Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 05, 2018

China PMI surveys point to slower growth momentum and weakening demand

- Caixin Composite PMI Output Index at five-month low in August

- New business growth weakest in just over two years

- Export sales remain in decline amid trade frictions

The Chinese economy lost some momentum midway through the third quarter amid signs of softer client demand, which suggests that business activity may slow further in coming months. The survey also brought further evidence that escalating trade frictions had weighed on demand, particularly in the manufacturing sector.

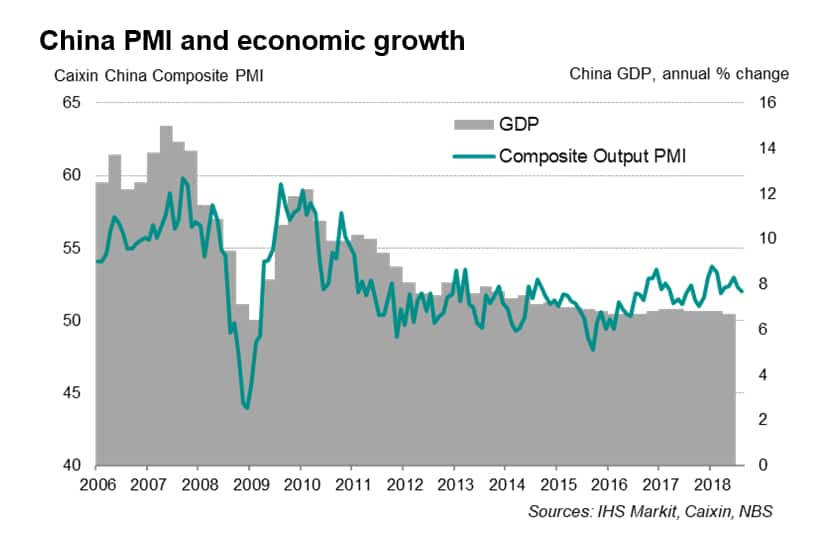

Softer economic growth

The Caixin China Composite PMI™ Output Index (which covers both manufacturing and services) fell from 52.3 in July to 52.0 in August, its lowest level for five months. The latest reading signalled a modest improvement in the health of the economy.

Most concerning was that new business growth fell to the lowest in just over two years, hinting at a further slowing in output growth in coming months. While the PMI's gauge of business confidence, the Future Output Index, improved, it remained below the average seen over the first half of 2018.

The latest PMI data underscored the need for the recent rollout of fiscal measures (including company tax cuts) designed to boost economic activity. The government has pledged to use proactive fiscal policy amid slower growth momentum and ongoing structural reforms.

