Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 19, 2022

Normalization is still a goal — not a reality — for logistics managers moving goods worldwide and within the United States. After three years of intense global supply chain disruptions, however, 2023 will likely be the year when the much-sought-after "new normal" emerges.

This yearning for normalization has become a mantra for shippers, who want nothing more than to return to a market in which they can forecast volumes and budget accordingly without having to continually tear up their plans. They long for a time when could confidently say, "This is what our transportation spend will be next year" without the need to add an "if."

But those "ifs" aren't leaving the room any time soon.

"The new normal is that change is constant," said John Janson, senior director of global logistics for apparel importer SanMar. "What will be the disruptor we don't see coming?" There are plenty to choose from, he said, from labor disputes to unforeseen geopolitical crises.

Normalization can mean many things, but one thing it does not mean is a return to the transportation world that existed prior to the COVID-19 pandemic. That world is as distant as Atlantis, and those who try to return to it will likely struggle.

"We're in the early stages now," Michael Pettit, CFO of trailer manufacturer Wabash National, told the Journal of Commerce. "We're not seeing things go back to the way they were, but we're seeing a more normalized trend."

Wabash in recent years has reorganized its supply chain to source more components and materials from North America, Pettit said. Because of supply chain disruption, "Every manufacturer is producing less than their optimal output, but that's a positive," he said, in that manufacturers that are still rebuilding production volumes can more easily scale to meet demand.

Jeff Tucker, CEO of third-party logistics provider (3PL) and brokerage firm Tucker Company Worldwide, said that although global and domestic US supply chains have not yet "normalized," pricing in most modes, especially transactional spot market pricing, is undergoing the type of correction that typically precedes a normalization of operations.

"Fulfillment rates are not so good, but all the shuffling of the deck with motor carriers has settled down," he said. "People were shipping extra stuff they didn't even know they had to ship."

Pettit expects Wabash to return to pre-pandemic production volumes in 2023, and for industry in general to return to the long-term, pre-pandemic trendline, at levels that erase the 2020-22 "bulge" seen in almost every graph of industrial activity, from inventories to production to pricing.

"The question is: Do we go way down with a recession, or do we snap back to the trendline?" he said.

The economic effects of the COVID-19 pandemic — more specifically, the brief but sharp recession in early 2020 and the break-neck recovery that saw US real gross domestic product (GDP) jump 5.9 percent on an annualized basis in 2021 — bent that trendline way out of shape.

In 2022, real GDP growth slowed to just 1.8 percent, according to S&P Global, parent company of the Journal of Commerce, which expects the US economy to contract 0.2 percent in 2023 and expand only 1.3 percent in 2024.

That signals a rather flat economic outlook, with minimal growth or contraction, over the next two years. "Normal" in that case would feel much softer than 2021, but inflation might come down to the 2.8 percent target set by the US Federal Reserve System for 2023 and 2.3 percent in 2024.

The 2.6 percent US GDP expansion in the 2022 third quarter was caused by what S&P Global called a "large and unsustainable" 14.4 percent surge in net exports, while net imports dropped 6.7 percent. That imbalance suggests global supply chains have yet to reach normality.

Given the long arc of a normalization that has only just begun, going forward, "the key is to build resilient supply chains and transportation partnerships," Tucker said.

One area in which normalization seems to be occurring is pricing, an area that makes for a fitting tip of the spear. After all, abnormal activity drove spot pricing on land and ocean to record highs in 2021. However, 2022 saw those short-term rates implode in a multi-modal pricing correction.

Container shipping spot rates were expected to hit 2019 levels by the end of 2022 as vessel demand weakened faster than expected and port congestion eased, according to global bank HSBC.

The eastbound trans-Pacific trade in the next few months will face a "hard landing," marked by declining freight volumes and spot rates, with a recovery occurring by peak season 2023 at the earliest, according to Lars Jensen, CEO of consultancy Vespucci Maritime and a Journal of Commerce analyst.

In a more "pessimistic" scenario, that recovery may not take place until Lunar New Year 2024, Jensen said during a Journal of Commerce webcast in December. Even though spot rates have dropped from an early 2022 high of $14,000 per FEU, according to some rate indexes, to $2,000 per FEU, this does not mean a rate war is under way. "That's a normalization of rates," he said.

On land, spot US truckload rates plummeted throughout 2022 but appear to be settling above "normal" pre-pandemic levels. National average monthly dry-van spot rates, including fuel surcharges, hit a high of $3.11 per mile in January before dropping to $2.38 per mile in November, according to DAT Freight & Analytics.

That was still about $0.18 per mile higher than in November 2019 and $0.32 per mile higher than in May 2020, but below spot truckload pricing levels reported in 2018, the strongest trucking market of the pre-pandemic era.

DAT and others predict the truckload spot market will hit bottom by mid-2023, or earlier. "We believe the bottoming process is beginning as spot rates are now further below costs than ever before," Tim Denoyer, senior analyst at ACT Research, said in November.

Less-than-truckload (LTL) rates have proven more resilient. That's largely because the LTL market is much smaller than the truckload sector, accounting for about $50 billion in for-hire trucking revenue in 2021, according to SJ Consulting Group.

