Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 10, 2020

Daily Global Market Summary - 10 June 2020

APAC equity markets closed higher on the day, while most US and all major European indices closed lower. Nasdaq closed higher and above 10,000 for the first time, with tech also being the only sector in the S&P 500 that closed higher today. European benchmark government bonds were lower on the day, while the long end of the US Treasury curve rallied significantly. The FOMC statement triggered a brief rally across US credit indices and equity markets, but the rally faded across both markets before the close.

Americas

- Most US equity markets closed lower except for the Nasdaq +0.7%, which also closed above 10,000 for the first time; Russell 2000 -2.6%, DJIA -1.0%, and S&P 500 -0.5%. The S&P 500 whipsawed back and forth from higher-to-lower after the FOMC meeting announcement at 2:00pm ET, ultimately closing on a downswing.

- 10yr US govt bond closed much higher today at -10bps/0.72% yield.

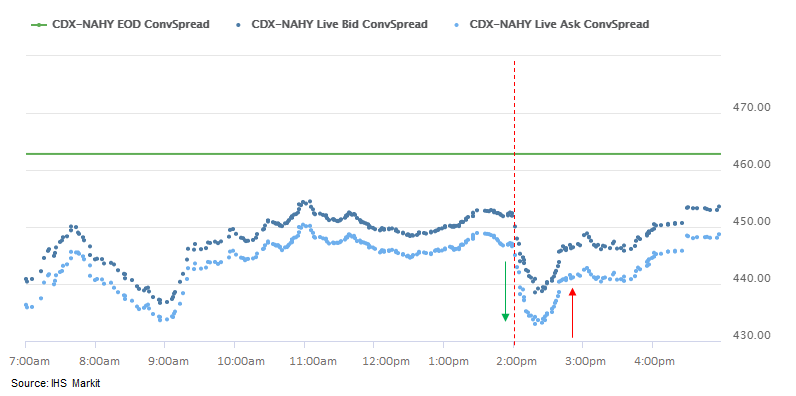

- CDX-NAIG closed +2bps/74bps and CDX-NAHY -8bps/451bps. CDX-NAHY

rallied on the FOMC announcement, but began to sell-off at 2:20pm

ET and closed near the widest spread of the day:

- Crude oil closed +1.7%/$39.60 per barrel.

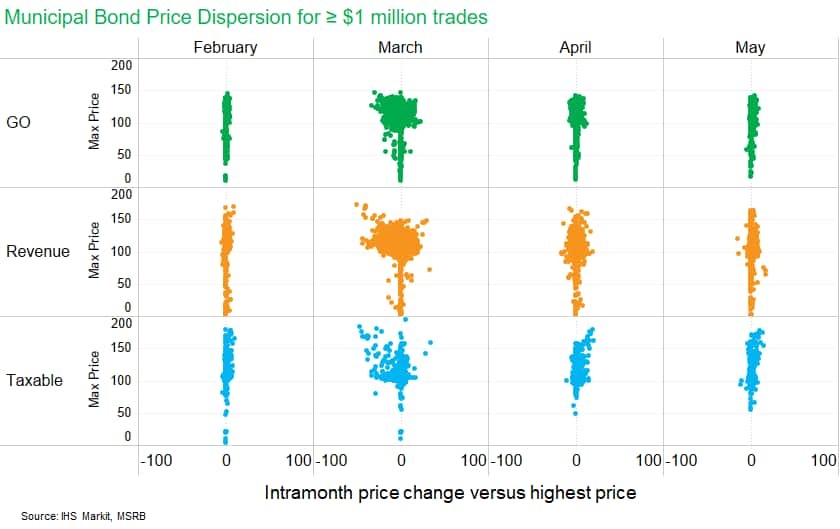

- The extreme price dispersion reported in the municipal bond

market in March had improved significantly as of May. The below

chart shows the price change versus the highest intramonth traded

price at the bond level. A negative price change (left of the zero

on the x-axis) indicates a bond that declined from its highest

price that month and a positive price change (right of zero)

indicates a price increasing to its highest price that month.

- The Federal Open Market Committee today concluded its scheduled

two-day policy meeting. As expected, it made no changes to its

setting for interest rates, including the target for the federal

funds rate that was maintained at a range of 0% to ¼%. It indicated

that securities purchases would continue at least at current rates.

