Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 29, 2015

Short interest spikes across the S&P

Short interest has climbed across a range of US large cap stocks as sector rallies lose and gain steam and macro expectations of a stronger dollar, weaker commodity markets and Chinese demand impacts markets.

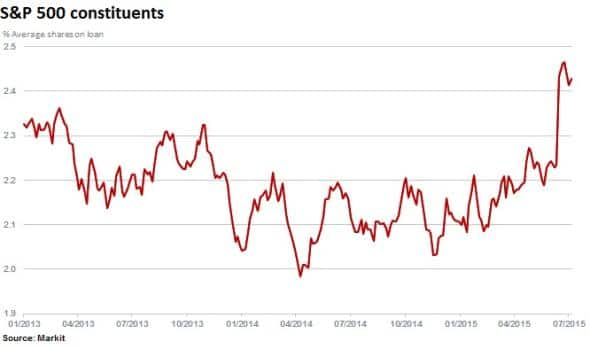

- S&P 500 average shares out on loan jumped by 8.9% to hit 2.4% in the last month

- Short selling strategies have outperformed the index year to date by over 200bps

- Oil price fragility motivates short sellers to add to energy names, lifting average

Short sellers target constituents

After a strong five year rally the S&P 500 is up by only 1.7% year to date (up 1.3% on July 28th alone) and has battled to gain ground in 2015. Amid concerns that the US market has lost steam, the market is digesting the impact of an impending interest rate hike and the recent pullback in tech and healthcare stocks has revealed how concentrated year to date performances have been.

Average short interest has increased across the S&P 500 index in the last month with the percentage of shares on loan spiking up 8.9% to 2.4%.

This increased propensity to sell short has occurred across the board, with 70% or 355 S&P 500 constituents seeing an increase in demand to borrow over the past month.

Short sellers have either trimmed positions or been proven right with falling prices over the last month, with the total value on loan decreasing by 5% to $148bn.

Shorts pick out underperformance

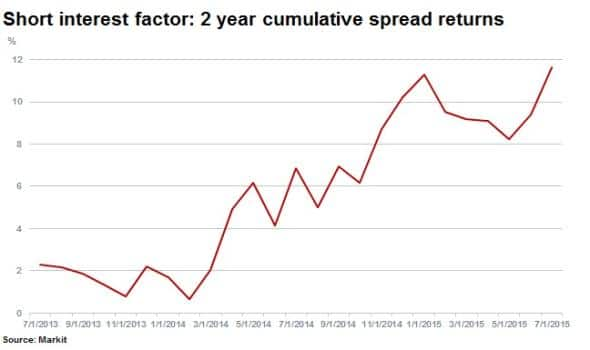

Markit Research Signals’ Short Interest factor indicates that it has likely been the latter. According to this factor, short sellers have been fairly accurate in identifying companies that are expected to underperform, outperforming the S&P 500 returns year to date.

Additionally, over the last month the top 20 most shorted stocks of the index have fallen by 7% on average.

The strategy of short selling companies that make up the most shorted 10% of firms (according to the factor) across the US large cap universe has outperformed the S&P 500 year to date.

Over 24 months, returns using a long-short strategy have been driven by shorts, with a cumulative short return of 7.0% across the most shorted names and 4.6% return on the least short sold, for a cumulative spread return of 11.6%.

Year to date this strategy has yielded a return of 1.4% with the least shorted stocks underperforming those most short sold (negative returns) by a spread of 6.6%. Going short the 10% most shorted alone would have yielded 4% year to date.

Weakest ranked sectors

On average the following five sectors rank unfavourably in the US according to the Short Interest factor; Industrials, Cyclical Goods & Services, Non-Cyclical Goods & Services, Healthcare, and Technology.

Interestingly, the Energy sector is neutrally ranked with an average ranking of 50, but has a high level average short interest of 4.5%. The sector is however poorly ranked according to the Demand Supply Ratio factor, which indicates that there is still strong demand to from short sellers to short energy names.

Single names lifting the average

The increased shorting has come from a minority of names, as the 50 names which have seen the greatest increase in short interest have been responsible for ~60% of the increase in average short interest seen in the last month.

A fifth of those names were energy firms, followed by Capital Goods (14%), Consumer Durables & Apparel (10%), Software & Services (8%) and Media (8%).

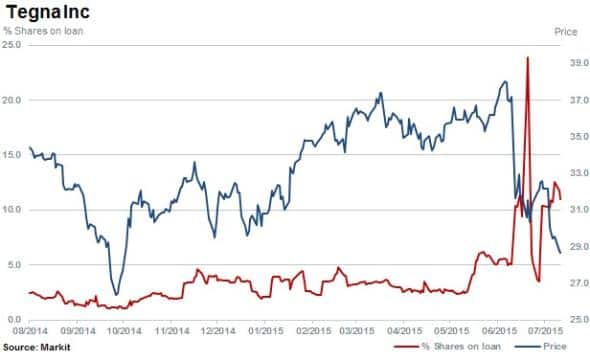

The largest contributing factor to the recent surge in short interest over the last month has been digital publishing firm Tegna.

Short interest in Tegna has climbed 100% over the last month to reach 11% of shares outstanding on loan. Short interest climbed just as shares plunged after the company’s publishing arm Gannet was spun out, separating it from the remaining digital media business assets. This trade has seen Media names become the most shorted sector of the S&P 500.

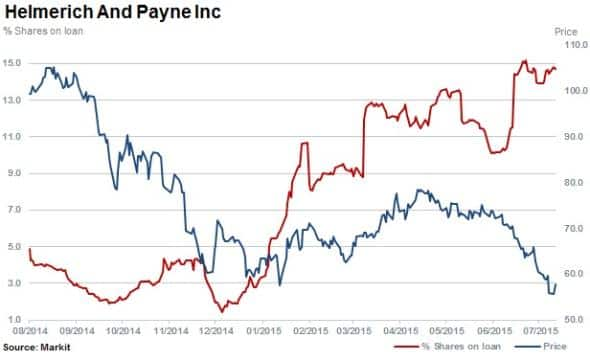

In the Energy space, oil and natural gas well driller for exploration and production companies Helmerich and Payne is the second highest contributor to the change in average short interest. Short interest has increased by 40% over the last month to 14.4% of shares outstanding on loan as the US shale and fracking industry continues to suffer lower crude oil prices.

p>Download Full PDFRelte Stephen Schutte, Analyst at Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072015-Equities-Short-interest-spikes-across-the-S-P.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072015-Equities-Short-interest-spikes-across-the-S-P.html&text=Short+interest+spikes+across+the+S%26P","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072015-Equities-Short-interest-spikes-across-the-S-P.html","enabled":true},{"name":"email","url":"?subject=Short interest spikes across the S&P&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072015-Equities-Short-interest-spikes-across-the-S-P.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+interest+spikes+across+the+S%26P http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072015-Equities-Short-interest-spikes-across-the-S-P.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}