Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 29, 2015

Credit markets react to prospect of Greek tragedy

As Greece calls for a referendum, volatility sees investors rush to safety of German bunds. Meanwhile, European periphery credit spreads widen only slightly; alleviating fears of contagion.

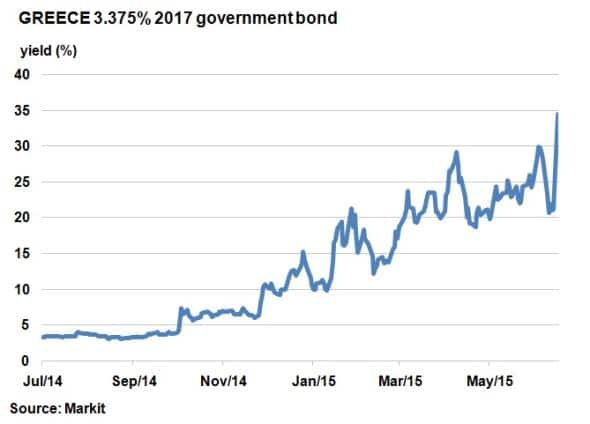

- Greek 2-yr bond yield has widened 13% to 34%; a new post-Syriza high

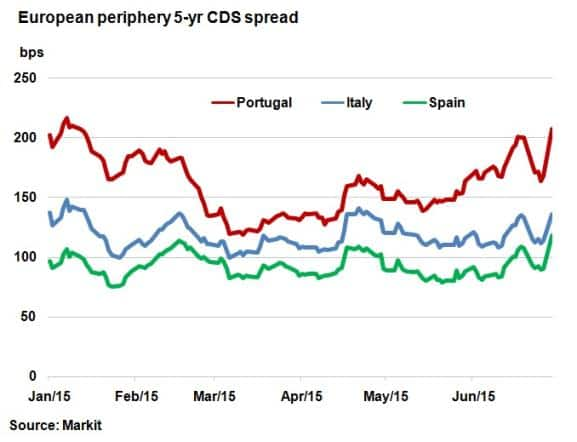

- European periphery 5-yr CDS spreads wider 23-40bps, touching ytd highs

- Safe haven bonds advance, with the 10-yr bund yield tightening 13bps

Late last night, Greek Prime Minister Alex Tsipras confirmed that Greek banks would not open today after a tumultuous and possibly pivotal weekend in the Greek crisis.

On Friday night, before a key meeting between Eurogroup ministers on Saturday, Tsipras shocked European officials by calling for a Greek referendum on Sunday July 5th. Tsipras intends to let the public decide whether Greece should accept or reject last week's set of proposals put forward by its creditors, in exchange for an extension of the current bailout agreement.

With Saturday's Eurogroup meeting thereby rendered practically pointless and the bailout extension deadline approaching, Greek negotiators requested that the bailout deadline be extended by one month, which the ECB duly rejected. To complicate things further the ECB also stated that the Emergency Liquidity Assistance (ELA) limit would not be raised from Friday's ceiling. ELA has been keeping Greek banks running for months. By not raising the ELA limit, Tsipras called this an "unprecedented act" and an insult to democracy. The Greek government had therefore no choice then but to call for a temporary bank holiday and put in place capital controls to protect banks from running dry.

The capital controls are as follows:

- Banks to remain shut for one week and one day at the minimum

- A maximum of €60 can be withdrawn per account per day

- No foreign movement of cash

- Athens Stock Exchange to be closed for a week

Market reaction

Markets have reacted this morning with the euro down sharply and global equities selling off. German equities are down around 3%; the biggest one day move since 2011.

This volatility has also been reflected in credit markets, with investors rushing toward the safety of bunds. The German benchmark 10-yr bond due 2025 yield tightened 13bps to 0.78% as of 11am BST, according to Markit's bond pricing service.

The Greek 2-yr bond due 2017, seen as the most sensitive to market news, has seen its yield jump 13% to 34.46%; the highest since Syriza came to power.

But all eyes are on the move in European periphery spreads for signs of market contagion. Latest levels show that Spain's and Italy's 5-yr CDS spreads are 26bps and 23bps wider respectively. Portugal's 5-yr CDS spread is 40bps wider at 207bps, but the level remains far off the 1000+bps seen in July 2011.

However, the fact these latest levels are barely touching year to date highs implies that fears of contagion are not yet rampant, according to credit market signals.

What next?

The capital controls will certainly not help Greece's economy, even in the short term, but are required to stem outflows and allow enough time for the referendum. The referendum itself may be more symbolic than anything given that the bailout agreement ends tomorrow.

One of Greece's largest bargaining chips in the current round of negotiations was fears over market reaction to the possibility of the eurozone breakup. The fact that the market has proven relatively resilient in the wake of the latest developments could embolden members opposed to any further Greek concessions.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-credit-credit-markets-react-to-prospect-of-greek-tragedy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-credit-credit-markets-react-to-prospect-of-greek-tragedy.html&text=Credit+markets+react+to+prospect+of+Greek+tragedy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-credit-credit-markets-react-to-prospect-of-greek-tragedy.html","enabled":true},{"name":"email","url":"?subject=Credit markets react to prospect of Greek tragedy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-credit-credit-markets-react-to-prospect-of-greek-tragedy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Credit+markets+react+to+prospect+of+Greek+tragedy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-credit-credit-markets-react-to-prospect-of-greek-tragedy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}