Manufacturing concerns

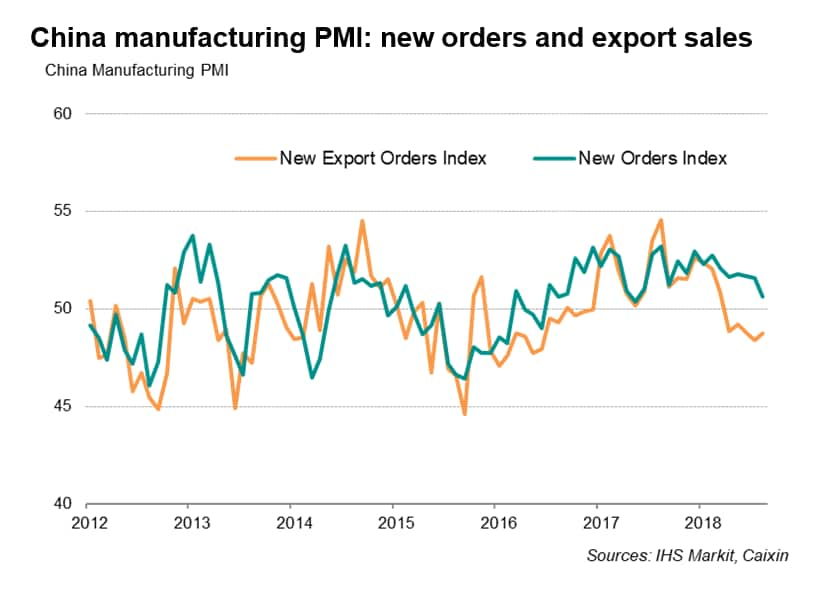

Sector-wise, manufacturing continued to signal weakening overall conditions. Although factory output growth rose to a seven-month high, several survey indicators pointed to a softening trend in the sector. New orders expanded at the weakest pace since May 2017, with export sales falling for a fifth straight month.

While the outlook remained positive, with the number of companies expecting to see activity rise in the coming year outnumbering those expecting a decline, business expectations towards factory production in the year ahead remained below the historical average. The accompanying panel member reports showed further evidence that rising trade tensions were a key concern among Chinese firms.

Supply constraints were another source of worry, as highlighted by delays in the receipt of purchased inputs. There has been no improvement in suppliers' delivery times for two years, meaning the recent supply chain trend is the worst recorded by the PMI since April 2012. Anecdotal evidence suggested that anti-pollution regulations that restrict production of certain raw materials, such as steel, were partly responsible for input shortages.

In services, business activity expanded at the slowest pace since October last year, which was also well below the historical average. Growth in new business remained modest and the level of backlogs was broadly unchanged in August, indicative of a softening trend in demand for services.

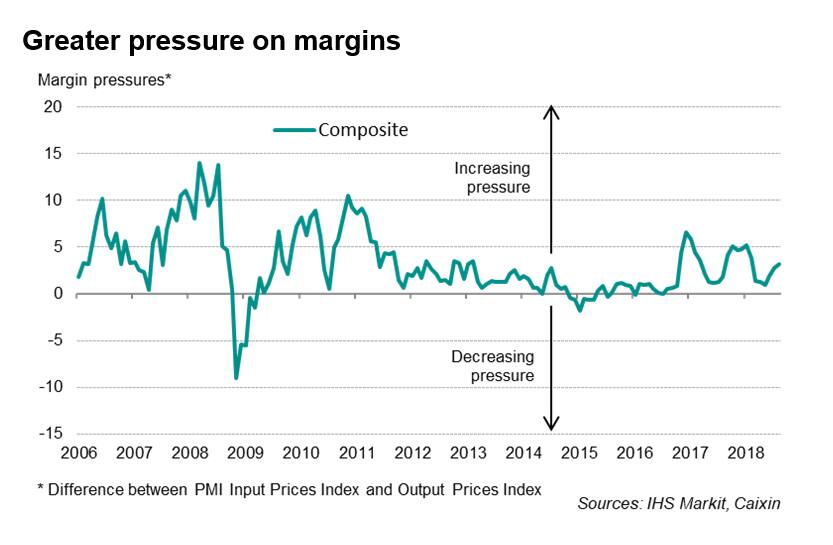

Greater margin pressures

Input price inflation meanwhile accelerated in August, with firms citing higher prices for commodities such as steel, plastics and petroleum. In response to higher costs, companies raised selling prices, albeit at a noticeably lower rate than that of cost inflation. August data saw a widening of the differential between input cost and output price inflation rates, implying greater pressure on profit margins.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-point-to-slower-growth-momentum-050918.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-point-to-slower-growth-momentum-050918.html&text=China+PMI+surveys+point+to+slower+growth+momentum+and+weakening+demand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-point-to-slower-growth-momentum-050918.html","enabled":true},{"name":"email","url":"?subject=China PMI surveys point to slower growth momentum and weakening demand | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-point-to-slower-growth-momentum-050918.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+PMI+surveys+point+to+slower+growth+momentum+and+weakening+demand+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-point-to-slower-growth-momentum-050918.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}