Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 30, 2015

Markit European loan volume survey

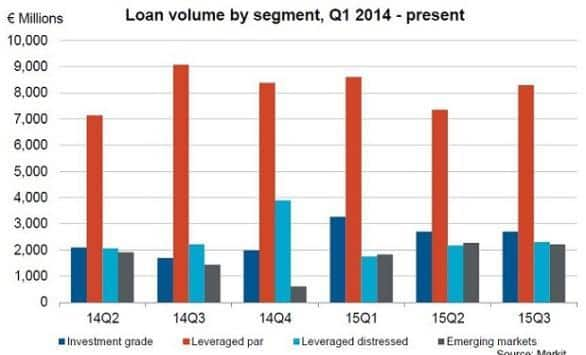

Total trade volumes in the European loan market have risen slightly in the third quarter of 2015. Total volumes have moved to €15.509bn, up 5.67% from the previous quarter. Year on year volume is also up 7.55% when compared to the overall volume of €14.692bn in the third quarter of 2014. Highlights include:

Leveraged loan volumes (Western Europe) constituted only 68.3% of the total volume in the second quarter, slightly up from the 66.1% composition of the previous quarter. Of the 68% of total trade volumes tracked, 53% of the total was conducted on Loan Market Association (LMA) par documentation versus 15% of LMA distressed documentation. European investment grade loan volumes represent 17.4% of the total, marginally down from last quarter’s share of 18.4%. Emerging market (Eastern Europe, Middle East and Africa) figures were down finally after three successive increases. They stand at 14.25% compared to 15.48% last quarter.

To read more, download the full PDF

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102015-credit-markit-european-loan-volume-survey.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102015-credit-markit-european-loan-volume-survey.html&text=Markit+European+loan+volume+survey","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102015-credit-markit-european-loan-volume-survey.html","enabled":true},{"name":"email","url":"?subject=Markit European loan volume survey&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102015-credit-markit-european-loan-volume-survey.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Markit+European+loan+volume+survey http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102015-credit-markit-european-loan-volume-survey.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}