Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 28, 2015

Refined returns in oil & gas

The recovery in crude prices has armed oil refining and marketing firms with the resources to conduct a wave of M&A activity, which has driven returns and fuelled the outlook dividend payments. The outlook for the majors is more mixed.

- The refining and marketing sub-sector outperformed in 2014 and year to date

- $1.5bn inflows in 2015 into oil & gas ETFs ~80% of total inflows for 2014

- Dividend increases expected at refiners; but explorers & producers forecast to cut by 22.5%

Refiners reaping rewards

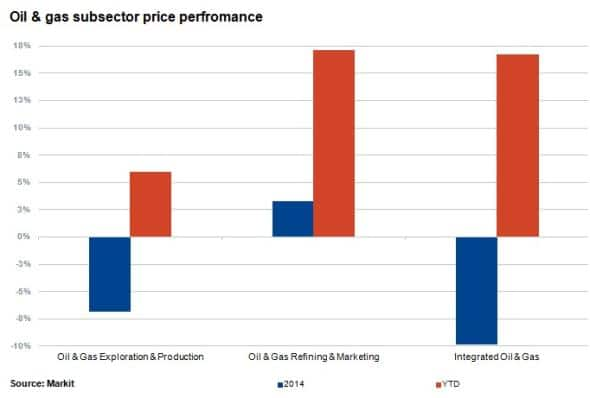

Integrated oil & gas firm’s stock prices declined by 10% on average during 2014 but have recovered well year to date with average price returns of 16%.

However, the winning segment of the market has been refining and marketing firms which managed to end 2014 in positive territory and have soared 17% higher year to date.

Refiners or firms with integrated operations have benefited from the crack spread during lower oil prices.

Exploration & production companies have recovered in 2015 on average but still face turbulence, especially in the US as rig counts continue to fall as lower WTI prices persist amid the increase in oil supply. The segment is comparatively five times more short sold with an average of 4.5% of shares outstanding on loan.

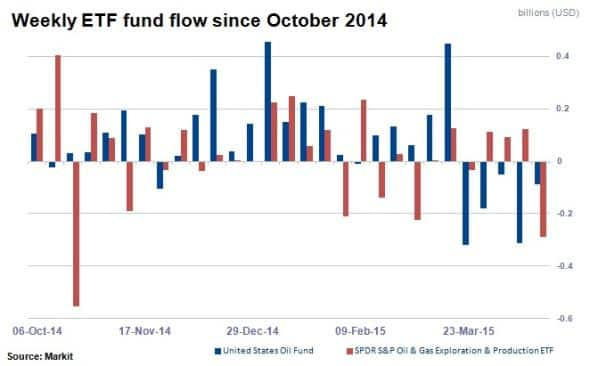

The two of the largest ETFs that track the sector’s explorers & producers are the United States Oil Fund ETF (USO) and the SPDR S&P Oil & Gas Exploration & Production ETFs (XOP) with $2.7bn and $1.6bn in AUM respectively.

On net basis, flows into the USO ETF year to date of $1.02bn represent 88% of total net inflows recorded in 2014. Similarly, strong net inflows year to date of $474m into XOP represent 78% of total inflows that occurred in 2014.

Despite outflows occurring in the most recent weeks of April 2015, these strong net inflows year to date indicate a growing consensus among investors that the oil and gas sector is on track to benefit from the recent price stabilisation.

Oil pays dividends

BP revealed a drop in its first quarter profits for 2015, however the company reaffirmed that its dividend was the group’s “first priority”. The dividend was unchanged quarter on quarter.

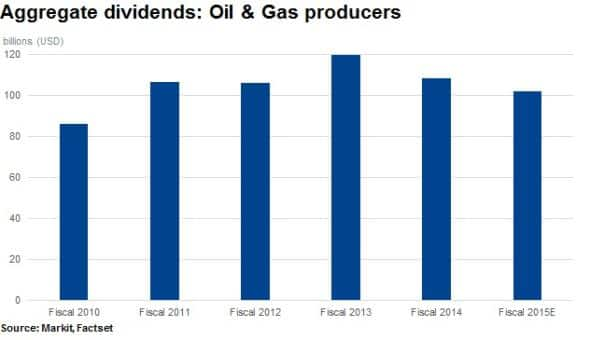

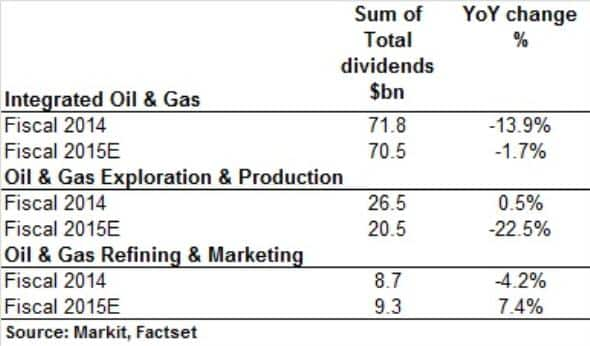

Aggregate dividends for the oil & gas sector have dropped almost 20% from $119bn in 2013 to $102bn expected for the 2015 fiscal year, according to Markit’s dividend forecast data.

Payments for integrated players are expected to fall in fiscal 2015 declining by 1.7% on average – but this is not as bad the 14% decline witnessed in fiscal 2014.

This relatively stable aggregate dividend expected for the large integrated players contrasts with exploration & production firms which are expected to cut dividends by 22.5% in 2015.

Refining and marketing firms have managed to buck the trend. Their aggregate dividend is expected to grow by 7.4% in the coming fiscal year.

Relte Stephen Schutte, Analyst at Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042015-equities-refined-returns-in-oil-gas.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042015-equities-refined-returns-in-oil-gas.html&text=Refined+returns+in+oil+%26+gas","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042015-equities-refined-returns-in-oil-gas.html","enabled":true},{"name":"email","url":"?subject=Refined returns in oil & gas&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042015-equities-refined-returns-in-oil-gas.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Refined+returns+in+oil+%26+gas http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042015-equities-refined-returns-in-oil-gas.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}