Almost all FOMC members expect that it will be appropriate to keep

the federal funds rate at its current level at least through 2022.

(IHS Markit Economists Ken Matheny and Kathleen Navin)

- The statement noted that weaker demand and lower oil prices are holding down consumer price inflation, and that the ongoing public health crisis will "weigh heavily on economic activity, employment, and inflation in the near term." The crisis poses "considerable risks" to the economic outlook over the medium term.

- In a somewhat surprising development, the FOMC expects the Open Market Desk to continue purchases of Treasury securities and agency residential and commercial mortgage-backed securities "at least" at the current pace, over "coming months". That implies Treasury purchases of about $80 billion per month and combined residential and commercial MBS purchases at approximately $40 billion per month in the aggregate.

- It would not have been surprising had the FOMC offered guidance that the pace of securities purchases would continue to slow, as it has since April, in response to improving financial conditions and the restoration of liquidity in securities markets.

- The US consumer price index (CPI) declined 0.1% in May, in part

reflecting a 1.8% decline in energy prices. The food CPI rose 0.7%

in May. The core CPI fell 0.1%, its third consecutive monthly

decline. This is the first time the core CPI has declined for three

consecutive months. (IHS Markit Economists Ken Matheny and Juan

Turcios)

- The 12-month change in the core CPI fell 0.2 percentage point to 1.2%, the lowest since March 2011. The 12-month change was 2.4% as recently as February.

- Prices in sectors of the economy where COVID-19-related disruptions greatly reduced activity generally continued to decrease in May. The CPI for apparel (down 2.3%), motor vehicle insurance (down 8.9%), and airline fares (down 4.9%) all fell substantially in May. The declines in prices for apparel and airline fares were not as steep as in April.

- Bureau of Labor Statistics (BLS) data collection efforts continued to be hampered in May by the coronavirus disease 2019 (COVID-19) pandemic. In-person price collection has been suspended since 16 March. Upon suspension, data collectors were instructed by the BLS to attempt to collect data by telephone, email, or the website of the establishment. Any missing prices were generally imputed by BLS. Despite these efforts, the percentage of unavailable prices in the CPI was elevated in May relative to a normal month.

- The Michigan-based company Zivo is developing natural nutritional compounds and bioactive molecules derived from proprietary algal strains. The firm is producing algal biomass compounds to be used as feed additives for cattle, poultry and dogs. The US Patent and Trademark Office issued the firm a notice of allowance for a US patent application titled 'Compounds and Methods for Affecting Cytokines'. A notice of allowance precedes the formal issuance of a US patent, which Zivo expects to follow shortly. Zivo's proprietary composition alters the production and function of proteins such as cytokines and transcription factors. The firm is developing its algal strain to tackle bovine mastitis, bovine respiratory disease complex, transition cow syndrome, canine osteoarthritis and canine skeletal-muscular overexertion, as well as porcine reproductive and respiratory syndrome virus immune disorder. (IHS Markit Animal Pharm's Joseph Harvey)

- General Motors' (GM) autonomous vehicle (AV) subsidiary Cruise Automation plans to launch its first driverless vehicle by 2025, reports Hindustan Times Auto News. GM CEO Mary Barra said in a recent interview, "I definitely think it will happen within the next five years. Our Cruise team is continuing to develop technology so it's safer than a human driver. I think you'll see it clearly within five years." (IHS Markit Economist Automotive Mobility's Surabhi Rajpal)

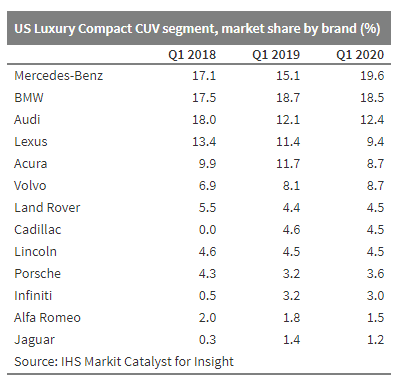

- IHS Markit's registration data for 1 January to 31 March 2020

shows that the market share of registrations of luxury models

continued to gain ground in the United States against non-luxury

vehicle models. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Although the sales volume dropped in first quarter 2020, in what was expected to be a year of lower demand, which has been exacerbated by the restrictions to slow the spread of the COVID-19 virus, the share of luxury vehicles reached 13.9%, up from 12.1% in first quarter 2018.

