Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 29, 2020

When looking at world exports of pharmaceutical and medical equipment/chemicals*, the total export market (by $ value), the market has increased by 44% between 2010 and 2019, with an average year-on-year increase of 4% over the ten-year period. Within this frame, China is the eleventh largest exporter when ranked by value, representing a 2.4% of total market value with a 6% year-on-year increase.

The US is the number one partner of pharmaceutical and medical equipment/chemical from China representing 18.07% of total Chinese exports. It's no surprise that market analysts are turning to trade data to assess the potential risks and disruptions to supply chains in 2020 amidst the coronavirus situation.

Reviewing Chinese exports data to date (January plus February), and comparing the percentage change of units and values compared to last year, we can see which commodities are being prioritised and to who amidst a 4.6% decrease in tonnage exports compared to last year. Only two subheading (HS4) commodity groups saw any positive increase in export volumes compared to last year: HS3822 Composite Diagnostic/Laboratory Reagents and HS4015 Surgical & Medical gloves made of rubber.

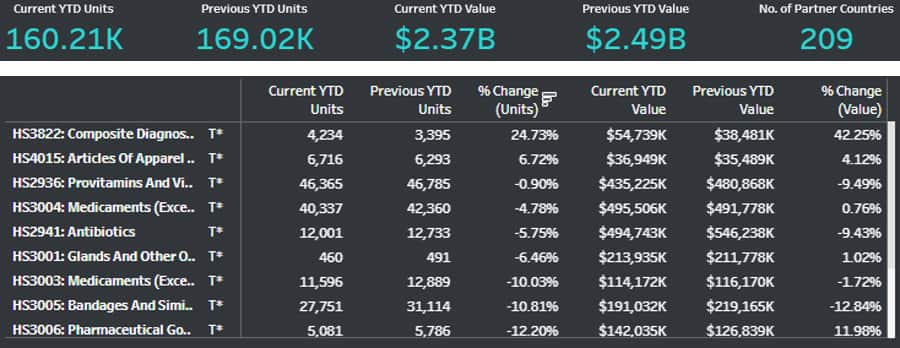

Figure 1: YTD (January plus February) 2020 comparison to 2019. Source: IHS Markit Global Trade Atlas

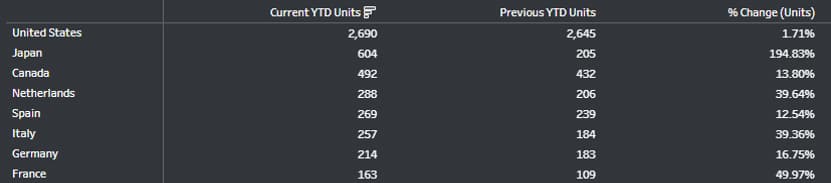

Composite Diagnostic or Laboratory Reagents (HS3822) had the highest year-on-year growth rate from 3.39K Tons / $38.48M in January plus February 2019 to 4.23K Tons / $54.74M in 2020 - representing a 24.73% volume change and 42.25 value change.

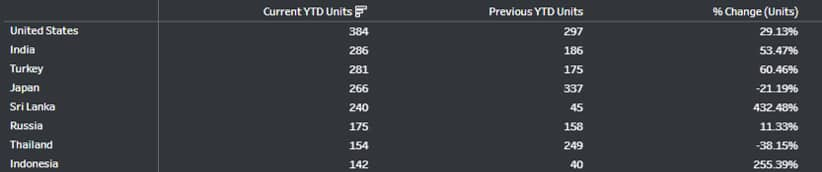

Figure 2: YTD (January plus February) 2020 comparison to 2019 ranked by current YTD units (Tons) by trade partner. Source: IHS Markit Global Trade Atlas

Surgical & Medical Gloves (HS4015) had the second highest year-on-year growth rate from 6.29K Tons / $35.49M in January plus February 2019 to 6.72K / $36.95M in 2020 - representing a 6.72% volume change and 4.12% value change.

Figure 3: YTD (January plus February) 2020 comparison to 2019 ranked by current YTD units (Tons) by trade partner. Source: IHS Markit Global trade Atlas

*This post is based on data from harmonised standard codes: HS29, HS30, HS38, HS40 and HS90

Posted 29 April 2020 by Jeremy Domballe, Subject Matter Expert, Maritime, Trade & Supply Chain, S&P Global Market Intelligence

How can our products help you?