Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 04, 2020

Can the sub-Panamax sector recover as strongly as Capesizes?

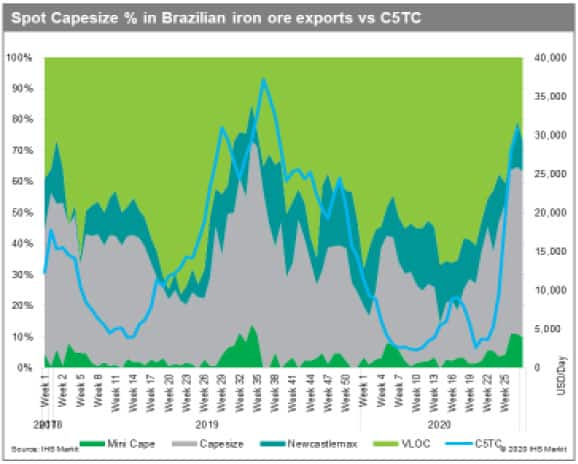

Without doubt, the current dry bulk market is Capesize-driven market. We have seen C5TC has increased to more than USD 30,000 per day in early July 2020 from USD 3,000 just a month ago, up almost 1,000% over just one month. Also, Panamax and Supramax have increased significantly with strengthening Capesize rates and adjusted down again in line with weakening Capesize rates towards the end of July. Therefore, in our view, regardless of actual fundamental of smaller size sector, we need to explore the key reasons behind the remarkable increase in the Capesize freight first and then analyze how different market conditions would impact Panamax and Supramax freight rates in the short and medium-term.

Source: IHS Markit Commodities at Sea

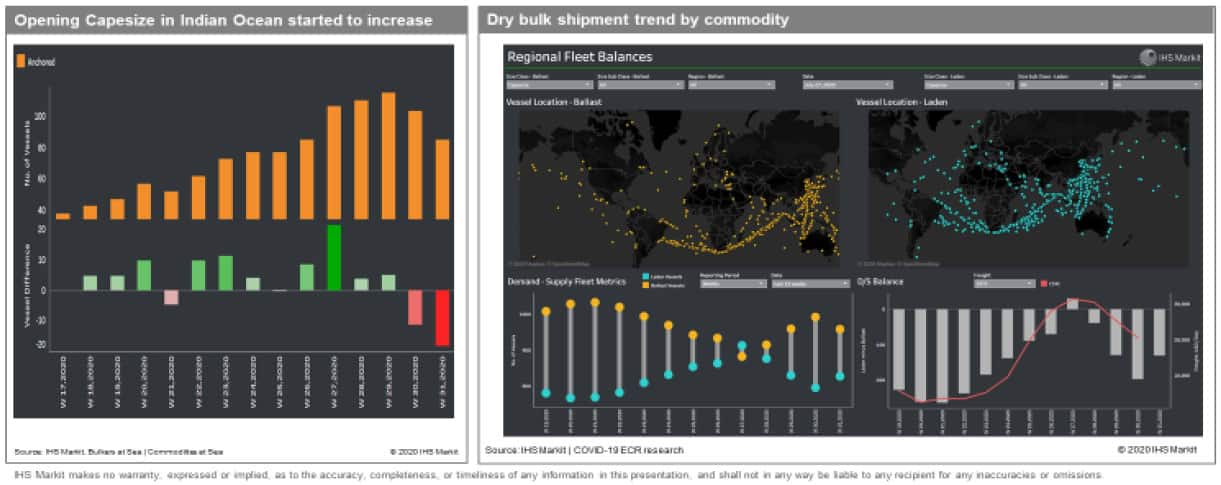

To answer this key question, we believe we need to measure positional squeeze first to predict the short-term direction of the Capesize market.

- On the 19th May, we reported that laden/ballast balance started to increase and signaled higher Capesize freight rates in the following weeks with stronger employments and less ballasters. Since then, we have seen the demand-and-supply balance in Brazilian routes continue to increase in line with Capesize 5TC average movement. This tightness is mainly caused by the coronavirus disease (COVID-19) impact. Indian buyers of coal and iron ore have not been actively importing cargo over the last two months with lockdown, which limited tonnage flow into the Indian ocean. Also, the Tonnage availability in the north Atlantic has decreased over the last few months.

- Under this circumstance, we observed increasing Capesize iron ore employment from Brazil, reaching last year's level in Week 26, and has stayed strong since then. Furthermore, Canadian and Ukrainian iron ore export volumes picked up and bauxite demand from Guinea has increased. All of those participants of Atlantic exports have been fighting for very limited tonnage in the short-term. Consequently, front-haul driven positional squeeze has been driving freight rates to increase very strongly.

