Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 22, 2024

The PMI® survey data for August have been especially eagerly awaited after the July PMI reading of 50.2 indicated that the economy started the third quarter close to contraction. Encouragingly, the provisional estimate of the August PMI is one of improved growth, suggesting a downturn has been avoided.

However, the improvement was largely driven by an upturn in the French service sector, which coincided with a temporary boost from the Paris Olympics, hinting that growth could subside again in September. This downbeat prognosis is supported by a renewed fall in employment amid deteriorating business confidence and a third month of worsening new order inflows, the latter especially severe in the manufacturing economy, which remained deep in contraction.

The flash PMI data do, however, signal a further cooling of input cost pressures in the service sector, which has been a key area of concern for the ECB's hawkish policymakers.

Here are our top-five takeaways from the August flash PMI data:

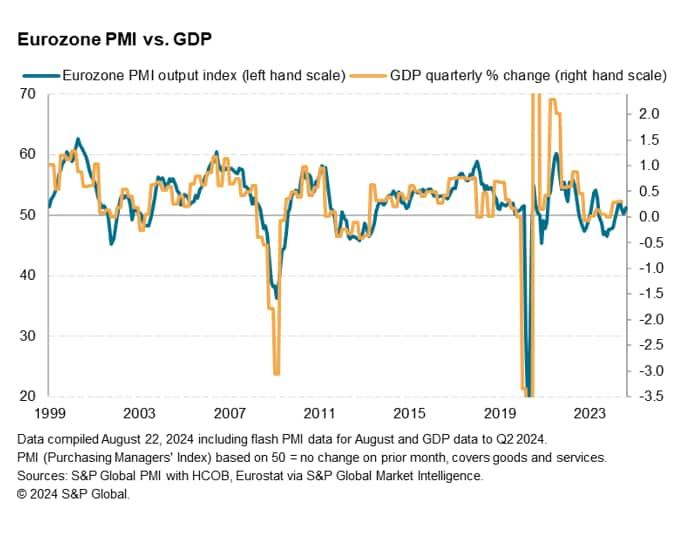

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, rose to 51.2 in August from 50.2 in July. The latest reading signals a faster pace of output growth following two successive months in which the pace of expansion had slowed to near-stagnation.

The uplift in the PMI is therefore welcome news in indicating that a renewed downturn in activity has been avoided in August. A simple model using OLS regression indicates that the August PMI is consistent with GDP rising at a quarterly run-rate of 0.15% after a flat July. This nevertheless hints at the economy losing momentum in the third quarter from the 0.3% increase registered by official data for the second quarter.

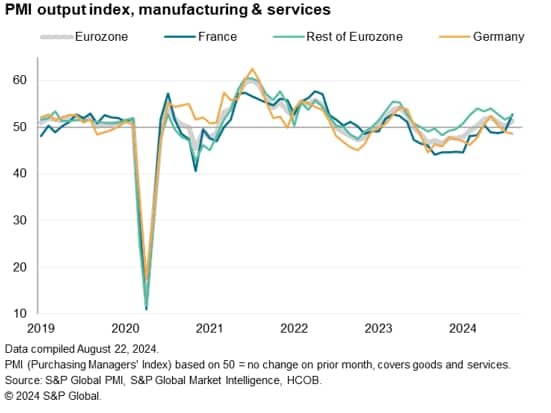

However, the upturn may prove to be short-lived. A key factor behind the stronger increase in eurozone business activity in August was a renewed expansion in France, where output rose to the largest extent in almost a year-and-a-half. More specifically, the French service sector reported the largest monthly rise in business activity for 27 months, coinciding with the Paris Olympics, suggesting that this burst of activity will prove temporary.

In contrast, the picture in French manufacturing remained one of accelerating decline. The flash PMI for Germany also remained subdued, with activity dropping for the second month running, and at the sharpest pace for five months, thanks to a steep manufacturing decline accompanied by only a modest expansion of activity in the service sector.

