- We have previously highlighted the rising probability of the Bank of England delivering an initial hike in policy rates as soon as its next meeting on 4 November.

- This followed the publication of the minutes of the previous meeting of the Monetary Policy Committee (MPC) on 23 September. At the time, financial markets were pricing in a first rate hike only in March 2022, with most forecasters (though not IHS Markit) predicting it much later in the year.

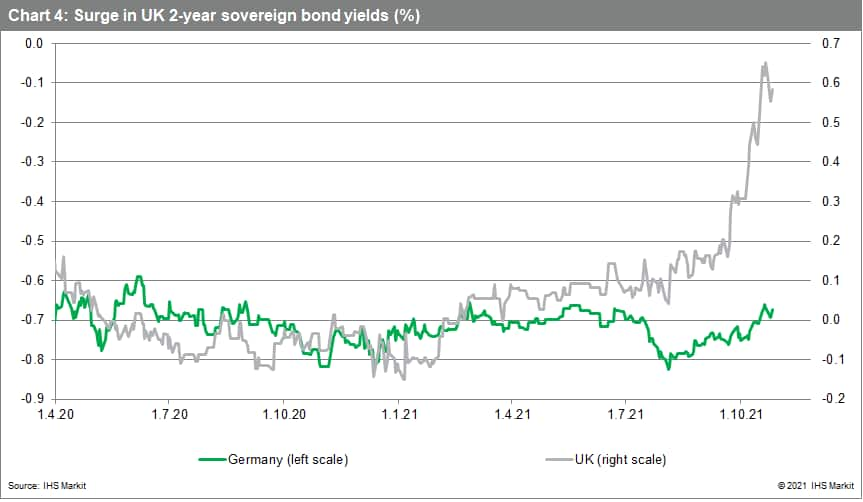

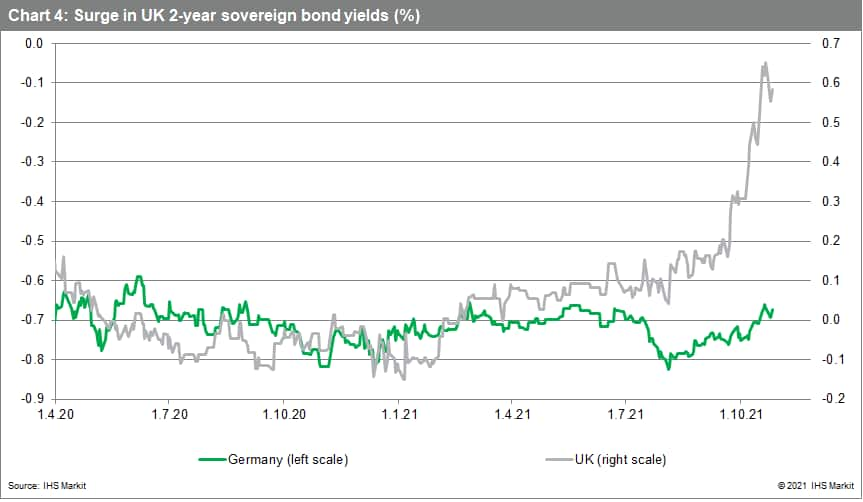

- The recent sharp rise in 2-year yields, and the consequent curve flattening, suggest a rising risk of over-tightening and a hard landing for the UK economy.

MPC signals tightening is on the way

There were various signals pointing in the direction of an early rate hike in September's MPC minutes, including:

- Recent developments had "strengthened" the case for some policy tightening. "Inflationary pressures remained strong" and there were signs that cost pressures "may prove more persistent".

- While the MPC's central expectation continued to be one of the transitory global cost pressures, its forecast for UK CPI inflation was markedly revised up again. The inflation rate was expected to rise above 4% in Q4 2021.

- Two MPC members voted for a tightening via an immediate end to the asset purchase program (which is scheduled to run until the end of the year).

- All nine members of the MPC agreed that any future initial tightening of monetary policy should be implemented by an increase in the key policy rate, even if this were to occur before the end of the asset purchase program.

A stitch in time?

The arguments favoring a rate hike as soon as November include:

- Since September's upward revision to the MPC's near-term CPI projections, energy prices have risen markedly, necessitating a further upward adjustment.

