Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 22, 2021

Australia economy sees first expansion in four months, but higher demand drives up prices

October flash PMIs signalled that APAC economies, including Australia and Japan, returned to a state of expansion. The easing of restrictions in Australia in particular had been the primary lever, supporting improvements in economic conditions. That said, the rise in demand and lingering supply-side pressures, including input shortages and labour constraints, continued to send prices soaring into the start of Q4. Here are three takeaways from the October flash Australia PMI*.

1. Gradual easing of restrictions drives immediate improvement in business activity and confidence

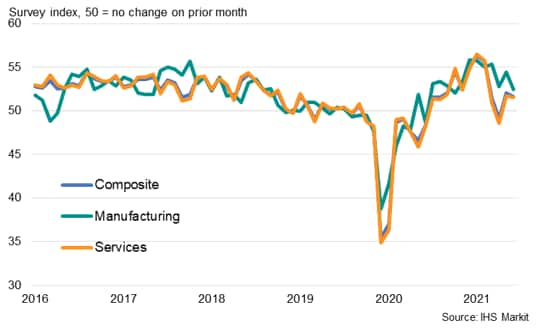

The latest IHS Markit Flash Australia Composite PMI® showed that

private sector output returned to expansion in October with the PMI

printing 52.2, up from September's final reading of 46.0. This was

the first expansion since June 2021, prior to when the Australian

economy was hard-hit by the latest COVID-19 Delta wave.

While manufacturing output growth improved to a four-month high,

the service sector had notably been the one to move the needle in

October, seeing business activity returning to growth from a

three-month period of contraction. Survey respondents widely

reported the easing of COVID-19 mobility restrictions provided a

boost for demand and output while business confidence also returned

a level above the survey average.

IHS Markit Flash Australia PMI output indices

As a testament to the strength of the recovery in October, the backlogs of work index - a key indicator of capacity utilisation - also rose above the 50.0 no-change mark for the first time in four months across both services and composite gauges.

Australia private sector backlogs of work

2. Firms continue to hire, but face labour constraints

The spill over of demand towards an increase in work outstanding in October had seen firms simultaneously expanding their operating capacity. Workforce levels continued to increase across both manufacturing and service sectors, though at a slower rate compared to September.

IHS Markit Flash Australia PMI employment indices

Where lower levels of employment were reported, panellists highlighted resignations underpinning the decline while others started to report facing shortages of staff amid the mandatory COVID-19 vaccination policy such as implemented in Western Australia. Difficulties in hiring were also widely noted across both the manufacturing and service sectors, highlighting the issue of labour shortages which indirectly contributed to higher costs for firms.

This also presents mixed signals for household consumption, which serves as a crucial growth driver, given the increased demand and relatively softer employment growth situation.

3. Recovery in demand drives input price inflation to survey record

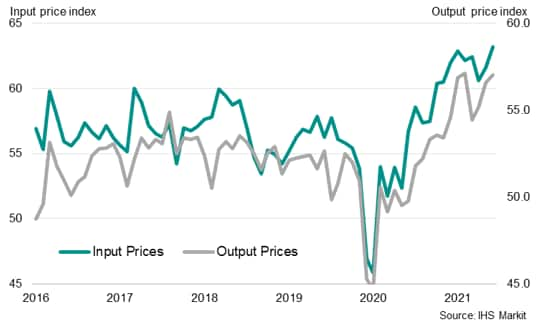

On prices, inflationary pressures continued to accelerate amid the growth in demand and with supply yet to catch up amid lingering COVID-19 disruptions.

Input price inflation notably accelerated to the fastest on record, supported by higher rates of price increases across both manufacturing and service sectors in October. Higher input costs were often associated with supply delays, as reflected in the continued lengthening of suppliers' delivery times in the manufacturing sector, which does not come as a surprise amid recent reports of supply issues across the globe. As such, firms were seeing both longer lead times and higher delivery costs which, alongside issues of input shortages and higher wages, offered no reprieve for the inflation situation in October.

Australia input and output price indices

Concurrently, output price inflation picked up from September and printed the third-highest rate of inflation in the survey history. The wider expectation remains one of transitory inflation even as the June quarter saw inflation rising above the upper bank of the RBA's 2.0%-3.0% target in Australia. That said, the first Q4 indication of prices once again spiking warrants further scrutiny on where prices are headed for the Australia economy.

*The IHS Markit Flash Australia Composite Output Index is a GDP weighted average of the IHS Markit Flash Manufacturing Output Index and the IHS Markit Flash Services Business Activity Index. Flash indices are based on around 85% of final survey responses and are intended to provide an advance indication of the final indices. The IHS Markit Australia Manufacturing and Services will be due November 1 (Monday) and November 3 (Wednesday) respectively. Read more of our press releases here.

Jingyi Pan, Economics Associate Director, IHS Markit

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-economy-sees-first-expansion-in-four-months-Oct21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-economy-sees-first-expansion-in-four-months-Oct21.html&text=Australia+economy+sees+first+expansion+in+four+months%2c+but+higher+demand+drives+up+prices+++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-economy-sees-first-expansion-in-four-months-Oct21.html","enabled":true},{"name":"email","url":"?subject=Australia economy sees first expansion in four months, but higher demand drives up prices | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-economy-sees-first-expansion-in-four-months-Oct21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australia+economy+sees+first+expansion+in+four+months%2c+but+higher+demand+drives+up+prices+++%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-economy-sees-first-expansion-in-four-months-Oct21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}