Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 08, 2018

Basic Materials sector shows signs of a pick-up through 2018

- IHS Markit Basic Materials Output Index dips at start of 2018…

- …but April and May data signal an uptick in production growth

- Recently introduced tariffs have the potential to threaten global export markets for U.S. goods

Increasing political tensions across major world markets are beginning to feed through to producers in the US. Greater speculation regarding metal prices and lower global demand for US manufactured goods has dropped the basic materials sector into a lower gear. That said, as the rhetoric regarding a 'trade-war' appears to be fading, the effects are also expected to subside.

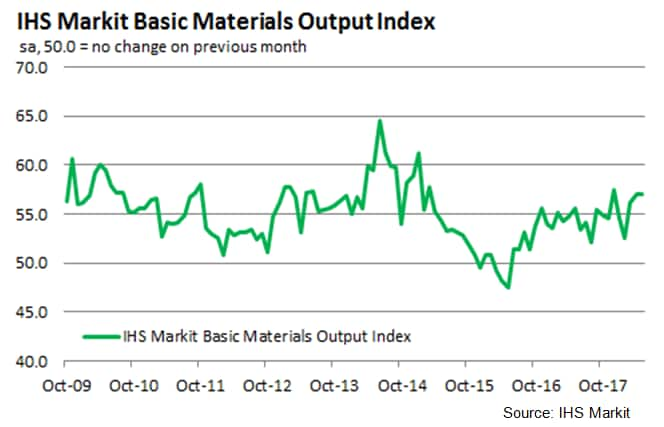

Following a gradual recovery through 2016 and 2017, the US Basic Materials sector signalled a slight slowdown at the start of the year. The dip in the pace of growth has been attributed to pressure on supply chains and recently proposed tariffs. The threat of reciprocation from key export markets is an imminent concern to US metal and chemicals manufacturers.

That said, goods producers in the basic materials sector have signalled signs of recovery from the weaker demand conditions seen at the start of the year. The headline IHS Markit Basic Materials PMI™ rose to a five-month high in May. New orders also increased at the sharpest rate since July 2014.

Tariffs create uncertainty across markets

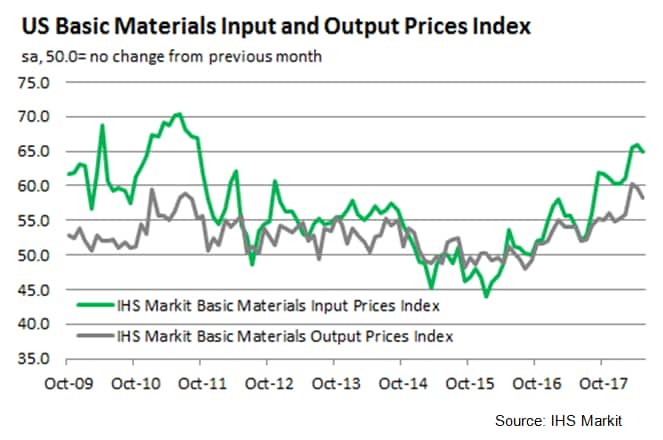

Recently introduced tariffs on global imports of steel and aluminium by the US (exempt for the EU until 1st June 2018) have sparked retaliation from key export partners, with initial trade talks breaking down. This comes at a time when global demand for inputs is already strong. Higher resulting import prices have impacted US firms' balance sheets and added pressure to supply chains. Both input costs and output prices have consequently risen sharply throughout 2018 so far. The IHS Markit US Basic Materials Input Prices Index indicated the fastest increase in cost burdens since September 2011 in April, followed by a further marked rise in May. Similarly, the latest survey data signalled a sharp rise in output prices, with May seeing one of the steepest increases since the series began in October 2009.

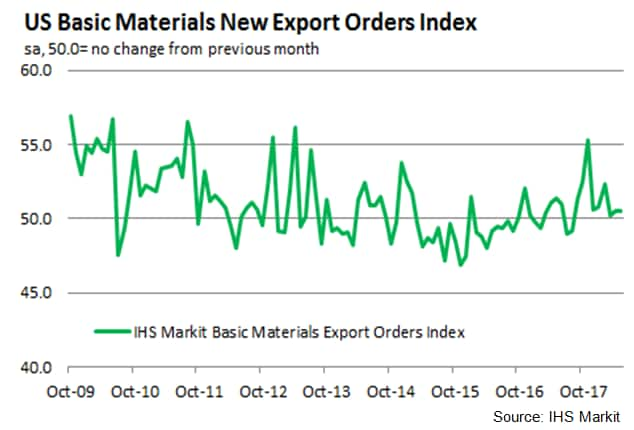

In addition, uncertainty among significant trading partners with the US, including the EU, China, Japan, Canada and Mexico, appears to have contributed to weaker global demand. New export orders have struggled to improve substantially through 2018 so far in the US's basic materials sector. In fact, the New Export Orders Index was only fractionally above the 50.0 'no-change' mark in May. This issue may be exacerbated as the year progresses, especially as reciprocal tariffs are due to come into effect.

