Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 30, 2015

Austrian manufacturing shifts into higher gear at start of the third quarter

Latest PMI data signalled that the Austrian manufacturing sector grew at its strongest pace in nearly one-and-a-half years during July, adding to hopes that the economy has moved into a higher gear after gross domestic product has failed to show any meaningful growth for over a year. The headline Bank Austria PMI" has now held above the crucial 50.0 threshold for four months running, suggesting that the Austrian economy jumped back into growth territory in the second quarter.

Bank Austria Manufacturing PMI hits 17-month high

The seasonally adjusted Bank Austria Manufacturing PMI - a composite indicator designed to provide a single-figure snapshot of manufacturing performance - rose from June's 51.2 to 52.4 in July, thereby signalling the greatest improvement in manufacturers' operating conditions since February 2014.

GDP growth set to accelerate

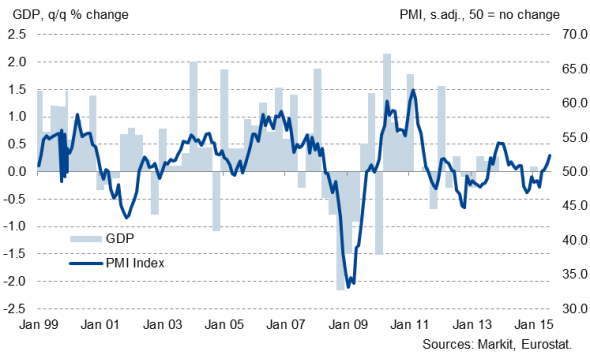

Despite the fact that Austria's goods-producing industry only accounts for roughly 28% of total GDP, a comparison between the PMI and GDP data shows that the two series exhibit a strong relationship. The PMI data therefore signal an acceleration in the pace of expansion from the 0.1% seen in Q1, with data for July suggesting that growth could pick up even further moving into the second half of the year.

Looking at the official measure for economic activity in the secondary (industrial) sector exhibits an even better relationship with the PMI and clearly shows that the goods-producing sector should have a positive impact on GDP in the second quarter.

Austrian economic growth and the PMI

Austria: Economic activity in secondary sector vs PMI

Employment returns to growth

The data signalled that new order growth accelerated in July, with companies reporting improving market conditions and a positive demand environment. The rates of growth were the steepest in 17 months in both cases.

Encouragingly, the pick-up in production and new order growth had a positive effect on the labour market, with employment levels rising for the first time in almost a year. However, the pace of jobs growth was still only marginal.

It also seems as if the weak euro is continuing to have positive effects on the sector, as new export business rose for a fourth month running.

A closer look at the sector data highlights the strong performance of makers of investment goods, which includes the production of plant, machinery and equipment. Manufacturers of consumer and intermediate goods also noted stronger output, but the rates of growth were much weaker than that recorded in the investment goods sub-sector.

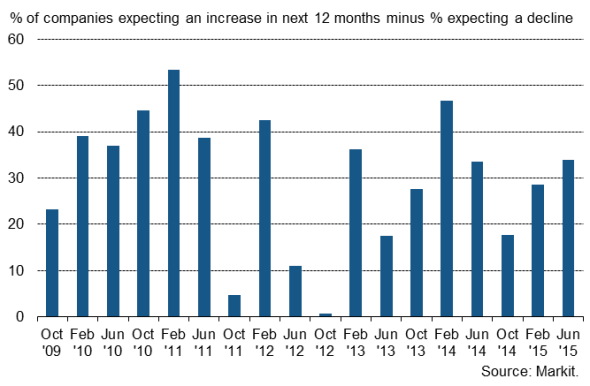

Business optimism highest since early-2014

Growth should continue to improve in coming months. Markit's latest Business Outlook Survey meanwhile revealed that optimism towards business activity at Austrian manufacturing companies improved further during June. Companies are optimistic that new export opportunities, new products, new customers, low energy prices and an improving economic climate are likely to support manufacturing growth over the next 12 months.

However, panel evidence also suggested that the Greek debt crisis, exchange rate factors, capacity bottlenecks and slower growth in China are some of the worries among Austrian manufacturers and could act as barriers to future growth.

Austria Business Outlook

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30072015-Economics-Austrian-manufacturing-shifts-into-higher-gear-at-start-of-the-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30072015-Economics-Austrian-manufacturing-shifts-into-higher-gear-at-start-of-the-third-quarter.html&text=Austrian+manufacturing+shifts+into+higher+gear+at+start+of+the+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30072015-Economics-Austrian-manufacturing-shifts-into-higher-gear-at-start-of-the-third-quarter.html","enabled":true},{"name":"email","url":"?subject=Austrian manufacturing shifts into higher gear at start of the third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30072015-Economics-Austrian-manufacturing-shifts-into-higher-gear-at-start-of-the-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Austrian+manufacturing+shifts+into+higher+gear+at+start+of+the+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30072015-Economics-Austrian-manufacturing-shifts-into-higher-gear-at-start-of-the-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}