Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 13, 2020

Daily Global Market Summary - 13 May 2020

APAC equity markets closed mixed, while the US and European markets closed lower on the day. Federal Reserve Chairman Powell indicated today that more government spending will likely be required to sustain US businesses long enough to weather COVID-19 disruptions and enable the recovery in employment. The somber tone on the day drove benchmark government bonds modestly higher across the globe, while European/US investment grade and high yield credit indices closed lower on the day. Tomorrow's 8:30am ET US initial claims for unemployment insurance report will shed some light on how the initial phase of the reopening of the country is (hopefully) tempering the pace of job losses.

Americas

- US equity markets closed lower today, with most indices peaking at 10:30am ET; Russell 2000 -3.3%, DJIA -2.2%, S&P 500 -1.8%, and Nasdaq -1.6%.

- 10yr US govt bonds closed -3bps/0.64% yield.

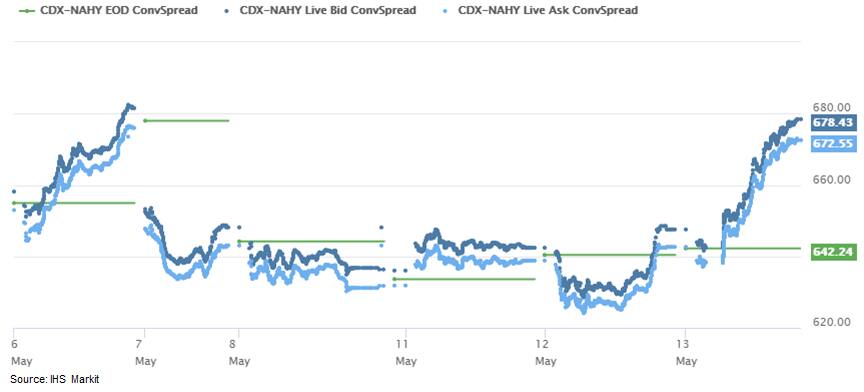

- CDX-NAIG closed +4bps/97bps and CDX-NAHY +33bps/675bps. CDX-NAHY has retraced all but 3bps of the gains made since 7 May.

- Federal Reserve Chairman Jerome Powell spoke at the Peterson Institute for International Economics today and urged the White House and Congress to spend more money to ensure their initial response to the coronavirus-induced economic downturn isn't squandered. Powell said businesses without revenues would face greater risk of failure from longer than anticipated closures, risking a much slower job market improvement and that "Additional fiscal support could be costly but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery." (WSJ)

- IHS Markit's Carlos Pascual, who has served as the US Ambassador to both Mexico and Ukraine and as US coordinator for international energy affairs, published an insightful paper today entitled 'Fears unbound - Geopolitics after the pandemic'. The report assesses how the COVID-19 pandemic will leave us, at least for the coming years, with a world more unstable:

- Nations and businesses, in fear of their vulnerabilities, will react against globalization, tending toward nationalism and protectionism.

- Rivalries and conflicts, with China and the United States at the epicenter, will intensify.

- Rich nations, focused on mending themselves, will have limited attention and resources for the brutal devastation of an impoverished developing world and the humanitarian and security issues arising from that.

- Crude oil closed -2.5%/$25.68 per barrel, despite increasing 3.3% to the day's high of $26.96 on the 10:30am ET EIA weekly inventory report indicating an unexpected 700K barrel draw.

- The US total producer price index (PPI) for final demand fell 0.2% in March, and 1.3% in April. (IHS Markit Economist Michael Montgomery)

- Total goods prices fell 3.3%, with energy down 19.0%, food off 0.5%, and "other" (or so-called core goods) down 0.4%. The dip in food prices hid a 12.6% spike in beef and veal prices and a 31.8% climb in eggs for fresh use.

- Total services prices fell 0.2%; the next lower level of services detail—trade margins (up 1.6%), transportation and warehousing (down 3.5%), and "other" services (down 0.9%)—shows more variation as the pandemic hit sectors differently.