Chemicals growth could ease

In retaliation to recent US tariffs, China have introduced taxes on $3 billion worth of imported American goods. Many of the included manufactured products are plastics or chemical related goods. The recent slowdown in output across the basic materials sector can be at least in part linked to weaker demand for plastics. The trend could worsen as other countries including Japan (a key importer of U.S. pharmaceuticals and a large supplier of automobiles and auto parts) are expected to inform the WTO of their planned retaliatory measures.

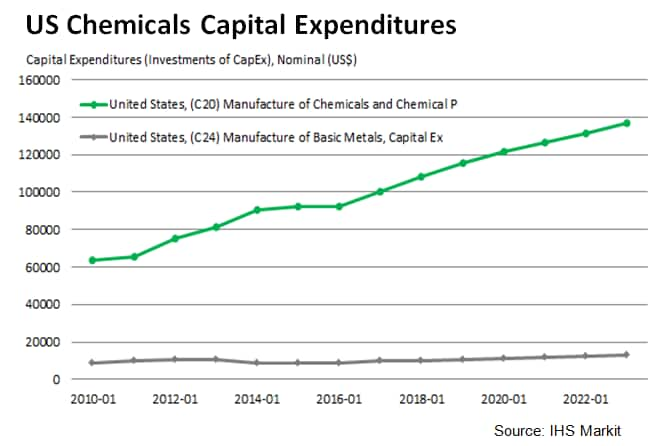

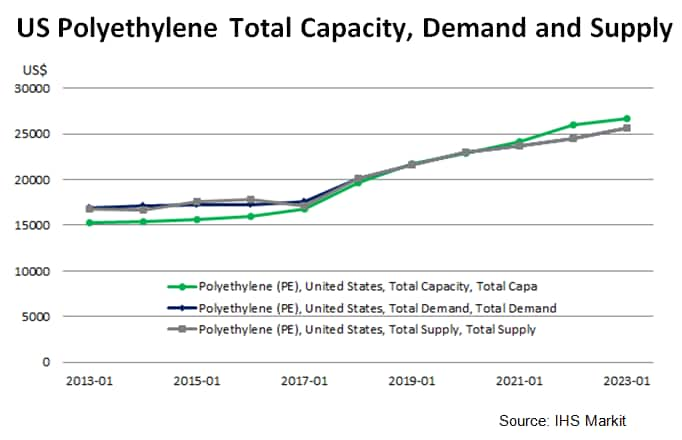

Over the last few years chemicals manufacturers have been investing heavily in new facilities and capacity expansion. Such large investments have left the sector vulnerable to recent metal price hikes, notably steel used in the construction of these plants, which is expected to hit profit margins. If such expenditures are to remain viable and tariffs were to continue, domestic customers are likely to need to fill the gap that a loss of global demand could leave.

Despite recent push backs and escalating political tensions, it is widely expected that upcoming talks between the US and China, and the US and the EU, will call an end to fears of a 'trade war'. As such, prices and demand in the basic materials sector will stabilise. Also, increased capacities and greater reserves of natural gas feedstocks are expected to enhance production processes and capabilities going forward.

2018 expected to progress strongly

Despite current concerns regarding tariffs and reciprocal taxes, it is expected that the revenue raised will only be around $10 billion this year, and that the positive revenue effects will wane throughout the year. In the near-term, however, speculation surrounding the price of aluminium and steel will continue to impact basic materials goods producers. Anecdotal evidence has suggested that suppliers are happy to hike prices on the back of such speculation.

Although the introduction of protectionist policies caused a shock to output growth at the beginning of the year, expectations for 2018 as a whole remain strong. Greater investment in expanding capacity should help to meet growing global demand for inputs. Meanwhile, it is currently not expected that an increase in cost burdens will filter through to a significant upturn in consumer price inflation.

Forthcoming economic data releases:

- June 22nd: IHS Markit Flash US Manufacturing, Services and Composite PMI (June data)

- July 2nd: IHS Markit US Manufacturing Final PMI (June data)

- July 5th: IHS Markit US Services and Composite Final PMI (June data)

- July 9th: IHS Markit U.S. Sector PMI (June data)

Sian Jones, Economist, IHS Markit

Tel: +65 44 1491 461017

sian.jones@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasic-materials-show-signs-of-pickup.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasic-materials-show-signs-of-pickup.html&text=Basic+Materials+sector+shows+signs+of+a+pick-up+through+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasic-materials-show-signs-of-pickup.html","enabled":true},{"name":"email","url":"?subject=Basic Materials sector shows signs of a pick-up through 2018 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasic-materials-show-signs-of-pickup.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Basic+Materials+sector+shows+signs+of+a+pick-up+through+2018+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasic-materials-show-signs-of-pickup.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}