Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 30, 2015

Japan's third arrow finds its mark

Abenomics has taken hold in Japanese equities as stocks continue to rally and management teams increasingly embrace global investors' perspectives on returns.

- Japanese equities rally to multi decade high on the back of monetary stimulus

- Nikkei 400 ETFs have attracted $6bn of funds since the launch of the index in January 2014

- Nikkei 400 constituents are set to raise dividends by 16.5% in the coming fiscal year

Abe's arrows line up

The three arrows of Abenomics are seemingly finding their targets in Japan, particularly with investors as multiple indices have hit record highs in 2015.

An example of this is the recent change in mandate at the Government Pension Investment Fund (GPIF) which saw the fund increase investment allocation towards equities, coupled with a switch from the Topix into the Nikkei 400 companies.

The Nikkei 400 was launched by the Japan Exchange Group in an effort to track companies that adhere to third arrow principles such as independent directors, the adoption of IFRS and the disclosure of earnings in English.

Efforts have been centred on structural corporate reform in Japan, motivating companies to utilise or distribute cash reserves to increase return on equity. This should ultimately encourage further investment to drive growth, all while incentivising change among current constituents and aspiring new entrants.

Nikkei 400 funds

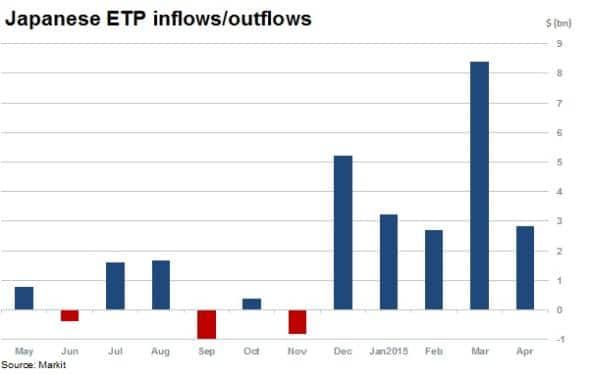

ETFs launched to track the newly created index have seen their AUM grown to $6bn. The strong growth represents 3.5% of total ETF AUM of $174bn tracking Japanese equities, which have seen cumulative inflows of $22bn year to date.

Attractive dividend growth

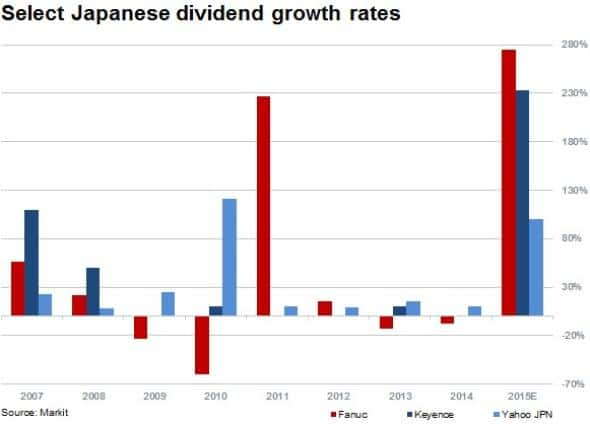

Markit expects aggregate dividends for constituents of the Nikkei 400 index to grow by 16.5% in FY15, reaching "7.47trn. Even though growth is slightly lower compared with the 19.3% achieved in FY14, the continued growth on a higher base of capital distributions represents a significant trend shift among Japanese firms.

Abenomic dividends

The growth in dividends is driven by companies that had previously sat on large cash piles and are now heeding to pressure to increase capital returns. One such company is factory automation and robotic equipment firm Fanuc. The firm held almost a "1trn in cash and no debt as of March 2015. It has raised its final dividend from "93 to "491 in 2015 while doubling the firms stated target pay-out ratio to 60% of earnings going forward. These developments sent shares in Fanuc up sharply by 6.6% on April 28th to hit a record high.

The shift in dividend policy here can be attributed to Abenomics and the aggressive lobbying from activist shareholder Daniel Loeb.

Another firm which has negligible debt and a management team under shareholder pressure to increase returns is sensor maker for the automation sector, Keyence Corp.

Keyence has guided for a threefold surge in dividends, increasing from "60 in FY14 to "200 in FY15. This has yet to be confirmed but the firm has declared and paid an interim dividend of "100 in FY15 and Markit is expecting a final dividend of "100 to be announced in May.

Yahoo Japan is also expected to double its annual dividend for FY15 to "8.86, translating into a payout ratio of almost 40%. The increase is unlikely to be a one off as management has guided to maintain an absolute dividend from FY16 onwards.

Markit Dividend Forecasting has recently started to provide up to four years of dividend forecasts for the JPX-Nikkei 400 Index.

Please contact your Markit account manager or dividendsupport@markit.com for more information.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-equities-japan-s-third-arrow-finds-its-mark.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-equities-japan-s-third-arrow-finds-its-mark.html&text=Japan%27s+third+arrow+finds+its+mark","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-equities-japan-s-third-arrow-finds-its-mark.html","enabled":true},{"name":"email","url":"?subject=Japan's third arrow finds its mark&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-equities-japan-s-third-arrow-finds-its-mark.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+third+arrow+finds+its+mark http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-equities-japan-s-third-arrow-finds-its-mark.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}