Although the rest of the euro area as a whole continued to see output increase at a slightly faster rate midway through the third quarter, the expansion was the second-weakest seen over the past seven months.

June's interest rate cut by the ECB meanwhile appears to have had limited impact on demand for goods. Eurozone manufacturing output continued to fall sharply in August, signaling a sustained downturn that is being mirrored in official data. The latter, currently available up to June, showed factory output falling at an accelerated annual rate of 4.9%.

With new orders falling in eurozone manufacturing at the fastest rate for eight months in August, the near-term prognosis is one of the sector being mired in its recession in the near-term, with particular weakness evident in both France and Germany.

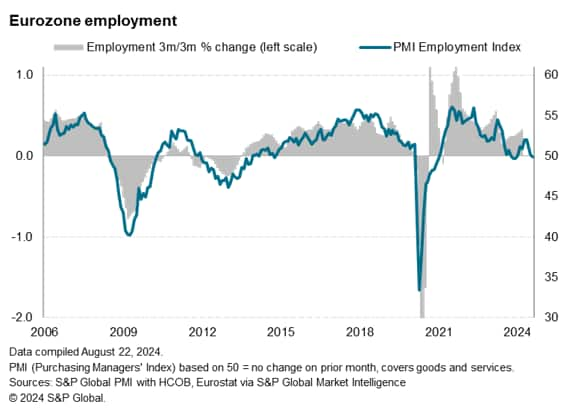

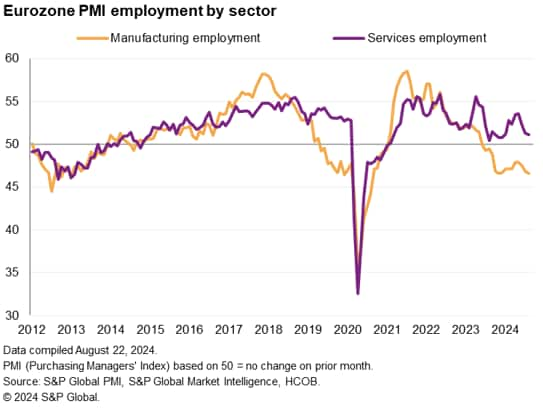

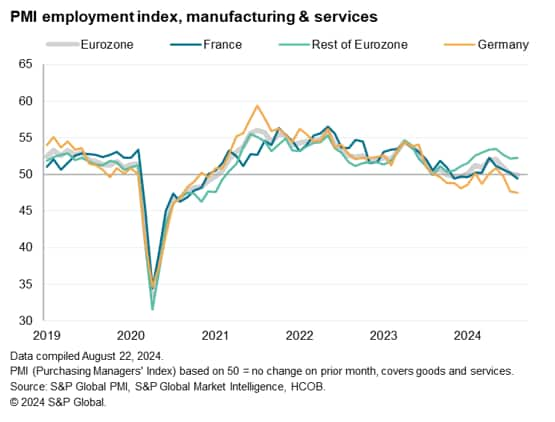

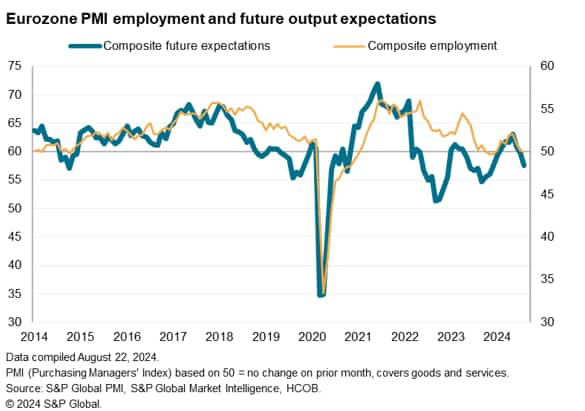

The deteriorating underlying picture darkens further once employment data are considered. The flash PMI signaled a decline in employment for the first time in eight months. Although only marginal, the latest decline represents a continuation of a weakened job market trend that has been evident over the past three months.