- In full-year 2019, crossover utility vehicles (CUVs) crossed

the threshold of more than 50% of luxury vehicle sales, reaching

51.8%. In the first quarter of 2020, this slipped slightly to

50.8%, but the dominance of CUVs in the luxury vehicle segment is

likely to continue.

- Brazilian agricultural exports reported monthly records in May,

with products such as sugar, soy meal, coffee and beef driven being

by currency movements as well as solid purchases from China.

Brazil's agricultural sector accounted for 32.9% of the country's

total exports, increasing its total share in the Brazilian trade

balance by 37.3% year-on-year, according to the Ministry of

Economy. (IHS Markit Agribusiness' Ana Andrade)

- Soy shipments reached 15.5 million tons - the 2nd largest volume in history, and greater than the 10 mln tons exported in May 2019. Concerning its by-product, soy meal, Brazil exported almost 2 mln tons in May, rising by 18.3% y-o-y.

- Between January and May, 49.1 mln tons of soy were exported, increasing by 40% over the same period last year and spurred by Chinese demand. Challenges surrounding ASF also contributed to rising foreign sales.

- Meanwhile, Brazil exported 155,136 tons of fresh beef in May, up by 24.8% y-o-y. Exports of fresh chicken rose by 4.3% to 372,501 tons, while pork jumped by 53.2%, to a record 90,722 tons.

- For sugar, shipments totaled 2.7 mln tons in May, up 1.5 mln tons on the same period in 2019. Brazilian mills are more focused on sugar production instead of ethanol, due to current foreign exchange rates and export prices. Sugar exports in May saw its highest monthly volume since September 2017, when shipments totaled 2.9 mln tons.

- Foreign sales of Brazilian coffee, also saw another record volume, hitting roughly 3.6 mln 60-kilos bags last month, versus 3.3 mln a year earlier. This was its highest level since December 2018, when Brazil shipped 4 mln tons.

Europe/Middle East/ Africa

- European equity markets closed modestly lower across the region; Spain -1.1%, Italy -0.9%, France -0.8%, Germany -0.7%, and UK -0.1%.

- 10yr European bonds closed mixed; UK -7bps, Germany -2bps, France +1bp, Spain +5bps, and Italy +8bps.

- Brent Crude closed +1.3%/$41.73 per barrel.

- iTraxx-Europe closed +2bps/67bps and iTraxx-Xover +18bps/376bps.

- On 9 June the International Capital Market Association (ICMA)

published voluntary guidelines for Sustainability-Linked Bonds

("SLBs"), adding to its existing taxonomies for Green and Social

Bonds. (IHS Markit Economist Brian Lawson)

- SLB instruments are bonds whose terms are dependent on the issuer meeting pre-defined sustainability or ESG objectives, committing to specific, measurable improvements in a defined timeline.

- Proceeds normally may be used for general corporate purposes, although some issuers may structure SLBs also compliant with Green or Social Bond criteria.

- SLBs will have clearly defined objectives measured by key performance indicators (KPIs), which should be strategically significant, readily quantifiable, externally measurable, and based on Sustainability Performance Targets.

- The KPIs should require "ambitious" improvements in performance and be easily referenced against external benchmarks.

- In turn, achievement of KPIs, or failure to meet them, should affect the terms of the bonds (e.g. coupon or principal due).

- As with Green and Social Bonds, instruments should be subject to regular disclosure requirements and independent performance measurement.

- The initial first-quarter estimate of a 3.8% quarter-on-quarter

(q/q) Eurozone GDP contraction has been revised to a 3.6% q/q

decline. Private consumption was the main contributor to the record

decline in GDP, but investment and exports also plunged. (IHS

Markit Economist Ken Wattret)

- Although the quarter-on-quarter (q/q) contraction in eurozone GDP during the first quarter of 2020 is now a little smaller than initially reported, it nonetheless remains the largest fall on record, surpassing the 3.2% q/q contraction in the first quarter of 2009 amid the global financial crisis. The second quarter of 2020 will be far weaker still.

