Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 15, 2019

Change is coming to the MBS Market

What is the Single Security Initiative?

The Single Security Initiative refers to a joint program between Fannie Mae and Freddie Mac that will combine their individual TBA markets into one unified market through the issuance of a new security, known as UMBS (Uniform Mortgage-Backed Security). The Initiative has also established a mechanism to exchange legacy Freddie Gold MBS into UMBS TBA-deliverable securities. The joint venture will create cost efficiencies for the GSEs by allowing for comingled MBS issuance and trading in both the TBA and specified pool markets.

How will I be affected by the Single Security Initiative?

Currently there are 70,000 Freddie Gold MBS that are eligible for exchange into Freddie Mirror UMBS. Holders of eligible Freddie Gold MBS have the option to convert those securities into Freddie Mirror UMBS either directly through Freddie Mac or through an approved dealer. A Mirror security will possess the same characteristics as the exchanged Gold security (coupon, factor, WAM, WALA, etc.) as it will be backed by the same loans as collateral. However, Mirror securities will have their own unique CUSIP and pool number identifiers, while adopting Fannie Mae's 55-day payment delay as opposed to the existing Freddie Gold 45-day payment delay.

What is the timeline for the Single Security Initiative?

June 3, 2019 is the scheduled go-live date for the Single Security Initiative. At this time Fannie and Freddie will begin issuance of UMBS. However, given the nature of the existing TBA market, forward trading of UMBS TBAs can start in March (those trades will settle in June). Eligible legacy Freddie Gold MBS can be exchanged into Mirror UMBS starting on May 7.

How can IHS Markit help?

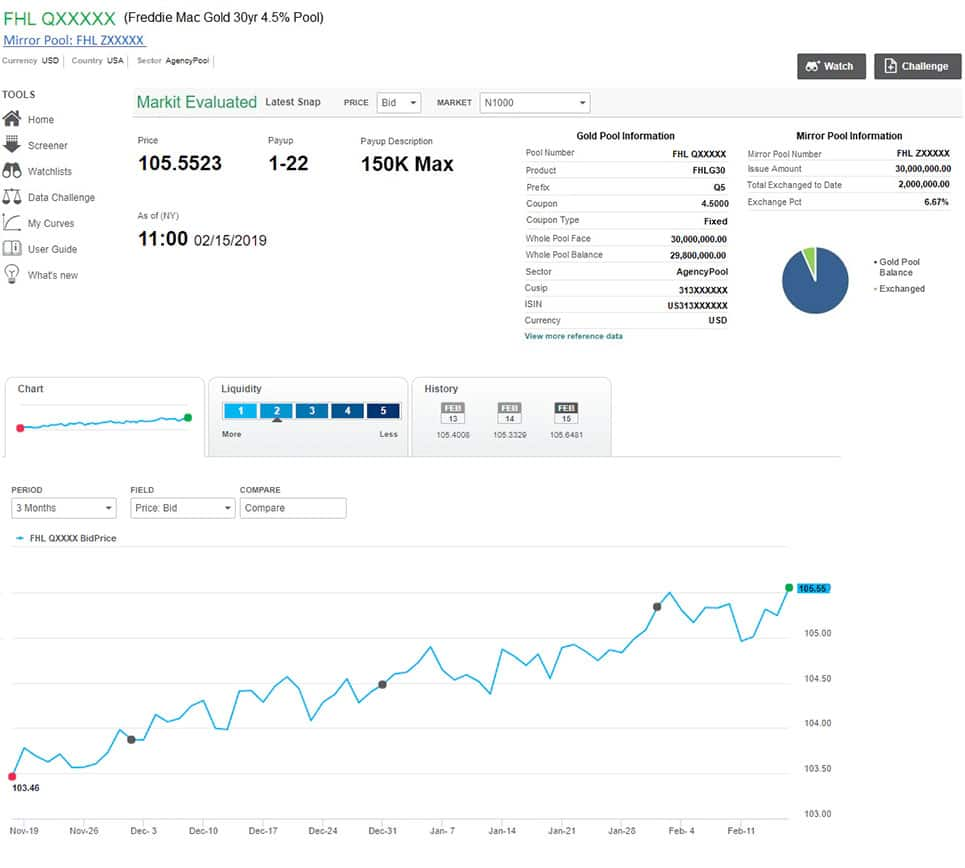

IHS Markit has been engaged with Freddie, Fannie and market participants throughout 2018 in key discussions around the major analytic, operational and technical changes that the launch of Single Security Initiative will introduce to the Agency MBS market. IHS Markit provides pricing on 99% of the securitized products universe (all sub-asset classes including Agency MBS, non-Agency RMBS, CLO, CDO, consumer ABS, etc.), and as such will continue to provide pricing for legacy Freddie Gold MBS, Freddie Mirror UMBS and newly issued Fannie UMBS pools and TBAs. Clients of IHS Markit's web-based Price Viewer portal can also screen for exchange-eligible Freddie Gold MBS and their respective Freddie Mirror UMBS counterparts. Exchange activity at the security level will also be tracked and displayed.

Price Viewer features for UMBS will be made available to current and prospective clients in Q2 2019, enabling users to challenge IHS Markit valuations and request pricing assumptions and observable market data points. Clients are also able to interact directly with IHS Markit subject matter experts to gain insight on our pricing approach and methodologies.

For additional details and to request trial access to Price Viewer please contact USABSPRICING@IHSMarkit.com or visit Price Viewer.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchange-is-coming-to-the-mbs-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchange-is-coming-to-the-mbs-market.html&text=Change+is+coming+to+the+MBS+Market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchange-is-coming-to-the-mbs-market.html","enabled":true},{"name":"email","url":"?subject=Change is coming to the MBS Market | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchange-is-coming-to-the-mbs-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Change+is+coming+to+the+MBS+Market+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchange-is-coming-to-the-mbs-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}