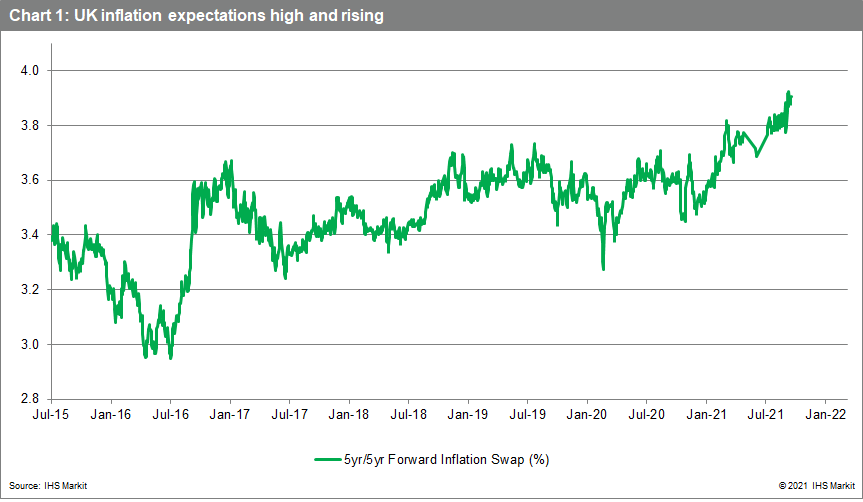

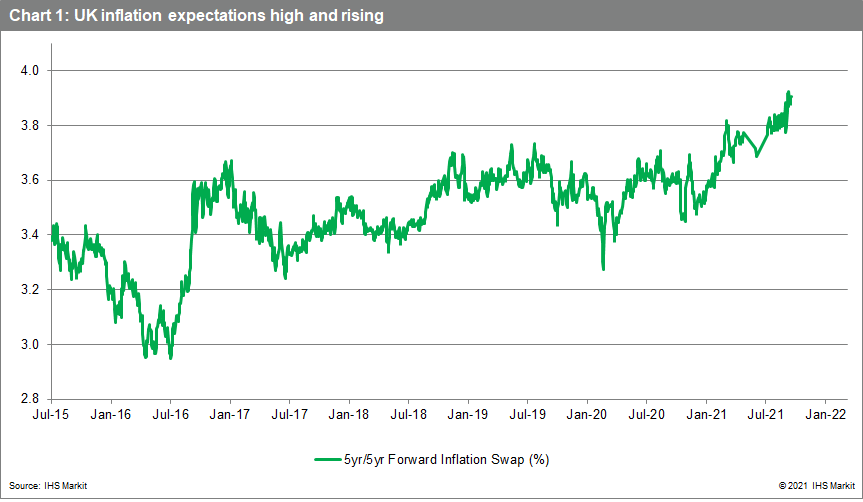

- Market-derived measures of inflation expectations have continued to rise from already uncomfortably high levels. The 5-year, 5-year forward inflation swap rate is now close to 4%, double the Bank of England's 2% medium-term target.

