Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 05, 2023

Our banking risk experts provide insight into events impacting the financial sector in emerging markets in May.

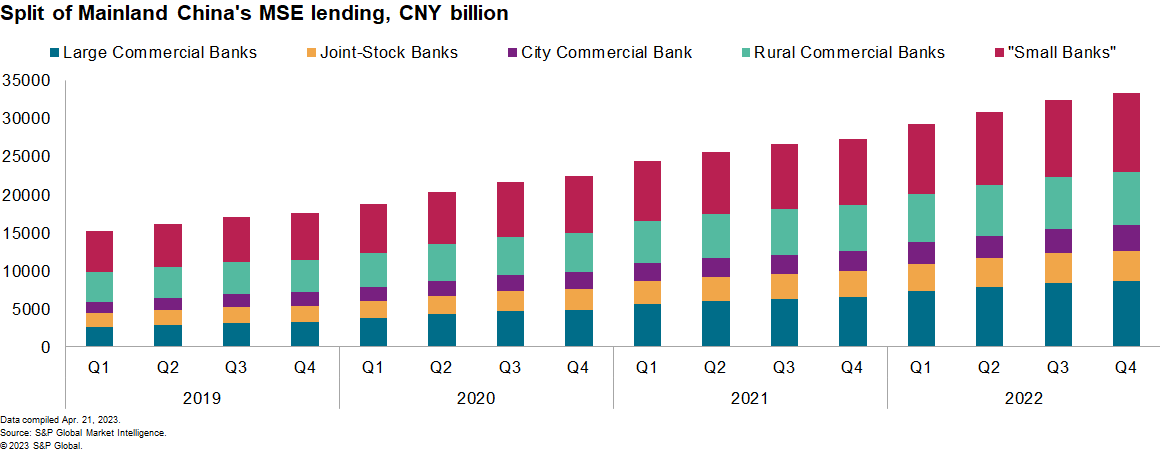

Micro and small enterprises' lending will likely continue to be rapid in China.

The first quarter data for lending to micro and small enterprises (MSEs) is due to be released at the end of April. Due to a broader push by the authorities to boost credit growth in the sector and prolong the economic growth, the loan disbursements by banks to MSEs will likely remain similar to the 23.6% recorded for end-2022 in both the first and the second quarter of 2023. More such loans likely disbursed by larger banks owing to their stronger liquidity positions.

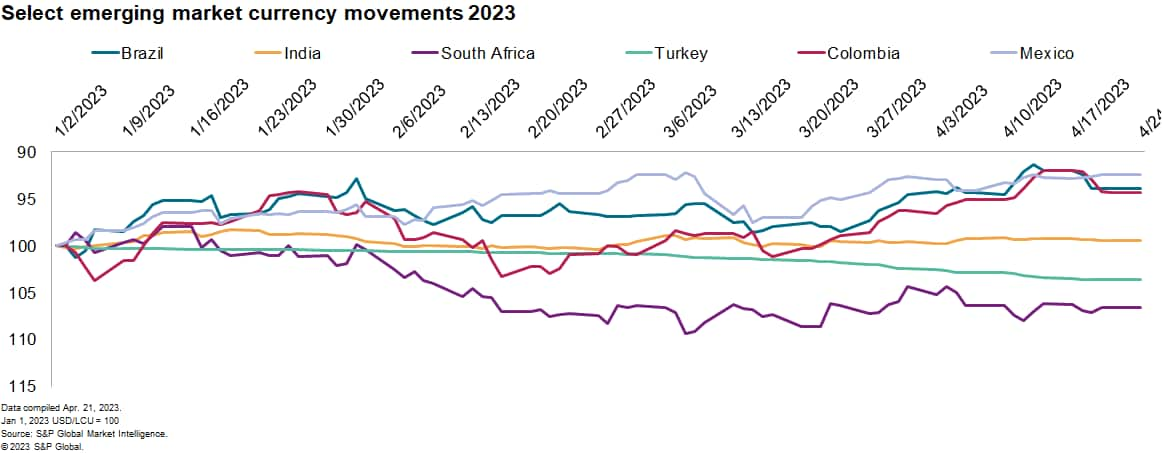

Turkey's presidential elections on May 14 could yield heightened lira volatility regardless of the outcome.

In the immediate run up to the election, President Recep Tayyip Erdoǧan and the AKP have instituted several regulations designed to hold back lira depreciation, including tighter reserve requirements and an added push to de-dollarize deposits. Should Erdoǧan secure another presidential term, recent comments suggest that loose monetary policy would continue, sustaining very high credit growth rates in the banking sector. Authorities are likely to allow for stronger depreciation of the lira, however, in favor of conserving foreign exchange reserves. Uncertainty surrounding the disjointed policy direction of Kemal Kilicdaroglu and the six-party coalition he is backed by could also lead to temporary volatility as markets react to a change in regime, although we would expect the central bank to regain some independence in monetary policy setting, unwinding many of the back-door capital controls put in place to support the lira in favor of tighter policy rates. Other points of focus would be to reduce credit growth of state-owned banks by tightening the regulatory framework, to strengthen debt management, and improve structural reforms.

