- Prices for beef and cattle strengthened in Brazil last week after another bumper month for exports. Trade in Brazilian slaughter-ready cattle picked up in key producer regions such as Pará state, where the price increased to BRL185.00 (USD32.10) per 15 kilo unit, compared to BRL182.00 (USD31.58) the previous week. (IHS Markit Agribusiness' Ana Andrade and Max Green)

- Brazil exported 116,296 tonnes in April. This was a record for the month and some 6% more than in the same month last year, when April had one more working day.

- Average export prices were 15.8% higher than last year at USD4,377.9/tonne (+ 15.8%), while shipments were worth USD509.1 mln versus USD427.1 mln in April 2019.

- In the first four months this year, Brazil boosted exports to China by 111% to 202,000 tonnes, generating revenue of USD1.1 bln, according to the Association of Brazilian Beef Exporters, Abiec.

- Crude oil closed +8.6%/$27.88 per barrel.

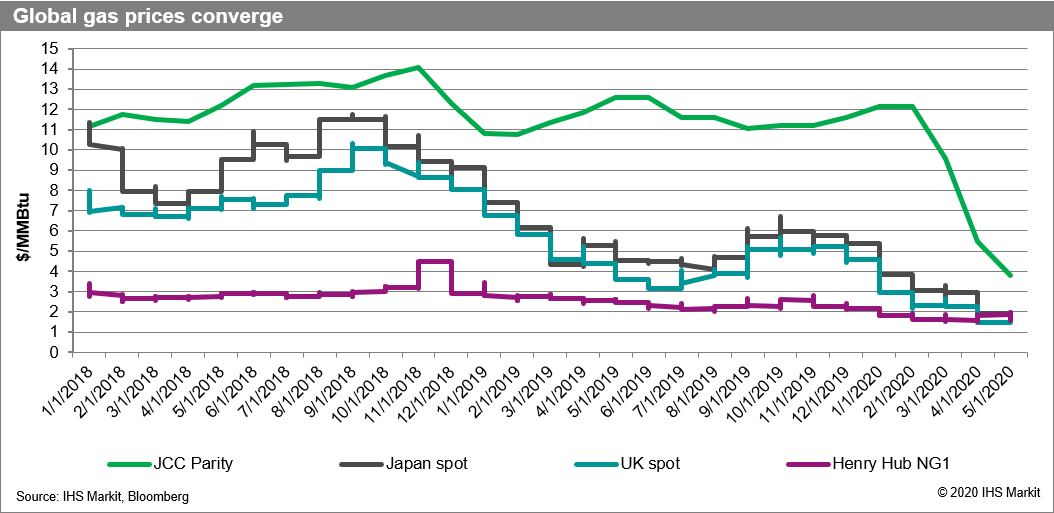

- The oil market has seen negative prices and northeast Asia spot LNG has moved below the critical psychological threshold of $2/MMBtu, pricing the once premium market roughly in line at times over the last couple of weeks with the typically discounted US Henry Hub benchmark. Global oil and gas markets have officially entered the twilight zone. In the last ten days of April, two key events sent already weak Asian gas markets into a tailspin that is likely to last through the summer. (IHS Markit Energy Advisory's Roger Diwan)

- First, on 20 April, WTI moved negative for the first time in history, reflecting extreme physical pressure within the US oil market as demand collapsed.

- Second, later that same week, the already oversupplied Asian spot LNG market got word that some Asian buyers began negotiations to defer over 40 LNG cargoes for delivery between May and October, signaling a significant rise in distressed spot LNG cargoes on the horizon.