Softer demand in the second half of 2022 led to some rate discounting, however, as some LTL carriers tried to keep trailers full and gain market share by lowering price, while others cut capacity and announced temporary layoffs, said Satish Jindel, president of SJ Consulting Group.

Transportation pricing will continue to slide from the all-time highs of 2021 this year, but shippers aren't likely to recover all pandemic-era price hikes. For one, outside of some retail sectors, freight demand hasn't fallen that much.

In October, for-hire truck tonnage slipped 2.3 percent from September, but was still 2.8 percent higher than in October 2021, according to data from the American Trucking Associations (ATA).

"Factory-related freight is holding up better than other areas," though those shipments are also decelerating, said Bob Costello, chief economist at the ATA.

The return of some measure of seasonality to shipping in 2022 was a silver lining for US logistics managers amid otherwise gloomy forecasts about the US and world economies.

US trucking companies and their shipper customers began to see seasonality — i.e., the month-to-month ups and downs in volume that were typical of the pre-pandemic era — reassert itself by mid-2022.

That's a sign that freight markets, at least on land, were beginning to behave more normally. But normalization is very much in the eye of the beholder.

Tucker, for example, said the trucking industry needs to reassess its idea of what constitutes a "normal" market. "Normal is a state of equilibrium that gets interrupted by a capacity crisis every couple of years," he said. "We need to be ready for ebbs and flows."

During the pandemic, it's been all flow and no ebb for shippers. A global economic slowdown or recession may paradoxically help logistics managers by relieving the incessant pressure to speed up goods they've suffered since COVID-19 arrived in 2020 — provided the slowdown doesn't snowball into a collapse.

"Lower demand will allow global supply chains to progressively improve, even if it still remains elevated in some geographies," Søren Skou, CEO of A.P. Møller - Maersk Group, said during an earnings call in November. "It will certainly also help Maersk deliver a more reliable ocean service, which is what we aim to do." The company has expected normalization to occur "for quite some time," he said.

But expectations have been frustrated repeatedly since 2020. US importers and shippers stymied by massive waves of imports and congestion at the ports of Los Angeles and Long Beach in 2021 were hit with a shortage of warehousing and storage space and fierce congestion at inland distribution points last year, especially in hubs such as Chicago, Memphis, Tenn., Kansas City, and Dallas-Fort Worth.

Some of the lower demand reported in the general media is a result of overstocked inventory. Front-loading of imports that typically arrive in the second half during the first half of 2022 created bloated inventories that are still being drawn down, especially for retailers.

Last fall, shippers that had to expedite containerized freight from US ports inland throughout 2022 found themselves with too much inventory on hand, and more inventory coming in trucks, on the rails, and on the sea. That build-up from comparatively low levels is another harbinger of normalization.

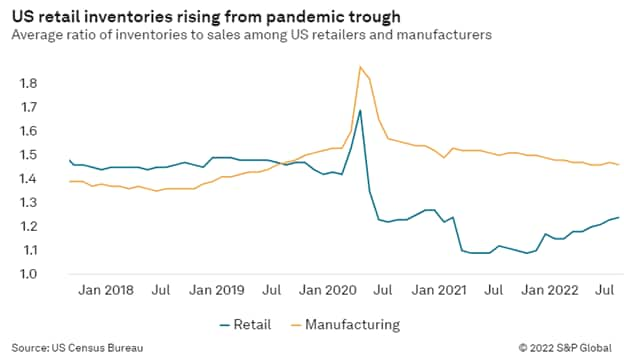

Although the average inventory-to-sales ratios for broad sectors such as US retail and manufacturing remain below pre-pandemic levels, many industries have built inventories back to where they were in 2019.

Retail inventories, excluding motor vehicles and parts, jumped 19.8 percent year over year by dollar value in September, according to the US Census Bureau, well above the rate of inflation. The inventory-to-sales ratio for furniture and appliances stores for the month was 1.63, up from 1.51 in September 2019, while the ratio for general merchandise stores was 1.54, the highest reading for such stores since March 2008.

Those ratios show that it took longer to clear goods from warehouse shelves last fall, a sign of falling demand amid high inventory supply. But the build-up of inventories also flooded available warehouses, reducing demand for further imports. For some importers, adding a few extra pounds to previously lean inventories may become the new norm.

The capacity shortage on the ocean in 2021 shifted to a shortage of US warehousing space near ports and further inland in 2022. Warehousing space became more constricted as the year went on, bringing the third-quarter US vacancy rate to 3.3 percent, an all-time low, according to industrial developer JLL.

As consumers demand more products and developers such as JLL build out industrial warehousing space to meet that need, importers are expected to embrace higher base levels of inventory.

That implies that normalization in supply chains will more closely resemble a gradual resumption of more typical behavioral and operational patterns, rather than a leap backward to the 2010s. Disruptions of the scope and depth of the COVID-19 pandemic generally herald enduring change, if not an evolutionary leap.

"Four years ago, people didn't order dinner through DoorDash; why should they go back?" said Jindel of SJ Consulting Group. "The same is true for businesses."

As such, shippers and their transportation providers must continue to innovate, even in times of relative normality. "Companies get in trouble because they get too comfortable with how they've been doing things, and they don't want to rock the boat," Jindel said. "Today, you need to rock your own boat, because if you don't someone else will."

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Sign-up to Maritime Trade & Supply Chain monthly newsletter.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.