Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 29, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- The largest producer of eggs in the US is the most short sold ahead of earnings

- Short sellers target Stevia sweetener maker Evolva

- Chinese firms dominate most shorted with coal, batteries and shipping featured

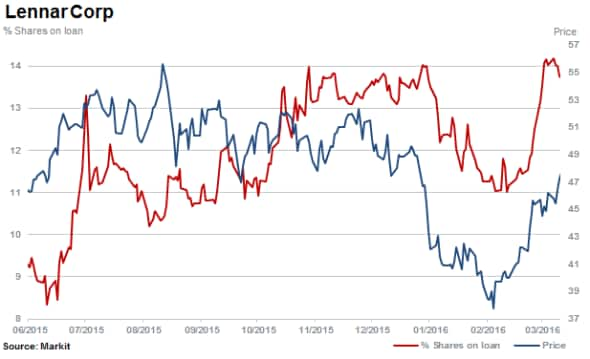

North America

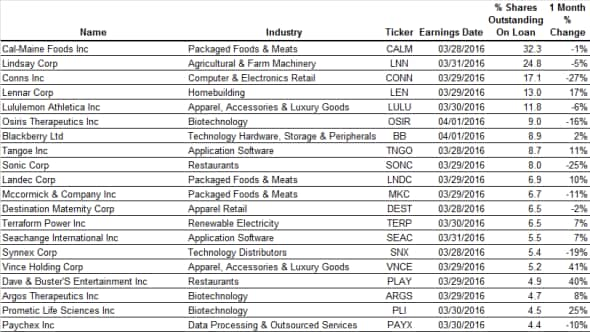

Cal-Maine Foods, the largest producer of eggs in North America is the most shorted ahead of earnings this week. The company produces over a fifth of domestic eggs supplied in the US and has a third its shares currently outstanding on loan. Short interest has increased two fold in the past twelve months while shares, after seeing some weakness recently, are up by 30%.

Demand to borrow Cal-Maine has been rising since late 2015 and the cost to borrow has soared towards 20% with the majority of available lending inventory currently utilised.

With almost a quarter of shares outstanding on loan and frequently appearing among the most shorted is runner up in North America, Lindsay Corp. The agricultural irrigation equipment supplier has seen short sellers retreat slightly in recent weeks as shares have risen 5% so far this year.

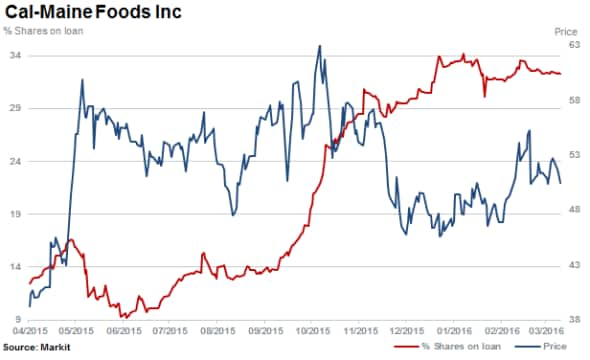

Attracting short sellers and seeing a fourfold increase in short interest over the past 12 months is credit furniture retailer Conn's. Shorts have covered in the weeks leading up to earnings however, with 17% of shares outstanding on loan currently.

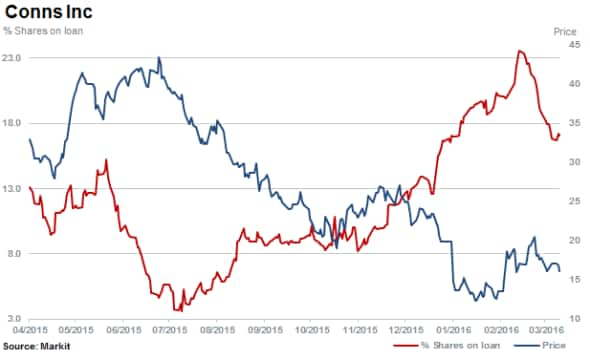

US homebuilder Lennar continues to attract high levels of short interest but has seen short sellers cover positions as shares surged by 20% with 13% of shares outstanding on loan currently.

Two fairly high profile brands making the top most shorted ahead of earnings are high end apparel retailer Lululemon Athletica and once prominent handset maker Blackberry. Short sellers have been covering positions in both stocks as of late, with Lululemon shares rising and impressive 15% in 2016.

