Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 30, 2015

Falling term premiums depress US yield curve

Low interest rates and tempered inflation expectations have seen long term yields fall, in a move catalysed by decreasing term premiums.

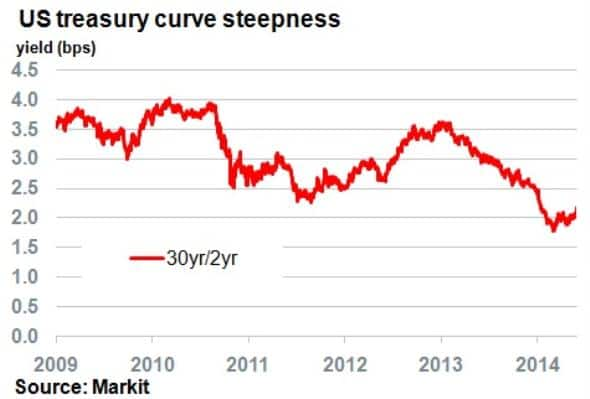

- The US treasury yield curve is at its flattest for five years, with the 30-yr /2-yr rate at 2%

- Recent higher inflation expectations have helped push the 30-yr rate up

- Rates remain low in terms of historical standards; possibly due to a falling term premium

With the US Fed on the brink of its first interest rate rise since 2006, the US yield curve has become one of the closely watched economic indicators by market participants. The yield curve represents the relationship between the yield and maturity of US treasuries.

The US yield curve's importance is unparalleled as it provides benchmark rates from which all other interest rate products are built. Its shape has been known to determine downturns in the economy and key rates such as the benchmark 10-yr are an indicator for the macroeconomic climate.

Deconstructing the curve

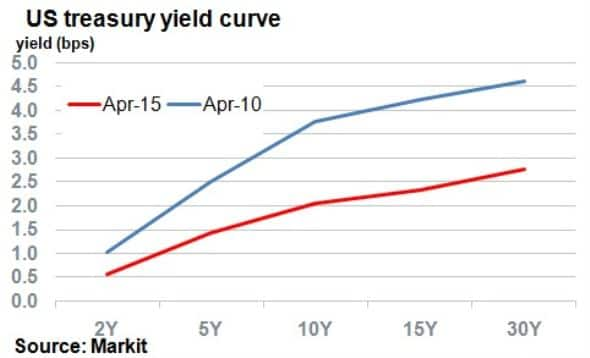

Since the financial crisis of 2008, the US Fed has implemented three rounds of QE and sustained a zero interest rate policy. In the same period the US yield curve has undergone a drastic change, especially on the long end. Over the last five years, the 30-yr treasury yield has declined 185bps, compared to around 45bps for the 2-yr rate.

The steepness of the yield curve, as measured by the difference between the 30-yr and 2-yr rate, has declined from 3.61% to 2.12% over the last 18 months. A flattening in the yield curve has in the past predicted looming economic downturns, yet the US economy in the same period has enjoyed annual growth rates above 2%; higher than many major western economies.

The reasons for long term interest rates having remained low and continuing to decrease (the benchmark 10-yr rate has been declining ever since 1987) has sparked debate. Breaking down the components that make up the yield curve reveals what's driving today's rates.

The shape of the US yield curve is essentially made up of short term interest rate expectations and long term interest rate expectation. Long term interest rate expectations are made up of inflation expectations and the term premium (the extra yield demanded by investors for taking on duration risk).

Low short term interest rates

Short term interest rates have remained low and stable over the last few years. Calls to hike interest rates have also been relatively muted, despite the fact that US unemployment is at its lowest since 2008, at 5.5%. The recent growth slowdown seen in first quarter GDP numbers has continued to rally Fed "doves" to keep monetary policy accommodative, until the economy fully recovers.

Inflation remains relatively subdued

The latest 10-yr breakeven inflation rate (what market participants believe inflation to be in the next ten years) on average, stands at 1.89%, below the Fed's target of 2%. Despite expectations having increased over the last two months from 1.54% in January, pushing the 30-yr rate up, inflation still remains historically low.

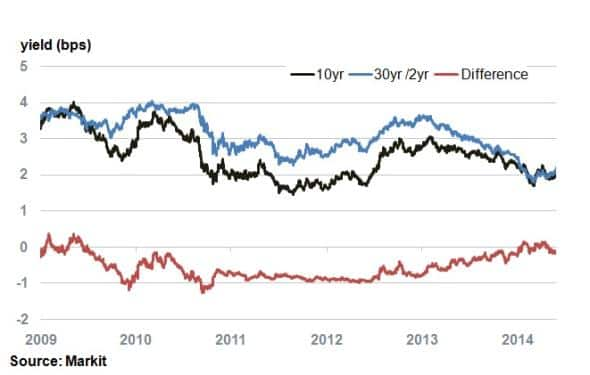

The difference between the 30/2yr rate and the 10yr rate highlights the effect the term premium has had on long term yields. A convergence can be seen starting in 2013 when the yield difference was around -1%, it has since steadily increased to zero.

With both the 10-yr rate and 30yr/2yr rate moving in tandem with recent increased inflation expectations, one could assume that most of the convergence previously can be attributed to a reduction in the term premium.

This signals investors are willing to accept less return for the increased risk of longer duration and/or that there has been a shift in the supply and demand dynamic for longer dated bonds (higher demand or short supply).

Low short term interest rates, subdued inflation and a lower term premium demanded by investors all have contributed to long term yields being low. This in turn has flattened the yield curve, even though macro data shows a robust economy.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-credit-falling-term-premiums-depress-us-yield-curve.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-credit-falling-term-premiums-depress-us-yield-curve.html&text=Falling+term+premiums+depress+US+yield+curve","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-credit-falling-term-premiums-depress-us-yield-curve.html","enabled":true},{"name":"email","url":"?subject=Falling term premiums depress US yield curve&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-credit-falling-term-premiums-depress-us-yield-curve.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Falling+term+premiums+depress+US+yield+curve http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-credit-falling-term-premiums-depress-us-yield-curve.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}