- Trade margins soared as food and alcohol margins climbed and the spread between wholesale gasoline and retail prices climbed by 35.3%.

- Plummeting oil prices induced a 56.6% plunge in gasoline and double-digit drops in other oil products. Core goods retreated 0.4%, but energy-intensive chemical product prices sank 11.5% and volume-sensitive steel scrap prices fell 15.6%.

- Rental-car company Hertz has cancelled 90% of its orders for 2020 model year vehicles as the company looks to stay out of bankruptcy. According to a Bloomberg report, Hertz Global Holdings CEO Kathy Marinello announced the decision on a conference call on 12 May. Bloomberg quotes Marinello as saying, "The coronavirus created a major disruption as the global travel market and the used-car market effectively shut down. We have to be pragmatic about the timing of an economic rebound including a second wave of the virus in the fall. So we are focused on safeguarding liquidity." (IHS Markit AutoIntelligence's Stephanie Brinley)

- The report also noted that Hertz had as many as 567,600 vehicles in its US fleet and 204,000 in its international fleet, and that it keeps its US fleet for about 18 months and international vehicles for 12 months, citing a US Securities and Exchange Commission (SEC) filing.

- In addition, Bloomberg reports that in 2019, General Motors (GM) provided 21% of the company's fleet, Fiat Chrysler Automobiles (FCA) provided 18%, Ford 12%, Kia 10%, Toyota 9%, Nissan 7% and Hyundai 5%.

- In addition, because these vehicles are used for a relatively short time before being sold at auction, the move could have some impact on used car availability in 2021 or 2022.

- Michigan State University is anticipating losses of up to $300 million for fiscal year 2021, President Samuel L. Stanley said in an email to the MSU community on Monday. In response, the university is considering campus-wide salary reductions in a scaled manner for all non-executive employees, and proposing reducing MSU's above-the-match retirement plan contributions, Stanley said in the May 11 email. (mlive.com via Bitvore)

- The University of Chicago expects a $220 million budget deficit this year due to the "negative impact" of the COVID-19 pandemic and will take steps beyond recent salary and hiring freezes in response, its president said in a letter. Losses next year could be "even greater" than those for the current academic year that ends in June, President Robert Zimmer said in the May 7 letter to the school's community. (Chicago Business via Bitvore)

- Hyundai has announced the partial resumption of operations at its vehicle plant in Piracicaba, São Paulo (Brazil) as of 13 May, reports Automotive Business. The plant has resumed operations with only 700 employees working on one shift instead of the three regular shifts before the COVID-19 virus pandemic, in addition to some administrative support. In other news, Ford has ruled out any possibility of resuming production at its Brazilian factories in May. Rogelio Golfarb, the company's vice-president for South America, said, "For now we are planning a return for the beginning of June, but this date is constantly reassessed." He added, "If we take as a basis the pace of the market in April, the stock level of the automotive industry is enough for 128 days of sales. I don't see any significant change. We must continue with a 60% to 70% drop in demand." (IHS Markit AutoIntelligence's Tarun Thakur)

- Media reports on 11 May stated that Minister of Economy Paulo Guedes has asked President Jair Bolsonaro to veto a bill approved by Congress on 7 May exempting civil servants from a salary freeze proposed by Guedes. The proposal seeks to save about USD130 billion so that the money can be redeployed to tackle the fallout from the COVID-19-virus outbreak. The approval of increased public expenditure by Congress despite the protests from Guedes provides further confirmation that the co-operation between the executive and the legislative that permitted the advancement of important fiscal reforms last year has collapsed. (IHS Markit Country Risk's Carlos Caicedo)