Services employment showed the smallest - only modest - rise for seven months, accompanied by a further solid fall in manufacturing workforce numbers. The latter decline was at a rate not exceeded since the height of the pandemic and, prior to that, 2012.

Germany reported the largest fall in employment since August 2020. Outside of the pandemic, German employment has not fallen at this rate since January 2010. Jobs were also cut in France, but rose elsewhere.

The growing reluctance to hire reflected a further worsening of business expectations about output growth in the year ahead, which fell for a third straight month in August to an eight-month low, dropping further below the survey's long-run average.

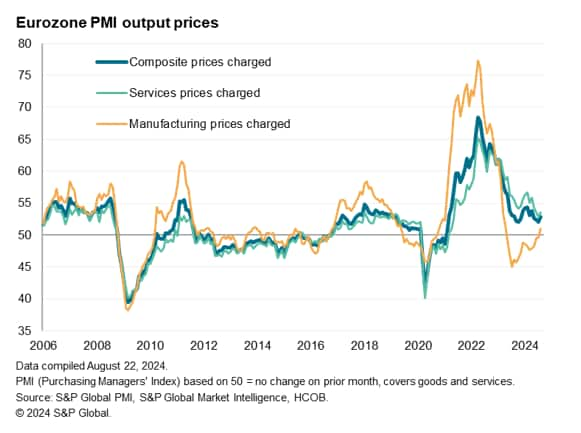

Although average prices charged for goods and services across the eurozone increased at the fastest pace in four months, the rate remains low by standards seen over the pandemic and broadly consistent with the ECB's 2% target according to historical comparisons. This suggests that headline inflation will fall further in the coming months from the 2.6% rate seen in July.

Services charges rose at the sharpest pace in three months, while manufacturing output prices increased for the first time since April 2023.

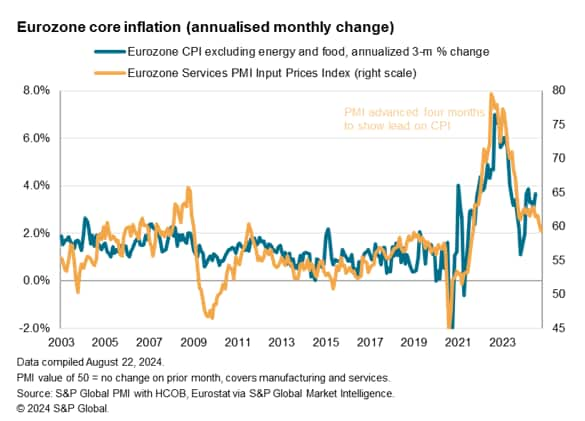

Encouragingly, from an inflation-fighting perspective, input cost pressures abated to the lowest for eight months. Services input prices rose at the softest pace since April 2021, while manufacturing cost inflation was unchanged from the 18-month high seen in July.

The cooling of services input cost inflation is especially important, as this wage-oriented data series points to a cooling of core inflationary pressures in the eurozone economy.

The August flash PMI corroborates S&P Global Market Intelligence's forecast for the eurozone to grow by a modest 0.8% in 2024, but this requires GDP to rise by almost 0.3% in the third and fourth quarters alike. This would clearly need the PMI to remain in growth territory and not fall back in September as some of the forward-looking data are hinting. September's PMI data will therefore prove important in confirming this outlook.

Our forecasters also expect the European Central Bank to cut interest rates twice more this year, by a cumulative 50 basis points, after having already cut by 25 basis points in June. The next cut is anticipated at September's meeting, in line with current market expectations. In this respect, the latest PMI data will likely not discourage any further loosening, though the August consumer price inflation numbers will be a major test of these monetary policy expectations.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.