Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 29, 2016

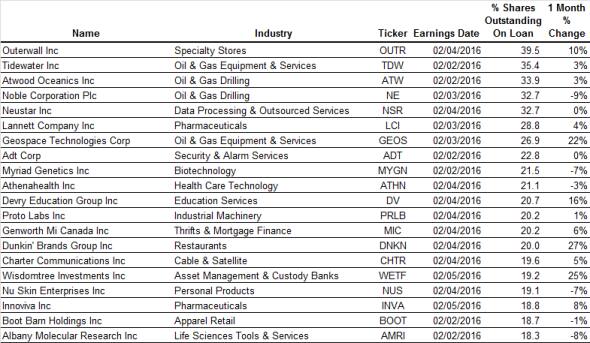

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Falling DVD rentals at Outerwall's Redbox sees short sellers continue to profit handsomely

- Outside the top 20, Fitbit and GoPro prove profitable shorts in 2016

- Short interest in Fingerprint sensors surge in Europe, while Japanese tech dominates Apac

North America

Most shorted ahead of earnings in North America this week is retail DVD-kiosk-rental operator, Outerwall. Targeted by short sellers for some time, the stock has been heavily sold off since the company released disappointing earnings guidance on December 7th 2015.

Outerwall guided its Redbox video rental segment to deliver lower revenues. However, it's increased promotional spend which was intended to "encourage consumers to return to normal rental patterns" impacted earnings. The firm was already highly shorted before the announcement and short sellers have been spurred on by recent events, with short interest rising to 40% since December 7th and shares falling 44%.

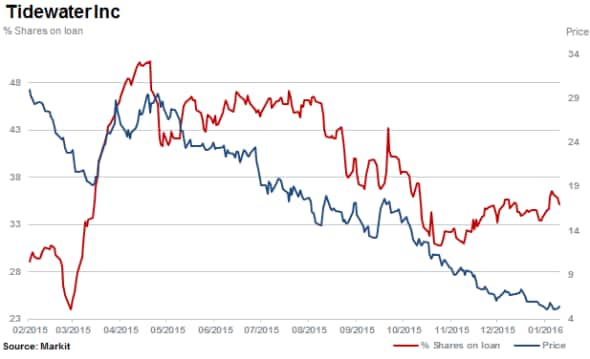

Short sellers have been covering positions in second most shorted Tidewater, with short interest briefly holding below a third of shares outstanding on loan. However increased shorting activity has been seen in the new year ahead of a dividend suspension announced this week. Short interest has increased back to 35% as shares continue their slide, down 81% over the past 12 months.

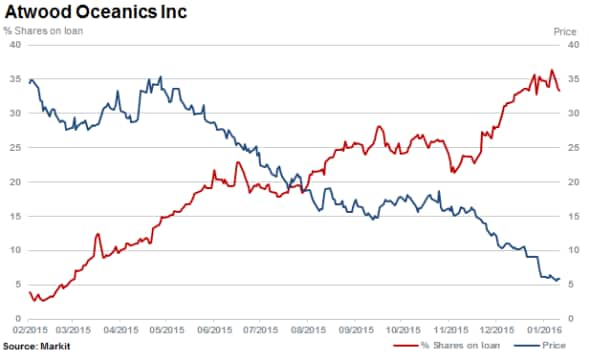

Similarly, with a third of shares sold short, Atwood Oceanics as seen resurgence in shorting activity despite the stock falling 82% in the last 12 months.

Not to be confused with Singapore listed Noble Group, Noble Corporation PLC (NE) saw short sellers push shares outstanding on loan to 37% in late 2015 with short interest declining to 33% currently. The stock is down 43% in the last three months alone.

Outside top twenty most shorted are newly listed consumer technology firms Fitbit and Gopro with 9.9% and 14% of shares outstanding on loan respectively. Shares in both companies have cratered in 2016, with Fitbit falling 47% and Gopro fairing marginally better, declining by 41%.

