Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 30, 2014

US defence shorts

As Western military involvement in the Middle East continues to grow, we review at investor sentiment in defence and aerospace firms.

- Short interest in defence firms has rebounded since the start of the year, mostly driven by a few small cap firms

- The five largest defence firms have seen little shorting activity since the start of the year

- Non US firm with heavy exposure to US defence have also performed well

The US military is once again actively involved in the Middle East, and if the spreading fighting is anything to go by, the country's engagement in the region could be a drawn out one. With these developments in mind, and increasingly frosty relations with Russia, we look to see if investors are using the situation as an opportunity to refocus their investments in military and aerospace firms.

Shorts jump, but mostly in small cap names

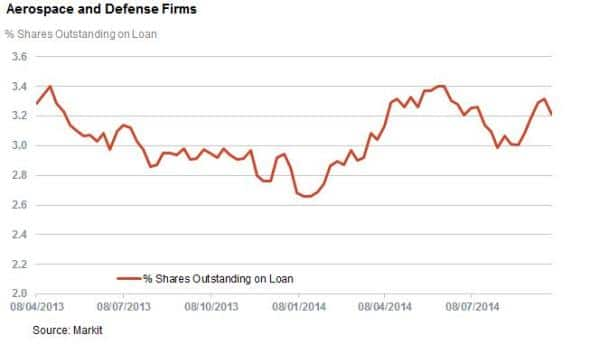

A look at the average short interest across the US defence sector, as measured by the average demand to borrow shares in the 54 constituents of the PowerShares Aerospace & Defense Portfolio ETF, has trickled up since the start of the year and now stands at 3.2% of shares outstanding. This represents a 19% jump in the average seen in the opening week of the year.

While this would indicate that investors are turning increasingly bearish in the sector, a closer look at the average sees that short sellers are targeting a relatively small minority of the ETF's constituents which tend to be on the small cap scale of the universe. This is evident by the fact that the shares seeing above average short interest in the universe have an average market cap of $1.5bn as opposed to $11bn for the index. In fact the three most shorted companies in the universe have a market cap smaller than $1bn so the increased average short interest is hardly reflective of bearish wave across the sector.

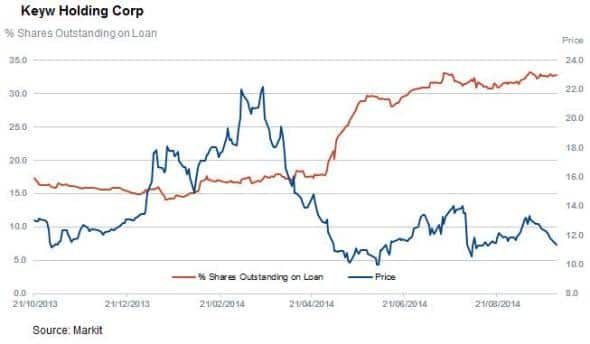

Highlights in that field include KEYW Holding which has seen demand to borrow double since the start of the year to 32.7% of shares outstanding after two sets of disappointing earnings sent its shares down sharply. This surge in shorting activity makes the firm the most shorted in the space by quite a distance.

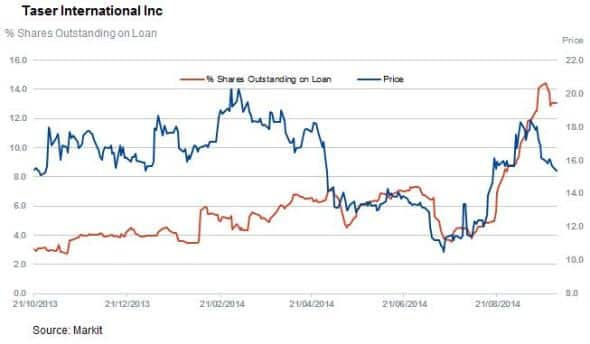

Another firm seeing rising short interest in the last few weeks is Taser which has seen short redouble their positions in the wake of a recent price surge.

Large firms see flat short interest after outperformance

Conversely to the rest of the defence and aerospace sector, the five largest defence contractors by sales have seen shorts cover with average demand to borrow stay flat at 0.7% of shares out on loan, less than a fifth of the index average.

This looks could be partially driven by the fact that these large cap names have by and far outperformed the rest of their peers in the mill aero sector. These five firms have seen their shares rise by 15% year to date while the overall constituents of the ETF have traded flat on average.

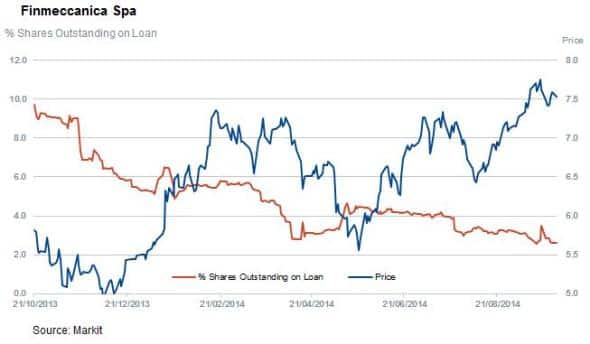

This trend also holds in non US firms with heavy exposure to the US defence sector, with Finmeccanica and BAE both seeing their shares advance while shorts have stayed in the sidelines.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092014-equities-us-defence-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092014-equities-us-defence-shorts.html&text=US+defence+shorts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092014-equities-us-defence-shorts.html","enabled":true},{"name":"email","url":"?subject=US defence shorts&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092014-equities-us-defence-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+defence+shorts http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092014-equities-us-defence-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}