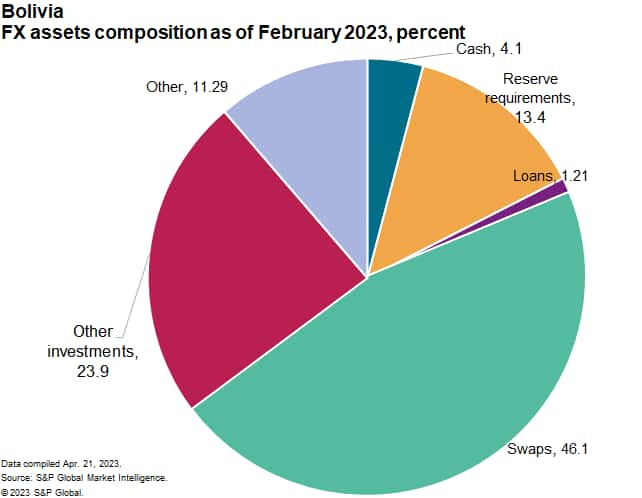

Further deterioration in Bolivia's banking sector considering pressure to service US dollar.

The Bolivian banking sector has experienced significant stress since the end of February 2023; depositors have encountered increasing problems in withdrawing dollars from their banks, leading to long lines that often result in US dollar requests being either denied or delayed. The situation stems from the central bank having low amounts of dollar reserves and banks being exposed to it by financing the central bank with dollar deposits. Given that this impasse remains — and that both the government and the central bank continue to remain passive upon the problem — it is likely that ongoing problems in the banking sector (such as further bank runs and no redeemability of dollar-denominated debts) will remain over the following months and the likelihood of further deterioration is high.

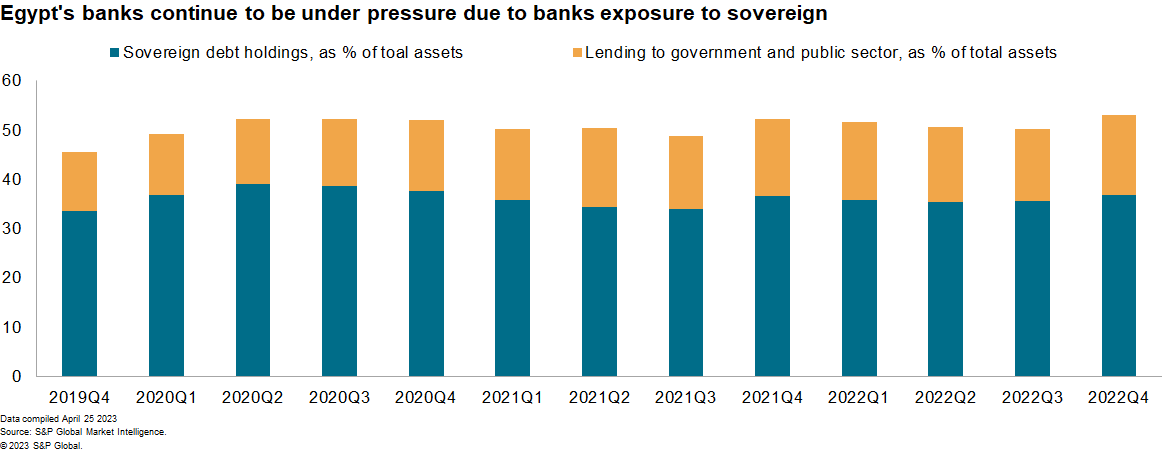

Banks in Tunisia and Egypt continue to digest pressure as IMF funding is delayed.

Although the IMF and Egypt reached a US$3 billion agreement in December 2022, the IMF wants Egypt to enact more reforms such as state privatization before it releases the second tranche of the funding. Banks will continue to increase their sovereign debt holdings in the first half of 2023, which increased by 33.1% year over year in end-2022. Borrowers' debt servicing capability is seen to decrease due to inflation, as indicated by a slight uptick in the NPL ratio of 3.4%. In Tunisian banks, delayed IMF funding will continue to increase banks' exposures to sovereign through loans to SOEs and banks' holdings of treasury bonds. The liquidity risk is expected to increase because the capacity of the banking sector to meet the government's high financing needs will be limited by slow customer deposits inflows.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.