- Moreover, VLOC's market share in Brazil has decreased substantially. In the first five months of this year, VLOC has more than 60% market share in Brazilian iron ore exports, but in June, it became less than 50%. As VLOC is used for dedicated shipments, Brazilian miners were required to charter in more spot Capesize vessels, which triggered much tough competition to secure limited prompt tonnage.

- However, we expect VLOCs currently heading to Asia will surely come back to Brazil in one or two months' time and reduce spot Capesize requirements. In 2019, there was a substantial delay in returning of VLOCs owing to the 'scrubber installation impact' with the increase in dry docking activities. For 2020, as scrubber installation has been discouraged so far owing to the narrow differential of LSFO/HSFO, we do not expect artificial supply tightness to happen again in the second half.

- Finally, when we looked at the movements in the Indian Ocean over weeks 26-28, demand and supply balance was starting to decrease, and we were seeing more ballasters in early July. In our view, this will surely put pressure on Capesize freight rates in ships that arrive in August.

Source: IHS Markit Freight Rate Forecast

Also, the Australian finance year started in July, many iron ore and coal traders tried to close deals in June, and this short-term artificial unbalanced market was intensified with higher congestion in China as well. This sudden spike in freight by these factors led many funds to cover their large short positions in FFA, specifically for nearby contracts in June and July 2020. These short-covering activities were not all that uncommon in the commodity future market, and many of short-covering driven prices rally eventually failed in the medium-term as the fundamental picture usually comes back and adjusts them down. Fundamentals will ultimately determine price in the long run.

All these factors indicate the extreme market above USD 30,000 per day cannot be sustainable over the course of the third quarter and therefore, in the dry bulk market briefing last month, we forecasted Capesize market to soften in July eventually. It indeed happened as predicted.

Meanwhile, when Capesize freight rates spiked, we also observed the Panamax and Supramax assessment of FFA to increase substantially with strengthening Capesize rates. However, can the current contango in FFA on sub-Panamax size sectors (where the future price/rates of freight are much higher than the spot rates) can be justified?

Source: IHS Markit

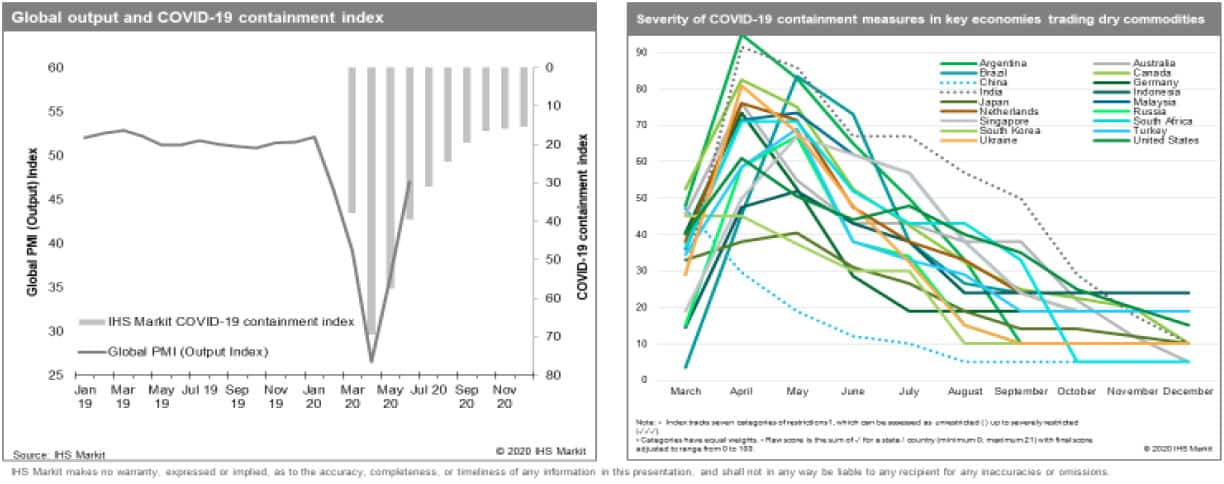

As the dry bulk freight has finally recovered across every size class. Attention is now beginning to shift from the depth of the recession to the shape and strength of the recovery. The key story still centers around the global economy gradually reopening after COVID-19-related disruptions, and Chinese stimulus package supporting demand of key dry bulk cargo, therefore, it seems the dry bulk market has passed the floor and now the focus has turned to speed and strength of freight rate recovery.