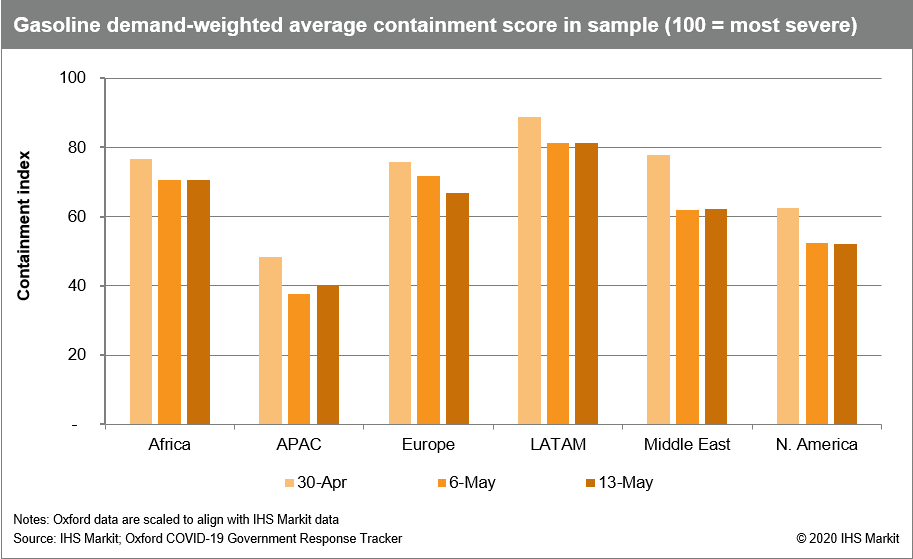

- As of 13 May, IHS Markit estimates that the share of global gasoline demand in countries under major restrictions or full shutdown remains flat at 72%, despite many countries and states making small moves towards opening. (IHS Markit Energy Advisory's Roger Diwan)

- We anticipate that this will be the arc of the recovery; a staggered incremental approach as countries monitor their own infection rates and those of the regions moving more rapidly.

- The US remains well ahead of the pack on reopening and we saw further reductions in restrictions in 14 states representing 33% of US gasoline demand. However, these moves were small, averaging around 6 containment index points.

- IHS Markit's recovery forecast was revised slightly from last week, and now shows 2.5% more of global gasoline demand under at least major restrictions in May and 4.5% more in June. This reflects a belief that the recovery will be even more incremental than previously believed.

- Lordstown Motors Corporation (LMC) has announced an agreement with Elaphe Propulsion Technologies regarding the latter's in-wheel hub motors, which will be produced at Lordstown's Ohio, Michigan (United States) plant. According to a number of media sources, LMC has signed an exclusive licence agreement with Elaphe, a Slovakian supplier. Elaphe will develop the motor, called the L-1500 Endurance, and LMC will produce it at its Ohio assembly plant, where the electric vehicle (EV) startup's pick-up truck will be built. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Reports indicate that Tesla and Alameda County have reached agreement for the company to reopen full production on 18 May. Separately, the company is preparing to open its first gallery store in Michigan. The Alameda County public health department released a statement on the issue. Dow Jones quotes the Alameda County public health department as saying that it has added recommendations to Tesla's already comprehensive return-to-work plan and that if those are included and public health indicators remain stable or improve, Tesla can expand minimum business operations this week to prepare for reopening as early as next week. Tesla's decision to return to production on 11 May despite the Alameda County's order against doing so has created a controversy, although other than the statement, no specific action has yet been taken against Tesla. (IHS Markit AutoIntelligence's Stephanie Brinley)

- FCA and PSA issued a joint statement announcing the cancellation of a planned dividend for 2020, related to fiscal year (FY) 2019, in reaction to the impact of the coronavirus disease 2019 (COVID-19) virus pandemic and economic fallout. The statement reads, "The board of directors of Fiat Chrysler Automobiles N.V. ("FCA") and the managing board of Peugeot SA ("Groupe PSA") each today decided not to distribute an ordinary dividend in 2020 related to fiscal year 2019, in light of the impact from the current COVID-19 crisis... FCA and Groupe PSA confirm that preparations for the 50/50 merger of their businesses announced in December 2019 are advancing well, including with respect to antitrust and other regulatory filings. Completion of the proposed combination is expected on schedule, before end of Q1 2021, subject to customary closing conditions." (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/ Africa

- European equity markets closed lower across the region; UK -2.8%, Germany -2.0%, Italy -1.8%, France -1.7%, and Spain -1.3%.

