Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 30, 2023

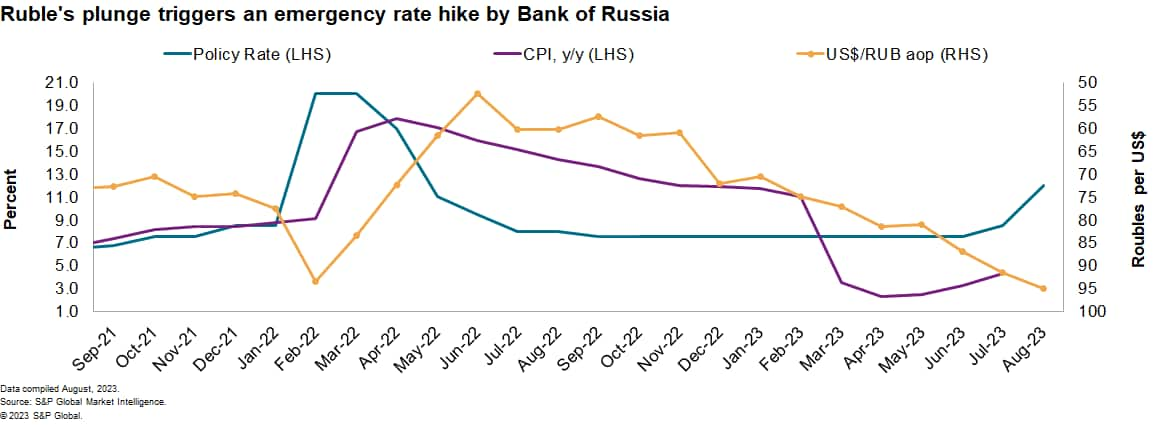

After the Russian ruble crossed its psychologically important mark of 100 per US dollar, the Central Bank of Russia (CBR) called an emergency meeting to stem the currency's further decline — contrary to earlier assurances that bank would not take an extra-term rate-setting decision until Sept. 15.

We projected that an emergency rate-setting meeting would be called in August to raise the key rate from 9.5% to 11%. The CBR opted for an even larger rate increase on Aug. 15, pushing the key lending rate to 12%. The move follows a 100-basis-point rate hike in July.

The CBR's rapid reaction came after the ruble/USD pair hit 101.4 on Aug. 14. The ruble has since firmed at 96.0 at the time of writing this article, although the depreciation risks remain high.

In a short press note following the extra-term meeting, the CBR's Board of Directors cited increased inflationary pressures of the past three months as the main reason behind its latest steps to "limit price stability risks." According to the bank, as of Aug. 7, the headline year-over-year inflation rose to 4.4%. The average inflation rate on annualized and seasonally adjusted bases during June-August reached 7.6%, while core inflation stood at 7.1%.

These pressures stem from strong domestic demand, coupled with production capacity constraints. Specifically, The recovery in household spending and manufacturing output has expanded the demand for imports of goods and inputs, putting pressure on the ruble.

At the same time, the import price inflation is once again elevating overall consumer and business inflation expectations. The CBR noted that the risks are tilting towards pro-inflationary developments, therefore the annual average inflation in 2024 is likely to be significantly higher than the bank's target of 4%. Under our current projections, consumer price inflation is to average 4.6% in 2023 and 4.5% in 2024.

The rate-setting process in the coming months would consider both actual and expected inflationary dynamics, as well as the reaction of financial markets, the CBR said.

The ruble's exchange rate is likely to remain volatile, and the central bank's monetary policy is unlikely to shield the Russian currency fully due to the mixed nature of these downside risks.

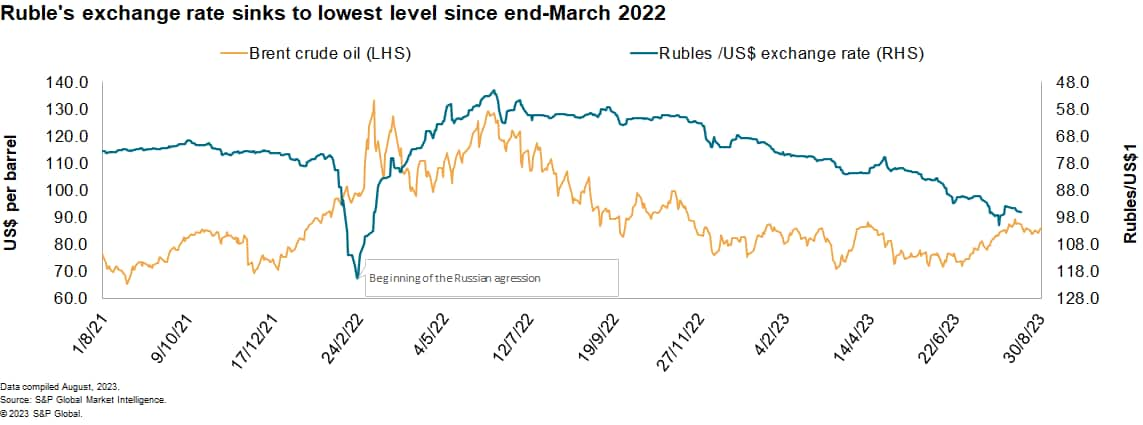

The exchange rate has come under pressure due to declining revenues generated from energy export. Even with the market's crude oil price gains, the ruble has been weakening, thus breaking the previous positive correlation, and showing the impact of the Western sanctions on Russian energy exports.

The ruble also saw a setback in late June in reaction to unprecedented domestic political stability risks due to the short-lived mutiny by the Wagner military company. The ruble/US$ pair stood at a monthly average rate of 87 for a time, the lowest rate since the Russian invasion of Ukraine.

Adjusting to the sanctions regime, Russia has quickly re-routed its supply lines away from the Western markets. This has helped imports to rebound, increasing the demand particularly for the Chinese yuan. The latter has emerged as a most favored currency for cross-border payment settlements. As part of Russia's de-dollarization drive, the yuan is also used for trade settlements in Latin America and Asia.

Lastly, the administration of the fiscal rule that restricts the use of the oil and gas windfall has also undermined the ruble's external value. The Finance Ministry has been carrying out regular currency market operations to reinforce the National Wealth Fund, which as of August 1, contains the equivalent of US$146 billion. In the wake of the ruble's fall, on Aug. 9, the CBR decided to stop buying foreign currency in the domestic market from Aug. 10-Dec. 31, 2023.

The CBR is likely to bring more tightening in September, before considering easing its monetary policy in the first half of 2024.

Learn more about our economic data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location