Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 29, 2015

Herding unicorn shorts

Start-ups and stalwart tech stocks have shown signs of weakness recently, trimming aggressive growth trajectories and staff while short sellers amass billions worth of positions.

- Short value on loan in IBM surges to $1.7bn after 14 consecutive quarters of meagre sales

- Chipmakers and domain name services form bulk of the largest shorts by value on loan

- Twitter short interest returns to IPO levels amid disappointing quarterly user figures

What next Watson?

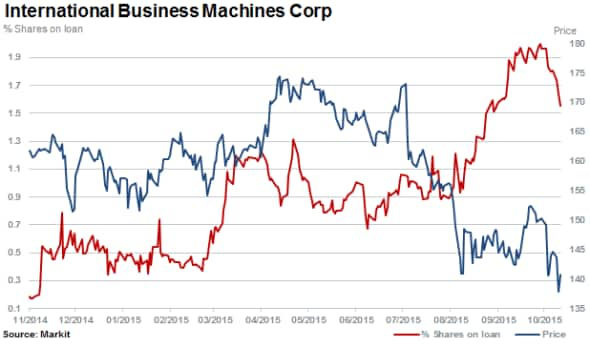

Warning that full year earnings would fall below analyst expectations, IBM released disappointing third quarter results, impacted by weaker emerging market sales and a stronger dollar diluting foreign earnings.

Revenues at IBM peaked during 2011 and the firm has since been under pressure to transform from an enterprise infrastructure provider into a modern ITC services based provider.

The company cut EPS guidance in 2014 as cloud computing and analytics revenue growth was not enough to counter declines in older businesses. The cut back in share buybacks amplified their impact on earnings and short interest has now increased to levels only breached once since the financial crisis. While a relatively low percentage of IBM shares are currently out on loan, the value of short positions is one of the largest of the sectors with $1.7bn of shares now out on loan.

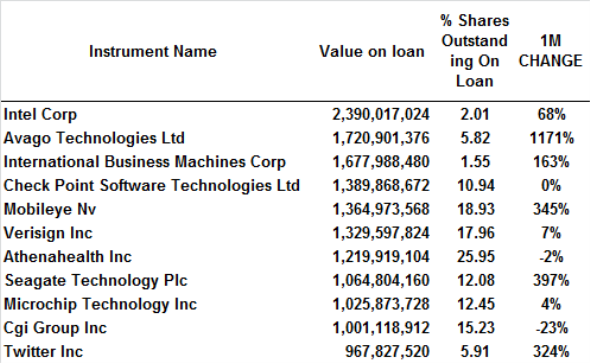

Old guard dominates short value

On aggregate, short sellers are targeting relatively mature tech based companies and technologies, as measured by a value on loan.

Ahead of IBM and leading the 'unicorns of short positions' are chipmakers Intel and Avago Technologies with $2.3bn and $1.7bn value on loan and 2.0% and 5.8% shares outstanding on loan respectively.

Both firms have seen a rise in short interest in the last six months as mobile device saturation and competition in component supply continues to impact the sector's dynamics.

VeriSign, the more than two decade old domain name service and internet security provider, has seen short sellers track its share price higher year to date. Shares outstanding on loan have risen to 18%, representing $1.3bn in value on loan.

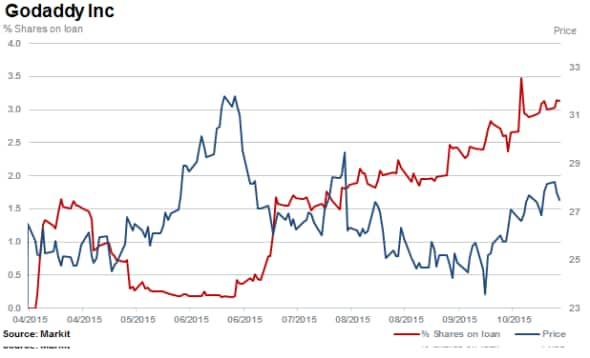

Long-time competitor to VeriSign, Godaddy, which only recently IPO'd has also attracted increasing levels of short interest with 3.1% of shares outstanding on loan. Despite being a mature company, Godaddy is still not profitable which may highlight underlying motives for short sellers targeting it and VeriSign. However value on loan for the company remains below $70m.

Just shy of unicorn short status

Slightly outside the top ten most shorted tech stocks by value on loan currently is Twitter with $970m. One of the youngest companies in terms of founding and listing, Twitter has 5.9% of shares outstanding, approaching an all-time high since its IPO in 2013.

Earnings released this week actually outperformed on revenue growth and earnings however lower than expected user stats saw shares fall as analysts were disappointed on growth prospects.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-Equities-Herding-unicorn-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-Equities-Herding-unicorn-shorts.html&text=Herding+unicorn+shorts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-Equities-Herding-unicorn-shorts.html","enabled":true},{"name":"email","url":"?subject=Herding unicorn shorts&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-Equities-Herding-unicorn-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Herding+unicorn+shorts http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-Equities-Herding-unicorn-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}