- 10yr European govt bonds closed mixed; Spain +3bps, Italy +2bps, France +1bp, UK flat, and Germany -1bp.

- Brent crude +6.6%/$31.13 per barrel.

- iTraxx-Europe investment grade index closed +2bps/90bps and iTraxx-Xover high yield closed +20bps/540bps.

- On 13 May, Norges Bank Investment Management (NBIM) announced that Norway's USD1-trillion Government Pension Fund Global (GPFG) has excluded 11 companies from its holdings and placed another four under review, keeping in mind that the announcement was made "a long time" after the decisions were taken and only after the disposals were completed, enabling it to dispose of shares in a "reasonable manner". (IHS Markit Economist Brian Lawson)

- AGL Energy, Anglo American, Glencore, RWE and Sasol were removed over the fund's "product-based coal criteria", the first time these have been used to justify exclusion.

- Four more firms - BHP, Enel, Vistra Energy and Uniper (formerly E-On's fossil fuel unit) - were placed under review on the same grounds.

- In parallel, GPFG also excluded Canadian National Resources, Cenovus Energy, Imperial Oil, and Suncor on the grounds that these firms breach its guidelines on "unacceptable greenhouse gas emissions", based on "carbon emissions from production of oil to oil sands".

- ElSewedy Electric and Vale were removed over alleged "contribution to severe environmental damage", the former because of involvement in a hydropower project in Tanzania and the latter for "repeated dam breach".

- Eletrobras was banned over the NBIM's perception that "the company contributes to serious or systematic human rights violations" involving its Belo Monte power plant.

- Several OEMs with production facilities in the United Kingdom are preparing to resume manufacturing in the coming days and weeks. (IHS Markit AutoIntelligence's Ian Fletcher)

- Groupe PSA has confirmed in a statement that it will restart vehicle production at its Luton facility on 18 May.

- Ford has also announced that it will resume production at its engine facilities in the UK. The company said in a statement that initial production at Dagenham and Bridgend will begin on 18 May. It added that its Dagenham site would also continue to build ventilator sub-assemblies for the VentilatorChallengeUK Consortium.

- In preparation for BMW Group's resumption of Mini production at its Oxford facility on 18 May, the Swindon Advertiser reports that a facility in Swindon will resume operations on Friday (15 May), albeit on a single shift initially.

- Honda's facility in Swindon has pushed back its restart date until June. According to a memo dated 13 May seen by Bloomberg News, operations will begin with its welding and painting units on 2 June, followed by all other production at the site the following day. It added that initially it intends to build 430 cars per day, but that this will rise to 450 cars per day by the week of 15 June.

- Merck KGaA (Darmstadt, Germany) says organic growth in sales and earnings resulted in a more than doubling year on year (YOY) in net income in the first quarter, to €456 million from €189 million. Net income benefited from some exceptional items, the company says. Merck's net sales were boosted mainly by increased demand for healthcare and life-science products due to the pandemic caused by COVID-19, reaching €4.4 billion ($4.8 billion), up 16.7% from €3.7 billion in the first quarter of 2019. Merck attributes 8.4% of the increase in net sales to the acquisition of Versum Materials in 2019 and the company's diversified portfolio.

- The Volkswagen (VW) Group has slowed production at its main Wolfsburg plant as a result of weak demand in the Western European market, according to a Times report. Production of the brand-new Mark 8 Golf will be reduced on a daily basis and production of the VW Touran, the Tiguan SUV, and the SEAT Tarraco will be entirely suspended on four separate days during the next two weeks. According to a separate report in the German media, VW is also planning to cut bonus payments to 18,000 managerial staff. The Wolfsburg plant is one of the largest car manufacturing facilities in the world and according to IHS Markit's latest production tracker, the plant has lost 83,310 units of production as a result of its overall stoppage period of 38 days. However, there will be a new calculation of losses resulting from the new stoppages. (IHS Markit AutoIntelligence's Tim Urquhart)