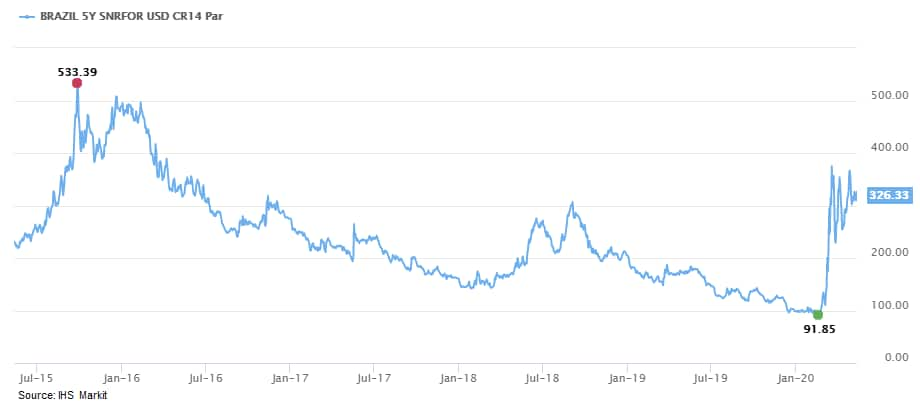

- Brazil's 5yr CDS spreads closed +19bp/349bps today and despite the current political and COVID-19 concerns, remains below the September 28, 2015 peak of 533bps:

- Merck will purchase Sentinel Flavor Tabs and Sentinel Spectrum Chews - both for dogs - from Virbac for $400 million in cash. The two Sentinel brands being acquired amassed $70 million in revenues in 2019. Before Virbac purchased them, the products recorded sales of $90 million as part of Elanco in 2014. Virbac acquired the Sentinel brand from Elanco in 2015 for $410 million - a price greater than the amount it is receiving in the Merck deal. The original purchase of the Sentinel portfolio is not only Virbac's biggest acquisition but it is also the last time the firm splashed out on M&A. (IHS Markit Animal Pharm's Joseph Harvey)

Europe/Middle East/ Africa

- European equity markets closed lower across the region; France -2.9%, Germany -2.6%, Italy -2.1%, Spain -1.9%, and UK -1.5%.

- 10yr European govt bonds closed higher across the region; Italy -8bps, Spain -5bps, UK -4bps, and France/Germany -2bps.

- European credit lower across IG/HY today; iTraxx-Europe investment grade index closed +4bps/88bps and iTraxx-Xover +17bps/521bps.

- Brent crude closed -2.7%/$29.19 per barrel.

- According to its first estimate, the UK economy shrank by 2% quarter on quarter (q/q) in the first quarter of 2020, the sharpest decline since the height of the 2007-08 financial crisis. In addition, real GDP contracted by 1.6% year on year (y/y) in the first quarter, the biggest fall since the end of 2009. More worryingly, the ONS reports that real GDP fell by 5.8% month on month (m/m) in March, the largest drop since the monthly series began in 1997. In annual terms, the economy was 3.5% smaller when compared with a year earlier. The services sector, which accounts for 80% of UK GDP, fell by 6.2% m/m in March, the largest monthly fall on record. The weakest sectors were wholesale, retail, motor trades, accommodation and food services, and education. (IHS Markit Economist Raj Badiani)

- March's 11.3% month-on-month (m/m) collapse in eurozone industrial production is by far the largest in the history of the series. (IHS Markit Economist Ken Wattret)

- On a year-on-year (y/y) basis, the 12.9% decline broadly matches the rate of contraction already signaled by IHS Markit's manufacturing.

- Broken down by type of production, non-durable consumer goods outperformed (-0.8% y/y) thanks to strong demand for food and beverages, presumably boosted by stockpiling. In the other areas, production of capital and consumer durable goods collapsed, with the latter partly reflecting continued weakness in the automotive sector.

- The biggest m/m decline in industrial production during March was evident in Italy (-28.4%), reflecting the earlier start of extensive coronavirus disease 2019 (COVID-19) virus-related lockdowns.

- To put March's m/m plunge in eurozone industrial production into perspective, the largest m/m contraction in production prior to this, at the height of the global financial crisis, was just over 4% in January 2009.

- The next key release for the industrial sector will be May's "flash" manufacturing PMI figures on 21 May, as it will be the first gauge of how soon and to what extent the unwinding of containment measures across the eurozone will generate a pick-up in activity.