Shorts have covered a fifth of positions in Blackberry year to date with short interest of 9% currently and the stock sliding down 21% further.

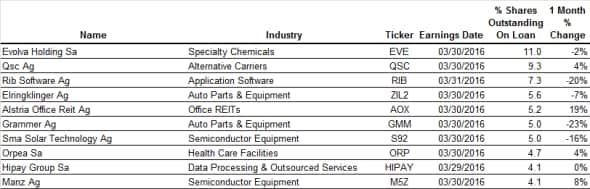

Europe

Evolva is the most shorted stock in Europe ahead of earnings with 11% of shares outstanding on loan. The Swiss nutritional and health products producer is gearing up to produce the sweetener stevia in a joint venture with Cargill. The company however has seen its stock fall by almost a third over the past 12 months.

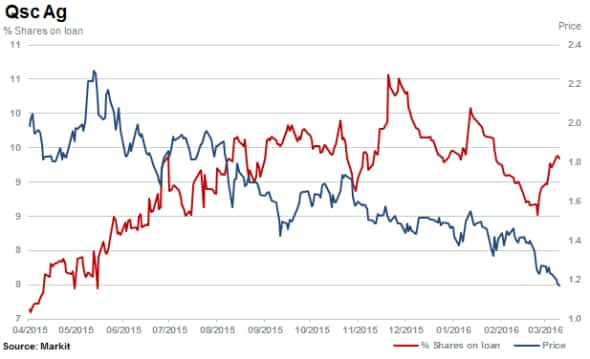

During March German telecommunications and ICT company Qsc saw an 8% spike in short interest rising to 9.3%. Shares of the firm have fallen 40% in the last 12 months.

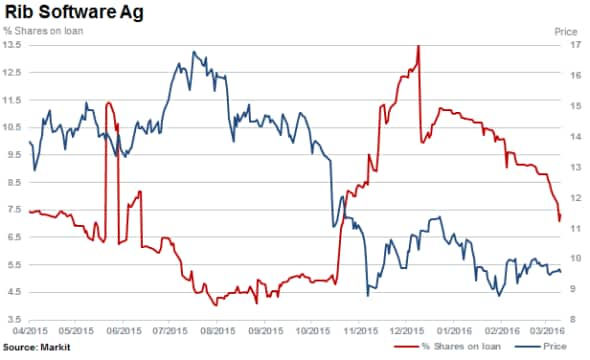

Third most shorted in Europe is German based Rib Software with 7.3% of shares outstanding on loan.

Rib Software develops applications specifically destined for the construction industry. Shares have fallen by a third over the last 12 months with short sellers taking profits and covering almost half of positions since December 2015.

Apac

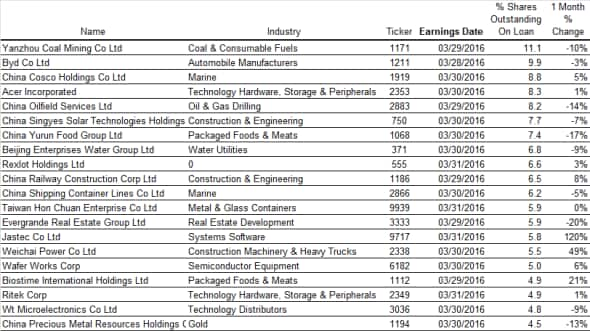

Most shorted ahead of earnings in Apac is Yanzhou Coal Mining with 11% of its shares sold short. Markit Dividend Forecasting expects a dividend suspension at the firm as a result of the slowdown in macroeconomic growth and overcapacity in the coal industry, which has drastically impacted prices.

Second most shorted is BYD, a Chinese manufacturer of IT components including rechargeable batteries, solar components and LEDs. The company has seen short interest rise to 10%; increasing over 50% in the last 12 months.

Third most shorted in Apac is China Cosco Shipping Corporation with 8.8% of shares outstanding on loan. Created out of a state influenced merger of China Ocean Shipping and China Shipping Group, the combined group controls one of the largest fleets of dry bulk vessels, container ships and oil tankers in the world. Unfortunately for the firm, the worst environment the shipping industry has seen in decades has seen their stocks pay a heavy price.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}