Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 25, 2023

The strategy of mainland China-based companies seeking to establish production hubs in other countries globally, known as "China Plus One," has attracted widespread attention, with major global companies in the electronics and other industries expanding to Southeast Asian countries such as Vietnam and Indonesia. When the strategy first emerged in the mid-2000s, the motivation was to reduce expenditure by moving production to lower-cost countries, but in recent years companies have pursued this business model to protect their supply chain and export markets against the potential fallout of US-mainland China conflict.

Southeast Asia's proximity to mainland China, its economic partnerships with the US and mainland China, and relative political stability — Thailand being a notable exception — make the region a preferred China Plus One destination.

Foreign direct investment (FDI) data and anecdotal evidence show Southeast Asia's increasing importance as a China Plus One destination for mainland Chinese and foreign companies. Notable examples include investments to build a chip-testing and packaging factory in Malaysia, a mines-to-manufacturing electric vehicle supply chain in Indonesia, and an expansion of consumer electronics production facilities in Vietnam.

The regional economic framework

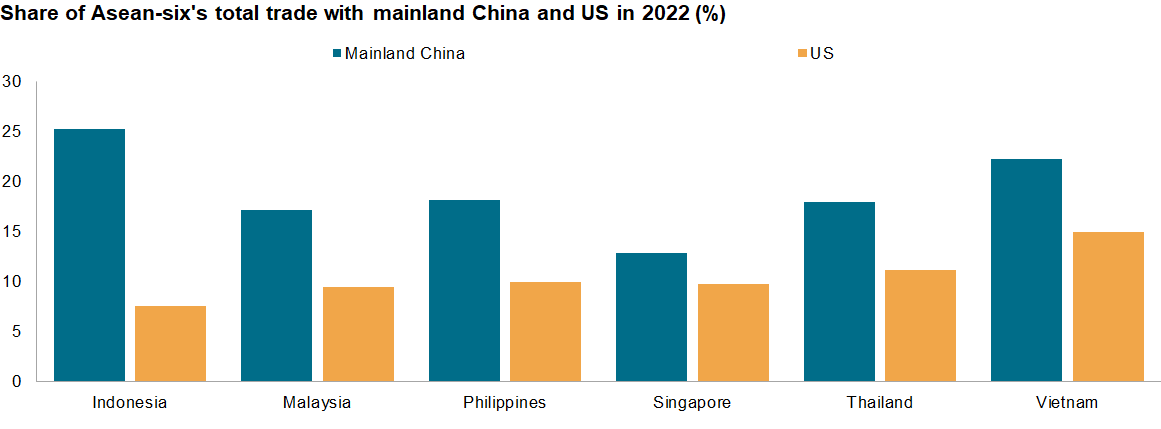

Closer economic ties between Association of Southeast Asian Nations (ASEAN) countries and both mainland China and the US encourage production relocation to the ASEAN-six countries: Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. The 10 ASEAN member states are becoming more integrated economically with mainland China, while the ASEAN-six countries are also part of a nascent US-led partnership that aims to counterbalance mainland China's economic influence in the Indo-Pacific region. The US trails mainland China in trade relations with the ASEAN-six.

The ASEAN-six countries (plus Brunei) are part of the US-led Indo-Pacific Economic Framework for Prosperity (IPEF). The IPEF does not offer the benefit of preferential access to the US market through lower tariffs, but it aims to lower nontariff barriers to the US and facilitate greater US investment in member countries through regulatory harmonization. ASEAN countries view their participation in the IPEF as a way to be included in the broader US strategy to minimize its dependence on mainland China.

The IPEF is still taking shape. In May it concluded substantive negotiations on the IPEF Supply Chain Agreement. Supply chain resilience is one of the IPEF's four pillars and the Agreement improves the prospect of its members becoming part of a US-approved supply chain in critical industries such as semiconductors and electric vehicles. The other three pillars — trade, clean economy and fair economy — are still under negotiations.

The ASEAN-six countries are generally neutral toward US-mainland China strategic rivalry and instead seek to maximize economic relations with both countries. ASEAN has initiated the Regional Comprehensive Economic Partnership (RCEP), a free trade agreement (FTA) that comprises all of its members, plus mainland China, Japan, South Korea, Australia and New Zealand.

The RCEP came into force in 2022 and provides the framework for trade and investment liberalization, facilitating the expansion of mainland China-based companies into ASEAN. The RCEP reduces the cost and increases the attractiveness for companies to establish production bases in multiple countries by standardizing rules of origins for goods exports, eliminating tariffs on most goods and liberalizing trade in services and investment rules. Specific RCEP trade and investment provisions will apply gradually over the next 10 years as member countries are given certain flexibility to proceed at their own pace. There will be variations in the speed and scope of liberalization among RCEP members, but the trend is for a more liberal trade and investment regime.

Beyond the IPEF and the RCEP, Malaysia, Singapore and Vietnam (as well as Brunei) are part of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), while Singapore and Vietnam have FTAs with the European Union. The CPTPP and the FTAs with the EU require adherence to labor and environmental standards, increasing compliance costs for companies but advantageous for those that trade in markets with stricter labor and environmental requirements.

Country-specific risk outlook in the ASEAN-six

On a national level, the six ASEAN countries present different risk profiles for investors.

At the time of writing, the identity of the next government in Thailand remains unclear two months after the general election. What is clear is that the failure of the biggest party in parliament, the progressive Move Forward party, to form a government reduces the likelihood of an overhaul of Thailand's economic and political framework. The role of the unelected Senate in blocking the establishment of a Move Forward government indicates that the royalist-military establishment, through the institutions they control, will play a key role in the stability of the next government. However, whoever forms the next government is unlikely to pursue policies that are detrimental to foreign investment.

Indonesia will elect a new leader in 2024 as President Joko Widodo ends his second and final term. The presidential election will take place in February 2024, but a runoff vote scheduled for June 2024 is highly likely. Regardless of the outcome, policy continuity is likely on labor market liberalization and the simplification of business permits.

Singapore must hold its general election by November 2025. The main political issue is when Prime Minister Lee Hsien Loong will step down and hand over power to his successor Lawrence Wong.

Vietnam's five-yearly National Congress will take place in 2026. During the congress, it will elect a new leader. Vietnam is highly likely to maintain its export-oriented economic growth model, although its investment promotion policy is evolving in response to tighter environmental and governance requirements in Western markets. Vietnam's anti-corruption campaign is likely to continue, likely affecting approval times for infrastructure projects. The Vietnamese government is reviewing its tax policy after countries including Japan and South Korea adopted or announced plans to adopt legislation to introduce a global minimum effective tax rate of 15% on large corporates effective from 2024 onward.

Malaysia must hold its next general election by February 2028. The current multi-coalition government of Prime Minister Anwar Ibrahim has a two-thirds parliamentary majority. The outcome of six state elections in the second half of 2023 will indicate the level of support for the government among the majority ethnic-Malays. However, a change of government is unlikely to lead to a reversal of Malaysia's pro-foreign investment policy that has been adopted by successive governments.

In the Philippines, President Ferdinand Marcos Jr. was elected to a single six-year term in 2022, assisting government stability in the next five years. Uniquely among the ASEAN-six countries, Marcos is deepening the Philippines' defense ties with the US and its allies Japan and Australia.

—With contributions from Hafiz Noor Shams

Learn more about our country risk data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.