- As expected, given the severe disruption caused by COVID-19 virus-related containment measures late in the quarter, the initial breakdown by expenditure of the first-quarter data shows a record q/q plunge in private consumption (-4.7%). There were also very large q/q contractions in investment (-4.3%) and exports (-4.2%), while public consumption fell comparatively modestly (-0.4%).

- Based on value added by output type, weakness was again broad-based in the first-quarter 2020 data, but the largest q/q contractions were evident in trade, transport, accommodation, and food service activities (-6.8%), arts, entertainment, and other services (-6.8%), construction (-3.8%), and manufacturing (-3.4%).

- April's 20.3% month-on-month (m/m) decline in French industrial

output was the largest since the current series started and

followed a fall of 16.2% m/m in March. On a year-on-year (y/y)

basis, output contracted by 34.2%, also the largest annual decline

on record. (IHS Markit Economist Diego Iscaro)

- The breakdown by type of production shows that output of consumer durables more than halved on a m/m basis, while production of capital and intermediate goods fell by 30.0% m/m and 20.9% m/m, respectively.

- Production of non-durables fell by a lesser 13.5% m/m, following a decline of 3.4% m/m in March.

- Production of transport equipment was particularly weak in April, hit by an 88% decline in production of motor vehicles.

- The fall in production of machinery and equipment goods also accelerated from 21.0% m/m in March to 24.6% m/m as a large number of firms remained closed throughout the whole of April because of the containment measures implemented in mid-March in response to the outbreak of the COVID-19 virus.

- Given the gradual unwinding of the containment measures from mid-May, IHS Markit expects production to have grown on a m/m basis in May. However, this would be a technical increase resulting from the easing of restrictions, and output will remain substantially below February's levels for a prolonged period (until mid-2024, according to our May forecasts).

- The Central Statistical Office (KSH) has published the latest

high frequency data showing the impact of the COVID-19 virus

pandemic on Hungarian economic activity. (IHS Markit Economist

Dragana Ignjatovic)

- In a first estimate, the KSH revealed that industrial activity collapsed in April, falling by nearly 40% y/y. Although the breakdown has not been published yet, all segments are likely to have suffered led by the manufacturing sector.

- Within manufacturing, the automotive segment is likely to have been particularly hard hit by supply chain disruption and closure of factories during the lockdown, and social distancing measures.

- In a separate KSH release, the collapse in foreign trade was detailed. Exports fell by nearly 40% y/y in euro terms, while imports dropped nearly 30% y/y in April. This resulted in the trade balance entering deficit (EUR611 million) for the first time since August 2018, although the balance for the first four months of the year remains in surplus (EUR1.2 billion).

- In a final KSH release, consumer price inflation continued to ease in May, rising by 2.2% y/y. The moderation in inflationary pressures has been driven by a near 8% y/y drop in fuel prices and a 1% fall in clothing prices as shops were closed. This has been offset by still elevated levels of food price growth (+8.4% y/y) and alcoholic beverages and tobacco (+6.7% y/y). Consumer price growth averaged 3.5% y/y in January-May.

- CNH Industrial has announced that its Iveco business now holds a 7.11% stake in Nikola Corporation after the company was merged with publicly traded special purpose acquisition company, VectoIQ Acquisition Corp. In a statement, the company said that under the terms and conditions, Iveco received 1.901 shares in VectoIQ Acquisition Corp for every share it held in Nikola, amounting to 25,661,449 shares, before it changed its name to Nikola Corporation and began trading on 4 June. Iveco's stake in Nikola Corporation has come about following an agreement announced in September 2019 for a partnership between the two companies for the development of new battery electric- and fuel-cell powered trucks. (IHS Markit AutoIntelligence's Ian Fletcher)

Asia-Pacific

- APAC equity markets closed mixed; India +0.9%, South Korea +0.3%, Japan +0.2%, Australia +0.1%, Hong Kong flat, and China -0.4%.

- China's year on year (y/y) consumer price index (CPI) fell by

0.9 percentage point from April to 2.5% in May, the fourth

consecutive month of decline after the Spring Festival, according

to the National Bureau of Statistics (NBS). (IHS Markit Economist

Yating Xu)

- The month on month (m/m) CPI reported a 0.8% deflation, compared to a 0.9% deflation a month ago.