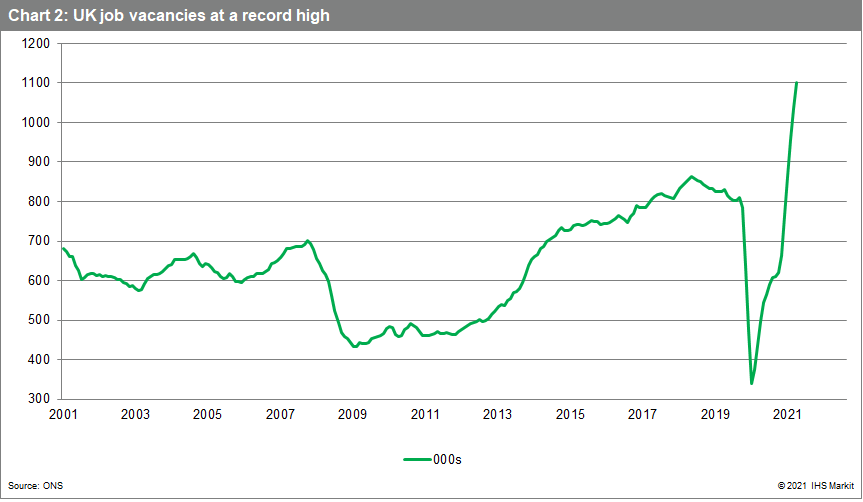

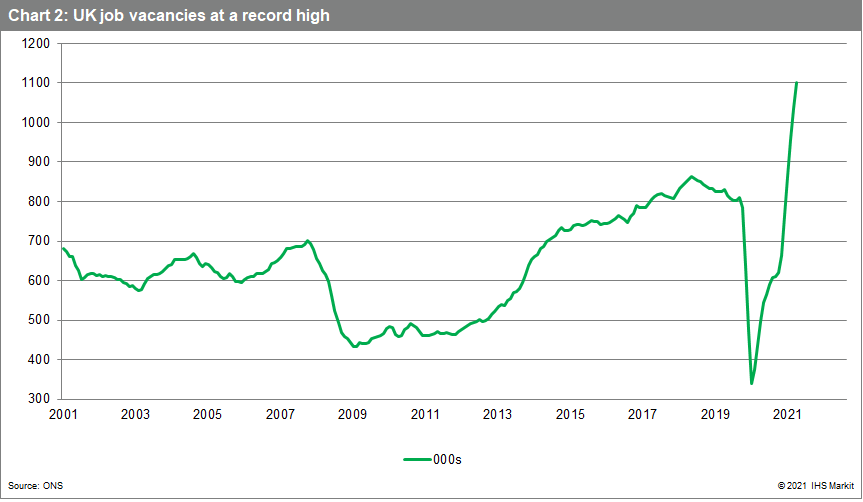

- Job vacancies have continued to increase, hitting a new all-time high, indicative of heightened labor shortages and an increasing risk of "second round" effects on inflation via higher future wage growth.

- The two MPC members voting for an end to asset purchases in September judged that, under the existing policy stance, inflation was likely to remain above the 2% target in the medium term. More MPC members are likely to have come around to that view given the news in the period since.

- Some MPC members will have merely been waiting for confirmatory evidence that policy tightening is required. November's updated forecast assessment in the quarterly monetary policy report (MPR) could provide that evidence.

- The two MPC members voting for an early end to asset purchases in September also cited the strategic benefit of a moderate, early policy tightening. This would mitigate the risk that a more abrupt and destabilizing tightening in policy might be needed further down the line. It would also demonstrate the MPC's commitment to returning inflation to target and would ensure that medium-term inflation expectations remained well anchored. More MPC members may also have come round to this view by the time of early November's meeting.

- Comments from Bank of Governor Andrew Bailey and other MPC members have hinted at a shift in position, expectations with his recent comments, including a confirmation that the MPC will "have to act" in response to inflation developments.

Or play for time?

A November hike is not quite a done deal. Counter arguments against it include:

- MPC members have cited considerable uncertainty over the outlook and underlying inflationary pressures. There has been a general preference therefore to wait for additional information which could help to clarify the outlook.

- In particular, there is high uncertainty about labor market trends and potential labor shortages, which are pivotal to medium-term inflation prospects. Once the impact of the end of the UK's furlough scheme is more apparent, the uncertainty should recede. While the MPC will review labor market developments as part of its forthcoming forecast round, it may be too soon to make a judgment.

