Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 30, 2016

UK business investment falls as uncertainty mounts and economy slows

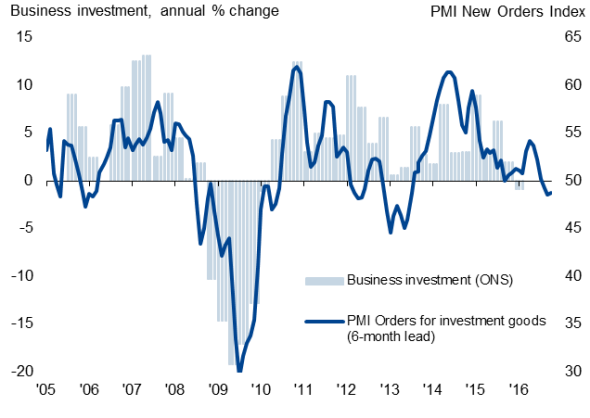

Signs of early Brexit worries affecting the economy were provided by official data showing business investment falling in the first quarter of the year. Gross fixed capital investment fell 0.1% in the first three months of the year, according to the Office for National Statistics, revised down from an earlier estimate that showed growth of 0.5%.

The narrower measure of business investment fell 0.6%, worse than the earlier estimate of a 0.5% decline, leaving it 0.8% lower than a year ago.

UK business investment

Economic growth slows

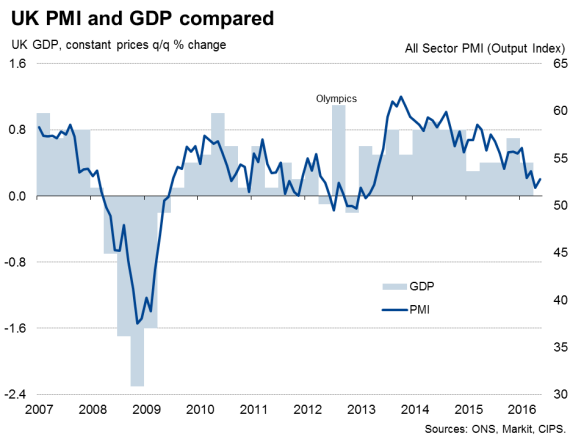

The overall pace of economic growth was left unchanged at 0.4% in the first quarter, despite the drop in investment, and the expansion in the fourth quarter of last year was revised higher to 0.7%, at least providing some brighter news on recent economic trends.

However, the pace of economic growth looks set to have slowed further in the second quarter, down to 0.2% according to PMI data available up to May, and the downturn in investment is an overriding concern. Rising business investment had been hoped to play a major role in the building a sustainable economic upturn in the UK, with forecasters such as the Office for Budget Responsibility pencilling-in strong growth of capital spending as a key driver of GDP.

Charts show PMI data up to May 2016.

Brexit worries

The drop in investment follows reports from the business surveys that companies became increasingly reluctant to make investment commitments earlier this year as worries about Brexit coincided with signs of slower economic growth both at home and at the global level. The potential for the UK to leave the EU in particular creates uncertainty about returns on investments, meaning the Brexit vote is likely to have exacerbated the downward trend in investment.

Services and consumer spending continued to drive growth in the first quarter, according to the ONS data, while manufacturing, construction and trade acted as additional drags alongside the downturn in investment.

Manufacturing output fell 0.2%, and construction output was down 0.3%, but service sector activity was 0.6% higher than in the fourth quarter.

Consumer spending was up 0.7%, buoyed by real disposable incomes rising 5.4% on the year in the first quarter, the largest gain in 15 years. However, spending is likely to come under pressure in coming months as a result of higher prices, driven in turn by the fall in the exchange rate.

Manufacturing and trade, in contrast, could well benefit from the weaker pound. Brexit may therefore have the benefit of helping rebalance the economy away from consumers towards manufacturing and exports.

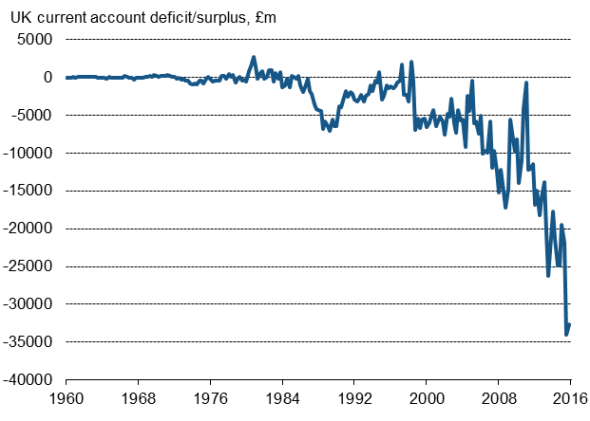

Near-record current account deficit

The current account deficit was estimated to have been running at 6.9% of GDP in the first quarter, narrowing slightly from the record 7.2% in the closing quarter of 2015 to "32.6bn. The deficit could therefore narrow further in coming months as the weaker pound boosts exports and helps attract foreign investment. However, to achieve this we will also need to see business confidence rise and uncertainty lift. Without such confidence, the current account situation could clearly deteriorate.

Current account

Source: ONS.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062016-Economics-UK-business-investment-falls-as-uncertainty-mounts-and-economy-slows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062016-Economics-UK-business-investment-falls-as-uncertainty-mounts-and-economy-slows.html&text=UK+business+investment+falls+as+uncertainty+mounts+and+economy+slows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062016-Economics-UK-business-investment-falls-as-uncertainty-mounts-and-economy-slows.html","enabled":true},{"name":"email","url":"?subject=UK business investment falls as uncertainty mounts and economy slows&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062016-Economics-UK-business-investment-falls-as-uncertainty-mounts-and-economy-slows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+business+investment+falls+as+uncertainty+mounts+and+economy+slows http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062016-Economics-UK-business-investment-falls-as-uncertainty-mounts-and-economy-slows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}