Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 30, 2015

Chinese investors rush to money market ETFs

Money market ETFs have failed to gain much traction in the current low interest rate environment, but Chinese investors have been clamouring to the asset class amidst the market volatility.

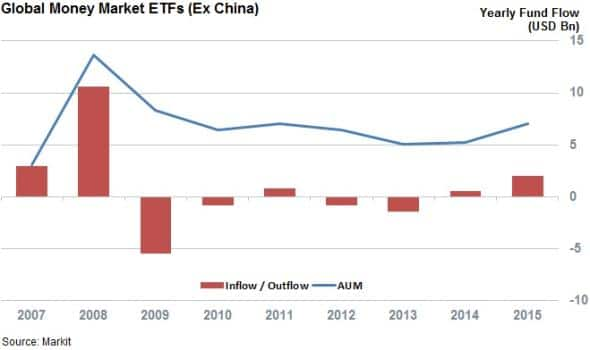

- Money market ETFs listed outside of China manage $7bn, less than half the 2008 total

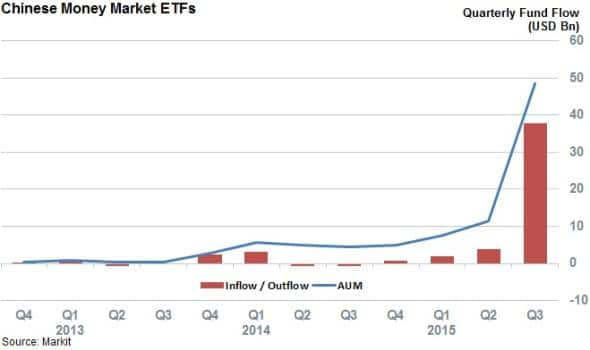

- Volatility in China has seen investors park over $37bn of assets in money market ETFs

- Chinese money market ETFs represented over half of all fixed income inflows over Q3

Money market funds promise to invest in the safest and most liquid portion of the bond market in order to safeguard investor assets. This is generally done by investing in very short dated securities of highly rated corporate issuers of government bonds.

This quest for asset protection has not proven profitable in the wake of the last eight years of zero interest rate monetary policy, which has nearly wiped out the yield on the assets these funds invest in. To this end, a $10,000 investment in the Vanguard Prime Money Market Fund for the last five years would have earned a paltry $15 or around 2bps per year.

These ultra-low returns have made the money market a poor candidate for the ETF asset class as seen by the fact that there is currently no US listed money market ETF tracked by Markit's ETF Encyclopaedia. In the rest of the developed world, this subset of the ETF universe only manages $7bn currently, less than half the assets managed at its peak in 2008.

While the asset class has seen some early success, most notably during the volatility of the financial crisis, the last seven years of relative calm and lacklustre yields means that investors have withdrawn a net $5.2bn since the start of 2009.

Chinese investors clamour for safety

While money market ETFs have proved a relative bust in developed markets, the recent volatility in China, where the mainland CSI 300 index is trading 40% off the June highs, has seen investors rush to money market ETFs at a pace unseen before in the ETF industry. The eight Chinese listed money market ETFs, which invest in local short dated debt instruments and cash, have experienced what is arguably the fastest AUM growth seen in any ETF asset class on record over the quarter with over $37bn of new inflows over Q3, more than tripling the $11.5bn AUM base seen three months ago. This rush to the safest end of the market mirrors, to a much larger extent, that seen in developed markets over the financial crisis in 2008 and no doubt speaks volumes about the desire of Chinese investors to preserve their assets amidst volatility in the rest of the market.

Another reason for the popularity of money market products over the last quarter has been the fact that the shutting of the IPO window was suspended in the wake of the volatility, forcing investors to shift funds dedicated towards IPO investing to money market products.

The two most popular products favoured by investors over that period have been the Fortune SG Money Market ETF and Yinhua Money Market ETF, which in true ETF fashion manage over 90% of the asset class.

The insatiable appetite for money market ETFs means that these niche products have been responsible for one-third of the net inflows seen by the entire ETF industry over the quarter.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092015-Credit-Chinese-investors-rush-to-money-market-ETFs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092015-Credit-Chinese-investors-rush-to-money-market-ETFs.html&text=Chinese+investors+rush+to+money+market+ETFs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092015-Credit-Chinese-investors-rush-to-money-market-ETFs.html","enabled":true},{"name":"email","url":"?subject=Chinese investors rush to money market ETFs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092015-Credit-Chinese-investors-rush-to-money-market-ETFs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+investors+rush+to+money+market+ETFs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092015-Credit-Chinese-investors-rush-to-money-market-ETFs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}