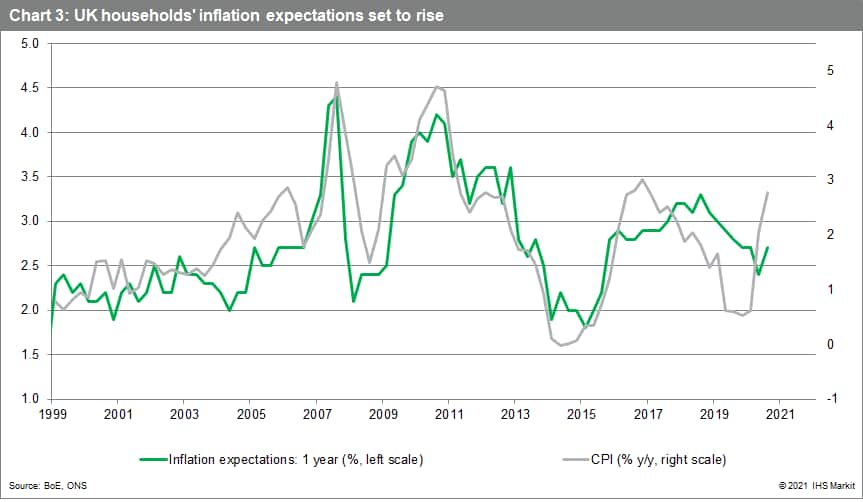

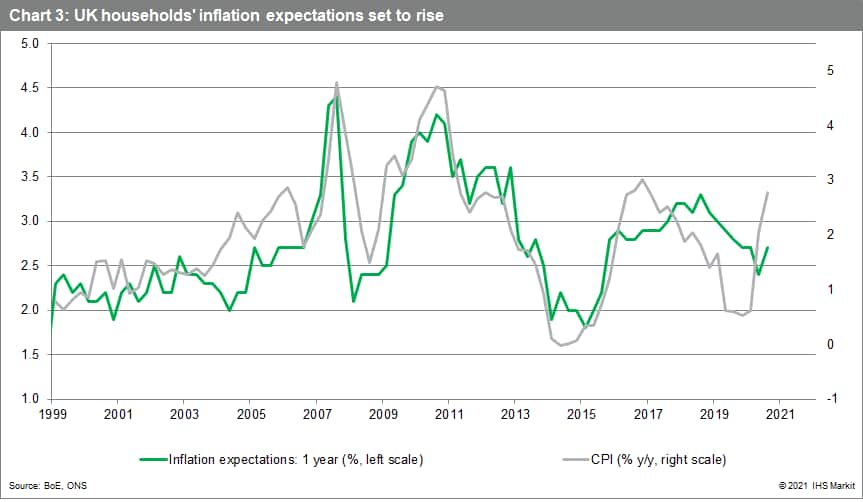

- Survey of households' inflation expectations have risen but by much less than market-derived measures. The survey of expected inflation over five years rose to 3.0% in August but this was still below its historical average of 3.2%. Still, with CPI inflation to rise markedly further, a pick-up in survey expectations is very likely.

- A rate hike in November could "scare the horses", fueling expectations of multiple additional hikes in 2022 and beyond. The Bank of England might struggle to rein in expectations and an abrupt tightening of financial conditions could exacerbate the slowdown in UK growth momentum already evident in various indicators.

A close call

IHS Markit's October baseline forecast was for an initial hike in Bank rate in February 2022 (of 15 basis points to 0.25%), in tandem with the subsequent MPR, due to a perceived preference among a majority of MPC members to wait for more information. Still, it would not come as a major surprise if the move occurred in November, for the reasons highlighted above.

At the time of writing, the implied probability from OIS markets of a 15 basis point rise in November is greater than 50%. This removes one potential impediment to immediate action from the Bank of England: that it would come as a shock.

As we see it, it is merely a question of when not if the Bank of England starts raising policy rates. The discussion surrounding November's meeting is predominantly a strategic one. The potential benefits of acting sooner to prevent even more tightening later, set against a possible preference to wait and see given the various uncertainties surrounding the outlook at present.

How would markets react?

With a 15 basis point hike not fully discounted for November at the time of writing, it would push up the pound and short-term bond yields, though both have already risen recently as rate hike speculation has mounted, particularly the latter.

The voting from MPC members will be important. A unanimous 9-0 vote in favor of a hike in November would send a strong signal. But only a narrow majority in favor of a hike, with some members favoring a more cautious approach, could temper future rate hike expectations.

The accompanying communication from the MPC will also be pivotal. In the event of a hike, rate expectations for next year will likely shift higher in the absence of a clear signal that the MPC will be cautious in its withdrawal of policy accommodation and that by moving early, it is likely to deliver less tightening overall. In the event of no rate hike in November, any relief rally would likely be limited given the high likelihood that the MPC would signal that a rate hike would likely follow soon after.

Further out, the key longer-term issue is whether there is a risk of over-tightening and a possible hard landing for the UK economy as a result. Given various existing headwinds to UK growth, including soaring energy prices and future increases in household and corporate taxes in 2022-23, this to us increasingly looks like a genuine risk.

Markets appear to see it the same way, with the rise in 2-year rates leading to a marked flattening of the yield curve. This could change once the MPC's intentions regarding the unwind of QE have been made clear. But for now, the signals suggest that while the market expects a more aggressive Bank of England due to rising inflation, the UK economy is not resilient enough to take it.

Posted 28 October 2021 by Ken Wattret, Vice-President, Global Economics, S&P Global Market Intelligence