However, when we account for changing trade patterns, energy competition, and fleet supply development, there are obvious winners and losers depending on the size segments. Overall, it seems more favorable to the bigger size segments.

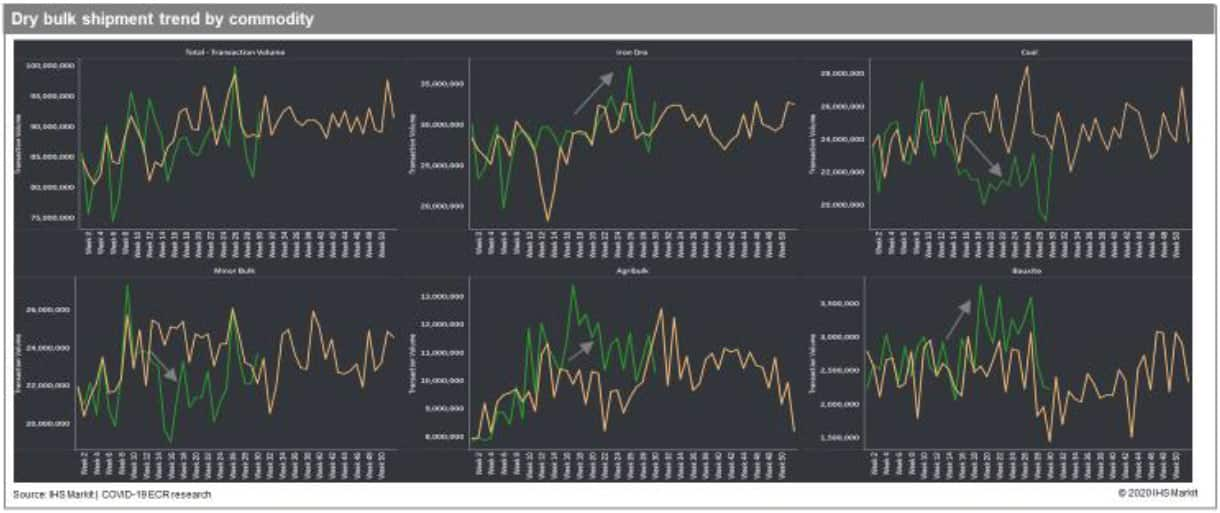

Over the first six months of 2020, bauxite and iron ore shipments, mainly carried by Capesize, have been quite stable amid the COVID-19 situation because of strong demand from China.

However, there is substantial downside risk in the coal sector, impacting more the smaller size segments. Specifically, in India, the coal import trend has declined significantly over the last few months. Although Indian coal imports are expected to recover to some extent, it is not likely to reach beyond last year's level owing to high coal stockpiles and competition with stable domestic output. Additionally, exceptional strength in Chinese coal imports over the first half would result in import controls in the second half with limited import quotas.

Source: IHS Markit Commodities at Sea

Clearly, there are also positive factors for grain carriers. With the phase-one deal between the US and China, there is potential upside risk in Atlantic grain tonnage demand in the early fourth quarter when the US grain season starts. However, strength in Brazil soybean exports in the second quarter, also expected is strength in Black sea grain season in the third quarter would limit upside potential of US grain season in the fourth quarter.

Moreover, in terms of supply, although we expect supply normalization in the coming 2-3 years with limited new building orders, capacity growth of Panamax and Supramax has been very strong so far, mainly because of limited demolition in sub-panamax sectors and a large number of scheduled deliveries. Therefore, global dry bulk freight rates are expected to rise in the second half of 2020 as the global economy gradually reopens and positive sentiment from the Capesize market raises expectation of shipowners, specifically in the period market. However, we expect Panamax and Supramax freight rates will still end the year well below its 2019 cyclical peak mainly owing to the risk in coal demand, and high capacity growth.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcan-the-subpanamax-sector-recover-as-strongly-as-capesizes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcan-the-subpanamax-sector-recover-as-strongly-as-capesizes.html&text=Can+the+sub-Panamax+sector+recover+as+strongly+as+Capesizes%3f++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcan-the-subpanamax-sector-recover-as-strongly-as-capesizes.html","enabled":true},{"name":"email","url":"?subject=Can the sub-Panamax sector recover as strongly as Capesizes? | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcan-the-subpanamax-sector-recover-as-strongly-as-capesizes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Can+the+sub-Panamax+sector+recover+as+strongly+as+Capesizes%3f++%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcan-the-subpanamax-sector-recover-as-strongly-as-capesizes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}