- April's final German inflation data based on the national methodology by the Federal Statistical Office (FSO) have led to a slight upward revision of the 'flash' data released on 29 April, showing a month-on-month (m/m) increase of 0.4% and an annual inflation rate of 0.9% (previously 0.3% and 0.8%, respectively). The latter still represents a decline from 1.4% in March. (IHS Markit Economist Timo Klein)

- Turkey's current-account deficit surged in March 2020, surpassing USD4.9 billion for the month, the largest single-month gap since May 2018, before the lira collapse later that year. (IHS Markit Economist Andrew Birch)

- Previous data from the Turkish Statistical Institute already detailed that merchandise exports plunged in March, by 19.0% year on year (y/y) according to the balance-of-payment data, leading to the sharp worsening of the trade deficit.

- The early plunge of tourism service exports also severely undermined the services surplus, which was down by more than USD900 million y/y. Together, the worsening of the trade and service balances triggered the sharp deterioration in the headline current-account deficit.

- In March, the country's net outflow of portfolio investment reached USD5.498 billion. The net outflow of capital was the largest such loss in a single month since the central bank has been measuring the data; dating back to 1989. The March 2020 outflow dwarfed the losses noted during the 2018 crisis, when the largest single month net outflow reached USD2.3 billion.

- In April, we expect that the current-account deficit will narrow from the March peak as the fight against COVID-19 really expanded significantly within Turkey, thus undercutting import demand.

- The significant fall of global commodity prices - particularly energy prices -the government in May raising import taxes on about 400 goods to further depress import demand.

- In May, the lira freshly depreciated at the beginning of the month but it has rallied in recent days. The preliminary weekly data on reserve levels will indicate how much of the rally is through a new set of central bank usage of foreign currency reserves, presumably attained through even more forward swap agreements with domestic banks.

- As highlighted above, the Turkish lira has been gradually recovering versus USD since hitting an all-time low of ₺7.27/USD on 7 May; it was ₺6.93/USD as of 5:08pm ET.

- IHS Markit has downgraded Congo's short-term and medium-term sovereign risk ratings' outlooks to Negative, prompted by rising liquidity pressures owing to falling global oil prices. Congo's external account is expected to take a big hit from the fall in oil export revenues. We estimate the current account to record a deficit of 7.7% of GDP in 2020, with the adverse pressure expected to linger into 2021. As a result, we expect foreign-exchange reserves to weaken significantly in 2020 to around USD441 million (equivalent to 0.5 months of import cover). (IHS Markit Sovereign Risk's Archbold Macheka)

Asia-Pacific

- APAC equity markets closed lower across the region; India -2.8%, Japan/Australia -1.7%, Hong Kong -1.5%, China -1.0%, and South Korea -0.8%.

- The Reserve Bank of New Zealand (RBNZ) held the official cash rate (OCR) at 0.25% in its Wednesday meeting, but announced further expansion of asset purchases to help counter the impact of the COVID-19 virus pandemic. The RBNZ plans to keep interest rates steady until early 2021, but is open to further easing if necessary. (IHS Markit Economists Bree Neff and Andrew Vogel)

- The Large Scale Asset Purchase (LSAP) program was almost doubled to a maximum of NZD60 billion (USD36.1 billion) over the next 12 months, from the initially announced maximum of NZD33 billion. Additionally, the RBNZ added New Zealand Government Inflation-Indexed Bonds to the program's potential assets for purchase, on top of the already included New Zealand Government Bonds and Local Government Funding Agency Bonds.

- The RBNZ currently assumes that GDP will contract by 8.4% in the year to March 2021, and inflation is expected to come in below previous forecasts at 1.2% for 2020 and 0.4% for 2021 despite the upside surprise to inflation in the March. The unemployment rate is now expected to peak at 9% during the September quarter.

