Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 30, 2016

Investors rekindle love for Latin American stocks

Latin American stocks are the flavour of the month in the ETF market, with investors rushing in as the market rebounds from the lows hit earlier in the year.

- ETF investors piled $773m into Latam ETFs in March, highest inflows since 2012

- Brazilian funds favoured with investors as their returns surge ahead of regional peers

- Short sellers covering Brazilian positions, with short interest at three year lows

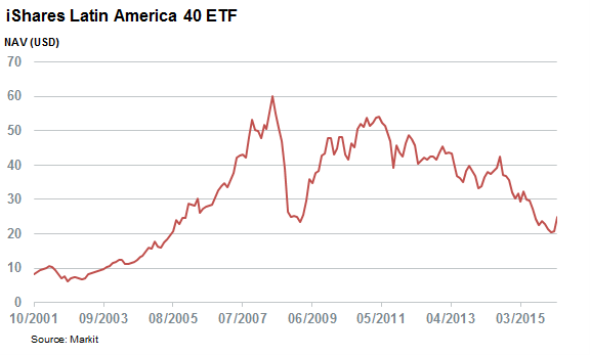

Investors have regained their fondness for Latin American (Latam) shares over March as the region rebounded from lows in the wake of bottoming out commodities prices, improving US relations, and a newly dovish Fed. These factors have combined to see the iShares Latin America 40 ETF, which tracks the 40 largest Latam listed equities, has returned over 20% for the month so far. This puts the ETF within reach of its best month on record; a 21% jump seen back in March 2007.

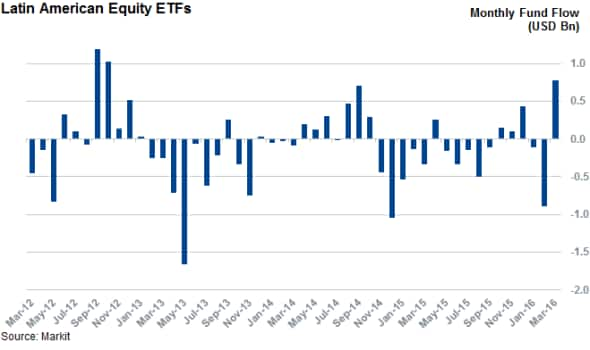

ETF investors have been clamouring to get a piece of the action as the 93 ETFs which track Latam stock returns have seen over $770m of inflows so far this month; the largest monthly gain since October 2012.

But Latam ETFs are still net down for the year due to the fact that investors withdrew over $1bn of assets from these funds in the opening two months of the year - a decision they are no doubt ruing in the face of the recent rebound.

Brazilian shares have been at the forefront of this trend as the IBOVESPA index, which tracks the country's largest companies, has surged by a quarter in March; helping it rebound from its post financial crisis low set earlier in the year. Ironically, the rally has been driven by political turmoil as investors view the recent impeachment proceedings against president Dilma Rousseff as a step in the right direction as it could lead to an ousting. Rousseff has so far been unwilling to make the cuts required to address Brazil's fiscal woes. These developments have seen the iShares MSCI Brazil Capped ETF attract over $380m of new assets over the month, the most out of any of the region's ETFs by over $110m.

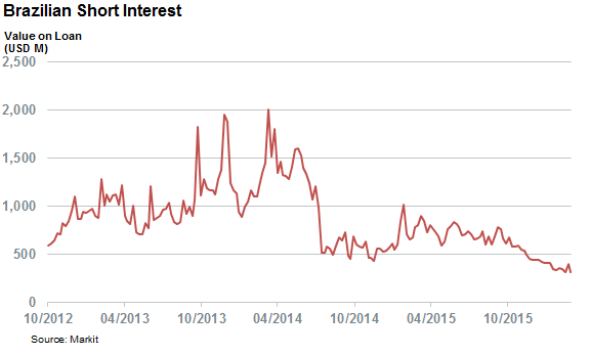

Short sellers have also shown no appetite to short Brazilian equities despite their recent surge. The value of Brazilian short positions has fallen by a quarter year to date. The $316m of short positions taken out against Brazilian equities marks the weakest appetite to short the asset class since 2010.

The value of shares borrowed by short sellers had fallen by $20m since the start of the month which marks a massive fall in real terms, given the strong performance of Brazilian equities over that time frame.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032016-Equities-Investors-rekindle-love-for-Latin-American-stocks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032016-Equities-Investors-rekindle-love-for-Latin-American-stocks.html&text=Investors+rekindle+love+for+Latin+American+stocks","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032016-Equities-Investors-rekindle-love-for-Latin-American-stocks.html","enabled":true},{"name":"email","url":"?subject=Investors rekindle love for Latin American stocks&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032016-Equities-Investors-rekindle-love-for-Latin-American-stocks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+rekindle+love+for+Latin+American+stocks http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032016-Equities-Investors-rekindle-love-for-Latin-American-stocks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}