- Meat processors in the UK have warned that soaring maritime freight costs could push up the cost of food, both in the UK and in countries where consumers may be even harder hit by the economic fallout from Covid-19. "Evidence of a doubling and in some cases nearly tripling of maritime freight costs over the last month from exporters across the food supply chain has raised a red flag for food prices," the British Meat Processors Association (BMPA) said in a statement. The association says it and other industry bodies have received reports showing that in some cases, costs of a refrigerated shipping container to China have rocketed by almost 200% from GBP1200 to GBP3500, often with a new £500 'fuel surcharge' included. To make matters worse, the BMPA says it has heard that new USD1000+ 'congestion taxes' are now being levied at ports in China and the Philippines. (IHS Markit Agribusiness' Max Green)

- CNH Industrial's revenues and profitability dropped during the first quarter of 2020. For the three months ending 31 March 2020, the company's consolidated revenues fell by 15.4% year on year (y/y) to USD5,461 million. Its adjusted EBITDA dropped by 66.1% y/y to USD245 million, as adjusted EBIT went from a profit of USD409 million during the first quarter of 2019 to a loss of USD38 million. Net income fell to a loss of USD54 million against a profit of USD264 million a year ago. On an adjusted basis, its net income ended up being a loss of USD66 million against a profit of USD248 million. (IHS Markit AutoIntelligence's Ian Fletcher)

- CNH Industrial's Commercial and Specialty Vehicles unit, which includes the Iveco brand, fell by 16.3% y/y to USD2,021 million.

- Powertrain business (which it intends to spin off alongside the majority of Commercial and Specialty Vehicles assets) fell by approximately 27.3% y/y to USD753 million due to the COVID-19 virus weakening demand in Europe and its Rest of World region.

- Agriculture equipment unit's revenues slipped 9.9% y/y to EUR2,294 million, while its adjusted EBITDA was down by 63.8% y/y to 88 million and adjusted EBIT dropped 85.7% y/y to USD24 million.

- Construction equipment unit contracted by 34.1% y/y to EUR422 million, as its adjusted EBITDA went from a profit of USD27 million to a loss of USD70 million.

- According to all measures, Swedish consumer price inflation collapsed in April. The consumer price index (CPI), which is the national definition, came in at -0.4% year on year (y/y), down from 0.6% in March. According to the EU-harmonised measure (HICP), inflation was -0.2% y/y, down from 0.8% in March. (IHS Markit Economist Daniel Kral)

- CPI at fixed interest rates (CPIF), which is the most closely watched indicator by the central bank, came in at just -0.4% y/y in April 2020, which is significantly below both scenarios for the second quarter published by the Riksbank in late April. CPIF excluding energy came in at 1.0% y/y, down from 1.5% in March.

- For the CPIF measure, the largest drag came from lower electricity prices, which dropped by 16.4% y/y and subtracted 0.7pp from headline inflation, and fuel, which dropped by 20.9% y/y and subtracted 0.6pp from headline inflation. The combined drag from energy prices is unprecedented.

- The largest support in CPIF came from food and non-alcoholic beverages, which grew by 3.5% y/y and added 0.5pp to headline inflation.

- Volvo Group's board of directors has withdrawn a proposal for an ordinary dividend for 2019. According to a statement, it had intended to propose at SEK5.50 per share dividend at its annual general meeting on 18 June. However, it is now proposing that no dividend should be paid in light of the COVID-19 virus pandemic. (IHS Markit AutoIntelligence's Ian Fletcher)

- In March, Slovenian industrial production dropped sharply, by more than 11% month on month. Leading sentiment suggests that output will drop significantly in April. Any recovery beginning in May will be modest at first, and leave total monthly output still well below pre-crisis levels. Total industrial production output was down by 7.7% year on year (y/y). As measured against the previous month, total output plunged by 10.7% month on month (m/m) in seasonally adjusted data. (IHS Markit Economist Andrew Birch)

Asia-Pacific

- APAC equity markets closed mixed; India +2.0%, South Korea +1.0%, Australia +0.4%, China +0.2%, Hong Kong -0.3%, and Japan -0.5%.