Western Europe

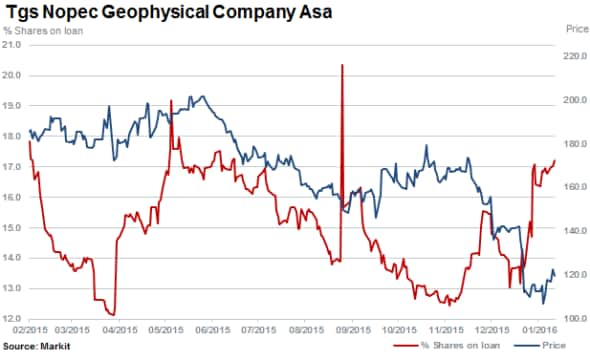

Most shorted ahead of earnings in Europe is Tgs Nopec Geophyiscal whose shares have continued to fall down by a quarter in the last three months alone. Short sellers continue to target the geological consulting firm which services the oil industry. Currently 17% of shares are outstanding on loan.

Second most shorted in Europe ahead of earnings but fourth most shorted across the FTSE 250 & FTSE 100 is online retailer Ocado. With 17.7% of shares outstanding on loan the stock has been heavily impacted by activities of rival Amazon. First, investor concerns over competition sent shares lower in December 2015 and then rumours of a potential tie up in 2016, with Amazon saw shares stage a brief rally.

Third most shorted ahead of earnings in Europe is Helsinki based Metso, a minerals processor, aggregate and services supplier to the oil & gas and mining sector. Shares have fallen by 32% in the last 12 months as short sellers raised positions by 90% with shares outstanding on loan increasing to 17%.

Resilient short sellers, who have been prepared to pay above 20% to short Fingerprint Cards Ab for over 12 months have increased positions to 12% of shares outstanding on loan. This follows a 15% selloff in shares in 2016 after the stock ran an incredible rally over the last 12 months.

Fingerprint Cards AB has benefited from the proliferation of fingerprint sensors in smartphones and the stock has risen 1300%, including the recent selloff.

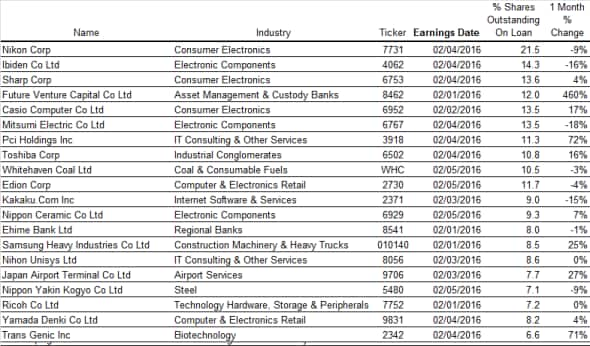

Apac

Short sellers continue to target Japanese camera maker Nikon who is the most shorted ahead of earnings in Apac with 21.5% of shares outstanding on loan. The company managed to maintain a flat dividend in FY15 however is expected to halve its annual dividend this year.

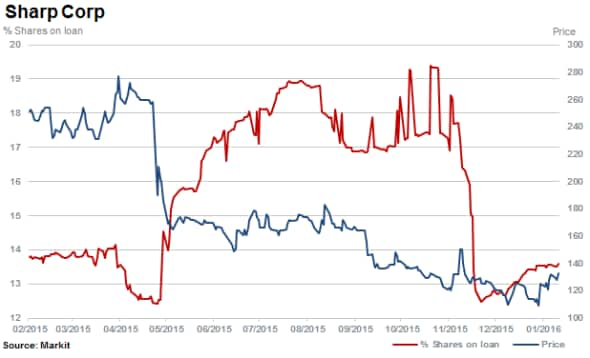

Third most shorted ahead of earnings in Apac is Sharp with 13.6% of shares outstanding on loan. Shares have fallen 40% in the last 12 months and the struggling electronics firm is now subject to take over bids from rivals in the region.

Shares in Casio have fallen by a fifth year to date attracting an 18% increase in short interest with shares outstanding on loan rising to 13.5%. The company is guiding a 22% lower final dividend for FY16 while earnings are expected to come in at JPY 33bn, up almost 25%. Markit Dividend Forecasting notes that current guidance translates to a payout ratio of about 28% which is relatively conservative compared to its recent trend of paying out around 40%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}