Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 28, 2014

China and Japan converge

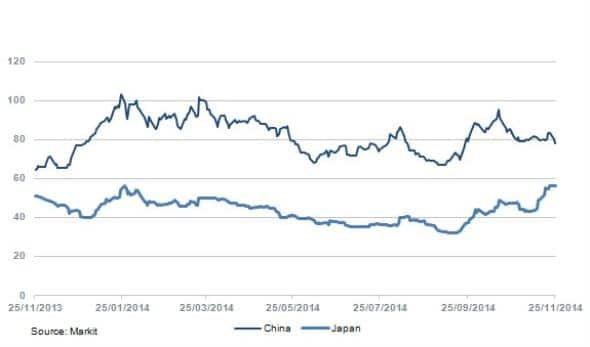

China's spreads have rallied and Japan's have lost ground, leading to a convergence of the two sovereigns.

- China's spreads tightened following interest rate cut

- Thoughts of a hard landing are suppressed by PBOC

- Japan is widening but a full convergence with China is unlikely

Back in the summer of 2013, there were two main themes that investors feared could trigger a change in the credit cycle. The first was the US Federal Reserve scaling back its quantitative easing programme, which precipitated the so-called taper tantrum.

The second was a possible "hard landing" for the Chinese economy. Concerns that a combination of an overheating property market and slowing growth - due to stagnant external demand - would prevent the Chinese authorities from stimulating the economy sent shockwaves through the rest of the world. China's CDS spreads spiked wider to 140bps, and the effects were felt across both developed and emerging markets.

The mood of the People's Bank of China (PBOC) in 2013 appeared to be one of tightening policy measures to restrict lending through the interbank market provided the main flashpoint. But in 2014 there seems to have been a change of heart. The PBOC announced on November 21st a cut in interest rates, the first in more than two years. The move was no doubt a response to the disappointing third quarter GDP figures, which showed the economy growing at its slowest pace in five years.

The credit markets gave a cautious welcome to the news. China's CDS spreads rallied to 78bps, 1bp tighter than where it started the year. Investors usually like loose monetary policy, so the reaction wasn't a surprise.

But the questions surrounding China's economy remain. In the long term there is a clearly a need to shift the balance away from investment and towards domestic consumption, but easier monetary policy may delay the necessary adjustment. However, it also suppresses thoughts of a potential hard landing, and the markets may be in the mood to search for positives going into year-end.

China's spreads may have been rallying, but the opposite has occurred on the Japanese sovereign. It is trading at around 55bps, and the 23bps differential between the two countries is the smallest for almost a year. Japanese Prime Minister Shinzo Abe announced a snap election after data showed that the economy had fallen into technical recession. The weak GDP figures throw Abe's radical policies into doubt, and it would be no surprise to see further volatility in the run up to next month's election.

However, given the commitment to loose monetary policy, it seems unlikely that the two countries' spreads will fully converge, as they did in the first half of 2013.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28112014-Credit-China-and-Japan-converge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28112014-Credit-China-and-Japan-converge.html&text=China+and+Japan+converge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28112014-Credit-China-and-Japan-converge.html","enabled":true},{"name":"email","url":"?subject=China and Japan converge&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28112014-Credit-China-and-Japan-converge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+and+Japan+converge http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28112014-Credit-China-and-Japan-converge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}