- Food price continued to deflate m/m and the y/y inflation narrowed. Consumer goods price inflation declined to the lowest since July 2019.

- Positive side is that transportation fuel price stopped declining as international oil price rose.

- Meanwhile, service price inflation edged up to 1.0% as nearly 90% of regions downgraded emergency control level to 3rd or lower and non-essential service businesses gradually reopen.

- Core CPI excluding crude oil and food stayed at 1.1% y/y, unchanged from the previous month.

- The m/m producer price index (PPI) deflated by 0.4% in May, narrowing from a 1.3% m/m deflation in April. However, the y/y PPI deflated further to 3.7% due to the high base data. The headline deflation was concentrated in mining and quarrying industries.

- Japan's private machinery orders (excluding volatiles), a

leading indicator for capital expenditure (capex), fell by 12.0%

month on month (m/m) in April for the second consecutive month of

increase. The larger-than-expected decline was due largely to a

drop in orders from non-manufacturing (down 20.2% m/m), in addition

to a third straight month of decline in orders from manufacturing

(down 2.6% m/m). Orders from overseas also declined sharply,

slipping by 21.6% m/m following a 1.3% m/m drop in the previous

month. (IHS Markit Economist Harumi Taguchi)

- The decline in orders from manufacturing was due largely to lower orders from general-purpose and production machinery, non-ferrous metals, and other transport equipment, while orders from many other industry groupings continued to decline.

- The sluggish orders were in line with weak demand and disruptions throughout the supply chain caused by the COVID-19 virus.

- The sharp fall in orders from non-manufacturing largely reflected slippage following robust increases in orders from transportation and postal activities as well as telecommunication.

- The April results signal significant effects from global containment measures on industrial production and the likeliness of a steep decline in private capex over the near term. According to the Machine Tool Builders' Association, domestic and foreign machinery orders continued to decline at a faster pace in May.

- S&P Global Ratings has revised its outlook on Japan's

long-term sovereign credit ratings from Positive to Stable while

maintaining its long- and short-term sovereign credit ratings on

the country at A+ (15 on the IHS Markit scale) and A-1,

respectively. (IHS Markit Economist Harumi Taguchi)

- The revision to Stable reflects S&P's view that Japan's net debt burden will rise to above 170% of GDP in fiscal year (FY) 2020 and relatively large fiscal deficits will continue to pressure the country's debt level for 2-3 years following the sizeable supplementary budget announced by the government on 27 May.

- Although S&P expects little effect on Japan's economic fundamentals from the COVID-19 virus pandemic, it anticipates that relatively large fiscal deficits will continue to keep upward pressure on the general government debt-to-GDP ratio.

- Honda's four-wheel vehicle plant in Turkey, and motorcycle plants in India and Brazil halted operations due to a cyberattack that affected several factories worldwide, reports France Media Agency. According to the report by the agency, the cyber-attack, which affected 11 Honda plants - including five in the US - targeted Honda's internal servers and spread a virus through the company's systems. The automaker is in the process of investigating details of the attack. (IHS Markit AutoIntelligence's Tarun Thakur)

- Taiwan's exports fell 2.0% year on year (y/y) in May,

accelerating slightly from a 1.3% y/y contraction in April. Robust

demand for technology products supported shipments to mainland

China, the United States, and Japan, jumping 10.6% y/y, 9.3% y/y,

and 7.5% y/y, respectively. They were boosted by restoring capacity

in mainland China, the gradually reopening in the US, and demand

related to working from home and online learning and games. (IHS

Markit Economist Ling-Wei Chung)

- Shipments to ASEAN - with non-technology exports accounting for the largest share - plunged 17.9% y/y in May, and exports to Europe slumped 13.1% y/y. They marked the second month of double-digit declines.

- Electronic exports continued to provide the key support to overall export growth, jumping by 13.2% y/y in May, after surging 24.3% in April. It marked the fourth straight month of double-digit expansions and benefitted from a 14.2% y/y increase in exports of semi-conductor products.

- Exports of information and communication products expanded 10.9% y/y in May, after climbing 12.9% y/y in April. Shipments of laptop computers and related products surged 32.5% y/y, and exports of servers and routers jumped 28.0% y/y. They mainly benefitted from increasing demand for products related to working from home, telecommunicating, and remote learning. These came despite a very high base effect.

