Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 28, 2016

Eurozone's rally not quite squeezing shorts

European equities have joined the global rally on the back of a recovery in energy and commodity prices, but short sellers are not yet fully covering positions to the extent that has been seen in the US.

- Short interest for energy sector declines 14% while broader market sees a significant rise

- Stoxx 600 surges 16% from lows but shorts hang onto positions in retailers

- Despite extensive covering and price declines, Seadrill remains a high conviction short

Average short interest across constituents of Europe's Stoxx 600 has rocketed 30% higher in 2016 despite the index staging a 16% recovery since February 11th.

While momentum in US equities this year has been in part fuelled by shorts sellers covering positions, Europe's largest firms have actually seen short interest levels trend higher on average. Across constituents of the Stoxx 600, short interest has risen 30%, reaching almost 3% on average.

As in the US, where significant covering has been seen as energy stages a comeback, European energy stocks have enjoyed an impressive 36% rally as oil prices continue to trend upwards. After touching 13 year lows in February, oil prices have now recovered by more than 70%; underpinning a global recovery in equities.

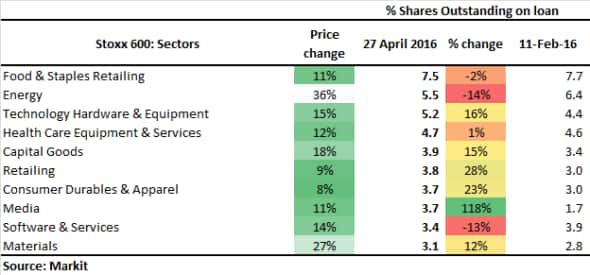

However, while short sellers in European energy names within the Stoxx 600 have covered 14% of positions, the sector remains the second most short sold overall. Only software and services has seen material levels of short interest being covered by short sellers in the past few months.

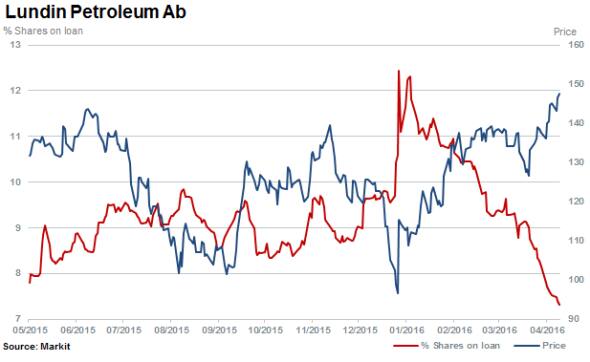

An example of the covering in energy names can be seen above in Swedish oil and gas firm Lundin Petroleum, with 7.3% of shares outstanding on loan. Short sellers have covered over a third of positions in the company in the last three months while shares have risen 25%.

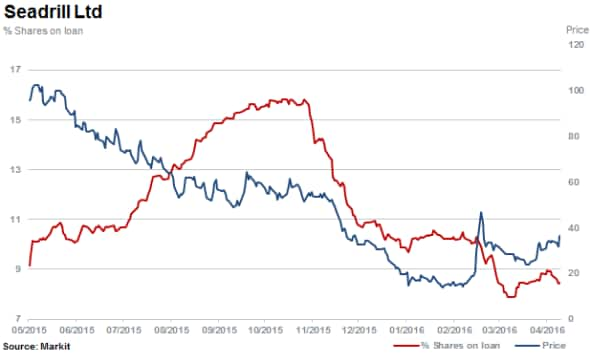

Another example of recent covering in energy, but remaining in the top ten most shorted stocks across Europe, is Seadrill with 8.4% of shares outstanding on loan. Seadrill has fallen 41% in the last six months with shorts covering almost half of positions. However, demand to borrow the stock remains significant with high levels of conviction seen among short sellers, indicated by the highest cost to borrow among energy names.

On average, out of 24 sector groupings in Europe, only a quarter has seen covering of positions since February 11th, which is the current year to date low point of the Stoxx 600.

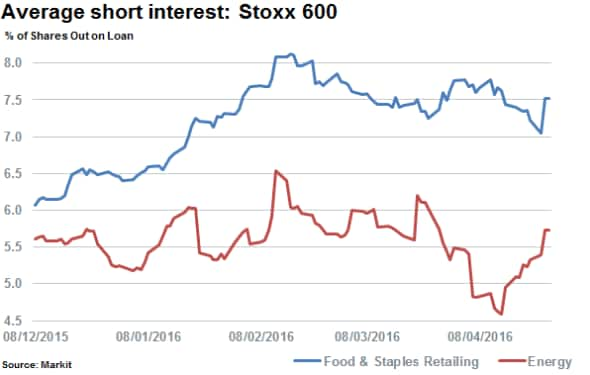

Remaining the shortest sold sector in Europe, short sellers have held onto positions in food & staples retailing stocks despite the sector moving higher by 11% on average. Average short interest has declined marginally but remains above at 7.5% currently.

Positive price movements in European retailers may be related to recent increased M&A activity, with bidding wars unfolding for French and UK retailers.

Retailers in Europe continue to face intense competition and, perhaps highlighting the plight of the ECB, face stubborn price deflation exacerbated by recent lower energy prices.

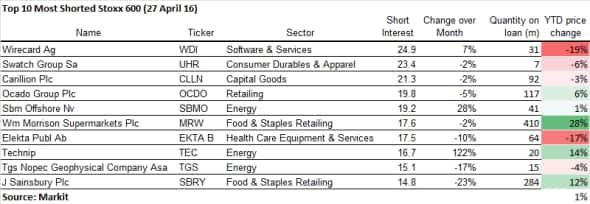

This has seen almost half of the top ten most shorted stocks belonging to the sector with the UK's Ocado Group currently in fourth place with a fifth of shares outstanding on loan.

Despite the covering seen in the energy sector and the recent rise in oil prices, three firms remain among the most shorted names in Europe currently.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Equities-Eurozone-s-rally-not-quite-squeezing-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Equities-Eurozone-s-rally-not-quite-squeezing-shorts.html&text=Eurozone%27s+rally+not+quite+squeezing+shorts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Equities-Eurozone-s-rally-not-quite-squeezing-shorts.html","enabled":true},{"name":"email","url":"?subject=Eurozone's rally not quite squeezing shorts&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Equities-Eurozone-s-rally-not-quite-squeezing-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone%27s+rally+not+quite+squeezing+shorts http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Equities-Eurozone-s-rally-not-quite-squeezing-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}