- Gilead has signed non-exclusive voluntary licensing deals with five generic drug companies based in India and Pakistan - Cipla (India), Ferozsons Laboratories (Pakistan), Hetero Labs (India), Jubilant Lifesciences (India) and Mylan (US). The agreements will enable these companies to manufacture bioequivalent versions of remdesivir for distribution in 127 countries, and therefore expand supply of the investigational antiviral in low-income and middle-income countries. The agreements will facilitate technology transfer of the manufacturing process for remdesivir; this will accelerate the scale-up of production capacity and distribution. The licensee companies will be permitted to set their own prices for their own generic products, which will lower prices and widen access in lower-income countries. (IHS Markit Life Science's Sacha Baggili)

- Indian Prime Minister Narendra Modi announced on 12 May a large-scale package of fiscal stimulus measures amounting to INR20 trillion (USD266 billion) in response to growing concerns among business leaders and in financial markets about the escalating economic shockwaves from the protracted lockdown measures. (IHS Markit Economist Rajiv Biswas)

- The total package of stimulus measures is estimated at around 10% of Indian GDP.

- PM Modi stated that Finance Minister Nirmala Sitharaman would unveil further details of the stimulus measures in the next few days.

- A key focus of the stimulus measures will be on assisting low-income workers, with many millions of workers having lost their jobs or been laid off owing to the lockdown measures. Significant assistance measures will also be provided for small to medium enterprises (SMEs) with many firms badly hit by the protracted lockdown.

- According to the 'Quick Estimates' released by India's National Statistics Office, Indian industrial production contracted by 16.7% year on year (y/y) in March, compared with a 4.6% rise in February, reflecting the impact of the commencement of a severe economic lockdown that began on 25 March. (IHS Markit Economist Rajiv Biswas)

- Manufacturing output fell by 20.6% y/y in March and was down by 1.3% y/y for the 2019-20 full financial year ending March 2020.

- Electricity output fell by 6.8% y/y in March, while mining output showed zero growth.

- The decline in manufacturing output was very severe in certain industries, with production of motor vehicles down by 49.6% y/y in March, while output of computer, electronic, and optical products fell by 41.7% y/y and output of chemicals fell by 26.5% y/y.

- Output of infrastructure/construction goods fell by 23.8% y/y while output of capital goods fell by 35.6% y/y, reflecting the weakness of new capital expenditure even before the lockdown commenced.

- IHS Markit has lowered India's outlook to Negative from Stable for the short- and medium-term outlooks while maintaining their respective numerical risk ratings of 5 and 35, or A+ and BBB on the generic scale. The revision to the outlooks stems from the heightened risks to foreign-exchange earnings via tourism, remittances, and capital flows from the COVID-19 viral pandemic. (IHS Markit Economist Bree Neff)

- In the near term, our biggest concern is liquidity metrics - particularly foreign-exchange earnings from exports and remittances - although India's robust foreign-exchange reserves of USD447 billion (excluding gold) assuages some of these concerns.

- The most concerning scenario would be a prolonged collapse in foreign direct investment, as that would necessitate extra external borrowing beyond current expectations due to India's significant investment needs and dependence on imports of consumer goods.

- Given that external debt as a share of adjusted foreign-exchange earnings is already over 100%, further rises in that ratio would increase solvency risks for the sovereign.

- Chinese oil services company COOEC reported a 24% year-on-year (y/y) revenue growth of USD331 million (CNY2.3 billion) for the first quarter of 2020 due to higher workload in offshore installations. Despite higher revenue, net loss widened for the quarter due to decreased workload during the quarter as a result of COVID-19 outbreak. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Net loss for the quarter widened 13% y/y to USD44 million (CNY305 million).

- Operating loss for the quarter deepened from USD44 million (CNY298 million) in the same period in 2019 to USD50 million (CNY348 million) last quarter.