- Weighted down by additional drag from lower global oil and commodity prices, shipments of mineral products plunged the most by 57.3% y/y. This was followed by 10-20% y/y drops in exports of plastics, chemicals, and base metals.

- Machinery exports continued to fall but at a smaller 6.1% y/y, as stronger demand from mainland China and a low comparison base provided some support.

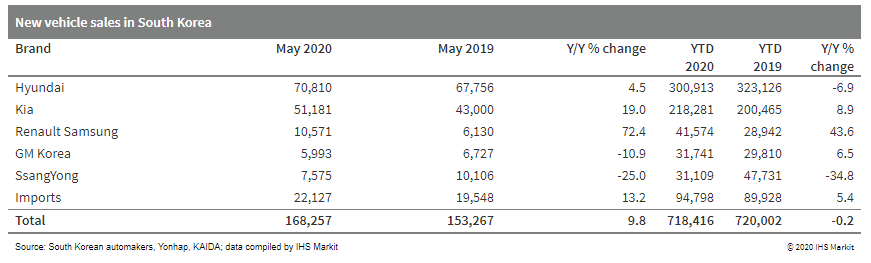

- New vehicle sales in South Korea, including passenger vehicle

imports, grew by 9.8% year on year (y/y) during May to 168,257

units, up from 153,267 units in May 2019, according to reports by

Yonhap News Agency and the Korea Automobile Importers and

Distributors Association (KAIDA), as compiled by IHS Markit. In the

year to date (YTD), total vehicle sales in the country stand at

718,416 units, down marginally by 0.2% y/y. (IHS Markit

AutoIntelligence's Jamal Amir)

- Hyundai and Kia maintained their lead of the South Korean vehicle market in May with a combined share of 72.5%.

- Hyundai posted a 4.5% y/y increase in its monthly sales to 70,810 units, while affiliate Kia recorded growth of 19.0% y/y to 51,181 units.

- Renault Samsung was the third-largest automaker with sales of 10,571 units during the month, up 72.4% y/y.

- SsangYong's sales plunged 25.0% y/y to 7,575 units, while General Motors (GM) Korea's sales decreased by 10.9% y/y to 5,993 units.

- The South Korean new vehicle market grew for a third

consecutive month during May. The growth last month can be

attributed to strong demand for new model launches and government

incentives.

- LG Chem will sell part of its liquid crystal display (LCD) polarizer business to Shanghai Shanshan Chemical (Shanghai, China) for 1.3 trillion South Korean won ($1.1 billion). LG Chem says that it is divesting the unit that makes LCD polarizers required to produce TVs and handsets, but will retain the unit that produces LCD polarizers used in cars. LG Chem says that the market for LCDs is deteriorating. It plans to focus on securing core competitiveness, mainly in organic light-emitting diodes (OLED) in the field of IT materials. LG Chem says customers are also expanding their investment in OLED, and that the material market is expected to change rapidly to OLED and next-generation displays.

- Bosch plans to build a semiconductor component manufacturing and sensor testing facility in Penang (Malaysia), reports New Strait Times. The report highlights that the construction of the plant at the Batu Kawan Industrial Park is expected to start in 2021 with first-series production expected in 2023. More than 400 associates are expected to work at the new facility. The plant will primarily focus on the final testing of components made at Bosch Automotive Electronics's fab in Dresden (Germany). The semiconductor components expected to be manufactured in the new plant will cater to airbag systems and engine control units, among other applications. (IHS Markit AutoIntelligence's Jamal Amir)

- Siemens Gas and Power Kazakhstan and Mangistaumunaigaz have signed a nine-year service contract for two STG-800 gas turbine units (GTU) at the Kalamkas oil and gas field. The contract includes servicing, upgrading power equipment, remote monitoring and technical support. Gas turbine units will be linked to Siemens remote monitoring center. Siemens is the original equipment manufacturer of the serviced gas turbines. The gas turbine power plant, located on Buzachi Peninsula, Kazakhstan's Mangystau Province, is designed to cover its own infrastructure needs, as well as the technological needs of the Kalamas oil and gas field. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-june-2020.html&text=Daily+Global+Market+Summary+-+10+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 10 June 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+10+June+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}