Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 04, 2018

Caixin China PMI surveys signal steady economic growth but rising prices

- Caixin Composite PMI Output Index rises to 53.0 in June, up from 52.3 in May

- Export orders fall further

- Firms face higher costs and supply chain delays

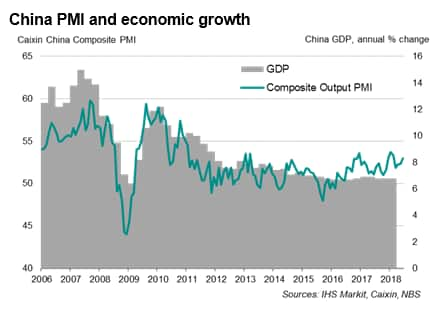

The steady expansion of China's economy was sustained at the end of the second quarter, according to the latest Caixin PMI surveys. However, the upturn was marred by sharper inflationary pressures, that partly reflected supply bottlenecks linked to ongoing output restrictions on heavy-polluting industries.

Steady growth momentum

The Caixin China Composite PMI™ Output Index rose to 53.0 in June, from 52.3 in May, signalling a solid increase in Chinese business activity. At 52.7, the average index reading for the first half of this year is the highest since 2011.

Other survey indicators are generally encouraging and pointing to resilient growth in coming months. Growth in new orders kept to a steady pace which, in turn, contributed to a stable rise in backlogs of work. The latter suggests that output could expand further as the year progresses. Furthermore, business confidence towards the year ahead remained positive.

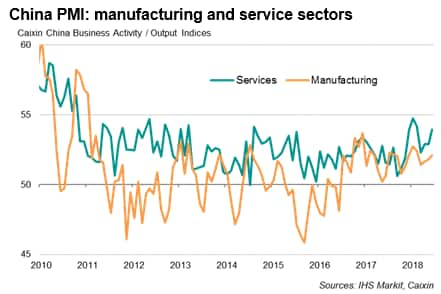

By sector, growth in both manufacturing output and services activity accelerated in June, while new business inflows rose modestly in both sectors.

Declining exports

Of particular note was a further decline in new export orders. Though modest, the rate of decrease was the steepest in two years. The June decline was the third month in as many months, which marked the first quarterly fall in foreign sales since 2016. Naturally, this raises the question of whether weaker overseas sales were linked to rising China-US trade tensions, but there was little anecdotal evidence referencing to trade wars and tariffs. Rather, lower client demand and high competition were commonly cited as reasons for the export decline.

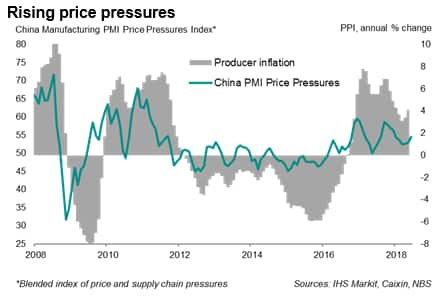

Rising prices

June saw inflationary pressures pick up for the second month running, though prices increases remained weaker than those seen in late 2017. Notably, the rate of input cost inflation rose to a four-month high. Cost pressures intensified across both the manufacturing and service sectors, with manufacturers recording the stronger rate of increase. Higher raw material costs, especially for steel, chemicals, plastics and packaging, which were in part connected to environmental protection laws, was a major factor driving inflation.

News of an expansion of the of the emissions curbs from 28 to as many as 80 cities could further weigh on the supply of raw materials (especially steel and coal) which, in turn, could drive up production costs in future. Meanwhile, greater cost burdens pushed factories to raise their selling prices to the greatest extent since September last year. In comparison, prices charged by services companies rose only slightly.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signal-steady-economic-growth-but-rising-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signal-steady-economic-growth-but-rising-prices.html&text=Caixin+China+PMI+surveys+signal+steady+economic+growth+but+rising+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signal-steady-economic-growth-but-rising-prices.html","enabled":true},{"name":"email","url":"?subject=Caixin China PMI surveys signal steady economic growth but rising prices | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signal-steady-economic-growth-but-rising-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Caixin+China+PMI+surveys+signal+steady+economic+growth+but+rising+prices+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signal-steady-economic-growth-but-rising-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}