Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 27, 2015

Smart money trades up; Chesapeake on the brink

Investment grade and high yield US corporate bonds have seen credit risk diverge over the past few months, while the oil & gas sector may see its latest casualty

- $ AA and $ CCC rated corporate bonds have seen credit risk diverge since August

- Chesapeake's CDS spread implies a default probability of 87.6% over the next five years

- Nigerian government bonds have returned over 30% so far this year

Higher quality

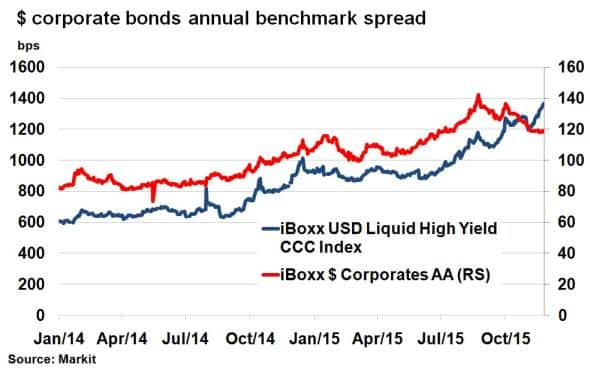

Over the past few months US corporate bond risk has dislocated along the quality spectrum. Up until August this year, both investment grade and high yield bonds saw benchmark spreads widen in tandem, but global markets volatility in August and September has disrupted this trend.

Since August 24th (dubbed "Black Monday"), the higher quality corporate bond sector represented by the Markit iBoxx $ Corporates AA index, has seen its annual benchmark spread tighten 24bps to 118bps. As global macro concerns cooled, bond spreads among the highest quality corporations retreated. In contrast, the lowest quality names, as represented by the Markit iBoxx USD Liquid High Yield CCC Index, saw annual benchmark spreads widen 184bps over the same period.

Even after global economic issues stabilised post September, lower quality US corporate debt has been blighted by idiosyncratic risk and exposure to a stubbornly weak commodities market.

The pending interest rate rise has also helped ratify the strength of the US economy, benefitting higher quality names as investor confidence turns positive. CCC rated corporates have not seen credit risk this high since the financial crisis, but default rates have so far remained sanguine in comparison to historic standards. If spreads continue to widen in CCC names, the potential for accelerated defaults has seen investors reallocating risk up the quality spectrum.

On the brink

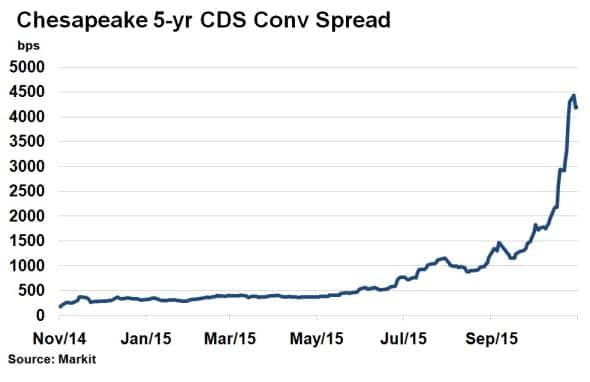

The US' second largest natural gas producer Chesapeake Energy appears to be on the brink of default as the firm continues to struggle with persistently low energy prices.

According to Markit's CDS pricing service, 5-yr CDS spreads have widened from around 500bps in July to over 4000bps and now imply a default probability of 87.6% over the next five years. The CDS curve has also seen risk spike in short term tenures, resulting in an alert being released by Leading Risk Indicators within Markit's Research Signals factor platform, which expects further credit deterioration.

Whether Chesapeake's fortunes turn will depend on how it handles its highly leveraged balance sheet and short term liquidity needs, but credit investors have already started to take cover in what could be the latest casualty in the US oil & gas sector.

Nigeria

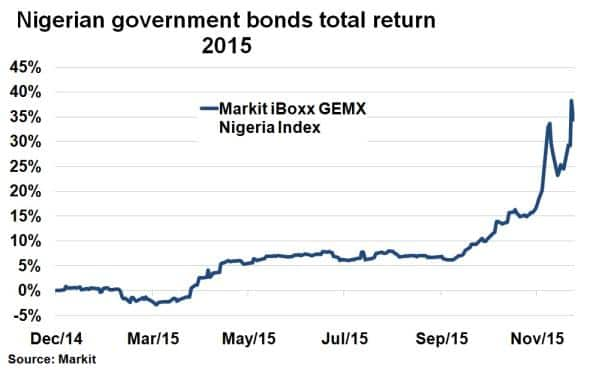

Surprisingly, Nigeria cut interest rates for the first time in six years this week in an effort to kick start Africa's biggest economy. The move is the latest cut among emerging market central banks attempting to overcome recent global macroeconomic struggles.

Nigerian government bonds reacted by yields falling; pushing prices up and returns in the process. In fact, according to the Markit iBoxx GEMX Nigeria Index, Nigerian government bonds have returned over 30% this year on a total return basis. Similar to Russia, Nigeria's government bonds were hit in 2014 by the fall in its most lucrative export, crude oil, only for investor confidence to return.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112015-credit-smart-money-trades-up-chesapeake-on-the.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112015-credit-smart-money-trades-up-chesapeake-on-the.html&text=Smart+money+trades+up%3b+Chesapeake+on+the+brink","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112015-credit-smart-money-trades-up-chesapeake-on-the.html","enabled":true},{"name":"email","url":"?subject=Smart money trades up; Chesapeake on the brink&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112015-credit-smart-money-trades-up-chesapeake-on-the.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Smart+money+trades+up%3b+Chesapeake+on+the+brink http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112015-credit-smart-money-trades-up-chesapeake-on-the.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}