Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 21, 2018

UK pay growth nudges higher but job market shows cracks

- Regular pay growth rises to 2.5%, highest for a year

- Employment rises less than expected

- Jobless rate rises for first time in two years amid higher unemployment

The latest labour market snapshot brings mixed messages for policymakers. While an upturn in pay growth opens the door further for interest rates to rise again, possibly as soon as May, signs of the labour market losing steam add to worries that the economy is struggling under heightened uncertainty.

Data from the Office for National Statistics showed underlying pay growth (excluding bonuses) rising at an annual rate of 2.5% in the three months to December, the highest rate seen for a year. Private sector pay growth accelerated to 2.6%. Total pay growth was likewise 2.5%, unchanged on the three months to November, though jumped by 2.8% on a year ago in December alone.

UK pay growth

Survey data suggest that the labour market continued to tighten at the start of 2018, with widespread shortages of staff again reported to have led to higher pay rates. Starting salaries rose at the fastest rate for over two-and-a-half years in January, which should feed through to higher pay growth across the economy.

However, while pay growth appears to be perking up, there are other signs that the labour market is starting to cool. The unemployment rate rose in the three months to December for the first time in nearly two years, up to 4.4% from 4.3%. However, this was linked to fewer inactive people, rather than redundancies. Nonetheless, the number of unemployed rose for a third successive month.

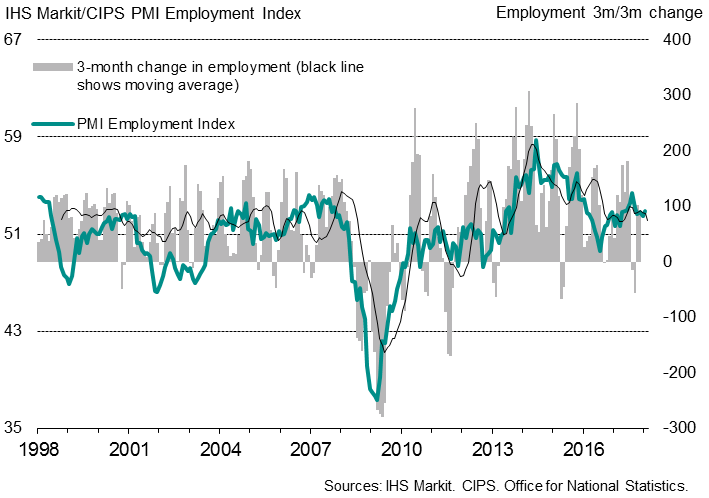

UK employment

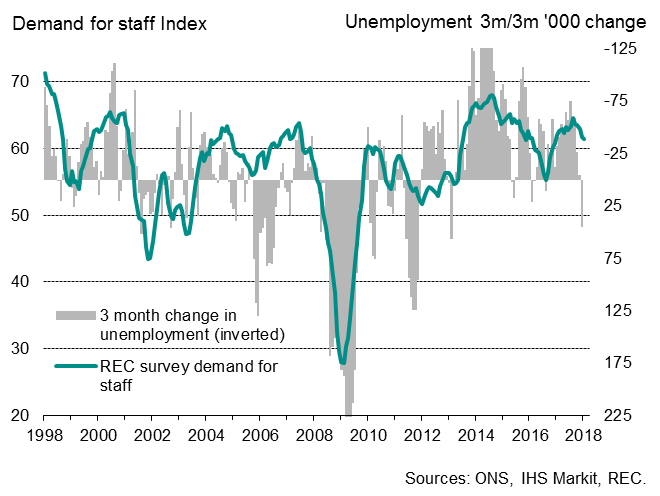

Further, employment rose less than expected, up by 88,000 in the three months to December, which mirrors a trend of slower growth of hiring indicated by the REC and PMI surveys. Recruitment agencies reported that demand for staff from employers cooled for a fifth successive month, rising at the slowest rate for 13 months in January.

The Bank of England has turned increasingly hawkish in recent weeks, leading to increased speculation that interest rates could rise again in May, when the Bank updates its forecasts in the next Inflation Report. However, while stubbornly high inflation and signs of higher wage growth have increased the perceived likelihood of rates rising again, it’s clear that policymakers will tread a cautious line amid the heightened uncertainty facing the UK economy as Brexit worries dominate. In addition to the recent signs of a cooling labour market, survey data hinted at the economy slowing in January, with the PMI surveys registering the weakest growth for nearly one-and-a-half years.

For a May rate hike to happen, policymakers will want to see not only persistent price pressures, but also signs that the economy has sufficient growth momentum to cope with a tighter monetary policy stance.

UK demand for staff and unemployment

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-pay-growth-nudges-higher.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-pay-growth-nudges-higher.html&text=UK+pay+growth+nudges+higher+but+job+market+shows+cracks","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-pay-growth-nudges-higher.html","enabled":true},{"name":"email","url":"?subject=UK pay growth nudges higher but job market shows cracks&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-pay-growth-nudges-higher.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+pay+growth+nudges+higher+but+job+market+shows+cracks http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-pay-growth-nudges-higher.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}