Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Sep 27, 2022

Research Signals - September 2022

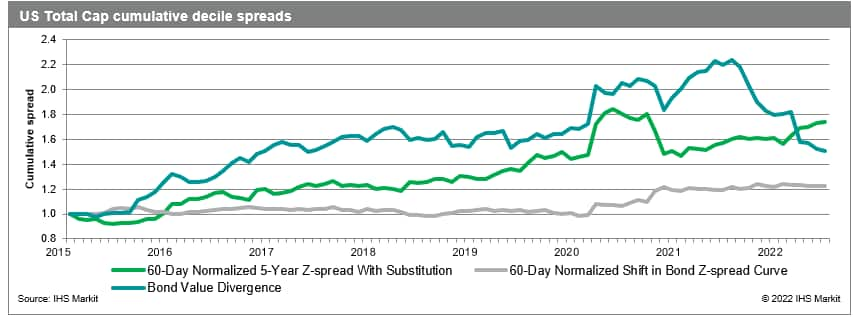

The bond market has long been considered a leading indicator of future economic conditions, yet the relationship between corporate bonds and the underlying company stock price is a less researched topic. However, this connection has become more acute in the current environment characterized by inflation running above central bank objectives and hawkish messaging in several key regions. Using data provided by the IHS Markit Corporate and Sovereign Bond Pricing team, now a part of S&P Global, Research Signals tests the use of corporate bond pricing data as a predictor of future stock returns. Using this rich dataset, we introduce 19 base factors (and seven variants to extend coverage) using bond return and curve data to predict equity price movement.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.