Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 28, 2016

US Fed holds policy but edges door open for further rate hikes

The US Federal Reserve kept policy on hold at its April FOMC meeting, as widely expected. Since hiking rates for the first time in almost a decade in December, appetite for further policy tightening has waned, though the statement accompanying the meeting still suggests the door remains open to two more rate hikes this year.

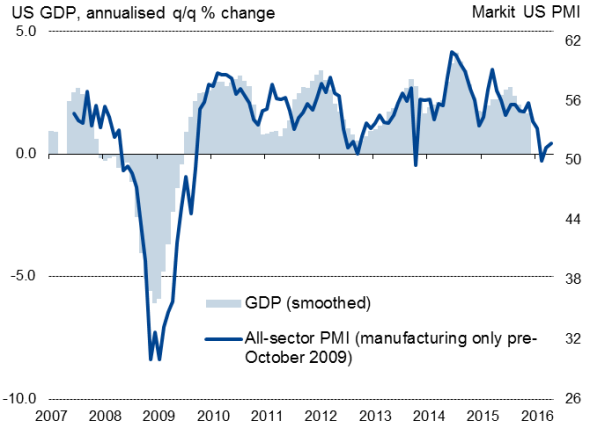

Markit PMI data suggest first quarter economic malaise has extended into the second quarter

Changed statement

Fed officials, including Chair Janet Yellen, have expressed worries about a softening of economic growth so far this year, anaemic and fragile global economic performance, a strong dollar and financial market volatility. Yet the labour market continues to impress, with a strong rate of job creation being sustained in recent months, and consumer sentiment remains elevated. The Fed also implied that it had fewer concerns about the global environment in its latest statement, removing a remark that the "global economic and financial developments continue to pose risks" which had appeared in last month's statement.

The Fed's issues are finding the right window to hike rates and then telegraphing that intention early enough to not unsettle the markets. June looks a distinct possibility, but it will require the data flow to improve.

Small window to hike

One of the Fed's problems is that it's getting difficult to see when the next opportunity for another rate hike will come. The next FOMC meeting is scheduled for June 14-15th, by which time the official economic numbers are likely to have shown GDP growth slowing to a crawl in the first quarter. PMI data pointed to a mere 0.7% annualised expansion over the first three months of the year.

The survey data have meanwhile also sent a disappointing signal for April, suggesting the malaise has extended into the second quarter, albeit not getting any worse.

However, the survey data are also sending a warning shot in relation to payroll growth, pointing to a 150,000 rise in April, down from an average of around 200,000 over the first three months of the year. The labour market may be also starting to cool.

Unless there's a robust pick up in the data for May, Fed policymakers are likely to be looking at some gloomy economic trends at the June meeting, making a rate hike hard to justify. The Fed may also not want to unsettle markets with a rate hike just days before the UK's June 23rd referendum on remaining in the EU.

Even if GDP growth picks up in the second quarter, the upturn won't be confirmed by the official data until July 29th, pushing any rate decision out to September. However, that might be judged too close to the November 8th presidential election to be tightening policy. That would then leave December as the next opportunity to raise interest rates, when the political and economic environments could look very different to now.

Barring a substantial and convincing improvement in the economic data flow between now and June, it looks like December could be the most likely next opportunity to hike rates.

To find out more contact economics@markit.com.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Economics-US-Fed-holds-policy-but-edges-door-open-for-further-rate-hikes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Economics-US-Fed-holds-policy-but-edges-door-open-for-further-rate-hikes.html&text=US+Fed+holds+policy+but+edges+door+open+for+further+rate+hikes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Economics-US-Fed-holds-policy-but-edges-door-open-for-further-rate-hikes.html","enabled":true},{"name":"email","url":"?subject=US Fed holds policy but edges door open for further rate hikes&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Economics-US-Fed-holds-policy-but-edges-door-open-for-further-rate-hikes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Fed+holds+policy+but+edges+door+open+for+further+rate+hikes http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Economics-US-Fed-holds-policy-but-edges-door-open-for-further-rate-hikes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}