- For first quarter 2020, COOEC secured new orders worth USD1.4 billion (CNY9.9 billion), mainly from the China market. Projects secured include the Lufeng Oilfields Development Project and the Hong Kong Offshore LNG Terminal Project.

- Imported vehicle sales in Japan declined 32.7% year on year (y/y) to 14,290 units during April 2020, compared with 21,245 units in April 2019, according to the Japan Automobile Importers Association (JAIA). (IHS Markit AutoIntelligence's Tarik Arora)

- Foreign brands' imported vehicle sales declined by 36.9% y/y to 11,164 units, while sales of Japanese-brand imports declined by 12.3% y/y to 3,126 units.

- Mercedes-Benz continued to lead the imported market with a 16% share, its sales declining 37.1% y/y to 2,288 units.

- BMW followed with a market share of 11.8% and sales of 1,691 units, down 41.1% y/y.

- Volkswagen (VW) took third place with sales of 1,607 units (down 28.6% y/y) and a market share of 11.2%.

- Mitsubishi Chemical Holdings reports a 68% decline in net income for the company's full fiscal year ended 31 March, to ¥54 billion ($503.5 million), versus ¥169.53 billion in the previous year. Operating income declined 51% to ¥144.28 billion versus ¥297.9 billion. Mitsubishi's performance products business reports a 12.1% decline in operating income to ¥62.6 billion on sales of ¥1.08 trillion, down 6.3%.

- The drop reflects lackluster demand, principally in semiconductor and automotive applications, and lower sales volumes in engineering plastics and other products for advanced moldings and composites.

- In performance chemicals, volumes decreased, reflecting an unfavorable market for the phenol-polycarbonate chain in the advanced polymers business.

- Operating profit for the chemicals business, Mitsubishi's largest, plunged 76% to ¥30.2 billion, compared with ¥127.9 billion in the previous year, on sales of ¥1.05 trillion, a decline of 17%. The company says that revenue dropped for methyl methacrylate (MMA) amid weaker demand and a downturn in MMA and other markets.

- Operating income at the industrial gases business, Taiyo Nippon Sanso, increased 38.9% to ¥87.9 billion. Sales at this division were ¥732.8 billion, up 15% from ¥843.3 billion. This sector saw continued firmness in the overseas gases business partly because of the acquisition of a portion of the European business of Praxair and a portion of the HyCO business and related assets in the US owned by Linde, adds Mitsubishi.

- Japan's current-account surplus for March fell by 32.1% year on year (y/y) to JPY2.0 trillion (USD18.4 billion) on a non-seasonally adjusted basis and also by 59.9% month on month (m/m) to JPY942.0 billion on a seasonally adjusted basis. The y/y decline was due largely to an 85.2% y/y (JPY842 billion) drop in the trade surplus and a 77.5% (JPY249 billion) fall in the service balance surplus, reflecting domestic and overseas measures to contain the COVID-19 virus. (IHS Markit Economist Harumi Taguchi)

- While improved production in China following the end of the extended Lunar New Year holidays softened a contraction of imports to 4.2% y/y, exports fell by 12.2% y/y because of disruptions affecting demand and the supply chain caused by the pandemic and containment measures of Japan's trade partners.

- The service balance surplus narrowed, largely reflecting a steep, sustained drop in travel revenue in line with a 93.0% y/y decline in the number of tourist arrivals. Primary income also fell by 4.0% y/y (or JPY87 billion) largely because of a decline in receipts from direct investment and interest from other investment.

- Primary income also fell by 4.0% y/y (or JPY87 billion) largely because of a decline in receipts from direct investment and interest from other investment.

- Japan's current account is likely to remain in surplus over the near term because of primary income, the major contributor to the surplus, in line with a continued uptrend of investment abroad. Weak energy prices will also mitigate the negative effect on the trade balance to some extent.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-may-2020.html&text=Daily+Global+Market+Summary+-+13+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 13 May 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+13+May+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}