- South Korea will hold the world's first hydrogen mobility energy show from 1 July to 3 July, reports Yonhap News Agency. The Korea Automobile Manufacturers Association (KAMA) will host the hydrogen show at the KINTEX exhibition hall, north of Seoul. The exhibition was originally scheduled to take place from 18 March to 20 March, but was delayed because of the spread of the COVID-19 virus. The hydrogen exhibition is in line with the South Korean government's wider aims to reduce greenhouse gas emissions, generate new growth momentum for its automotive industry, and reduce its heavy reliance on imported oil. South Korea relies on oil imports from the Middle East for most of its energy needs. (IHS Markit Autointelligence's Jamal Amir)

- Mitsui Chemicals has registered a 50% decline in net profit for the full fiscal year ended 31 March to ¥37.9 billion ($353.9 million), compared with ¥76.1 billion in the year-ago period. Operating income fell 23% to ¥71.6 billion, due to increased fixed costs and lower sales, says the company. Net sales were ¥1.3 trillion, down by 10%. A drop in the price of naphtha and other raw materials, as well as fuel, drove down selling prices.

- Sales remained steady for polymers used mainly in information- and communication-technology related products. In its overseas polypropylene (PP) business, Mitsui says results were squeezed due to the slowdown in automotive production, in addition to COVID-19.

- Demand for phenol and olefins was lower in overseas markets. Demand for polyethylene (PE) and PP was low due to falling demand for packaging products because of COVID-19.

- Sales decreased by 2.8% to ¥193.8 billion in the food and packaging business unit, with 1.6% growth in operating income to ¥18.1 billion. Sales for coatings and engineering materials were low. Mitsui recorded firm sales for performance films and sheets. Agricultural chemical volume declined.

- Mazda has reported its financial results for the financial year (FY) ended 31 March 2020. Mazda recorded a net income of JPY12.1 billion, down 81% year on year (y/y). (IHS Markit AutoIntelligence's Tarik Arora)

- Operating income during the year declined 47% y/y to JPY43.6 billion on revenue of JPY3.43 trillion (down 4% y/y).

- Mazda sold 1.419 million vehicles during the year, down 9% y/y. Sales in North America and China were down 6% y/y and 14% y/y to 397,000 and 212,000 units, respectively, while sales in the domestic market declined 6% y/y to 202,000 units. Sales in Europe totaled 264,000 units, a 2% y/y fall.

- Mazda reported an 8% y/y decline in net profit during the first nine months of FY 2019/20. The sharp deterioration in the full-year FY 2019/20 net profit came on the back of a poor performance recorded in the fourth quarter of the year.

- Mazda has not provided any forecast for FY 2020/21 owing to the uncertainties caused by the COVID-19 virus crisis.

- Pharmaceutical sales in the domestic Indian market fell by 11.2% year on year (y/y) in April, according to data from the All-India Organization of Chemists and Druggists (AIOCD)' AWACS pharmaceutical market research organization. The sharpest fall was in sales of gynecological drugs, which constituted about 5% of the total market and which dropped by 23% y/y in April. Dermatology medicines, which accounted for 6% of the market, fell by 22.5%. Sales of anti-infectives, which accounted for about 11% of the domestic pharmaceutical market, fell by 21.5% y/y, according to the data that has been cited by India's Business Standard. The fall in April is likely due to higher volume purchasing in the previous month and difficulties in accessing prescriptions from physicians because of the strict virus containment measures that were imposed nationally at the end of March. (IHS Markit Life Science's Sacha Baggili)

- Maruti Suzuki has reported that its net profit plunged by 28% y/y to INR12.9 billion during the fourth quarter of FY 2019/20 as the automobile market continued to remain sluggish. Towards the end of March 2020, the automaker's operations were hit by a nationwide lockdown imposed by the Indian government to mitigate the spread of the COVID-19 virus pandemic. Full-FY net earnings were down by 24.7% y/y to INR56.5 billion. Maruti Suzuki stated that during the fourth quarter of the FY, lower sales volume and higher spending on sales promotions outweighed its efforts to cut operating expenses and cost reduction efforts, as well as the reduction in the corporate tax rate. (IHS Markit AutoIntelligence's Isha Sharma)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-may-2020.html&text=Daily+Global+Market+Summary+-+14+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 14 May 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+14+May+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}