Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 31, 2015

Europe rebounds while Turkey stumbles

This week caps off the best month for eurozone sovereign debt since January, but neighbouring Turkey has not enjoyed the same positive performance.

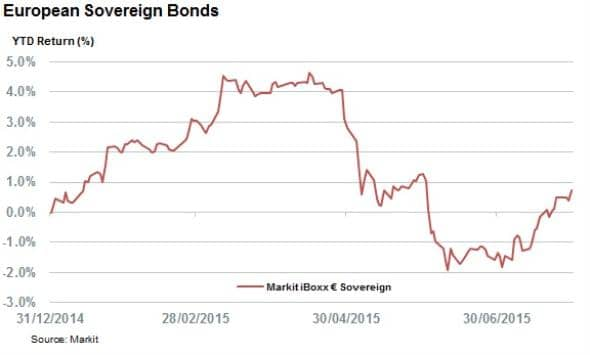

- July has seen the best performance of the Markit iBoxx € Sovereign index since January

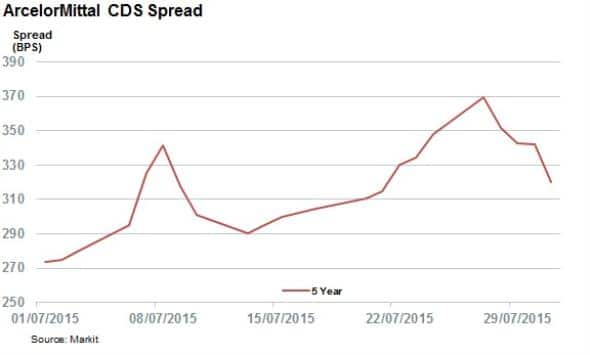

- Buoyant European trading conditions have seen ArcelorMittal's CDS spreads tighten 28bps

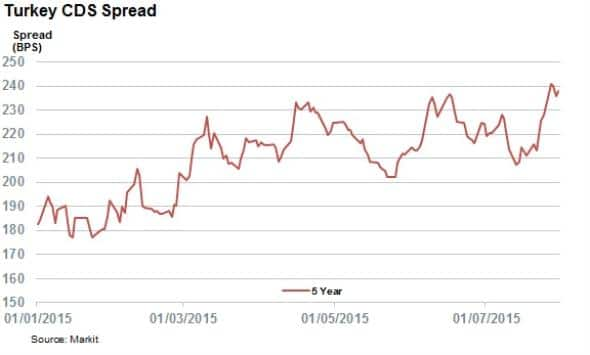

- Turkey has bucked the trend after seeing its CDS spread widen to 240bps; 15 month high

The final week of July caps off a turbulent month for the credit markets which saw Greece flirt with a potential exit from the eurozone, only to come back into the fold after tense negotiations. These turbulent times marked a low point for eurozone sovereign debt, as gauged by the Markit iBoxx € Sovereign index which registered its lowest point of the year so far on July 2nd.

But the breakthrough in Greece seems to have appeased investors as the index has now delivered over 2.6% of total returns in the subsequent four weeks. There was no exception this week with the index of eurozone sovereigns delivering 20bps of total returns. This takes the index total returns for the July to 2.1%; the best performance since January.

These strong returns were driven by improving investor sentiment in periphery countries, with the likes of Italy and Spain seeing investors view their debt as less risky in the wake of the Greek turnaround. This improved sentiment has seen the yield of the Markit iBoxx € Sovereign index, which is made up of 36% of Italian and Spanish debt, fall by 27bps over July.

Also filtering though corporates

The improving eurozone numbers are also reflected in the latest release of the region's Flash PMI numbers which indicated that the region's economic output grew near June's four year high pace. This resilient growth has helped countries with large European exposure buck weakness in other markets globally, most notably China. This was the case with steel manufacturer ArcelorMittal which cited Europe as a bright spot, helping the firm deliver results on track with its guidance despite a global slump in industrial metals.

This saw the firm's CDS spread tighten by 50bps from the 20 month high seen earlier in the month.

Turkey bucks the trend

While the eurozone has been a bright spot in the credit markets, the same can't be said for the region's neighbour Turkey which has seen its CDS spreads widen to new highs after the country's recent counter terrorist actions. While the country has largely been lauded for its actions against Isis in Syria, its decision to also bomb Kurdish PKK separatist bases has raised the fear that its president could risk alienating domestic Kurds. This move could exacerbate the region's political turmoil given that the pro-Kurdish HDP entered parliament in the recent election.

The spectre of political turmoil has seen Turkish CDS spreads trade at their highest level in over 15 months on Monday.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-credit-europe-rebounds-while-turkey-stumbles.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-credit-europe-rebounds-while-turkey-stumbles.html&text=Europe+rebounds+while+Turkey+stumbles","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-credit-europe-rebounds-while-turkey-stumbles.html","enabled":true},{"name":"email","url":"?subject=Europe rebounds while Turkey stumbles&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-credit-europe-rebounds-while-turkey-stumbles.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Europe+rebounds+while+Turkey+stumbles http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-credit-europe-rebounds-while-turkey-stumbles.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}